|

市场调查报告书

商品编码

1690141

低温泵:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Cryogenic Pump - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

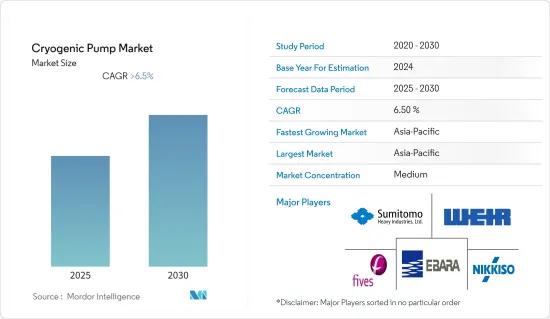

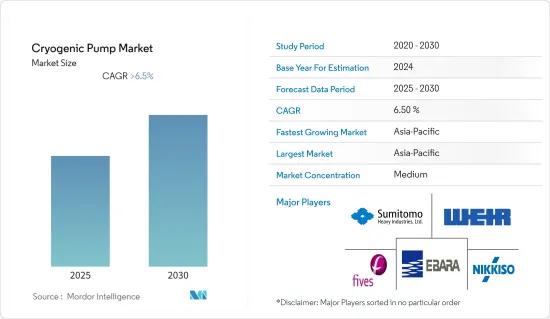

预计预测期内低温帮浦市场复合年增长率将超过 6.5%。

由于正排量低温泵在各种终端行业中的应用以及相对于动态泵的优势,预计在预测期内,正排量低温泵领域的需求将显着增长。

由于低温泵主要用于太阳能板的製造,对太阳能的日益关注和太阳能光伏製造基础设施的发展可能会在未来几年创造巨大的机会。

预计亚太地区将主导市场,大部分需求来自中国和印度等国家。

低温泵市场趋势

正排量低温帮浦强劲成长

正排量帮浦 (PDP) 或往復式低温帮浦旨在将马达的机械能转换为泵送流体的机械能。此帮浦的基本动作是将一定量的液体还原并置换到汽缸中。通常,正排量低温帮浦由动力帮浦和直动帮浦组成。例如,动力帮浦使用带有马达或引擎的曲轴,而直动帮浦使用气体或液体等动力流体。

由于双相流体,这些泵浦通常取代离心式低温泵浦使用。例如,这些泵浦设计用于运输液体和固体颗粒的混合物。由于混合物中含有固体颗粒,离心式帮浦浦的叶轮可能会损坏,导致泵浦故障,因此 PDP 类型比动态类型具有优势。

PDP 通常用于将低温气瓶和气体填充到工业和医用瓶中。此外,这些泵浦也用于其他几种工业LNG和CO2应用。

2020 年 1 月,Ampco Pumps 推出了用于低温处理应用的低温泵技术。 ZP3 系列正排量型采用高度专业的内部密封设计,适用于低至 -70°F 或 -56 度C 的低温处理。

因此,基于上述因素,正排量低温泵将出现显着成长,从而在预测期内推动低温泵市场的需求。

亚太地区占市场主导地位

亚太地区由于工业基础设施的发展正在经历强劲的经济成长。中国、印度和其他亚洲国家等能源丰富的经济体对液化天然气(LNG)运输和储存的需求不断增长,推动了亚太地区低温泵市场的成长。

亚太地区对基础设施领域的高投资和对可再生能源发电的日益关注预计将为全球低温泵市场提供巨大的成长机会。

中国是电子及半导体产业需求庞大的主要国家之一。中国製造商高度注重加强材料、零件和设备领域的能力。

2020年,印度在蒙德拉运作第六个LNG接收站。该LNG接收站的产能为每天0.6亿立方英尺,总合气化产能为每天5.2亿立方英尺。截至 2020 年,还有 4 个 LNG 进口终端正在建设中,预计将于 2023 年运作,将增加 25 亿立方英尺/天的 LNG 进口能力。这些终端可能会增加该国对低温泵的需求。

2021 年 1 月,法孚集团订单,为中国一个新的空气分离装置 (ASU) 购买 13 台 Cryomec® 低温离心式帮浦。此新建空分装置的製氧能力将超过2000吨/日,将建于天津港保税区港口经济区。预计营运将于 2022年终。

因此,由于上述因素,预计亚太地区将在预测期内主导低温泵市场。

低温泵产业概况

低温泵市场中等程度分散。市场的主要企业包括日机装、住友重工业有限公司、法孚集团、荏原株式会社、威尔集团等。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2027 年市场规模与需求预测

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 类型

- 动态泵浦

- 正排量泵

- 气体

- 氮

- 氧

- 氩气

- LNG

- 其他气体

- 最终用户

- 发电

- 化学

- 卫生保健

- 其他最终用户

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 南美洲

- 中东和非洲

第六章 竞争格局

- 併购、合资、合作、协议

- 主要企业策略

- 公司简介

- Nikkiso Co. Ltd

- Sumitomo Heavy Industries Ltd

- Flowserve Corporation

- Ebara Corporation

- Weir Group PLC

- Fives Group

- Beijing Long March Tianmin Hi-Tech Co. Ltd

- KSB SE & Co. KGaA

- PHPK Technologies Inc.

