|

市场调查报告书

商品编码

1636180

全球电动车锂离子电池隔离膜市场:市场占有率分析、产业趋势与成长预测(2025-2030)Global Lithium-ion Battery Separator For Electric Vehicle Application - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

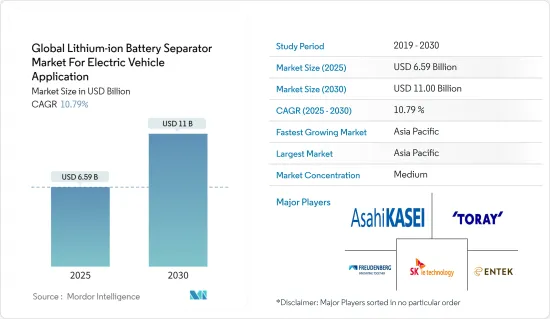

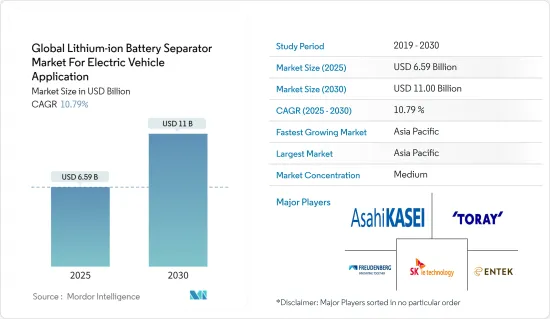

全球电动车锂离子电池隔膜市场预计将从2025年的65.9亿美元成长到2030年的110亿美元,预测期间(2025-2030年)复合年增长率为10.79%。

主要亮点

- 从中期来看,电动车销量增加和锂离子电池成本下降等因素预计将成为预测期内全球电动车锂离子电池隔膜市场的最大推动力之一。

- 另一方面,电池隔膜製造面临复杂的供应链限制,在预测期内对电动车应用的全球锂离子电池隔离膜市场构成威胁。

- 人们不断努力开发增强型电池隔膜材料。预计这一因素未来将为全球电动车锂离子电池隔膜市场创造多个机会。

- 预计亚太地区将出现强劲成长,并可能在预测期内实现最高的复合年增长率。这是因为该地区拥有大规模的电池及相关设备和材料製造业。

锂离子电池隔离膜的全球趋势

聚乙烯推动成长

- 聚乙烯(PE)已成为电动车应用锂离子电池隔膜的关键材料。主要原因是其优异的化学稳定性、机械强度和生产薄多孔膜的能力。由于电动车行业的快速扩张以及对高性能、安全和具有成本效益的能源储存解决方案的需求不断增加,近年来电动车电池中聚乙烯隔膜的全球市场经历了显着增长。

- 聚乙烯隔膜,特别是高密度聚苯乙烯(HDPE) 和超高分子量聚乙烯 (UHMWPE) 隔膜,具有多种特性,使其适合在电动汽车电池的恶劣环境中使用。这些材料对锂离子电池中使用的电解和电极材料表现出优异的耐化学性,同时提供热稳定性,这对于防止电池系统的热失控至关重要。

- 随着全球电动车需求的扩大,电动车电池的需求将快速增加,导致聚乙烯作为电池隔膜材料的需求增加。这种需求的成长是由电动和混合动力汽车的,这些汽车需要高效、耐用的电池组件。此外,电池技术的进步进一步推动了对高品质聚乙烯隔膜的需求。

- 据奖励总署(IEA) 称,由于大众采用永续交通解决方案的意识不断增强以及地方政府对脱碳目标的承诺,近年来电动车销量大幅增长。 2023年至2022年,电动车销量将成长30.13%,2019年至2023年年平均成长超过100%。

- 在最近的趋势中,製造商正在采用最新的製造技术,开发新的材料成分,并与其他材料一起开发新的材料化学。这些进步不仅提高了聚乙烯隔膜的功能特性,而且还有助于降低製造成本,使得聚乙烯隔膜越来越受到想要优化电池性能同时控制生产成本的电动车製造商的欢迎。

