|

市场调查报告书

商品编码

1636159

北美液氢 -市场占有率分析、产业趋势与统计、成长预测(2025-2030)North America Liquid Hydrogen - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

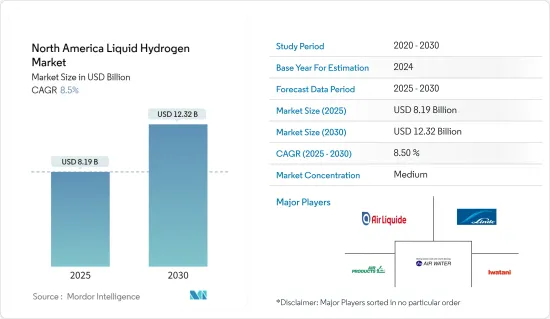

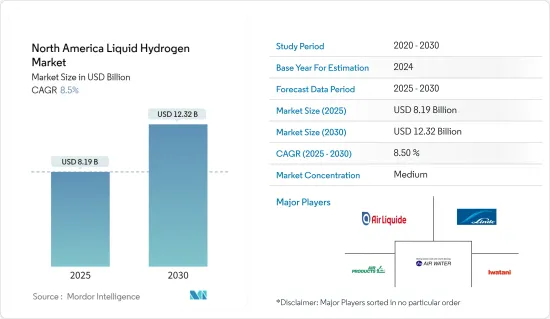

北美液氢市场规模预计到2025年为81.9亿美元,预计2030年将达123.2亿美元,预测期内(2025-2030年)复合年增长率为8.5%。

主要亮点

- 从中期来看,全球能源产业脱碳的日益关注、汽车产业和其他最终用户产业的成长和扩张等因素预计将在预测期内推动北美液氢市场的发展。

- 另一方面,与运输液氢相关的高成本预计将对液氢市场的成长构成重大挑战。大规模储存液氢的复杂性进一步限制了该市场的成长范围。

- 人们对液氢作为船用燃料的日益关注以及航太业不断推进的技术创新预计很快就会为北美液氢市场提供利润丰厚的成长机会。

- 预计在预测期内,美国将主导北美液氢市场。这是由于太空探勘对液氢的需求不断增加,以及氢燃料电池在商用车中的采用越来越多。

北美液氢市场趋势

汽车板块实现显着成长

- 由于汽车产业对无污染燃料的需求不断增加,北美液氢市场预计将显着成长。液氢具有更大的优势,因为它可以更好地储存和运输。

- 在汽车应用中,固体电解质燃料电池等新技术允许将液氢用作二次能源来源,而不排放二氧化碳。

- 到2022年,美国将拥有北美最多的加氢站。该国大约有 54 个正在运作的加氢站,其次是加拿大(9 个)。此外,根据美国氢能经济蓝图,2030年美国将建成4,300座大型加氢站。这几乎是2019年运作的大型加氢站数量的70倍。

- 此外,根据美国电池和氢能协会 (FCHEA) 的数据,到 2030 年,美国将有 4,300 个大型加氢站。然而,到2050年,运输燃料预计将占美国氢气需求的最大量。石化燃料动力汽车产生的污染直接排放到环境中,造成健康问题。

- 例如,2022年5月,液化空气集团上週在拉斯维加斯开设了一个新的液氢生产设施和物流中心,旨在抓住移动领域对液态氢作为燃料的新需求。氢气作为燃料在航运和物流领域越来越受欢迎,因为它不像电动车那样需要停机充电。新厂利用蒸汽甲烷重整从天然气中提取氢气,将能够生产足够为 40,000 辆汽车提供燃料的氢气。此类计划可能会在汽车领域创造对液氢的活跃需求。

- 因此,基于上述因素,预计汽车领域在预测期内北美液氢市场将表现出巨大的需求。

美国主导市场

- 北美地区石油和天然气下游产业的成长预计将对预测期内的氢需求产生积极影响。截至2023年8月,美国炼油厂的净氢供给能力为7,099,000桶。

- 在美国,页岩革命导致精製能力空前扩张,主要是在墨西哥湾沿岸。油气领域计划数量和投资金额稳定成长。氢气用于从化学分离过程(称为加氢脱硫)中产生的燃料中去除硫。

- 此外,美国能源资讯署(EIA)报告称,精製中的氢气净输入量为80,919,000桶,比2021年增长5.2%。氢气也广泛用于生产氨和甲醇,并为化学和工业应用提供工业热量。