- Cryostar SAS

第七章 市场机会与未来趋势

The Cryogenic Pump Market is expected to register a CAGR of greater than 6.5% during the forecast period.

The positive displacement cryogenic pumps segment is expected to witness significant demand during the forecast period, owing to its adoption in various end-use industries and its advantages when compared to dynamic pumps.

Growing focus on solar power generation and development of solar PV manufacturing infrastructure can create immense opportunities over the coming years because cryogenic pumps are majorly used in the manufacturing of solar panels.

Asia-Pacific is expected to dominate the market, with a majority of the demand coming from countries such as China and India.

Cryogenic Pump Market Trends

Positive Displacement Cryogenic Pump Segment to Witness Significant Growth

Positive displacement pump (PDP) or reciprocating cryogenic pumps are designed to convert motor mechanical energy into pumped fluid mechanical energy. The basic operation of this pump consists of restoring and displacing a fixed liquid volume cylindrically. Typically, a positive displacement cryogenic pump consists of a power pump and a direct-acting pump. For instance, a power pump utilizes a crankshaft with a motor or engine, while a direct-acting pump uses a drive fluid, such as a gas or liquid.

These pumps are typically used over centrifugal cryogenic pumps because of a two-phase fluid. For instance, these pumps are designed to transport a mixture of liquid and solid particles. Because of the solid particles in the mixture, the impeller of the centrifugal pump could be damaged, leading to the breakdown of these pumps, hence giving an edge to the PDP type over the dynamic one.

PDPs are mostly used for cryogenic cylinder filling and industrial and medical bottle filling with gaseous products. Moreover, these pumps are also used in several other industrial LNG and CO2 applications.

In January 2020, Ampco Pumps introduced cryo-pump technology for low-temperature processing applications. The ZP3 series positive displacement has been designed with highly specialized internal seals for processing at temperatures as low as -70°F or -56°C.

Therefore, based on the abovementioned factors, positive displacement cryogenic pumps are expected to witness significant growth, which, in turn, is expected to boost the demand for the cryogenic pump market during the forecast period.

Asia-Pacific to Dominate the Market

Asia-Pacific is witnessing huge economic growth due to the development of industrial infrastructure. The demand for shipping and storing liquified natural gas (LNG) is increasing in energy-famished economies, such as China, India, and other Asian countries, which is driving the growth of the cryogenic pump market in the Asia-Pacific region.

High investments in the infrastructure sector and an increase in focus on renewable-based electricity generation in the Asia-Pacific region is expected to provide substantial growth opportunities for the global cryogenic pumps market.

China is one of the major countries with significant demand in the electronics and semiconductor industry. Manufacturers in China are highly focused on strengthening their capabilities in the fields of materials, components, and equipment.

In 2020, India commissioned its sixth LNG Terminal in Mundra. The LNG terminal had a capacity of 0.6 bcf/d, bringing the total regasification capacity to 5.2 Bcf/d. As of 2020, four more LNG import terminals were under construction and expected to come online by 2023, adding 2.5 bcf/d of LNG import capacity. The terminals are likely to propel the demand for cryogenic pumps in the country.

In January 2021, Fives Group was awarded a contract for the supply of 13 Cryomec(R) cryogenic centrifugal pumps for a new Air Separation Unit (ASU) in China. The new ASU, with an oxygen production capacity of more than 2,000 ton per day, will be built in the Lingang Economic District, Tianjin Port Free Trade Zone. It is expected to become operational by the end of 2022.

Therefore, based on the abovementioned factors, the Asia-Pacific region is expected to dominate the cryogenic pump market over the forecast period.

Cryogenic Pump Industry Overview

The cryogenic pump market is moderately fragmented. The key players in the market include Nikkiso Co. Ltd, Sumitomo Heavy Industries Ltd, Fives Group, Ebara Corporation, and Weir Group PLC, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Dynamic Pump

- 5.1.2 Positive Displacement Pump

- 5.2 Gas

- 5.2.1 Nitrogen

- 5.2.2 Oxygen

- 5.2.3 Argon

- 5.2.4 LNG

- 5.2.5 Other Gases

- 5.3 End User

- 5.3.1 Power Generation

- 5.3.2 Chemicals

- 5.3.3 Healthcare

- 5.3.4 Other End Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 South America

- 5.4.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Nikkiso Co. Ltd

- 6.3.2 Sumitomo Heavy Industries Ltd

- 6.3.3 Flowserve Corporation

- 6.3.4 Ebara Corporation

- 6.3.5 Weir Group PLC

- 6.3.6 Fives Group

- 6.3.7 Beijing Long March Tianmin Hi-Tech Co. Ltd

- 6.3.8 KSB SE & Co. KGaA

- 6.3.9 PHPK Technologies Inc.

- 6.3.10 Cryostar SAS