- 例如,2024年1月,近代物理研究所(IMP)和广东省先进能源科学与技术实验室的科学家开发了一种用于锂离子电池的耐高温聚对苯二甲酸乙二醇酯(PET)隔膜。隔膜作为锂离子电池的关键部件,对于确保电池安全起着重要作用。它不仅使正负极绝缘,防止短路,还能促进锂离子的传输。

- 因此,鑑于以上几点,预计聚乙烯隔膜材料在预测期内将会成长。

亚太地区主导市场

- 亚太地区在全球电动车锂离子电池隔膜市场中占据主导地位,其影响力远远超出其地理界限。这项优势源自于多种因素,包括该地区强大的製造能力、政府的大力支持、广泛的研发倡议以及整个电动车供应链中关键参与企业的存在。

- 中国、日本、韩国以及最近的印度等国家正在利用其在电子、汽车製造和先进材料方面的现有优势,为电池隔膜製造建立强大的生态系统,并成为这个快速发展行业的领跑者。该地区在这一市场的快速成长不仅归功于其製造能力,还源于其认识到电动车将在未来全球交通中发挥关键作用的战略远见。

- 例如,国际能源总署(IEA)近年来电动车销量显着成长。 2022年至2022年,电动车销量成长速度将超过24%,2019年至2023年,复合年增长率将接近100%。这意味着电动车正在获得牵引力,从而为锂离子电池隔膜市场带来有利的市场环境。

- 这种认可导致了在产能扩张、技术创新以及培养专门从事电池和隔膜技术的熟练劳动力方面的大量投资。这种独特的因素组合使亚太地区成为目前电动车锂离子电池隔膜生产的领导者。随着其他地区寻求发展这一重要技术领域的能力,亚太地区有能力在未来保持这一领先地位。

- 例如,旭化成公司计划于2023年10月进行新的资本投资,以提高高孔锂离子电池(LIB)隔膜的产能。该公司计划在目前位于美国、日本和韩国的锂离子电池隔膜工厂安装新的涂层生产线。预计从 2026 年上半年开始分阶段营运。这项策略性倡议将使旭化成能够满足约 170 万辆电动车的电池需求。

- 旭化成公司的最新投资凸显了其致力于推进电池技术以满足电动车不断增长的需求的承诺。旭化成公司旨在透过提高产能来巩固其在全球锂离子市场的地位。新的涂装线将配备最新技术,以确保高品质和高效的生产过程。此次扩张符合旭化成支持向永续能源解决方案过渡的长期策略。

- 因此,如上所述,亚太地区预计将在预测期内主导市场。

全球锂离子电池隔膜产业概况

全球电动车锂离子电池隔膜市场呈现半截结构。该市场的主要企业(排名不分先后)包括旭化成公司、东丽电池隔膜、Freudenberg Performance Materials、SKie Technology Corporation Ltd 和 Entek International。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 电动车销量成长

- 锂离子电池价格下降

- 抑制因素

- 供应链限制

- 促进因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品/服务的威胁

- 竞争公司之间的敌对关係

- 投资分析

第五章市场区隔

- 材料

- 聚乙烯

- 聚丙烯

- 复合材料

- 其他的

- 2029 年之前的市场规模和需求预测(按地区)

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 北欧的

- 俄罗斯

- 土耳其

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 澳洲

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 奈及利亚

- 埃及

- 卡达

- 南非

- 其他中东/非洲

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 北美洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略及SWOT分析

- 公司简介

- Asahi Kasei Corporation

- Toray Battery Separator Film Co. Ltd

- Freudenberg Performance Materials

- SK ie Technology Corporation Ltd

- Entek International

- Sumitomo Chemical Co. Ltd

- Ube Maxell Co. Ltd

- W-Scope Corporation

- Daramic

- Amer SIL

- 其他知名公司名单

- 市场排名/份额(%)分析

第七章 市场机会及未来趋势

- 强化隔膜材料的开发

The Global Lithium-ion Battery Separator Market For Electric Vehicle Application Industry is expected to grow from USD 6.59 billion in 2025 to USD 11.00 billion by 2030, at a CAGR of 10.79% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as rising growth in electric vehicle sales and declining cost of lithium-ion batteries are expected to be among the most significant drivers for the global lithium-ion battery separator market for electric vehicle applications during the forecast period.

