|

市场调查报告书

商品编码

1635490

欧洲小水力发电 -市场占有率分析、产业趋势/统计、成长预测(2025-2030)Europe Small Hydropower - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

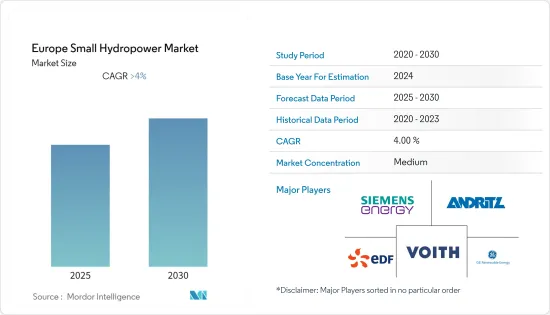

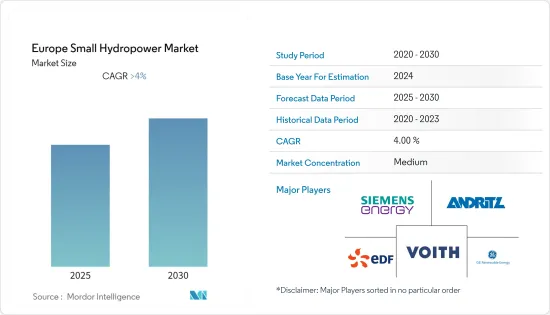

预计欧洲小水力发电市场在预测期内将维持4%以上的复合年增长率。

2020 年市场受到 COVID-19 的负面影响。目前市场处于大流行前的水平。

主要亮点

- 从中期来看,不断增加的投资和雄心勃勃的水力发电目标预计将推动市场成长。

- 另一方面,组串式逆变器的技术缺陷预计将阻碍欧洲小水力发电市场在预测期内的成长。

- 在预测期内,在政府支持下新建小发电工程的增加可能会为欧洲小水力发电市场提供利润丰厚的成长机会。

- 挪威在市场上占据主导地位,并且可能在预测期内实现最高的复合年增长率。这一增长得益于该国投资的增加以及政府的支持措施。

欧洲小水力发电市场趋势

容量1-10MW细分市场占据主导地位

- 预计1-10兆瓦装置容量部分将成为预测期内最丰富的小型水力发电市场。这是由于欧洲正在推出小规模的分散式电气化计划。

- 2021年,欧洲水力发电装置容量达到224GW。水力发电总装置容量包括小型、中型和大型发电工程的水力发电量。

- 在欧洲,1-10兆瓦的小型水力发电市场成长强劲,大部分装机来自挪威、法国和义大利等国家。这些国家对农村电气化投资的增加推动了小水力发电的需求。

- 2021年11月,欧洲投资银行(EIB)授予Iniziative Bresciane SpA(INBRE)4900万日元用于建设12座小流量水力发电厂,以加固和修復意大利托斯卡纳阿尔诺河上的13座河堰。 INBRE 将把该计划所需的 EIB 资金借给 Iniziative Toscane (Intos)。

- 此外,2022年9月,Voltalia宣布计画在法属圭亚那马里帕-苏拉省开发一座2.9兆瓦的径流式水力发电厂。该公司已与EDF SEI签署了为期30年的购电协议,该合约计划于2026年随着计划的试运行开始生效。法国能源管理委员会(CRE)批准了该合约。

- 因此,由于上述因素,预计1-10兆瓦装置容量段将在预测期内主导欧洲小水力发电市场。

挪威主导市场

- 挪威拥有欧洲最大的水力发电能力,到2021年将增加396兆瓦的发电量,其中约70兆瓦来自现有发电厂的升级改造。除62MW Jolstra水力发电厂、42MW Tolga水力发电厂及22MW Herand水力发电厂外,50个新计画均为10MW及以下小型水力发电厂。

- 挪威的小型水力发电厂及时竣工,赶上了绿色电力的再生能源凭证的截止日期,绿色电力证书是该国针对所有可再生能源的补贴计划,该计划将于 2021 年 12 月结束。

- 2021年,挪威是欧洲最大的水力发电国,发电量约144兆瓦时。挪威在水力发电装置容量方面也领先欧洲。瑞典是该地区第二大水力发电国,发电量为 71兆瓦时。

- 2022 年 5 月,欧洲最大的可再生能源公司 Statkraft运作了位于哈当厄尔高原对岸的两座小型水力发电厂 Vesle Kjela 和 Storlia。这些发电厂每年生产的电力足以为约 4,000 个挪威家庭供电。

- 因此,由于上述因素,预计挪威在预测期内将主导欧洲小水力发电市场。

欧洲小水电产业概况

欧洲小水力发电市场适度细分。市场上的主要企业包括(排名不分先后)Voith GmbH &Co.KGaA、Siemens Energy AG、Andritz AG、GE Renewable Energy 和 Electricite de France SA (EDF)。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2027年小水力发电装置容量及预测(单位:GW)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

第六章 能力

- 1MW以下

- 1~10MW

第七章 区域范围

- 英国

- 挪威

- 荷兰

- 德国

- 欧洲其他地区

第八章 竞争格局

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Voith GmbH & Co. KGaA

- Siemens Energy AG

- Andritz AG

- GE Renewable Energy

- Iberdrola SA

- Electricite de France SA(EDF)

- PJSC RusHydro

- Gilbert Gilkes & Gordon Ltd.

