|

市场调查报告书

商品编码

1636140

印度合约物流:市场占有率分析、产业趋势与统计、成长预测(2025-2030)India Contract Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

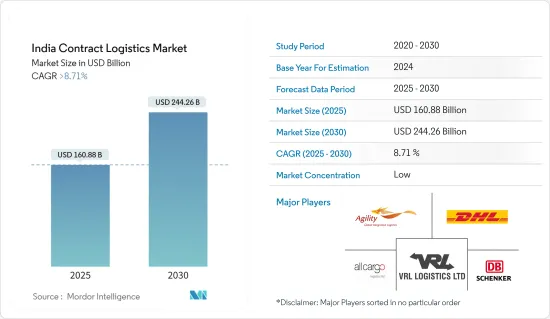

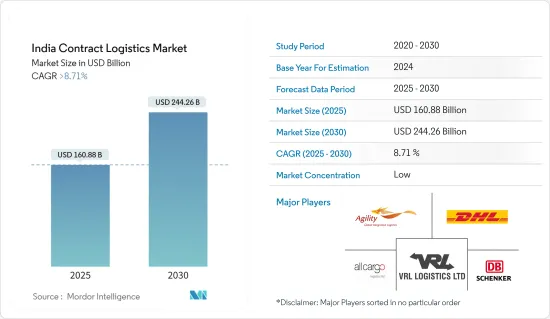

印度合约物流市场规模预计到2025年将达到1,608.8亿美元,预计2030年将达到2,442.6亿美元,预测期(2025-2030年)复合年增长率将超过8.71%。

主要亮点

- 随着印度经济持续崛起,合约物流的需求迅速增加。电子商务正在改变格局,客户优先考虑其核心竞争力,对客製化解决方案和成本效率的需求不断增加。这种不断变化的格局迫使参与企业跳出框框进行适应。过去十年,印度的合约物流领域经历了重大转型,这在很大程度上是由该国经济崛起所推动的。这个快速成长的市场的吸引力甚至吸引了外国参与企业的注意。

- 例如,2023年8月,CMA CGM旗下子公司CEVA Logistics收购了孟买Stellar Value Chain Solutions 96%的股份,成为头条新闻。这项策略性倡议凸显了合约物流日益增长的重要性,特别是电子商务、汽车、食品、消费品、时尚、零售、医疗保健和製药等不同领域的履约服务。 Stellar目前在印度21个城市拥有70多个设施,总面积达770万平方英尺。

- 都市化、经济发展和新兴的中产阶级正在刺激印度国内的消费。这种激增延伸到家庭用品、汽车、消费品和奢侈品,并推动零售业合约物流的成长。

- 此外,电子商务已成为加强印度合约物流业的基石。行动商务的兴起、创新的付款方式、电子商务向农村地区的扩张以及人工智慧和自动化的采用等趋势正在重塑线上销售的动态。这一转变不仅将加强线上销售,还将扩大合约物流行业的成长。此外,巨量资料分析、物料输送设备和先进的追踪行动应用程式等尖端干预措施正在彻底改变印度的合约物流格局。

印度合约物流市场趋势

乘着印度内部资源物流电子商务与数位转型的浪潮

在供应链敏捷性、数位创新和电子商务繁荣的需求激增的推动下,印度的内部资源物流行业必将大幅扩张。大型公司主要主导这一领域,但随着技术降低传统的进入壁垒,中型公司也正在进入这一领域。电子商务的快速成长促使许多公司开发内部物流能力,以加快交付速度并更好地控制客户体验。随着物流业的发展,在电子商务快速发展的推动下,对服务的需求迅速增加。印度电子商务物流市场的主要驱动因素包括互联网普及率的提高、最后一英里配送的兴起、由于有吸引力的折扣而增加的网路购物偏好以及网上杂货物流范围的扩大。

据预测,2030年,印度电子商务产业规模将激增至3,250亿美元。到 2024 年,第三方物流供应商将在未来七年内处理约 170 亿件货物。印度拥有约9.3616亿网路用户,其中约3.5亿是积极参与交易的资深线上用户。 2023 年 12 月,印度电商巨头 Flipkart 准备在新资金筹措中筹集 10 亿美元,母公司沃尔玛预计将融资 6 亿美元。在此轮融资的基础上,Google LLC 将于 2024 年 5 月向 Flipkart 注资 3.5 亿美元。此次资金筹措主要由 Flipkart 的大股东沃尔玛公司主导,旨在扩大 Flipkart 的业务,并为更广泛的印度客户群实现其数位框架的现代化。此外,两家公司还正在製定一项策略,以加强 Flipkart 与Google云端平台的整合。

