|

市场调查报告书

商品编码

1636167

日本船用燃料:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Japan Bunker Fuel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

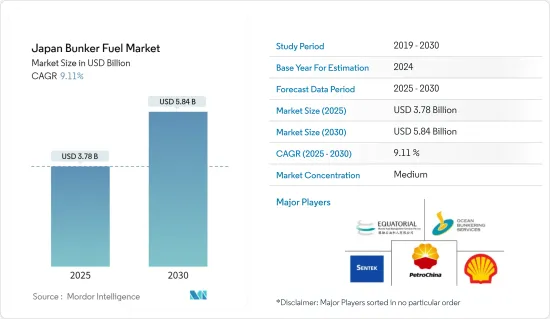

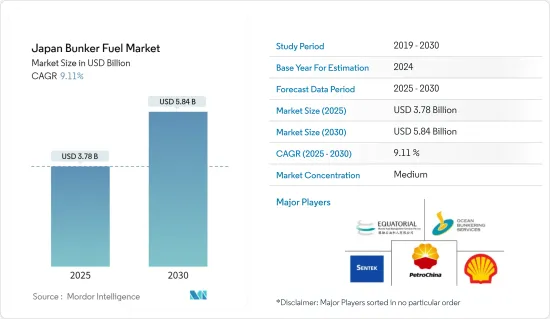

日本船用燃料市场规模预估至2025年为37.8亿美元,预估至2030年将达58.4亿美元,预测期间(2025-2030年)复合年增长率为9.11%。

主要亮点

- 中期来看,由于实施更严格的环境法规而导致对清洁船用燃料的需求增加以及各地区电力行业扩大液化天然气贸易等因素预计将推动2024年至2029年的市场。

- 另一方面,船用燃料和原油成本的变化预计将阻碍市场成长。

- 预计2024年至2029年,服役船舶数量和海上运输需求将创造多个未来市场机会。

日本燃料油市场趋势

极低硫燃料油(VLSFO)显着成长的前景

- 船用燃料硫含量高,会排放有害气体。有多种方法可以降低硫含量。超低硫燃料油就是此类燃料之一。随着 IMO 法规于 2020 年 1 月生效,对硫含量为 0.5% 或以下的极低硫燃油 (VLSFO) 的需求不断增加。

- 预计大部分高硫燃料油(HSFO)船用燃料油市场很快就会被低硫替代品取代。市面上大多数的 VLSFO 将渣油和馏分油成分与不同黏度和硫含量的切割剂结合,以生产符合规格的产品。

- 日本正致力于增加炼油厂数量,以满足对极低硫燃油不断增长的需求。截至2024年1月,日本有20家炼油厂。日本的精製能力为 323 万桶/日,而 20 世纪 80 年代初为 600 万桶/日。日本正在增加炼油厂的数量以满足 VLSFO 的需求,并正在製定策略以再次达到以前的数量。所有这些策略都可能满足 2024 年至 2029 年间不断增长的需求。

- 截至2023年,日本70%的燃油需求将是用于远洋船舶的低硫燃油(VLSFO)。这取决于炼油厂的产能。政府与多个组织制定了提高炼油厂产能的计画。 2024年2月,Kosmos宣布炼油厂产能可能在2024-25年超过90%(2023-24年为87.5%)。

- 此外,2023 年 8 月,Pemex 宣布与日本国际协力机构 (JICA) 和永续解决方案公司 Adaptex 合作,为使用极低硫燃料油 (VLSFO) 的炼油厂开发创新解决方案,以提高能源效率。技术计划的合约。所有这些协议都将增加 2024 年至 2029 年对 VLSFO 的需求,并为该组织创造未来机会。

- 因此,在国内高需求、近期趋势和即将推出的炼油计划的推动下,该地区预计将在 2024 年至 2029 年期间推动市场需求。

液化天然气作为船用燃料可能会显着成长

- 在全球液化天然气使用量增加、清洁能源需求以及尽量减少温室气体排放的机会的推动下,日本液化天然气燃料库产业在过去十年中得到了发展。液化天然气运输船的需求逐渐增加,天然气价格的下降标誌着该类型船舶市场开始扩大。

- 将目前营运的船舶改装为液化天然气运输船需要大量成本。因此,它在经济上不可行。新的污染法规生效后,液化天然气动力船舶预计将成为所有燃料选择中营运成本最低的。此外,从重油、船用轻油、船用柴油等传统船用燃料供应方式逐步过渡到LNG推进更具优势。采用液化天然气推进,船舶营运将更加高效,碳排放将显着减少。