- Kolektor Group

第九章 市场机会及未来趋势

简介目录

Product Code: 92863

The Europe Small Hydropower Market is expected to register a CAGR of greater than 4% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently, the market reached pre-pandemic levels.

Key Highlights

- Over the medium term, increased investments and ambitious hydropower targets are expected to drive the market's growth.

- On the other hand, technical drawbacks of the string inverters are expected to hamper the growth of Europe's small hydropower market during the forecast period.

- Nevertheless, in the forecast period, an increasing number of new small hydropower projects backed by government support will likely create lucrative growth opportunities for the Europe small hydropower market.

- Norway dominates the market and would likely witness the highest CAGR during the forecast period. This growth is attributed to the increasing investments, coupled with supportive government policies in the country.

Europe Small Hydropower Market Trends

1-10 MW Capacity Segment to Dominate the Market

- The 1-10 MW capacity segment is projected to be the most abundant small hydropower market during the forecast period. This is attributed to the small-scale decentralized projects deployed in Europe for electrification.

- In 2021, Europe's hydropower installed capacity recorded 224 GW. The total hydropower installed capacity includes hydropower generated for small, medium, and large-scale hydropower projects.

- Europe has witnessed significant growth in the 1-10 MW segment of the small hydropower market, with most installations coming from countries like Norway, France, and Italy. The demand for small hydropower is driven by increasing investments in rural electrification in these countries.

- In November 2021, The European Investment Bank (EIB) announced the funding of EUR49 million to Iniziative Bresciane SpA (INBRE) to construct 12 small run-of-river hydroelectric plants for the enhancement and restoration of 13 river weirs on the Arno river in Tuscany, Italy. INBRE will lend the EIB funds to Iniziative Toscane (Intos) for the project.

- Moreover, in September 2022, Voltalia announced plans to develop a 2.9MW run-of-river hydroelectric power station in the commune of Maripa-Soula in French Guiana. The company signed a 30-year contract with EDF SEI for the sale of electricity, and the contract due to start with the commissioning of the project is scheduled for 2026. The French Energy Regulation Commission (CRE) authorized the deal.

- Therefore, based on the factors mentioned above, the 1-10 MW capacity segment is expected to dominate the Europe small hydropower market during the forecast period.

Norway to Dominate the Market

- Norway has the largest installed hydropower fleet in Europe, which increased its capacity by 396 MW in 2021 including around 70 MW from upgrades at existing plants. About 50 new projects commissioned were small-scale hydro below 10 MW in size, in addition to the 62 MW Jolstra, 42 MW Tolga and 22 MW Herand larger hydropower stations.

- Norway's small hydropower plants were completed on time to meet the deadline for green electricity certificates, a national subsidy scheme covering all renewable energy sources that ended in December 2021.

- In 2021, Norway was the largest hydropower-producing country in Europe, with some 144 terawatt-hours generated. Norway is also the leading European country in terms of installed hydropower capacity. Sweden ranked second in hydropower generation in the region, with 71 terawatt-hours.

- In May 2022, Statkraft, Europe's largest renewable energy company, commenced the two small-scale hydropower power plants, Vesle Kjela and Storlia, located on opposite sides of the Hardanger mountain plateau. The plants produce enough electricity to power around 4,000 Norwegian households annually.

- Therefore, based on the above-mentioned factors, Norway is expected to dominate the Europe small hydropower market during the forecast period.

Europe Small Hydropower Industry Overview

Europe's small hydropower market is moderately fragmented in nature. Some of the major players in the market (in no particular order) include Voith GmbH & Co. KGaA, Siemens Energy AG, Andritz AG, GE Renewable Energy, and Electricite de France SA (EDF).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Small Hydropower Installed Capacity and Forecast in GW, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

6 Capacity

- 6.1 Up to 1 MW

- 6.2 1-10 MW

7 Geography

- 7.1 United Kingdom

- 7.2 Norway

- 7.3 Netherlands

- 7.4 Germany

- 7.5 Rest of Europe

8 COMPETITIVE LANDSCAPE

- 8.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 8.2 Strategies Adopted by Leading Players

- 8.3 Company Profiles

- 8.3.1 Voith GmbH & Co. KGaA

- 8.3.2 Siemens Energy AG

- 8.3.3 Andritz AG

- 8.3.4 GE Renewable Energy

- 8.3.5 Iberdrola SA

- 8.3.6 Electricite de France SA (EDF)

- 8.3.7 PJSC RusHydro

- 8.3.8 Gilbert Gilkes & Gordon Ltd.

- 8.3.9 Kolektor Group

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219