- 美国一直处于氢及相关技术研发的前沿,从太空计画开始,一直延伸到交通、固定电源和携带式电源应用技术的商业化。多年来,能源部 (DOE) 根据多项法定授权,包括 Spark M. Matsunaga 氢研究、开发和 2005 年能源政策法案 ( EPACT)。

- 2022年10月,空气产品公司将投资约5亿美元,在纽约马塞纳的待开发区上建造一座日产35吨级的绿色(可再生)液态氢工厂,以及液态氢分销和销售业务I。并经营它。该设施预计将于 2026 年至 2027 年开始商业运营。

- 2024 年 1 月,Plug Power 获得了超过 10 亿美元的政府资金。我们已开始在乔治亚工厂生产液态绿氢。这些新兴市场的发展预计将对预测期内的北美液氢市场产生积极影响。

- 因此,由于上述因素,美国预计将在预测期内主导北美液氢市场。

北美液氢产业概况

北美液氢市场是一个半本土市场。该市场的主要企业(排名不分先后)包括液化空气公司、林德公司、空气化学产品公司、空气水公司和岩谷公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 全球能源脱碳日益受到关注

- 汽车工业的扩张

- 抑制因素

- 运输液态氢高成本

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 分配

- 容器

- 坦克

- 最终用户

- 车

- 化学/石化

- 航太

- 其他的

- 地区

- 美国

- 加拿大

- 其他北美地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Air Liquide SA

- Air Products and Chemicals, Inc.

- AIR WATER INC

- Iwatani Corporation

- Linde plc

- Universal Industrial Gases, Inc.

- Messer Group GmbH

- Engie SA

- Market Player Ranking

第七章 市场机会及未来趋势

- 人们越来越关注液氢作为船用燃料并不断加强航太业的创新

简介目录

Product Code: 50001782

The North America Liquid Hydrogen Market size is estimated at USD 8.19 billion in 2025, and is expected to reach USD 12.32 billion by 2030, at a CAGR of 8.5% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as increasing focus on the decarbonization of the global energy industry along with growth and expansion of the automobile industry and other end-user verticals are expected to drive the North America liquid hydrogen market during the forecast period.

- On the other hand, high costs associated with the transportation of liquid hydrogen is expected to pose a major challenge to the growth of the liquid hydrogen market. Complexities involved in storing liquid hydrogen on a large scale will further restrict the scope of growth for this market.

- Nevertheless, rising emphasis on liquid hydrogen as a marine fuel and increasing innovations in the aerospace industry is expected to create lucrative growth opportunities for the liquid hydrogen market in North America soon.

- United States is expected to dominate the North America liquid hydrogen market during the forecast period. Owing to the growing demand for liquid hydrogen for space exploration and the increasing adoption of hydrogen fuel cells in commercial vehicles.

North America Liquid Hydrogen Market Trends

Automotive Segment to Witness Significant Growth

- North America's liquid hydrogen market is expected to grow significantly due to the rising demand for clean fuel in the automotive industry. Liquid hydrogen offers more significant advantages because of its storage and transportation qualities.

- In an automotive application, liquid hydrogen can be used as a secondary energy source without emitting any CO2 using new technologies like Proton Exchange Membrane fuel cells to produce electricity for an electric drive and a direct fuel for ICE (internal combustion engines).

- In 2022, United States has the most significant number of hydrogen fueling stations in the North American region. There are about 54 operational hydrogen refueling stations in the country, followed by Canada (9 stations). Furthermore, as per the road map to a US hydrogen economy, 4,300 large hydrogen fueling stations in the United States were expected by 2030. This would be close to 70 times the number of operational large fueling stations in 2019.

- Moreover, according to United States Fuel Cell & Hydrogen Energy Association (FCHEA), by the year 2030, the country is expected to have 4,300 large hydrogen fueling stations. However, by 2050, transportation fuels are expected to account for the greatest volume of United States hydrogen demand becuase pollution all around the globe is increasing from vehicles and transportation over time. Pollution from fossil fuel-powered vehicles is emitted directly into the environment, which causes health risks.