随着电子商务在全球范围内日益普及,合约物流的角色对于零售公司来说变得至关重要。随着公司专注于整合线上和全通路策略,合约物流的重要性变得越来越明显。合约物流统筹库存管理、包装、运输、彙报、预测和仓储,在帮助零售商更好地履行线上订单方面发挥着至关重要的作用。

製造业和汽车业的成长推动合约物流市场

在「印度製造」倡议的推动下,合约物流市场正在强劲成长。製造商越来越注重核心竞争力,追求成本效率,并将先进技术融入其供应链活动。

同时,製造业正引领外包供应链管理的趋势。这项转变是由服务供应商发展成为关键合作伙伴推动的,他们提供全面的解决方案,包括文件、追踪、仓储和法规合规性。此外,汽车产业对多模态物流的需求正在增加。

同时,2023-24年,印度汽车零件进口额成长3%,达到209亿美元,高于2022-23年的203亿美元。来自亚洲的进口占总量的66%,其次是欧洲(26%)和北美(8%)。值得注意的是,来自亚洲的进口成长了3%。主要进口产品为引擎零件、车身及底盘、悬吊及煞车、变速箱及转向系统。因此,汽车进出口的增加预计将促进全国的合约物流服务。

印度合约物流业概况

印度的合约物流市场竞争激烈且分散,有许多国际参与者和小型国内参与者。

合约物流市场的主要企业正在采取行动,以最大限度地利用印度的机会。合约物流市场的主要企业包括德国邮政 DHL、DB Schenker、Kuehne+Nagel International AG 和 Allcargo。印度的合约物流业处于持续成长的曲线上。这种成长给产业带来了新的挑战,从运作更有效率的网路、扩大产品和服务组合到管理不可预测的成本。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

- 分析方法

- 调查阶段

第三章执行摘要

第四章市场洞察

- 市场概况

- 洞察技术趋势

- 政府法规与措施概述

- 价值链/供应链分析

- 洞察货运成本/运费

- 洞察该地区的电子商务产业(国内和跨境)

- 售后服务/逆向物流背景下对合约物流的见解

- 消费税实施对物流业影响的见解

- 合约物流参与企业提供的各种服务(一般仓储/运输、供应链服务和其他附加价值服务)概述

- 深入了解主要经济特区 (SEZS) 和製造地

- 地缘政治与疫情如何影响市场

第五章市场动态

- 马杰特 司机

- 电子商务的成长

- 政府措施提振市场

- 市场限制因素

- 缺乏技术纯熟劳工

- 高资金投入

- 市场机会

- 技术创新

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第六章 市场细分

- 按类型

- 内部资源

- 外包

- 按最终用户

- 製造/汽车

- 消费品/零售

- 高科技

- 医疗和製药

- 其他最终用户(能源、建筑、航太等)

第七章 竞争格局

- 市场集中度概览

- 公司简介

- 参与企业海外市场

- Kuehne+Nagel Private Limited

- Hellmann Worldwide Logistics India Private Limited

- Agility Logistics

- CH Robinson Worldwide Freight India Private Limited

- DSV Panalpina

- Nippon Express (India) Private Limited

- FedEx Corporation

- Expeditors International (India) Private Limited*

- 参与企业国内市场

- All Cargo Logistics Limited

- VRL Logistics Ltd

- Adani Logistics Company

- Aegis Logistics Ltd

- Transport Corporation of India

- Gati Litmited

- Delhivery Private Limited

- Future Supply Chain Solutions Ltd

- TVS Supply Chain Solutions*

- 参与企业海外市场

- 其他公司(Mahindra Logistics、Safexpress Pvt Ltd、Snowman Logistics、GS Logistics、Nitco Logistics、Gateway Distriparks Limited*)

第八章 市场未来展望

第九章 附录

- GDP 分布(依活动、地区)

- 资本流向洞察(按行业分類的投资金额)

- 深入了解主要出口目的地

- 主要进口原产国洞察

The India Contract Logistics Market size is estimated at USD 160.88 billion in 2025, and is expected to reach USD 244.26 billion by 2030, at a CAGR of greater than 8.71% during the forecast period (2025-2030).

