|

市场调查报告书

商品编码

1636196

印度的薪资核算服务:市场占有率分析、产业趋势与统计、成长预测(2025-2030)India Payroll Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

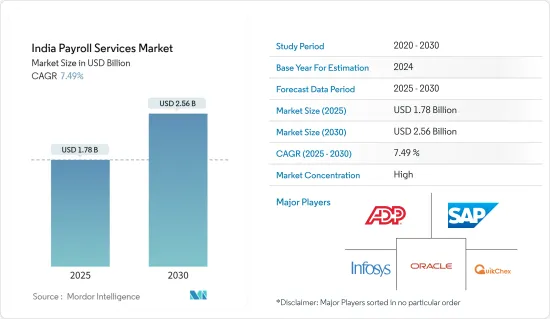

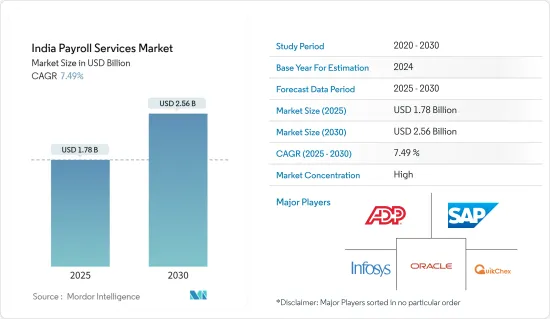

印度薪资核算服务市场规模预计到 2025 年为 17.8 亿美元,预计到 2030 年将达到 25.6 亿美元,预测期内(2025-2030 年)复合年增长率为 7.49%。

薪资核算服务包括各种薪资管理解决方案。印度薪资核算市场的特点是既有成熟的跨国薪资核算服务供应商,也当地企业,可满足不同司法管辖区企业的不同需求。

该市场提供的主要服务包括薪资核算、税务计算和申报、遵守国家和国际法规以及提供员工社会福利。鑑于该地区多样化且复杂的监管环境,薪资核算服务提供者必须遵守各种劳动法、税法和报告要求,以确保准确性和合规性。

该市场受到多种因素的推动,包括越来越多地采用云端基础的薪资核算解决方案、在该地区运营的跨国公司数量的增加以及对外包薪资核算业务以提高效率和降低营运成本的需求不断增长。 。该地区的数位转型趋势,加上云端运算、自动化和数位转型的进步,也正在提高薪资核算服务供应商的能力和服务。

总体而言,由于经济扩张、技术进步以及在多元化法规环境下管理薪资核算的复杂性不断增加,印度薪资核算服务市场有望显着成长。

印度薪资核算服务市场趋势

技术进步与云端服务推动市场

- 云端业务流程即服务 (BPaaS) 在印度各地的收益正在显着成长,并且正在改变企业管理业务的方式。这种快速成长背后有几个推动 BPaaS 解决方案采用和投资的关键因素。

- 首先,印度企业正在认识到 BPaaS 提供的可扩展性和灵活性的好处。透过将关键业务流程外包给云端基础的服务供应商,公司可以简化业务、降低成本并提高整体效率。这种模式在一个以其多样化的市场格局和快速发展的法规环境而闻名的地区尤其有吸引力。

- 其次,COVID-19 大流行加速了数位转型的挑战,促使企业优先考虑支援远距工作和数位协作的云端解决方案。 BPaaS 不仅有利于远端操作,还可以与 SaaS 和平台即服务 (PaaS) 等其他云端基础的技术无缝集成,进一步强化其价值提案。

- 此外,云端基础设施的日益成熟以及针对本地市场需求量身定制的专业 BPaaS 的可用性不断增加也支持了采用。服务供应商正在利用人工智慧、自动化和分析等先进技术来提供更复杂和客製化的 BPaaS 解决方案,以满足不同的行业需求。

- 总之,印度 BPaaS收益的显着成长凸显了向敏捷、可扩展和数位整合业务流程的策略支点。这一趋势使印度成为拥抱和推动全球数位转型倡议的关键参与者。

数位付款机制激发市场活力

印度正在经历薪资核算的重大变革,被称为「工资革命」。这场革命主要由两个关键因素推动:当今工人偏好的变化和多样化行动付款解决方案的兴起。纸本薪资单和银行排队的传统景象正在消失。现代员工希望即时获得无忧且安全的薪水。将数位付款整合到薪资系统中并不是一种短暂的趋势。这是一个策略转变,对雇主和员工都有实质的好处。

印度薪资核算服务业概况

印度薪资核算服务市场竞争激烈,各大公司竞相争取霸主地位。随着市场的整合,少数参与者现在占据了大部分市场占有率。这些市场领导正在积极寻求国内和国际市场的成长。主要参与者包括 ADP、SAP、 Oracle、Infosys Limited、Quichex 等。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态与洞察

- 市场概况

- 市场驱动因素

- 小型企业数量的增加推动了对扩充性薪资核算解决方案的需求

- 持续的技术进步和云端服务的增加推动市场

- 市场限制因素

- 成本敏感性,尤其是中小型企业

- 薪资核算服务提供者之间的激烈竞争

- 市场机会

- 扩展云端基础的解决方案

- 印度的新兴市场为薪资核算服务供应商提供了未开发的机会

- 价值链分析

- 产业吸引力波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- 洞察产业技术进步

- COVID-19 对市场的影响

第五章市场区隔

- 按类型

- 杂交种

- 完全外包

- 按组织规模

- 小型企业

- 大公司

- 按最终用户

- BFSI

- 消费品/工业

- 资讯科技/通讯

- 公共部门

- 卫生保健

- 其他最终用户

第六章 竞争状况

- 市场集中度概况

- 公司简介

- ADP

- SAP

- Oracle

- Infosys Limited

- Quikchex

- Paysquare

- ZingHR

- Excelity Global

- Hinduja Global Solutions

- Osource

第七章 市场机会及未来趋势

第 8 章 免责声明与出版商讯息

The India Payroll Services Market size is estimated at USD 1.78 billion in 2025, and is expected to reach USD 2.56 billion by 2030, at a CAGR of 7.49% during the forecast period (2025-2030).

