|

市场调查报告书

商品编码

1636101

低温流程帮浦:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Cryogenic Process Pumps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

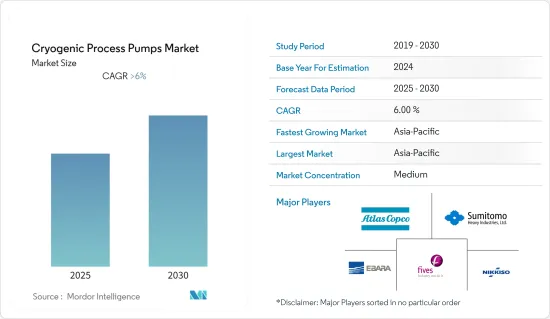

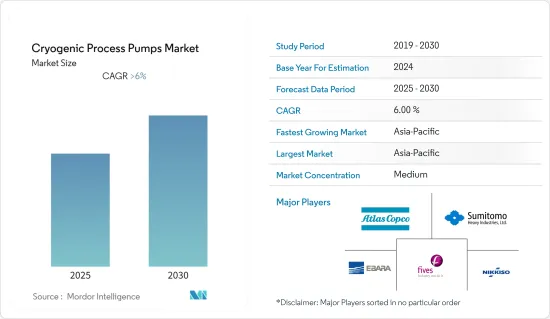

预计低温流程帮浦市场在预测期内的复合年增长率将超过 6%。

2020年,COVID-19对市场产生了负面影响。目前,市场已达到疫情前水准。

主要亮点

- 从中期来看,由于发电用天然气需求的增加,预计低温流程帮浦的需求将会扩大。

- 另一方面,高投资成本预计将阻碍市场成长。

- 增加对半导体等高效能电气设备组件市场的技术投资预计将为低温流程帮浦市场创造巨大机会。

- 由于电力行业的发展,预计亚太地区将在预测期内主导市场。

低温流程帮浦市场趋势

正排量帮浦领域经历显着成长

- 正排量低温泵是工业中用来输送低温液体和冷媒的一种帮浦。它是密封的,由专有的合成橡胶体製成,可承受低温并防止热量洩漏。这些泵浦使用一个或多个叶轮和扩散器。扩散机制将低温泵中的流量转换成压力。

- 对医用气体的需求增加、可再生能源发电以及基础设施投资的增加正在推动容积式低温泵的发展。此外,发电行业中液化天然气的使用不断增加正在推动市场扩张。

- 这些泵浦在发电以及石油和天然气行业中很受欢迎,因为与其他类型的泵浦相比,它们效率高且产生的有害环境排放相对较少。因为这些行业专注于减少排放,而这些泵浦满足了这一目标。

- 无论排出压力水平如何,正排量泵都能够产生相同的流量,这是优于离心式帮浦的基本优势,离心泵的设计目的是响应压力波动。与离心式帮浦不同,正排量泵不依赖特定的压力水平来实现效率和最大程度的运作成功。

- 此外,对太阳能发电的重视和太阳能基础设施的扩张为这种主要用于太阳能电池板生产的泵浦提供了巨大的潜在机会。

- 根据国际可再生能源机构(IRENA)的数据,全球太阳能发电累积设置容量增加了22.33%,从2021年的855GW增加到2022年的1,046GW。

- 因此,基于上述因素,正排量帮浦预计在预测期内将呈现显着成长。

亚太地区主导市场

- 亚太地区可能会主导全球市场。由于能源资源的减少和排放法规的严格化,燃气发电厂对这些泵浦的需求正在增加。此外,扩大政府监管以加强燃气发电厂的清洁发电,以及增加对医疗保健、食品饮料和钢铁的投资,将支持地区繁荣。

- 由于人口成长、都市化进程加快和基础设施发展活动,亚太地区的电力需求和供应正在显着增加。电力基础设施的成长预计将导致清洁能源来源的成长,从而导致低温流程帮浦的使用增加。

- 2021年总发电量为13,994.4太瓦时,根据BP 2022年世界能源统计回顾,此数字为8,875.5太瓦时。过去十年,能源需求平均每年增长约4.7%。预计这一趋势将在预测期内持续下去。

- 由于严格的环境法规和雄心勃勃的减少环境排放的目标,该地区各国开始将可再生能源纳入其发电结构,其中主要是太阳能和风力发电。这些低温流程帮浦是太阳能板和风力发电结构零件生产中的重要部件。

- 例如,2022 年 9 月,亚马逊印度公司宣布在印度最新的公用事业规模可再生能源计划。这是位于拉贾斯坦邦的三座太阳能发电厂,总合清洁能源潜力 (MW) 为 420 兆瓦。 ReNew Power 将开发 210 兆瓦计划,Amp Energy India 将开发 100 兆瓦计划,Brookfield Renewable 将开发 110 兆瓦计划。

- 因此,由于上述因素,预计亚太地区在预测期内将主导低温流程泵市场。

低温流程泵产业概述

全球低温流程帮浦市场适度细分。市场的主要企业(排名不分先后)包括阿特拉斯科普柯、住友重工业株式会社、法孚集团、荏原株式会社和日机装株式会社。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 类型

- 动力泵

- 正排量泵

- 低温气体

- 氮

- 氩气

- 氧

- LNG

- 氢

- 其他的

- 最终用户

- 发电

- 化学

- 医疗保健

- 其他的

- 2028年之前的市场规模和需求预测(按地区)

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 澳洲

- 日本

- 其他亚太地区

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他中东/非洲

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 北美洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Atlas Copco AB

- Ebara Corporation

- Sumitomo Heavy Industries, Ltd.