- 由于新的环境法规,各国目前正关注液化天然气装运船隻的使用。第一艘动力来源天然气动力海岬型散装货船计划于 2024 年 2 月交付日本。根据日本邮船研究,该船是日本造船厂建造的第一艘海岬型液化天然气燃料散装货船。透过扩大液化天然气船队,NYK 正在努力实现整个供应链脱碳,并实现 NYK 集团从 2021 财年到 2030 财年将温室气体排放减少 45% 的目标。这些发展将增加 2024 年至 2029 年对液化天然气作为船用燃料的需求。

- 根据世界能源资料统计,2022年液化天然气进口量预计为983亿立方米,较2021年下降2.96%。由于政府透过签署多项合约来专注于提高炼油厂产能,未来几年进口量可能会增加。

- 此外,2023年8月,日本液化天然气公司同意支付高达8.8亿美元购买澳洲海上大型天然气计划的股权。对于斯卡伯勒计划,伍德赛德能源集团将把10%的所有权转让给住友商事株式会社和双日持有的合资企业。此外,还签署了一份合同,从 2026 年开始的 10 年内,每年从该计划供应 12 批约 90 万吨液化天然气 (LNG)。所有这些合约都将在 2024 年至 2029 年间增加液化天然气产能,为该组织创造未来机会。

- 因此,在国内高需求、近期趋势和即将开展的计划的推动下,该地区预计将在 2024 年至 2029 年期间推动市场需求。

日本船用燃料油产业概况

日本的船用燃料油市场正变得半固体。该市场的主要企业是:中国石油天然气股份有限公司、Ocean Bunkering Services (Pte) Ltd、Shell Eastern Trading (Pte) Ltd、Equatorial Marine Fuel Management Services Pte Ltd 和 Sentek Marine & Trading Pte Ltd。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 至2029年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 液化天然气贸易增加

- 海运增加

- 抑制因素

- 原油价格波动

- 促进因素

- 供应链分析

- PESTLE分析

第五章市场区隔

- 按燃料类型

- 高硫燃料油(HSFO)

- 极低硫燃油(VLSFO)

- 船用轻柴油 (MGO)

- 其他燃料类型

- 按船舶类型

- 容器

- 油船

- 杂货船

- 散货船

- 其他船型

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- 燃料供应商

- PetroChina Company Limited

- Ocean Bunkering Services(Pte)Ltd

- Sentek Marine & Trading Pte Ltd

- Equatorial Marine Fuel Management Services

- Shell Eastern Trading(Pte)Ltd

- 船东

- Cosco Shipping Lines Co Ltd

- Orient Overseas Container Line(OOCL)

- Parakou Group

- Nan Fung Group

- Mediterranean Shipping Company

- The Great Eastern Shipping Co. Ltd

- 燃料供应商

- 市场排名/份额分析

第七章 市场机会及未来趋势

- 海运需求

The Japan Bunker Fuel Market size is estimated at USD 3.78 billion in 2025, and is expected to reach USD 5.84 billion by 2030, at a CAGR of 9.11% during the forecast period (2025-2030).

Key Highlights

- In the medium period, factors such as rising demand for cleaner bunker fuels due to implementing more restrictive environmental regulations and the growing trade of LNG for the power sector in the regions are expected to drive the market between 2024 and 2029.

- On the other hand, changes in the cost of bunker fuel and crude oil are expected to hinder the market's growth.

- Nevertheless, the number of ships in service and the demand for maritime transportation are expected to create several future market opportunities from 2024 to 2029.

Japan Bunker Fuel Market Trends

Very Low Sulfur Fuel Oil (VLSFO) is Expected to Witness Significant Growth

- Bunker fuels have a high sulfur content and may emit harmful fumes. Different methods can be employed to lower sulfur concentration. Ultra-low-sulfur fuel oil is one of the varieties of this kind of fuel. With an IMO regulation going into effect in January 2020, there is a growing need for very low sulfur fuel oil (VLSFO) with a sulfur concentration of less than 0.5%.

- The majority of the market for high-sulfur fuel oil (HSFO) bunker fuel is anticipated to be replaced soon by low-sulfur substitutes. The majority of VLSFO sold on the market is made up of residual and distillate components combined with different cutters with different viscosities and sulfur contents to produce a product that meets specifications.

- The nation is focusing on increasing the number of refineries to overcome the increased demand for VLSFO. As of January 2024, Japan had 20 refineries. The country's refining capacity is 3.23 million b/d, compared to 6 million b/d in the early 1980s. The country is making strategies to increase the number of refineries to fulfill the demand for VLSFO and reach the previous numbers again. All these strategies are likely to fulfill the increased demand between 2024 and 2029.

- As of 2023, Japan's total bunker demand involved 70% of low-sulfur fuel oil (VLSFO) for deliveries of ocean-going vessels. This is more dependent on the refinery's capacity. The government is making plans to increase the refinery's capacity with several organizations. In February 2024, Cosmos announced that the refinery capacity is likely to be above 90% during FY2024-25 compared to 87.5 % in FY23-24.

