|

市场调查报告书

商品编码

1692454

液氢-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Liquid Hydrogen - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

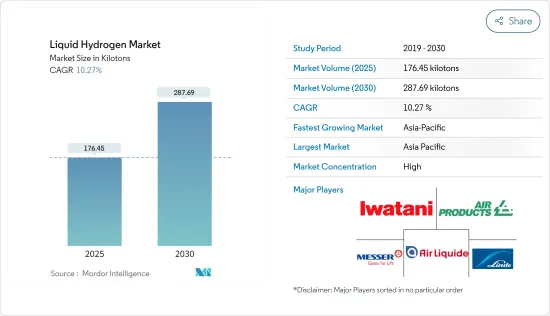

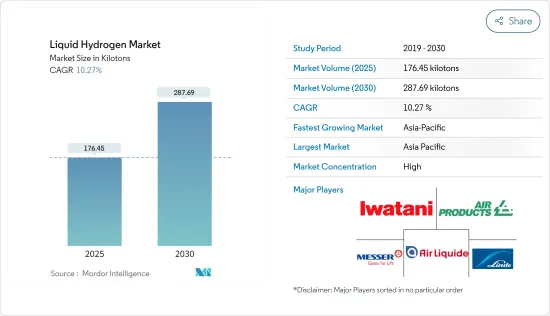

液氢市场规模预计在 2025 年为 176.45 千吨,预计在 2030 年达到 287.69 千吨,预测期内(2025-2030 年)的复合年增长率为 10.27%。

由于所有行业都停止了生产流程,COVID-19 对市场产生了负面影响。封锁、社交隔离和贸易制裁已对全球供应链网路造成严重破坏。不过,预计这种情况将在 2021 年恢復,有利于预测期内的市场。

主要亮点

- 从中期来看,太空探勘对液态氢的需求不断增长以及商用汽车对氢燃料电池的日益普及是推动市场发展的关键因素。

- 然而,与处理和储存相关的高成本可能会抑制市场成长。

- 人们对氢气作为船用燃料的使用日益重视以及航太工业的技术创新可能会在未来几年为市场提供机会。

- 亚太地区贡献了最高的市场占有率,并可能在预测期内占据市场主导地位。

液氢市场趋势

航太航太业占市场主导地位

- 航太工业代表了液氢在各种应用中的应用,从机场行李处理到氢动力飞机推进,再到太空产业的低温发动机。

- 对于推进应用,液氢与液态氧等氧化剂结合用作燃料。这种组合使其具有已知火箭推进剂中最高的比衝,或相对于消耗的推进剂量的效率。

- 根据国际航空运输协会(IATA)的预测,2021年全球商业航空公司的销售额将达到4,720亿美元,2022年将达到7,270亿美元,与前一年同期比较去年同期成长43.6%。预计到 2023 年底将达到 7,790 亿美元。

- 随着空中交通从疫情引发的放缓中復苏,各国正加强温室气体排放法规,推动航空业走向碳中和。例如,2022年6月,美国联邦航空管理局提案了新的气候规则,以遏止温室气体排放。新规则将适用于已投入使用的飞机,并允许製造商改善动态和引擎效率。该规则对尚未获得认证的新型亚音速喷射机、大型涡轮螺旋桨飞机和螺旋桨飞机以及2028年1月后製造的飞机提出了效率要求。

- 世界各地的太空计画都依赖液态氢作为各种航太计画的火箭燃料。近年来,太空计画的成长推动了对液态氢的需求。

- 2022年,全球各国政府在太空计画上的支出大幅增加。以美国为例,政府支出从2021年的545.9亿美元增加到2022年的619.7亿美元。

- 技术进步的快速成长正在产生对更先进卫星的需求。结果,2022 年尝试了 186 次以上的轨道发射,其中 180 次成功。

- 据美国国家航空暨太空总署太空总署称,太空梭的火箭发动机在每次发射过程中消耗约 50 万加仑的冷冻液氢,另外在储存蒸发和转移操作中还会消耗 239,000 加仑。每次发射的消费量增加以及发射频率的增加正在推动对液氢的需求。