- Nikkiso Corporation Limited

- Fives Group

- Sulzer Limited

- Cryostar

- Trillium Flow Technologies

- Ruhrpumpen Group

- Flowserve Corporation

第七章 市场机会及未来趋势

简介目录

Product Code: 93873

The Cryogenic Process Pumps Market is expected to register a CAGR of greater than 6% during the forecast period.

In 2020, COVID-19 had a detrimental effect on the market. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, the increasing demand for gases for power generation is expected to increase the demand for the cryogenic process pumps market.

- On the other hand, high investment costs are expected to hinder market growth.

- Nevertheless, the increasing technological investments in the market for efficient electrical device components, such as semiconductors, are expected to create huge opportunities for the Cryogenic Process Pumps market.

- Asia-Pacific is expected to dominate the market during the forecasted period due to the development of the power industry in the region.

Cryogenic Process Pumps Market Trends

Positive Displacement Pump Segment to Witness Significant Growth

- Positive displacement cryogenic pumps are a type of pump that is used in industries to transport low-temperature liquids and coolants. It is hermetically sealed and made of unique elastomers to endure low temperatures and prevent heat leakage. One or more impellers and a diffuser are used in these pumps. The diffusion mechanism converts velocity inside a cryogenic pump to pressure.

- An increase in the demand for medical gases, the production of electricity using renewable sources, and increased infrastructure investments are driving the positive displacement cryogenic pump. In addition, the increased use of liquefied natural gas in the power generation industry is likely to drive market expansion.

- These pumps are highly efficient and have relatively low harmful environmental emissions as compared to other pump types, which makes them popular in the power generation and oil and gas industries as these industries are focusing on reducing their emissions and these pumps fall in line with their targets.

- The capacity of positive displacement pumps to produce the same flow rate regardless of discharge pressure level is a fundamental advantage over centrifugal pumps, which are designed to react to pressure variations. Positive displacement pumps, unlike centrifugal pumps, do not rely on certain pressure levels for efficiency and maximal operational success.

- Furthermore, the increased emphasis on solar-based power generation and the expansion of solar photovoltaic infrastructure are providing enormous potential opportunities for these sorts of pumps, which are primarily employed in the production of solar panels.

- According to the International Renewable Energy Agency (IRENA), the cumulative global installed solar PV capacity grew by 22.33%, i.e., from 855 GW in 2021 to 1046 GW in 2022.

- Therefore, based on the abovementioned factors, positive displacement pumps are expected to witness significant growth during the forecasted period.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region would likely dominate the worldwide market. Due to dwindling energy resources and tight emissions rules, demand for these pumps is increasing at gas-fired power plants. Furthermore, expanding government regulations to enhance clean power generation from gas-fired power plants, as well as increased investment in healthcare, food and beverage, and steel, will push regional prosperity.

- Asia Pacific is witnessing a massive rise in the supply and demand of electricity owing to the rising population, growing urbanization, and infrastructure development activities in the region. The growth in electricity infrastructure is expected to increase the growth of cleaner energy sources, which consequently increases the use of cryogenic process pumps.

- The total electricity generation in 2021 was recorded at 13,994.4 TWh, compared to 8875.5 TWh as per the BP Statistical Review for World Energy 2022. The energy demand has increased on average by around 4.7% annually over the past decade. This trend is likely to continue in the future during the forecasted period.

- Due to stringent environmental rules and ambitious targets for reducing environmental emissions, various countries in the region have started integrating renewable energy to their power generation mix, which mostly involves solar and wind energy. These cryogenic process pumps are an essential part of producing solar panels and parts for wind energy structures.

- For instance, in September 2022, Amazon India unveiled its latest utility-scale renewable energy projects in India: three solar farms in Rajasthan totaling 420 megawatts of clean energy potential (MW). ReNew Power will create a 210 MW project, Amp Energy India will develop a 100 MW project, and Brookfield Renewable will develop a 110 MW project.

- Therefore, based on the abovementioned factors, the Asia-Pacific region is expected to dominate the cryogenic process pump market over the forecast period.

Cryogenic Process Pumps Industry Overview

The global market for cryogenic process pumps is moderately fragmented. Some of the key players in this market (in no particular order) are Atlas Copco AB, Sumitomo Heavy Industries, Ltd., Fives Group, Ebara Corporation, and Nikkiso Corporation Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Dynamic Pump

- 5.1.2 Positive Displacement Pump

- 5.2 Cryogen

- 5.2.1 Nitrogen

- 5.2.2 Argon

- 5.2.3 Oxygen

- 5.2.4 LNG

- 5.2.5 Hydrogen

- 5.2.6 Other Cryogens

- 5.3 End-User

- 5.3.1 Power Generation

- 5.3.2 Chemical

- 5.3.3 Healthcare

- 5.3.4 Others

- 5.4 Geography [Market Size and Demand Forecast till 2028 (for regions only)]

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 France

- 5.4.2.3 United Kingdom

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Australia

- 5.4.3.4 Japan

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 Saudi Arabia

- 5.4.4.2 UAE

- 5.4.4.3 South Africa

- 5.4.4.4 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Columbia

- 5.4.5.4 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Atlas Copco AB

- 6.3.2 Ebara Corporation

- 6.3.3 Sumitomo Heavy Industries, Ltd.

- 6.3.4 Nikkiso Corporation Limited

- 6.3.5 Fives Group

- 6.3.6 Sulzer Limited

- 6.3.7 Cryostar

- 6.3.8 Trillium Flow Technologies

- 6.3.9 Ruhrpumpen Group

- 6.3.10 Flowserve Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219