- Moreover, in August 2023, Pemex announced that it had inked a deal with the Japan International Cooperation Agency (JICA) and the sustainable solutions company Adaptex to implement a plan for innovative technology to operate with greater energy efficiency in the refinery involving very low-sulfur fuel oil (VLSFO). All these types of agreements increase the demand for VLSFO between 2024 and 2029 and create future opportunities for the organization.

- Hence, driven by high domestic demand, recent developments, and upcoming oil refinery projects, the region is expected to drive the demand for the market from 2024 to 2029.

LNG as a Bunker Fuel is Likely to Witness Significant Growth

- The Japan LNG bunkering industry has developed over the last decade, driven by increased global LNG usage, clean energy demand, and the opportunity to minimize greenhouse gas emissions. LNG-powered vessels are becoming progressively higher in demand, and lower natural gas prices signaled the start of an expansion in the market for these kinds of vessels.

- The cost of converting the current operational vessels to LNG-powered vessels is significant. It is, therefore, not feasible economically. After the new pollution restrictions take effect, LNG-based vessels are anticipated to have the lowest operating costs of all the fuel options. Furthermore, a gradual transition from conventional ship fueling methods, such as heavy fuel oil, marine gas oil, and marine diesel oil, to LNG propulsion is more advantageous. The ship's operational efficiency has increased, and its carbon footprint is significantly reduced with LNG-based propulsion.

- Countries are now focusing on using LNG power carriers owing to the new environmental regulations. In February 2024, the first-ever capsized bulk carrier powered by LNG was to be delivered to Japan. The ship is the first Capesize LNG-fueled bulk carrier ever constructed at a Japanese shipyard, according to an NYK investigation. Expanding its fleet of LNG-fueled ships, NYK is taking on the issue of decarbonizing a complete supply chain while meeting the NYK Group's target of a 45% reduction in GHG emissions from FY2021 to FY2030. These developments increase the demand for LNG as a bunker fuel between 2024 and 2029.

- According to the Statistical Review of World Energy Data, LNG imports were reported to be 98.3 billion cubic meters in 2022, which was reduced by 2.96% compared to 2021. The imports are likely to increase in the coming years as the government focuses on increasing the refinery capacity by signing multiple deals.

- Furthermore, in August 2023, LNG Japan Corp. agreed to pay up to USD 880 million for a stake in a massive natural gas project off the coast of Australia. The Scarborough project will see Woodside Energy Group give up 10% of its ownership to the joint venture, which Sumitomo Corp. and Sojitz Corp hold. Furthermore, a deal was reached to deliver 12 cargoes, or roughly 900,000 tons, of liquefied natural gas (LNG) annually for ten years starting in 2026 from the project. All these types of agreements increase the capacity of LNG between 2024 and 2029 and create future opportunities for the organization.

- Hence, driven by high domestic demand, recent developments, and upcoming projects, the region is expected to drive the demand for the market from 2024 to 2029.

Japan Bunker Fuel Industry Overview

The Japanese bunker fuel market is semi-consolidated. Some of the major players in this market are PetroChina Company Limited, Ocean Bunkering Services (Pte) Ltd, Shell Eastern Trading (Pte) Ltd, Equatorial Marine Fuel Management Services Pte Ltd, and Sentek Marine & Trading Pte Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing LNG Trade

- 4.5.1.2 Rising Marine Transportation

- 4.5.2 Restraints

- 4.5.2.1 Fluctuations in Crude Oil Prices

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 By Fuel Type

- 5.1.1 High Sulfur Fuel Oil (HSFO)

- 5.1.2 Very-low Sulfur Fuel Oil (VLSFO)

- 5.1.3 Marine Gas Oil (MGO)

- 5.1.4 Other Fuel Types

- 5.2 By Vessel Type

- 5.2.1 Containers

- 5.2.2 Tankers

- 5.2.3 General Cargo

- 5.2.4 Bulk Carrier

- 5.2.5 Other Vessel Types

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Fuel Suppliers

- 6.3.1.1 PetroChina Company Limited

- 6.3.1.2 Ocean Bunkering Services (Pte) Ltd

- 6.3.1.3 Sentek Marine & Trading Pte Ltd

- 6.3.1.4 Equatorial Marine Fuel Management Services

- 6.3.1.5 Shell Eastern Trading (Pte) Ltd

- 6.3.2 Ship Owners

- 6.3.2.1 Cosco Shipping Lines Co Ltd

- 6.3.2.2 Orient Overseas Container Line (OOCL)

- 6.3.2.3 Parakou Group

- 6.3.2.4 Nan Fung Group

- 6.3.2.5 Mediterranean Shipping Company

- 6.3.2.6 The Great Eastern Shipping Co. Ltd

- 6.3.1 Fuel Suppliers

- 6.4 Market Ranking/Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Demand for Marine Transportation