|

市场调查报告书

商品编码

1635487

亚太地区低温泵:市场占有率分析、产业趋势和成长预测(2025-2030)Asia-Pacific Cryogenic Pump - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

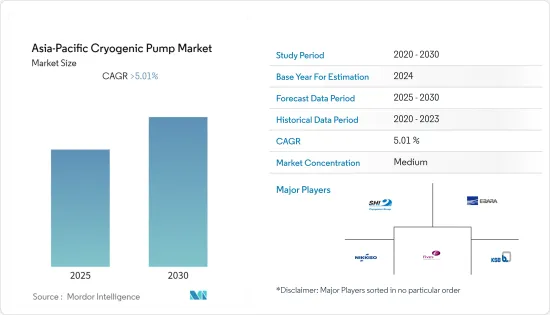

预计亚太地区低温泵市场在预测期内的复合年增长率将超过 5.01%。

2020 年市场受到 COVID-19 的负面影响。目前已达到疫情前水准。

主要亮点

- 从长远来看,天然气发电的增加、能源和电力行业投资的增加以及国内应用对液化天然气燃料的需求增加预计将成为市场的主要驱动力。

- 另一方面,成本限制和主要国家缺乏处理这些设备的专业知识预计将限制市场成长。

- 由于低温泵主要用于太阳能电池板的生产,因此对太阳能发电和太阳能光伏製造基础设施的发展的日益关注可能会在未来几年创造巨大的机会。

- 在预测期内,印度亚太低温泵市场可能会显着成长。

亚太低温泵市场趋势

正排量帮浦显着成长

- 正排量帮浦 (PDP) 或往復式低温帮浦旨在将机械马达能量转换为泵送流体的机械能。此帮浦的基本操作是将一定量的液体恢復并置换成圆柱形。正排量低温帮浦通常由动力帮浦和直动帮浦组成。例如,动力帮浦利用马达或引擎的曲轴,而直接驱动帮浦使用驱动流体,例如气体或液体。

- 由于其两相流体性质,这些泵浦比离心低温泵浦更常用。例如,这些帮浦设计用于输送液体和固体颗粒的混合物。混合物中固体颗粒的存在会损坏离心式帮浦的叶轮并导致这些泵发生故障,因此 PDP 类型比动态泵具有优势。另一方面,低温 PDP 的一个主要缺点是由于齿轮、皮带、轴承、包装和阀门中的摩擦而导致效率降低。此外,初始成本高于离心式帮浦。

- PDP主要用于低温钢瓶的填充以及工业和医用瓶的气体填充。此外,这些泵浦也用于其他几种工业液化天然气和二氧化碳应用。截至2021年,该地区进口液化天然气371.8立方厘米,比上年(346.3立方厘米)增加约7.7%。中国是该地区最大的液化天然气进口国,进口量为 109.5 bcm,其次是日本和韩国。

- 儘管2020年液化天然气加气站产业的业务因COVID-19的限制和关闭而萎缩,但预计未来投资将增加。例如,印度和中国等国家预计将投资约12亿美元和50亿美元来开发液化天然气加气站基础设施。在研究期间,这种情况预计将在液化天然气加气站产业产生对低温 PDP 的需求。

- 因此,基于上述因素,预计在预测期内,亚太地区低温泵市场将显着成长。

印度预计将出现显着成长

- 印度拥有世界上最大的化学和製药工业之一。农业和运输部门是该国这些行业的主要消费者。

- 印度计画确保24x7供电。然而,要实现这一目标,发电能力必须增加一倍。截至2022年3月31日,天然气在发电结构中的比例为24,899.51MW。政府正在重点关注天然气发电厂。因此,在预测期内,液化天然气液化厂对低温泵的需求预计将增加。