- 因此,预计预测期内航太工业对液氢的需求将会成长。

亚太地区占市场主导地位

- 由于中国、印度和日本等国家对液氢的需求不断增加,预计亚太地区将在预测期内成为最大的液氢市场。

- 由于对替代燃料的需求强劲,尤其是在航太和汽车产业,中国已成为液氢强大且利润丰厚的市场。随着航太领域的显着增长,包括卫星发射和火箭任务数量的增加,对液氢的需求正在急剧增加,因为它在火箭燃料中发挥着至关重要的作用。

- 中国燃料电池汽车销售和产量的不断增长也促进了液氢燃料电池的需求成长。根据中国工业协会预测,2022年氢燃料电池汽车产销将分别达到3,626辆和3,367辆,较前一年增加一倍以上。

- 氢燃料已显示出作为飞机和汽车动力来源的潜力,印度正在大力发展和努力推动氢发动机的发展。例如,2023年2月,信实工业有限公司和阿萧克利兰推出了印度首款氢内燃机(H2-ICE)驱动的重型卡车。该卡车将使用氢气驱动,同时保留传统的柴油内燃机结构。 H2-ICE 卡车的负载容量为 19 至 35 吨,能够以相对较低的成本差异快速过渡到更清洁的能源。

- 根据汽车检查和登记资讯协会 (AIRIA) 的数据,截至 2022 年 3 月 31 日,日本共有约 7,110 辆氢燃料电池汽车投入使用,高于 2021 财年的 5,280 辆。这些氢燃料电池汽车大部分是以氢气为动力的乘用车。

- 因此,受上述因素影响,预计预测期内亚太地区液氢需求将会增加。

液氢产业概况

液氢市场高度整合。市场的主要企业(不分先后顺序)包括液化空气集团、空气产品和化学品公司、林德集团、岩谷公司和梅塞尔集团有限公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 太空探勘对液态氢的需求不断增加

- 氢燃料电池在商用车辆的应用日益增多

- 限制因素

- 高成本

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 分配

- 低温储罐

- 高压管拖车

- 最终用户产业

- 车

- 航太(包括航天)

- 海洋

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 世界其他地区

- 南美洲

- 中东和非洲

- 亚太地区

第六章竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Air Liquide

- Air Products and Chemicals, Inc.

- Iwatani Corporation

- Linde PLC

- Messer Group GMBH

- Nippon Sanso Holdings Corporation

- Universal Industrial Gases Inc.

第七章 市场机会与未来趋势

- 氢气作为船用燃料日益受到重视

- 航太工业技术创新的进步

The Liquid Hydrogen Market size is estimated at 176.45 kilotons in 2025, and is expected to reach 287.69 kilotons by 2030, at a CAGR of 10.27% during the forecast period (2025-2030).

COVID-19 negatively impacted the market as all the industries halted their manufacturing processes. Lockdowns, social distances, and trade sanctions triggered massive disruptions to global supply chain networks. However, the condition is recovered in 2021, which is expected to benefit the market during the forecast period.

Key Highlights

- In the medium term, the major factors driving the market studied are the growing demand for liquid hydrogen for space exploration and the increasing adoption of hydrogen fuel cells in commercial vehicles.

- On the flip side, the high cost associated with handling and storage is likely to restrain the market growth.

- Growing emphasis on utilizing hydrogen as a marine fuel and increasing innovations in the aerospace industry are likely to act as opportunities for the market in the coming years.

- Asia-Pacific accounted for the highest market share, and the region is likely to dominate the market during the forecast period.

Liquid Hydrogen Market Trends

Aerospace Industry to Dominate the Market

- Aerospace industries imply the application of liquid hydrogen for various applications ranging from airport bagging handling to hydrogen aircraft propulsion to cryogenic engines in the space industry.

- In propulsion applications, liquid hydrogen is used in combination with an oxidizer, such as liquid oxygen, to serve as fuel. This combination yields the highest specific impulse, or efficiency in relation to the amount of propellant consumed, of any known rocket propellant.

- According to the International Air Transport Association (IATA), the global revenue for commercial airlines was valued at USD 472 billion in 2021 and USD 727 billion in 2022, registering a growth rate of 43.6% Y-o-Y. Furthermore, the revenue is expected to reach USD 779 billion by the end of 2023.