Payroll services encompass a diverse range of payroll management solutions. The Indian payroll market is characterized by a mix of established multinational payroll service providers and local companies that address the different needs of businesses in various jurisdictions.

Key services offered in this market include payroll processing, tax calculation and filing, compliance with local and international regulations, and handling of employee benefits. Given the region's diverse and complex regulatory landscape, payroll service providers must navigate varying labor laws, tax codes, and reporting requirements, ensuring accuracy and compliance.

The market is driven by several factors, including the increasing adoption of cloud-based payroll solutions, the growth of multinational corporations with operations in the region, and the rising demand for outsourcing payroll functions to improve efficiency and reduce operational costs. In addition, the digital transformation trends in the region, mixed with advancements in cloud computing, automation, and digital transformation, are enhancing the capabilities and offerings of payroll service providers.

Overall, the Indian payroll service market is poised for significant growth, driven by economic expansion, technological advancements, and the increasing complexity of payroll management in a diverse regulatory environment.

India Payroll Services Market Trends

Technological Advancements and Cloud Services Driving the Market

- Cloud business process-as-a-service (BPaaS) has experienced significant revenue growth across India, marking a transformative shift in how businesses manage their operations. This surge can contribute to several key factors driving adoption and investment in BPaaS solutions.

- Firstly, businesses in India are increasingly recognizing the scalability and flexibility benefits offered by BPaaS. By outsourcing critical business processes to cloud-based service providers, companies can streamline operations, reduce costs, and enhance overall efficiency. This model is particularly attractive in a region known for its diverse market landscapes and rapidly evolving regulatory environments.

- Secondly, the COVID-19 pandemic accelerated the digital transformation agenda, prompting organizations to prioritize cloud solutions that support remote work and digital collaboration. BPaaS not only facilitates remote operations but also integrates seamlessly with other cloud-based technologies, such as software-as-a-service and platform-as-a-service (PaaS), further enhancing its value proposition.

- In addition, the growing maturity of cloud infrastructure and the increasing availability of specialized BPaaS offerings tailored to regional market needs has fueled adoption. Service providers are leveraging advanced technologies like AI, automation, and analytics to deliver more sophisticated and customized BPaaS solutions, catering to diverse industry requirements.

- In conclusion, the significant increase in BPaaS revenue in India highlights a strategic pivot toward agile, scalable, and digitally integrated business processes. This trend positions the country as a major player in embracing and driving global digital transformation initiatives.

Digital Payment Mechanism Fueling the Market

India is witnessing a significant shift in its payroll landscape, termed the "paycheque revolution." This revolution is primarily fueled by two pivotal factors: the changing preferences of today's workforce and the rising availability of varied mobile payment solutions. The traditional scene of paper payslips and bank queues is fading. Modern employees demand immediate, hassle-free, and secure salary access. The integration of digital payments into payroll systems is not a passing trend. It is a strategic shift that promises concrete advantages for both employers and employees.

India Payroll Services Industry Overview

The Indian payroll services market is fiercely competitive, with various big firms competing for dominance. Due to the consolidated nature of the market, a select few players currently hold the majority of the market share. These market leaders are aggressively pursuing growth at home and in international markets. The key players include ADP, SAP, Oracle, Infosys Limited, and Quikchex.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 The Increasing Number of SMEs is Driving the Demand for Scalable Payroll Solutions

- 4.2.2 Continuous Technological Advancements and Increasing Cloud Services are Driving the Landscape

- 4.3 Market Restraints

- 4.3.1 Cost Sensitivity, Especially for SMEs

- 4.3.2 Intense Competition Among Payroll Service Providers

- 4.4 Market Opportunities

- 4.4.1 Expansion of Cloud-based Solutions

- 4.4.2 Emerging Markets in India Provides Untapped Opportunities for Payroll Service Providers

- 4.5 Value Chain Analysis

- 4.6 Industry Attractiveness: Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights into Technological Advancements in the Industry

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Hybrid

- 5.1.2 Fully Outsourced

- 5.2 By Organization Size

- 5.2.1 Small and Medium-Sized Enterprises

- 5.2.2 Large Enterprises

- 5.3 By End-User

- 5.3.1 BFSI

- 5.3.2 Consumer and Industrial Products

- 5.3.3 IT and Telecommunication

- 5.3.4 Public Sector

- 5.3.5 Healthcare

- 5.3.6 Other End Users

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.3 ADP

- 6.4 SAP

- 6.5 Oracle

- 6.6 Infosys Limited

- 6.7 Quikchex

- 6.8 Paysquare

- 6.9 ZingHR

- 6.10 Excelity Global

- 6.11 Hinduja Global Solutions

- 6.12 Osource