Key Highlights

- As the Indian economy continues its upward trajectory, the demand for contract logistics is witnessing a notable surge. E-commerce is reshaping the landscape, and as customers prioritize their core competencies, there's an increasing demand for tailored solutions and cost efficiency. This evolving landscape is pushing players to adapt beyond their traditional boundaries. Over the past decade, the Indian contract logistics scene has undergone significant transformations, primarily fueled by the nation's economic ascent. The allure of this burgeoning market has even drawn the attention of foreign players.

- For instance, in August 2023, CMA CGM's subsidiary, CEVA Logistics, made headlines by acquiring a 96 percent stake in Mumbai's Stellar Value Chain Solutions. This strategic move underscores the growing prominence of contract logistics, especially with omnichannel fulfillment services spanning diverse sectors such as e-commerce, automotive, food products, consumer goods, fashion, retail, healthcare, and pharmaceuticals. Stellar, now a pivotal player, boasts an expansive footprint with 7.7 million square feet of space distributed across over 70 facilities in 21 cities throughout India.

- Urbanization, economic development, and a burgeoning middle class have fueled domestic consumption in India. This surge spans everyday fast-moving consumer goods, personal automobiles, household essentials, and even luxury items, all propelling the growth of contract logistics within the retail sector.

- Moreover, e-commerce stands as a cornerstone in bolstering the country's contract logistics sector. Trends like the rise of mobile commerce, innovative payment methods, e-commerce's reach into rural territories, and the adoption of artificial intelligence and automation are reshaping online sales dynamics. These shifts not only bolster online sales but also amplify the growth of the contract logistics sector. Furthermore, cutting-edge interventions such as big data analytics, intelligent material handling equipment, and advanced tracking mobile apps are revolutionizing India's contract logistics landscape.

India Contract Logistics Market Trends

India's Insourced Logistics: Riding the Wave of E-Commerce and Digital Transformation

Driven by the surging demand for supply chain agility, digital innovation, and the e-commerce boom, India's insourced logistics sector is on the brink of significant expansion. While predominantly dominated by large corporations, mid-sized enterprises are making their foray into the sector, due to technology reducing traditional entry barriers. The e-commerce surge has prompted numerous businesses to cultivate in-house logistics capabilities, ensuring quicker deliveries and enhanced control over customer experiences. As the logistics sector evolves, it's responding to the burgeoning demand for services, largely spurred by the rapid advancements in e-commerce. Key drivers for India's e-commerce logistics market include increased internet penetration, the rise of last-mile delivery, a growing preference for online shopping-amplified by attractive discounts-and the broadening scope of online grocery logistics.

Forecasts suggest the Indian e-commerce industry will soar to USD 325 billion by 2030. In 2024, third-party logistics providers are set to handle around 17 billion shipments over the next seven years. With approximately 936.16 million internet subscribers in India, about 350 million are seasoned online users actively participating in transactions. In December 2023, Indian e-commerce titan Flipkart is gearing up to secure USD 1 billion in a fresh funding round, with its parent entity, Walmart, expected to infuse USD 600 million. Further bolstering this round, in May 2024, Google LLC is channeling USD 350 million into Flipkart. This funding, predominantly led by Walmart Inc.-Flipkart's majority stakeholder-aims to amplify Flipkart's operations and modernize its digital framework for a broader Indian customer base. Additionally, both entities are strategizing to enhance Flipkart's integration with Google's cloud platform.

As e-commerce garners global momentum, the role of contract logistics has become paramount for retailers. The emphasis on cohesive online and omnichannel strategies highlights the critical nature of contract logistics. By overseeing inventory management, packaging, transportation, reporting, forecasting, and warehousing, contract logistics plays a pivotal role in enhancing online order fulfillment for retailers.

Growth in the Manufacturing and Automotive Sector Driving the Contract Logistics Market

Fueled by the 'Make in India' initiative, the contract logistics market is witnessing robust growth, largely due to the rapid expansion of the manufacturing industry. Manufacturers are increasingly emphasizing core competencies, seeking cost efficiencies, and integrating advanced technologies into their supply chain activities.