- On the other hand, there are complex supply chain constraints for manufacturing battery separators that pose a threat to the global lithium-ion battery separator market for electric vehicle applications during the forecast period.

- Nevertheless, continued efforts are being made to develop enhanced battery separator materials. This factor is expected to create several opportunities for the global lithium-ion battery separator market for electric vehicle applications in the future.

- The Asia-Pacific region is expected to witness significant growth and is likely to register the highest CAGR during the forecast period. This is due to the presence of a significant battery and associated equipment and materials manufacturing industry in the region.

Global Lithium-ion Battery Separator Market Trends

Polyethylene to Witness Growth

- Polyethylene (PE) has emerged as a dominant material for lithium-ion battery separators in electric vehicle applications. This is mainly due to its excellent chemical stability, mechanical strength, and ability to be manufactured into thin, porous membranes. The global market for Polyethylene separators in electric vehicle batteries has seen substantial growth in recent years, driven by the rapid expansion of the electric vehicle industry and increasing demand for high-performance, safe, and cost-effective energy storage solutions.

- Polyethylene separators, particularly those made from high-density polyethylene (HDPE) and ultra-high molecular weight polyethylene (UHMWPE), offer a compelling combination of properties that make them well-suited for use in the demanding environment of electric vehicle batteries. These materials provide good thermal stability, which is crucial for preventing thermal runaway in battery systems, while also offering excellent chemical resistance to the electrolytes and electrode materials used in lithium-ion cells.

- As global electric vehicle demand escalates, the demand for batteries in electric vehicle applications is set to surge, consequently boosting the need for polyethylene in battery separator materials. This increase is driven by the growing production of electric and hybrid vehicles, which require efficient and durable battery components. Additionally, advancements in battery technology are further propelling the demand for high-quality polyethylene separators.

- According to the International Energy Agency (IEA), electric vehicle sales have witnessed a significant surge in recent years owing to the growing awareness of adopting sustainable transportation solutions amongst the public and various financial incentives offered by regional governments to meet their decarbonization targets. Between 2023 and 2022, electric vehicle sales witnessed an uptick of 30.13%, whereas the annual average growth rate between 2019 and 2023 was over 100%, signifying the growing traction for electric vehicles.

- In recent years, manufacturers have adopted the latest manufacturing techniques, developed new material compositions, and developed new material chemistries with other materials. These advancements have not only improved the functional properties of Polyethylene separators but have also contributed to reducing manufacturing costs, making them an increasingly attractive option for electric vehicle manufacturers looking to optimize battery performance while managing production expenses.

- For instance, in January 2024, Scientists at the Institute of Modern Physics (IMP) of the Chinese Academy of Sciences (CAS) and the Advanced Energy Science and Technology Guangdong Laboratory have developed high-temperature-resistant polyethylene terephthalate (PET) separators for lithium-ion batteries. The separator, a pivotal component of lithium-ion batteries, is instrumental in safeguarding battery safety. It not only insulates the cathode and anode to prevent short-circuiting but also facilitates the transport of lithium ions.

- Therefore, as per the points mentioned above, the polyethylene separator material is expected to witness growth during the forecast period.

Asia Pacific to Dominate the Market

- The Asia-Pacific region has emerged as the dominant force in the global lithium-ion battery separator market for electric vehicle applications, with its influence extending far beyond its geographical boundaries. This dominance is rooted in a variety of factors, including the region's robust manufacturing capabilities, significant government support, extensive research and development initiatives, and the presence of major players across the entire electric vehicle supply chain.

- Countries like China, Japan, South Korea, and, to a growing extent, India have positioned themselves at the forefront of this rapidly evolving industry, leveraging their existing strengths in electronics, automotive manufacturing, and advanced materials to create a formidable ecosystem for battery separator production. The region's rapid growth in this market is not only a result of its manufacturing prowess but also stems from its strategic foresight in recognizing the pivotal role that electric vehicles will play in the future of global transportation.

