|

市场调查报告书

商品编码

1631618

小水力发电 -市场占有率分析、产业趋势/统计、成长预测(2025-2030)Small Hydropower - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

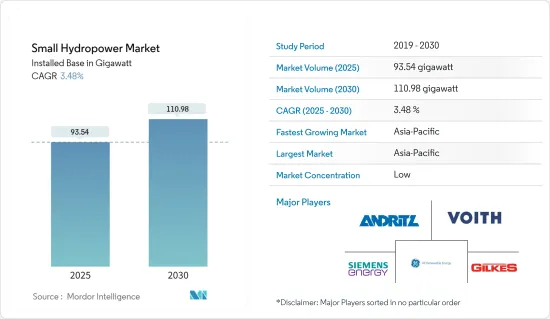

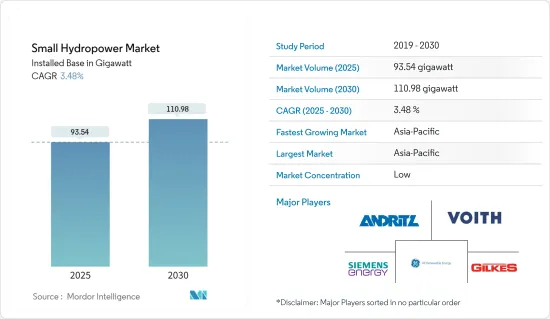

小水力发电市场规模预计将从2025年的93.54吉瓦扩大到2030年的110.98吉瓦,预测期间(2025-2030年)复合年增长率为3.48%。

主要亮点

- 中期来看,小水力发电市场投资增加和绿能需求上升等因素预计将推动市场发展。

- 另一方面,不稳定的能源供应极大地阻碍了市场的成长。

- 物联网与水力发电的整合以及小水力发电维持农村生计的积极前景预计将为小水力发电市场创造巨大机会。

- 由于电力需求旺盛,亚太地区预计将成为预测期内最大的市场。预计这将导致进一步增长。

小水力发电市场趋势

1-10MW细分市场预计将主导市场

- 在预测期内,1-10兆瓦部分预计将拥有小水力发电市场的最大容量。 1-10 MW 电厂的比例如此之高,是由于开发中国家(特别是亚洲)正在开发小型分散的农村电气化计划。

- 此外,1至10兆瓦之间的小水力发电厂每千瓦的投资成本通常低于1兆瓦以下的电站。此外,1~10MW水力发电厂具有水头高、装置容量大的优点。

- 印度和中国等新兴经济体、东南亚和乌兹别克等地区以及英国等欧洲国家都将小水力发电发电工程与其他再生能源来源同等重视。

- 根据英国能源统计摘要 (DUKES) 的数据,2013 年至英国英国水力发电发电量持续成长。到 2023 年,英国已从小型水力发电设施获得了 1,377 吉瓦时的电力。预计这种成长率将在预测期内持续下去。

- 此外,国际可再生能源机构(IRENA)对开发中国家的几个实际小水力发电发电工程进行了评估,发现度电成本在0.02美元/千瓦时至0.10美元/千瓦时之间。因此,小规模水力发电被定位为电网供电和离网农村电气化工作的具有成本竞争力的选择。在这种情况下,许多新兴国家的小型发电工程正在蓬勃发展。

- 例如,20242年4月,肯亚国家发电公司肯亚发电公司(KenGen)邀请合格顾问表达意向。其重点是为开发新的小型水力发电厂进行预可行性研究,并评估现有发电厂修復和再开发的潜力。

- 因此,由于上述因素,预计1-10兆瓦装置容量领域将在预测期内主导全球小水力发电市场。

亚太地区预计将主导市场

- 近年来,亚太地区在小水力发电 (SHP) 市场上占据主导地位,并可能在预测期内保持其主导地位。截至2023年,亚太地区持续拥有最大的装置容量和高达10MW的小水力发电潜力。

- 印度和中国等主要国家将小水力发电发电工程与其他再生能源来源同等重视。例如,2016年,印度鲁尔基理工学院对小水力发电的潜力进行了评估。根据结果,小水力发电潜力估计为 21,133 兆瓦,分布在 7,133 个已确定地点。该评估包括流域、运河和水坝计划。

- 根据中央电力局 (CEA) 报告,截至 2024 年 3 月,印度小型水力发电 (SHP)总设备容量为 5,003.25 兆瓦。 2023-24年小水力发电发电容量为948,504万单位(MU)。