Simultaneously, the manufacturing sector has pioneered the trend of outsourcing supply chain management. This shift is bolstered by the evolution of service providers into pivotal partners, delivering comprehensive solutions that encompass documentation, tracking, warehousing, and legal compliance. Furthermore, the automobile sector is amplifying the demand for multi-modal logistics.

On the other hand, In 2023-24, India saw a 3 percent rise in auto component imports, totaling USD 20.9 billion, up from USD 20.3 billion in 2022-23. Asia dominated the import landscape, contributing 66 percent, trailed by Europe at 26 percent and North America at 8 percent. Notably, imports from Asia experienced a 3 percent uptick. Major import categories encompassed engine components, body & chassis, suspension & braking, and drive transmission & steering. Thus, the growing automobile export imports are expected to drive contract logistics services across the country.

India Contract Logistics Industry Overview

The Contract Logistics market in India is fiercely competitive, fragmented in nature with the presence of many international and too many small domestic companies.

Key players in the contract logistics market are taking initiatives to gain maximum benefit from the opportunities in India. Some of the major players in the contract logistics market include Deutsche Post DHL, DB Schenker, Kuehne + Nagel International AG, Allcargo, among others. The contract logistics sector in India is on a constant growth curve. This growth has brought with it a new set of industry challenges, from running more efficient networks and expanding product and service portfolios to gaining control over unpredictable costs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Insights in Technological Trends

- 4.3 Brief on Government Regulations and Initiatives

- 4.4 Value Chain/Supply Chain Analysis

- 4.5 Insights on Freight Transportation Costs /Freight Rates

- 4.6 Insights on E-Commerce Industry in the Region (Domestic and Cross-Border)

- 4.7 Insights on Contract Logistics in the Context of After-Sales/Reverse Logistics

- 4.8 Insights on the impact of Implementation of GST in the Logistics Sector

- 4.9 Brief on Different Services Provided by Contract Logistics Players (Integrated Warehousing & Transportation, Supply Chain Services, and Other Value-Added Services)

- 4.10 Insights into Key Special Economic Zones (SEZS) and Manufacturing Hubs

- 4.11 Impact of Geopolitics and Pandemic on the Market

5 MARKET DYNAMICS

- 5.1 Marjet Drivers

- 5.1.1 Growth in Ecommerce

- 5.1.2 Government intiatives are boosting the market

- 5.2 Market Restriants

- 5.2.1 Skilled Labor Shortages

- 5.2.2 High Intiatial Investments

- 5.3 Market Oppurtunities

- 5.3.1 Technological Innovations

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Insourced

- 6.1.2 Outsourced

- 6.2 By End User

- 6.2.1 Manufacturing and Automotive

- 6.2.2 Consumer Goods & Retail

- 6.2.3 High - Tech

- 6.2.4 Healthcare and Pharmaceutical

- 6.2.5 Other End Users (Energy, Construction, Aerospace, etc.)

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 International Players

- 7.2.1.1 Kuehne + Nagel Private Limited

- 7.2.1.2 Hellmann Worldwide Logistics India Private Limited

- 7.2.1.3 Agility Logistics

- 7.2.1.4 CH Robinson Worldwide Freight India Private Limited

- 7.2.1.5 DSV Panalpina

- 7.2.1.6 Nippon Express (India) Private Limited

- 7.2.1.7 FedEx Corporation

- 7.2.1.8 Expeditors International (India) Private Limited *

- 7.2.2 Domestic Players

- 7.2.2.1 All Cargo Logistics Limited

- 7.2.2.2 VRL Logistics Ltd

- 7.2.2.3 Adani Logistics Company

- 7.2.2.4 Aegis Logistics Ltd

- 7.2.2.5 Transport Corporation of India

- 7.2.2.6 Gati Litmited

- 7.2.2.7 Delhivery Private Limited

- 7.2.2.8 Future Supply Chain Solutions Ltd

- 7.2.2.9 TVS Supply Chain Solutions *

- 7.2.1 International Players

- 7.3 Other Companies (Mahindra Logistics, Safexpress Pvt Ltd, Snowman Logistics, GS Logistics, Nitco Logistics, Gateway Distriparks Limited*)

8 FUTURE OUTLOOK OF THE MARKET

9 APPENDIX

- 9.1 GDP Distribution, by Activity and Region

- 9.2 Insight into Capital Flows (investments by sector)

- 9.3 Insight into Key Export Destinations

- 9.4 Insight into Key Import Origin Countries