- For instance, the International Energy Agency has witnessed significant growth in electric vehicle sales in recent years. Between 2022 and 2022, the growth in electric vehicle sales increased by more than 24%, whereas between 2019 and 2023, the annual average growth rate was close to 100%. This signifies the growing traction for electric vehicles, which in turn developed favorable market conditions for the lithium-ion battery separator market.

- This recognition has led to substantial investments in capacity expansion, technological innovation, and the development of a highly skilled workforce specializing in battery and separator technologies. This unique combination of factors has established the Asia-Pacific as the current leader in lithium-ion battery separator production for electric vehicles. Still, it has also positioned itself to maintain this leadership well into the future, even as other regions seek to develop their capabilities in this critical technology sector.

- For instance, in October 2023, Asahi Kasei is set to invest in new equipment to bolster its production capacity for Hipore lithium-ion battery (LIB) separators. The company plans to set up fresh coating lines at its current LIB separator plants in the United States, Japan, and South Korea. Operations are slated to commence in stages, starting in the first half of fiscal year 2026. This strategic move will enable Asahi Kasei to cater to the battery needs of approximately 1.7 million electric vehicles.

- Asahi Kasei's investment underscores its commitment to advancing battery technology and meeting the growing demand for electric vehicles. By enhancing its production capabilities, the company aims to strengthen its position in the global lithium-ion market. The new coating lines will incorporate state-of-the-art technology to ensure high-quality and efficient production processes. This expansion aligns with Asahi Kasei's long-term strategy to support the transition to sustainable energy solutions.

- Therefore, as mentioned above, the Asia-Pacific region is expected to dominate the market during the forecast period.

Global Lithium-ion Battery Separator Industry Overview

The global lithium-ion battery separator market for electric vehicle applications is semi-fragmented. Some of the key players in this market (in no particular order) are Asahi Kasei Corporation, Toray Battery Separator Film Co. Ltd, Freudenberg Performance Materials, SK ie Technology Corporation Ltd, and Entek International.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Electric Vehicle Sales

- 4.5.1.2 Decreasing Lithium-ion Battery Price

- 4.5.2 Restraints

- 4.5.2.1 Supply Chain Constraints

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Material

- 5.1.1 Polyethylene

- 5.1.2 Polypropylene

- 5.1.3 Composite

- 5.1.4 Other Materials

- 5.2 Geography [Market Size and Demand Forecast till 2029 (for regions only)]

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 France

- 5.2.2.3 United Kingdom

- 5.2.2.4 Italy

- 5.2.2.5 Spain

- 5.2.2.6 NORDIC

- 5.2.2.7 Russia

- 5.2.2.8 Turkey

- 5.2.2.9 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Australia

- 5.2.3.4 Japan

- 5.2.3.5 South Korea

- 5.2.3.6 Malaysia

- 5.2.3.7 Thailand

- 5.2.3.8 Indonesia

- 5.2.3.9 Vietnam

- 5.2.3.10 Rest of Asia-Pacific

- 5.2.4 Middle East and Africa

- 5.2.4.1 Saudi Arabia

- 5.2.4.2 United Arab Emirates

- 5.2.4.3 Nigeria

- 5.2.4.4 Egypt

- 5.2.4.5 Qatar

- 5.2.4.6 South Africa

- 5.2.4.7 Rest of Middle East and Africa

- 5.2.5 South America

- 5.2.5.1 Brazil

- 5.2.5.2 Argentina

- 5.2.5.3 Colombia

- 5.2.5.4 Rest of South America

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted & SWOT Analysis for Leading Players

- 6.3 Company Profiles

- 6.3.1 Asahi Kasei Corporation

- 6.3.2 Toray Battery Separator Film Co. Ltd

- 6.3.3 Freudenberg Performance Materials

- 6.3.4 SK ie Technology Corporation Ltd

- 6.3.5 Entek International

- 6.3.6 Sumitomo Chemical Co. Ltd

- 6.3.7 Ube Maxell Co. Ltd

- 6.3.8 W-Scope Corporation

- 6.3.9 Daramic

- 6.3.10 Amer SIL

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Enhanced Separator Materials