|

市场调查报告书

商品编码

1636099

鼓风机 -市场占有率分析、产业趋势/统计、成长预测(2025-2030)Blowers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

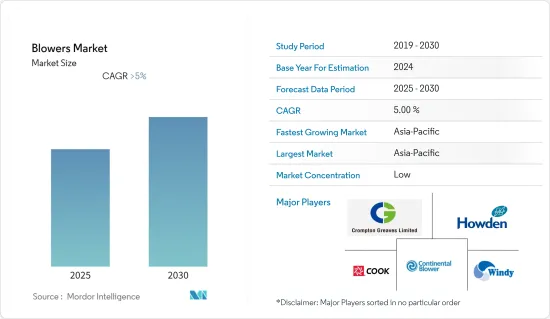

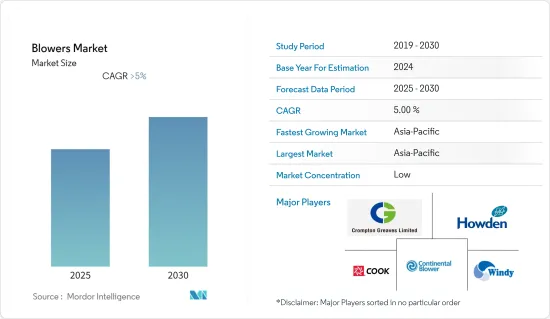

预计鼓风机市场在预测期内的复合年增长率将超过 5%。

2020年,COVID-19对市场产生了负面影响。目前,市场已达到疫情前水准。

主要亮点

- 从中期来看,由于工业自动化投资的增加和资料中心的兴起,对鼓风机的需求预计将增加。

- 另一方面,高昂的营运和维护成本预计将阻碍市场成长。

- 增加对製造节能鼓风机的技术投资预计将为鼓风机市场创造巨大的机会。

- 由于化学、采矿和石油和天然气计划的增加,预计亚太地区将在未来几年引领市场。

鼓风机市场趋势

石油和天然气产业预计将成长

- 在下游石油和天然气产业,风扇和鼓风机主要用于精製和石化过程中的排气、通风和维持气流。

- 世界各地也提案了几个石化计划。例如,预计2021年至2025年间,中国将有512家石化厂开始营运。根据国际能源总署 (IEA) 石化评估,到 2050 年,除欧洲外几乎所有地区的初级化学品产量都将增加。

- 此外,世界各地的石油消费量显着增加。例如,2021年石油消费量较2020年增加6.1%。 2021年石油消费量为9,690.8万桶/日,2020年约为9,136万桶/日。

- 下游产业的主要成长预计将来自中东和非洲。俄罗斯和乌克兰战争后,许多欧盟成员国开始依赖中东国家满足石油和天然气需求。

- 因此,为了满足全球需求、最大化盈利并更好地控制全球石油和天然气市场,该地区各国政府正在努力发展国内市场的下游产业。预计下游产业将占这些投资的最大份额。

- 根据BP《2022年世界能源统计年鑑》显示,全球可精製石油量大幅增加,2021年达到101,912桶/日。

- 例如,尼日利亚汽油综合国际公司宣布计划于2022年11月在尼日利亚通盖兹岛建造炼油厂。该炼油厂的精製能力为每天 100,000 公升,并可扩建至约 400,000 公升。计划预计36个月内完工,预计总投资约6,800万美元。

- 由于对石油产品的需求不断增加,石油和天然气产业预计将成为未来几年最重要的产业。

亚太地区主导市场

- 在亚太地区,工业和商业领域对风扇和鼓风机的需求量很大。新的公司办公室和办公室搬迁、增加仓库和配送中心、老化设施以及技术和物流要求等需求都在推动商业部门的发展。

- 这些是建筑业支出的增加以及对建筑所用货物和材料的需求的增加。这导致新基础设施中对通风系统的需求增加。

- 在工业领域,建筑业的成长、对天然气发电厂取代老式燃煤发电厂的关注以及石油和天然气基础设施的增长导致对风机和鼓风机(尤其是风机)的需求增加和带有防爆马达。

- 此外,钢铁业是风机和鼓风机的主要消费者之一。中国的钢铁产能位居世界第一。过去20年见证了全球最大规模的钢铁产能扩张。这种趋势导致了产能过剩。中国拥有全世界污染最严重的城市。

- 例如,2022年中国粗钢产量较2018年成长近8.5%。 2021 年总产量为 1,013,000 吨,而 2018 年为 929,038 吨。由于钢铁需求量大,未来几年也可能会发生同样的情况。

- 此外,印度和中国等国家的资料中心数量正在强劲增长,预计这种情况将在未来五年内持续下去。风扇和鼓风机用于加热、冷却、通风,并为这些资料中心提供必要的气流,资料中心数量的增加将导致对风扇和鼓风机的需求更大。

- 基于上述情况,预计亚太地区将在未来几年引领这一细分市场。

鼓风机产业概况

全球鼓风机市场较为分散。该市场的主要企业(排名不分先后)包括 Continental Blower LLC、CG Power and Industrial Solutions Limited、DongKun Industrial、Howden Group Ltd. 和 Loren Cook Company。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 技术部分

- 离心式

- 轴流式

- 部署

- 工业的

- 发电

- 石油和天然气

- 建造

- 钢

- 化学

- 矿业

- 其他部署类型

- 商业的

- 工业的

- 2028年之前的市场规模和需求预测(按地区)

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 澳洲

- 日本

- 其他亚太地区

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他中东/非洲

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 北美洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Acme Engineering & Manufacturing Corp.

- Airmaster Fan Company Inc.

- Continental Blower LLC

- CG Power and Industrial Solutions Limited

- DongKun Industrial Co. Ltd.