- For instance, in May 2022, Air Liquide opened a new liquid hydrogen production facility and logistics center in Las Vegas last week, aiming to capitalize on emerging demand for liquid hydrogen as a fuel in the mobility sector. Hydrogen is gaining traction as a fuel within the shipping and logistics arena because it does not require downtime for charging like electric-powered vehicles. The new plant is capable of producing enough hydrogen to fuel 40,000 vehicles, using steam methane reforming, which derives hydrogen from natural gas. Such projects are likely to create positive demand for liquid hydrogen in automotive segment.

- Therefore, based on the above-mentioned factors, automotive segment is expected to witness significant demand in the North America liquid hydrogen market during the forecast period.

United States to Dominate the Market

- The growth of the oil and gas downstream sector in the North American region is expected to impact the demand for hydrogen during the forecast period positively. As of August 2023, the United States refinery net input of hydrogen capacity stands at 7,099 thousand barrels.

- The shale revolution in the United States has resulted in an unprecedented oil refining capacity creation and expansion, primarily along the Gulf Coast. As a result, steady growth in the number of projects and investments has been witnessed in the oil and gas sector. Hydrogen is used to remove the sulfur content from the fuels produced in a chemical separation process called hydro-desulphurization.

- Also, the United States Energy Information Administration (EIA) reported the net input of hydrogen in oil refining as 80,919 thousand barrels, recording a growth of 5.2% as compared to 2021 levels. Hydrogen is also used extensively in the generation of ammonia and methanol and in providing industrial heat for chemicals and industrial applications.

- The United States has been at the forefront of hydrogen and related technology R&D, from its inception in the space program to enabling technology commercialization in transportation, stationary power, and portable-power applications. Over the years, the Department of Energy (DOE) has established robust R&D activities on hydrogen and related technology aligned with several statutory authorities, including the Spark M. Matsunaga Hydrogen Research, Development, and the Energy Policy Act of 2005 (EPACT).

- Air Products, in October 2022, planned to invest about USD 500 million to build, own and operate a 35 tonne/day facility to produce green (renewable) liquid hydrogen at a greenfield site in Massena, New York, as well as liquid hydrogen distribution and dispensing operations. Commercial operation of this facility is expected to commence in 2026-2027.

- In January 2024, Plug Power secured over USD one billion in government funding. It commenced producing liquid green hydrogen at its Georgia plant. Such developments are likely to create positive impact on the North America liquid hydrogen market during the forecast period.

- Therefore, based on the above-mentioned factors, United States is expected to dominate the liquid hydrogen market in North America during the forecast period.

North America Liquid Hydrogen Industry Overview

The North America liquid hydrogen market is semi consolidated in nature. Some of the major players in the market (in no particular order) include Air Liquide S.A., Linde plc, Air Products and Chemicals Inc., Air Water Inc., and Iwatani Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Focus on the Decarbonization of Global Energy

- 4.5.1.2 Expansion of Automobile Industry

- 4.5.2 Restraints

- 4.5.2.1 High Costs Associated with Transportation of Liquid Hydrogen

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Distribution

- 5.1.1 Containers

- 5.1.2 Tanks

- 5.2 End-User

- 5.2.1 Automotive

- 5.2.2 Chemicals and Petrochemicals

- 5.2.3 Aerospace

- 5.2.4 Other End-Users

- 5.3 Geography

- 5.3.1 United States

- 5.3.2 Canada

- 5.3.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Air Liquide S.A.

- 6.3.2 Air Products and Chemicals, Inc.

- 6.3.3 AIR WATER INC

- 6.3.4 Iwatani Corporation

- 6.3.5 Linde plc

- 6.3.6 Universal Industrial Gases, Inc.

- 6.3.7 Messer Group GmbH

- 6.3.8 Engie SA

- 6.4 Market Player Ranking

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Emphasis on Liquid Hydrogen as a Marine Fuel and Increasing Innovations in the Aerospace Industry

02-2729-4219

+886-2-2729-4219