- 此外,越南于2021年宣布了电力发展计画8(PDP8),目标是到2045年将可再生能源的份额提高到75%。小水力发电总发电量目标是2025年达到4800MW,2030年达到5,000MW,2045年接近6,000MW。政府计划在电力领域投资130亿美元,其中水电占总总设备容量的17.7%至19.5%。

- 此外,该地区的小型发电工程也得到了大力发展。例如,2024 年 1 月,梅加拉亚邦政府与 ONGC Tripura Power Company Ltd (OTPC) 签署了一份谅解备忘录 (MOU),以采取战略倡议来利用该州巨大的水力发电潜力。该谅解备忘录设定了雄心勃勃的目标,包括建立抽水蓄能发电工程、大大小小的水力发电企业以及浮体式太阳能发电工程等创新解决方案。

- 因此,由于上述因素,亚太地区预计将在预测期内主导全球小水力发电市场。

小水电产业概况

全球小水力发电市场是细分的。主要参与企业(排名不分先后)包括 Andritz AG、Voith GmbH &Co.KGaA、Siemens Energy AG、GE Renewable Energy 和 Gilbert Gilkes &Gordon Ltd。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 到2029年的装置容量和预测

- 主要地区小型水力发电装置容量占比(2023年)

- 管道和即将进行的小型发电工程

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 对清洁和可持续电力的需求快速增长

- 抑制因素

- 能源供应不稳定

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 发电能力

- 1MW以下

- 1~10MW

- 目的

- 电力基础设施

- 土木工程工作

- 其他的

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧的

- 土耳其

- 俄罗斯

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 越南

- 其他亚太地区

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 奈及利亚

- 埃及

- 南非

- 其他中东/非洲

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 北美洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Voith GmbH & Co. KGaA

- Andritz AG

- GE Renewable Energy

- Siemens Energy AG

- Gilbert Gilkes & Gordon Ltd.

- Toshiba Energy Systems & Solutions Corporation

- PJSC RusHydro

- FLOVEL Energy Private Limited

- Natel Energy, Inc.

- Kolektor Group

- List of Other Prominent Players

- 市场排名分析

第七章 市场机会及未来趋势

- 物联网与水力发电融合,小水力发电大坝前景看好

简介目录

Product Code: 72369

The Small Hydropower Market size in terms of installed base is expected to grow from 93.54 gigawatt in 2025 to 110.98 gigawatt by 2030, at a CAGR of 3.48% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors like increasing investment in the small hydropower market and increasing demand for clean electricity are expected to drive the market.

- On the other hand, an unstable energy supply significantly hinders market growth.

- Nevertheless, integrating IoT with hydropower and the positive outlook toward small hydropower dams to sustain lives in rural communities are expected to create enormous opportunities for the Small Hydropower Market.

- Asia-Pacific is expected to be the largest market in the forecast period due to the high demand for electricity in the region. This will facilitate further growth.

Small Hydropower Market Trends

The 1-10 MW Segment Expected to Dominate the Market

- During the forecast period, the 1-10 MW segment is expected to be the most abundant small hydropower market in capacity. This higher proportion of 1-10 MW plants can be attributed to small-scale decentralized projects for rural electrification deployed in developing countries, particularly in Asia.

- Further, the investment costs per kW for small hydropower plants in the 1 - 10 MW range are generally lower than those for plants under 1 MW. The 1 - 10 MW plants also benefit from a higher head and greater installed capacity.

- Developing economies, such as India and China, regions in Southeast Asia and Uzbekistan, and countries in Europe, like the United Kingdom, are giving equal priority to small hydropower projects along with other renewable energy sources.

- According to Digest of UK Energy Statistics (DUKES), From 2013 to 2023, the United Kingdom (UK) saw a consistent rise in electricity generation from small-scale hydro sources. By 2023, the UK harnessed 1,377 gigawatt hours of electricity from its small hydropower facilities. This increase in growth rate is expected to continue during the forecasted period.

- Moreover, the International Renewable Energy Agency's (IRENA) evaluation of several real-world small hydropower projects in developing countries revealed an LCOE range of USD 0.02 to USD 0.10/kWh. This positions small hydro as a highly cost-competitive choice for grid electricity supply and off-grid rural electrification initiatives. Many developing countries witnessed significant developments in small hydropower projects in such a scenario.

- For instance, in April 20242, Kenya Electricity Generating Company (KenGen), the state power producer of Kenya, called for expressions of interest from qualified consultants. The focus is on conducting pre-feasibility studies for the development of new small hydropower plants and assessing the potential rehabilitation and redevelopment of existing ones.