- Flakt Woods Group SA

- Gardner Denver Inc.

- Greenheck Fan Corp.

- Howden Group Ltd.

- Loren Cook Company

- Pollrich GmbH

第七章 市场机会及未来趋势

简介目录

Product Code: 93869

The Blowers Market is expected to register a CAGR of greater than 5% during the forecast period.

In 2020, COVID-19 negatively impacted the market. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, the increasing investment in industrial automation and the increasing number of data centers are expected to increase the demand for blowers.

- On the other hand, high operations and maintenance costs are expected to hinder market growth.

- Nevertheless, the increasing technological investments in the market to produce energy-efficient blowers are expected to create enormous opportunities for the blower market.

- Due to the growing number of chemical, mining, and oil and gas projects, Asia-Pacific is expected to lead the market over the next few years.

Blowers Market Trends

Oil and Gas Sector Expected to Witness Growth

- Fans and blowers are mostly used in the downstream part of the oil and gas industry for exhaust and ventilation and to keep the airflow going in refining and petrochemical processes.

- Additionally, several petrochemical projects are being proposed around the world. For instance, 512 petrochemical plants were anticipated to begin operations in China between 2021 and 2025. According to an International Energy Agency (IEA) petrochemicals assessment, practically all areas except Europe will increase their primary chemical production by 2050.

- Furthermore, the consumption of oil has increased significantly around the world. For instance, in 2021, oil consumption increased by 6.1% compared to 2020. In 2021, the oil consumption was 96908 thousand barrels per day, and in 2020, it was around 91360 thousand barrels per day.

- Major growth in the downstream sector is expected to come from the Middle East and African regions. After the Russia-Ukraine war, many of the countries in the European Union started depending on the Middle Eastern countries to meet their oil and gas needs.

- Therefore, to meet the global demand, maximize profitability, and gain more control over the global oil and gas market, governments in the region are moving toward developing the downstream sector in their domestic markets. The downstream sector is expected to receive the largest share of these investments.

- According to the BP Statistical Review of World Energy 2022, the amount of oil that can be refined around the world grew a lot, reaching 101,912 barrels per day in 2021.

- For example, Gasoline Integrated International of Nigeria announced planned to build a refinery on Tongeji Island in Nigeria in November 2022.The refinery will have a capacity of refining 100,000 liters per day, and the expansion capacity will be around 400,000 liters. The project is expected to be completed in 36 months, and the total investment in the project is expected to be around USD 68 million.

- Due to higher demand for petroleum products, the oil and gas industry is expected to be the most important segment over the next few years.

Asia-Pacific to Dominate the Market

- In the Asia-Pacific, fans and blowers have a huge demand in the industrial and commercial sectors. The need for new corporate offices and office relocations, more warehouses and distribution centers, as well as outdated facilities and technological and logistical requirements, all drive the commercial sector.

- These things have caused the construction industry to spend more money, which has increased the demand for goods and raw materials used in construction. This has translated into increased demand for ventilation systems in the new infrastructure.

- In the industrial sector, the growth of the construction industry, the focus on natural-gas-fired power plants to replace old coal-fired ones, and the growth of oil and gas infrastructure have all led to a higher demand for fans and blowers, especially those with explosion-proof motors.

- Additionally, the steel industry is one of the major consumers of fans and blowers. China has the biggest steel production capacity in the world. The country had the largest steel manufacturing capacity additions in the world during the past two decades. This trend resulted in excessive production capacity. China has some of the most polluted cities in the world.

- For instance, crude steel production in China increased by almost 8.5% in 2022 compared to 2018. In 2021, total production was 1013,000 metric tons, compared to 929,038 metric tons in 2018. Due to the high demand for steel, the same thing is likely to happen over the next few years.

- Also, the number of data centers in places like India and China has been growing a lot, and this is expected to continue over the next five years. Fans and blowers are used to provide heating, cooling, ventilation, and the necessary airflow for these data centers, and increasing the number of data centers will lead to a further increase in the demand for fans and blowers.

- Thus, based on the above, it seems likely that the Asia-Pacific region will lead this market segment over the next few years.

Blowers Industry Overview

The global blower market is fragmented. Some of the key players in this market (in no particular order) are Continental Blower LLC, CG Power and Industrial Solutions Limited, DongKun Industrial Co. Ltd., Howden Group Ltd., and Loren Cook Company.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Centrifugal

- 5.1.2 Axial

- 5.2 Deployment

- 5.2.1 Industrial

- 5.2.1.1 Power Generation

- 5.2.1.2 Oil and Gas

- 5.2.1.3 Construction

- 5.2.1.4 Iron and Steel

- 5.2.1.5 Chemical

- 5.2.1.6 Mining

- 5.2.1.7 Other Deployment Types

- 5.2.2 Commercial

- 5.2.1 Industrial

- 5.3 Geography [Market Size and Demand Forecast till 2028 (for regions only)]

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Australia

- 5.3.3.4 Japan

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 Saudi Arabia

- 5.3.4.2 United Arab Emirates

- 5.3.4.3 South Africa

- 5.3.4.4 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Columbia

- 5.3.5.4 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Acme Engineering & Manufacturing Corp.

- 6.3.2 Airmaster Fan Company Inc.

- 6.3.3 Continental Blower LLC

- 6.3.4 CG Power and Industrial Solutions Limited

- 6.3.5 DongKun Industrial Co. Ltd.

- 6.3.6 Flakt Woods Group SA

- 6.3.7 Gardner Denver Inc.

- 6.3.8 Greenheck Fan Corp.

- 6.3.9 Howden Group Ltd.

- 6.3.10 Loren Cook Company

- 6.3.11 Pollrich GmbH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219