- 印度政府非常重视清洁能源,政府的目标是到2030年减少碳排放。天然气是近年来最受欢迎且成长最快的能源之一。

- 根据「印度製造」计划,政府希望将印度打造成世界地图上的製造中心。根据印度品牌资产基金会(IBEF)预测,到 2025 年,印度製造业的产值将达到 1 兆美元。预计到 2022 年中期,它将跻身经济和製造业成长前三名的目的地之列。

- 然而,印度是天然气净进口国。该国从港口进口设施(再气化厂)进口天然气。近年来,该国液化天然气进口量大幅增加。预计这一趋势将在预测期内持续下去,从而推动液化LNG接收站对低温泵的需求。

- 因此,基于上述因素,预计印度在预测期内亚太低温泵市场将呈现显着成长。

亚太低温泵产业概况

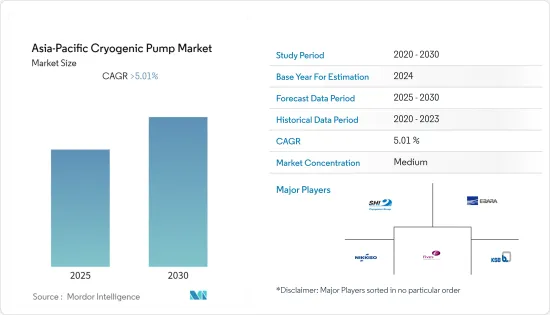

亚太地区低温泵市场适度细分。市场主要企业包括(排名不分先后)Nikkiso、SHI Cryogenics Group、Ebara Corporation、Fives Group 和 KSB SE & Co.KGaA。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 至2027年市场规模及需求预测(单位:百万美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 市场驱动因素

- 市场限制因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品/服务的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 按类型

- 动力泵

- 正排量泵

- 通过气体

- 氮

- 氧

- 氩气

- LNG

- 其他气体

- 按最终用户

- 石油和天然气

- 医疗保健

- 化学

- 其他的

- 按地区

- 中国

- 印度

- 日本

- 其他亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Nikkiso Co. Ltd

- SHI Cryogenics Group

- Flowserve Corporation

- Ebara Corporation

- Weir Group PLC

- Fives Group

- Beijing Long March Tianmin Hi-Tech Co. Ltd

- KSB SE & Co. KGaA

- Cryostar SAS

第七章 市场机会及未来趋势

简介目录

Product Code: 92848

The Asia-Pacific Cryogenic Pump Market is expected to register a CAGR of greater than 5.01% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. It has now reached pre-pandemic levels.

Key Highlights

- Over the long term, the major driving factors of the market are expected to be the increase in gas-based power generation, increasing investments in the energy and power sector, and rising demand for LNG fuel in domestic applications.

- On the flip side, cost constraints and a lack of expertise in handling these devices across major countries are anticipated to restrain the growth of the market.

- Growing focus on solar power generation and the development of solar PV manufacturing infrastructure can create immense opportunities over the coming years because cryogenic pumps are majorly used in the manufacturing of solar panels.

- India is likely to witness significant growth in the Asia-Pacific cryogenic pump market during the forecast period.

APAC Cryogenic Pump Market Trends

Positive Displacement Pump Type to Witness Significant Growth

- Positive displacement pumps (PDP) or reciprocating cryogenic pumps are designed to convert mechanical motor energy into pumped fluid mechanical energy. The basic operation of this pump consists of restoring and displacing a fixed liquid volume cylindrically. Typically, a positive displacement cryogenic pump consists of a power pump and a direct-acting pump. For instance, a power pump utilizes a crankshaft with a motor or engine, while a direct-acting pump uses a drive fluid like gas or liquid.

- These pumps are typically used over centrifugal cryogenic pumps because of a two-phase fluid. For instance, these pumps are designed to transport a mixture of liquid and solid particles. Because of the solid particles in the mixture, the centrifugal pump's impeller could be damaged, leading to the breakdown of these pumps, hence giving an edge to the PDP type over the dynamic one. On the flip side, a major disadvantage of Cryogenic PDP is the efficiency loss due to friction in gears, belts, bearings, packaging, and valves. Moreover, it has a higher initial cost as compared to centrifugal pumps.