- Therefore, based on the abovementioned factors, the 1-10 MW capacity segment will dominate the small global hydropower market during the forecast period.

Asia-Pacific Expected to Dominate the Market

- The Asia-Pacific region has dominated the small hydropower (SHP) market in recent years and will likely maintain its dominance during the forecast period. As of 2023, Asia-Pacific continues to have the largest installed capacity and potential for small hydropower up to 10 MW.

- Major countries such as India and China are giving equal priority to small hydropower projects along with other renewable energy sources. For instance, in 2016, the Indian Institute of Technology, Roorkee, conducted an assessment of the potential for Small Hydropower. According to their findings, Small Hydropower has an estimated potential of 21,133 MW, spread across 7,133 identified sites. This assessment encompasses Run-of-River, Canal-based, and Dam-toe projects.

- As of March 2024, the total installed capacity for small-hydro power (SHP) in India reached 5,003.25 MW, as reported by the Central Electricity Authority (CEA). In the fiscal year 2023-24, SHP plants generated 9,485.04 million units (MUs).

- Furthermore, Vietnam published Power Development Plan 8 (PDP8) in 2021, which targets a share of 75% for renewable energy by 2045. The total capacity of small hydropower sources is targeted to reach 4,800 MW in 2025, 5,000 MW in 2030, and nearly 6,000 MW by 2045. The government plans to invest USD 13 billion in the power sector, and hydropower would account for 17.7% -19.5% of the total installed capacity.

- Further, the region witnessed significant developments in small-scale hydro projects. For instance, in January 2024, the government of Meghalaya signed a Memorandum of Understanding (MOU) with ONGC Tripura Power Company Ltd (OTPC), marking a strategic initiative to tap into the state's vast hydropower potential. The MOU sets ambitious goals, including establishing a Pump Storage Hydro Power Project, various large and small-scale hydroelectric power ventures, and innovative solutions like floating solar projects.

- Therefore, based on the abovementioned factors, Asia-Pacific is expected to dominate the global small hydropower market during the forecast period.

Small Hydropower Industry Overview

The global small hydropower market is fragmented. Some major players (in no particular order) include Andritz AG, Voith GmbH & Co. KGaA, Siemens Energy AG, GE Renewable Energy, and Gilbert Gilkes & Gordon Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Installed Capacity and Forecast, till 2029

- 4.3 Small Hydropower Installed Capacity Share, by Major Region, 2023

- 4.4 Small Hydropower Projects in Pipeline and Upcoming

- 4.5 Recent Trends and Developments

- 4.6 Government Policies and Regulations

- 4.7 Market Dynamics

- 4.7.1 Drivers

- 4.7.1.1 Surge in Demand for Clean and Sustainable Power

- 4.7.2 Restraints

- 4.7.2.1 Unstable Energy Supply

- 4.7.1 Drivers

- 4.8 Supply Chain Analysis

- 4.9 Porter's Five Forces Analysis

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Consumers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitute Products and Services

- 4.9.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Capacity

- 5.1.1 Up to 1 MW

- 5.1.2 1-10 MW

- 5.2 Application

- 5.2.1 Power Infrastructure

- 5.2.2 Civil Works

- 5.2.3 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Nordic

- 5.3.2.7 Turkey

- 5.3.2.8 Russia

- 5.3.2.9 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Malaysia

- 5.3.3.6 Thailand

- 5.3.3.7 Vietnam

- 5.3.3.8 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 Saudi Arabia

- 5.3.4.2 United Arab Emirates

- 5.3.4.3 Nigeria

- 5.3.4.4 Egypt

- 5.3.4.5 South Africa

- 5.3.4.6 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Colombia

- 5.3.5.4 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Voith GmbH & Co. KGaA

- 6.3.2 Andritz AG

- 6.3.3 GE Renewable Energy

- 6.3.4 Siemens Energy AG

- 6.3.5 Gilbert Gilkes & Gordon Ltd.

- 6.3.6 Toshiba Energy Systems & Solutions Corporation

- 6.3.7 PJSC RusHydro

- 6.3.8 FLOVEL Energy Private Limited

- 6.3.9 Natel Energy, Inc.

- 6.3.10 Kolektor Group

- 6.4 List of Other Prominent Players

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Integrating IoT with Hydropower and the Positive Outlook toward Small Hydropower Dams

02-2729-4219

+886-2-2729-4219