- As air traffic recovers from the pandemic slowdown, the regulations on controlling greenhouse gas emissions are being tightened in different economies to head forward with the transition to carbon neutrality in the aviation sector. For instance, the Federal Aviation Administration, in June 2022, proposed new climate rules for curtailing GHG emissions. The new rules will be applied to planes already in service, allowing manufacturers to improve aerodynamics and engine efficiency. The rules would enforce efficiency requirements for new subsonic jet aircraft, large turboprop and propellor planes that are not yet certified, and planes built after January 2028.

- Space programs across the world rely on liquid hydrogen as the rocket fuel for various aerospace operations. The recent growth in space programs has been driving the demand for liquid hydrogen in recent years.

- In 2022, global government expenditure for space programs in various countries increased considerably. For instance, in the United States, government spending grew from USD 54.59 billion in 2021 to USD 61.97 billion in 2022.

- Rapid growth in technological advancements is creating the demand for more advanced satellites. As a result, in 2022, over 186 attempts of orbital launches, of which 180 were successful.

- According to the National Aeronautics and Space Administration (NASA), for each launch, the rocket engines of each shuttle flight burn about 500,000 gallons of cold liquid hydrogen, with another 239,000 gallons depleted by storage boil-off and transfer operations. The large volume of consumption per operation, coupled with the growing frequency of launches, is propelling the demand for liquid hydrogen.

- Therefore, the demand for liquid hydrogen is expected to grow in the aerospace industry during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to be the largest market for liquid hydrogen during the forecast period owing to the growing liquid hydrogen demand in China, India, and Japan, among others.

- China's strong inclination toward alternative fuels, particularly in the aerospace and automotive industries, positions the country as a robust and favorablemarket for liquid hydrogen. With substantial growth in the aerospace sector, including increased satellite launches and rocket missions, the demand for liquid hydrogen has witnessed a positive surge due to its essential role in rocket fuel.

- The rising sales and production of fuel cell vehicles in China have also contributed to the growing demand for liquid hydrogen-based fuel cells. According to the China Association of Automobile Manufacturers, the production and sales of hydrogen fuel cell vehicles in 2022 more than doubled compared to the previous year, with 3,626 and 3,367 units produced and sold, respectively.

- Hydrogen fuel presents opportunities for powering aircraft and automobiles, and significant developments and initiatives are taking place in India to advance hydrogen-powered engines. For instance, in February 2023, Reliance Industries Limited and Ashok Leyland launched India's first Hydrogen Internal Combustion Engine (H2-ICE) powered heavy-duty truck. This truck operates on hydrogen while maintaining a conventional diesel combustion engine architecture. With a 19 to 35 tons loading capacity, the H2-ICE truck enables a swift transition to cleaner energy at a relatively lower cost differential.

- According to the Automobile Inspection & Registration Information Association (AIRIA), as of March 31, FY 2022, Japan had approximately 7.11 thousand hydrogen fuel cell vehicles in use, representing an increase from 5.28 thousand in FY 2021. The majority of these hydrogen-fuel cell vehicles are hydrogen-fueled passenger cars.

- Hence, due to the abovementioned factors, the demand for liquid hydrogen in the Asia-Pacific region is expected to increase over the forecast period.

Liquid Hydrogen Industry Overview

The liquid hydrogen market is highly consolidated in nature. Some of the major companies in the market (not in any particular order) include Air Liquide, Air Products and Chemicals Inc., Linde PLC, Iwatani Corporation, and Messer Group GmbH.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Liquid Hydrogen for Space Exploration

- 4.1.2 Increasing Adoption of Hydrogen Fuel Cell in Commercial Vehicle

- 4.2 Restraints

- 4.2.1 High Cost Associated with Handling and Storage

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Distribution

- 5.1.1 Cryogenic Tank

- 5.1.2 High-Pressure Tube Trailers

- 5.2 End-user Industry

- 5.2.1 Automotive

- 5.2.2 Aerospace (including Outer Space)

- 5.2.3 Marine

- 5.2.4 Other End-User Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Air Liquide

- 6.4.2 Air Products and Chemicals, Inc.

- 6.4.3 Iwatani Corporation

- 6.4.4 Linde PLC

- 6.4.5 Messer Group GMBH

- 6.4.6 Nippon Sanso Holdings Corporation

- 6.4.7 Universal Industrial Gases Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Emphasis on Utilizing Hydrogen as a Marine Fuel

- 7.2 Increasing Innovations in Aerospace Industry