- PDPs are mainly used for cryogenic cylinder filling and industrial and medical bottle filling with gaseous products. Moreover, these pumps are also used in several other industrial LNG and CO2 applications. As of 2021, the region imported 371.8 bcm of LNG, i.e., an increase of about 7.7% compared to the previous year's value (346.3 bcm). China is the leading LNG importer in the region, with 109.5 bcm, followed by Japan and South Korea.

- Though the LNG fuel station industry witnessed a shrink in its business during 2020 on account of restrictions and lockdowns imposed due to COVID-19, the industry is expected to witness increased investments going forward. For instance, countries like India and China are expected to invest nearly USD 1.2 billion and USD 5 billion to develop LNG fuel station infrastructure. Such a situation would generate demand for cryogenic PDPs in the LNG fuel station industry during the study period.

- Therefore, based on the above-mentioned factors, positive displacement cryogenic pumps are expected to witness significant growth in the Asia-Pacific cryogenic pump market during the forecast period.

India Expected to Witness Significant Growth

- India has one of the largest chemical and pharmaceutical industries in the world. The agricultural and transportation sectors are some of the major consumers of these industries in the country.

- India is planning to ensure a 24x7 electricity supply. However, the country has to double its electricity generation capacity to achieve this target. As of March 31, 2022, the share of natural gas in the power generation mix stood at 24,899.51 MW. The government is emphasizing natural gas-fired power plants. Therefore, the demand for cryogenic pumps is expected to increase in the LNG liquefaction plants during the forecast period.

- The Indian government is emphasizing clean energy, owing to the government's aim to reduce carbon emissions by 2030. Natural gas has been one of the most popular and fastest-growing sources of power in the recent past.

- Under its 'Make in India' program, the government expects to place India on the world map as a manufacturing hub. According to the Indian Brand Equity Foundation (IBEF), the country's manufacturing sector has the potential to reach USD 1 trillion by 2025. It is expected to rank among the top three growth economies and manufacturing destinations by mid-2022.

- However, India is a net importer of natural gas. The country imports natural gas from its import facilities at ports (regasification plant). The LNG imports of the country have been increasing significantly over the recent past. The trend is expected to continue over the forecast period, boosting demand for cryogenic pumps in LNG terminals.

- Therefore, based on the above-mentioned factors, India is expected to witness significant growth in the Asia-Pacific cryogenic pump market during the forecast period.

APAC Cryogenic Pump Industry Overview

The Asia-Pacific cryogenic pump market is moderately fragmented in nature. Some of the major players in the market (in no particular order) include Nikkiso Co. Ltd, SHI Cryogenics Group, Ebara Corporation, Fives Group, and KSB SE & Co. KGaA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, in USD million, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Market Drivers

- 4.5.2 Market Restraints

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Dynamic Pump

- 5.1.2 Positive Displacement Pump

- 5.2 By Gas

- 5.2.1 Nitrogen

- 5.2.2 Oxygen

- 5.2.3 Argon

- 5.2.4 LNG

- 5.2.5 Other Gases

- 5.3 By End-user

- 5.3.1 Oil and Gas

- 5.3.2 Healthcare

- 5.3.3 Chemicals

- 5.3.4 Other End-users

- 5.4 By Geography

- 5.4.1 China

- 5.4.2 India

- 5.4.3 Japan

- 5.4.4 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Nikkiso Co. Ltd

- 6.3.2 SHI Cryogenics Group

- 6.3.3 Flowserve Corporation

- 6.3.4 Ebara Corporation

- 6.3.5 Weir Group PLC

- 6.3.6 Fives Group

- 6.3.7 Beijing Long March Tianmin Hi-Tech Co. Ltd

- 6.3.8 KSB SE & Co. KGaA

- 6.3.9 Cryostar SAS

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219