|

市场调查报告书

商品编码

1636250

欧洲货柜运输:市场占有率分析、产业趋势、成长预测(2025-2030)Europe Container Drayage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

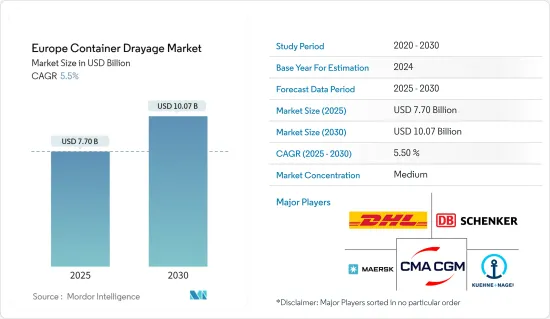

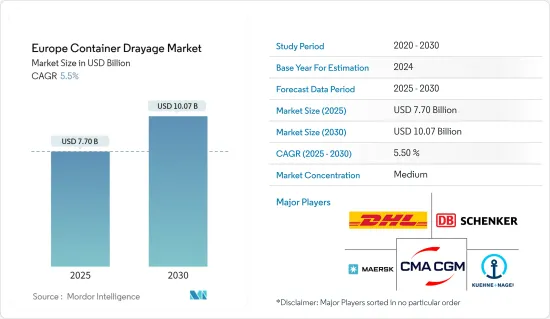

预计2025年欧洲货柜运输市场规模为77亿美元,预计2030年将达100.7亿美元,预测期内(2025-2030年)复合年增长率为5.5%。

主要亮点

- 欧洲货柜运输市场由贸易成长、基础设施发展、技术进步和永续发展措施推动。

- 国际贸易量和通过欧洲港口的货柜货物量的增加是货柜运输市场的主要驱动力。欧洲正步入强劲復苏的轨道,预计2024年出口成长将成长2.2%,显着高于2023年的0.4%。相应地,2023年下降的进口贸易量预计2024年将恢復1.6%。

- 利率上升、通膨飙升、乌克兰旷日持久的衝突以及全球需求疲软等挑战将给 2023 年欧洲贸易量带来压力。然而,随着利率预计在 2024 年放缓,经济活动预计将復苏并刺激对欧洲出口的需求。

- 2023年,欧洲跨境电商市场激增,销售额达2,370亿欧元(2,565.4亿美元),较2022年成长32%。欧洲线上零售商为跨境电子商务总额贡献了 1,070 亿欧元(1,158.2 亿美元)。更广泛的欧洲 B2C 电子商务市场也蓬勃发展,销售额达到 7,410 亿欧元(8,020.9 亿美元),成长了 13%,令人印象深刻。目前,跨国交易占欧洲线上销售额的 32%。

- 基础设施投资,特别是道路网路、港口和多式联运设施,对于确保货柜运输服务的无缝运作、从而推动市场向前发展至关重要。

欧洲货柜运输市场趋势

跨境电商带动货柜需求

2023年,欧洲跨境电商市场呈现显着成长,销售额达2,370亿欧元(2,565.4亿美元),较2022年成长32%。欧洲线上零售商发挥了至关重要的作用,跨境电子商务总额达到1,070亿欧元(1,158.2亿美元)。更广泛的欧洲 B2C 电子商务市场也蓬勃发展,销售额达到 7,410 亿欧元(8,020.9 亿美元),强劲成长 13%。值得注意的是,跨境交易占欧洲所有线上销售额的 32%。

跨国销售额成长 28%,达到 430 亿欧元(465.4 亿美元),其中德国线上零售商居首。相较之下,英国略有下降 1.8%,跨境销售额为 275 亿欧元(297.7 亿美元),低于 2022 年的 280 亿欧元(303.1 亿美元)。

法国网路商店的跨境销售额显着成长 30%,达到 320 亿欧元(346.4 亿美元)。此外,西班牙平台成长了50%,达到180亿欧元(194.8亿美元),而荷兰平台也出现了强劲成长,成长了45%,达到70亿欧元(75.8亿美元)。

2023年,服饰鞋类已成为欧洲跨境电商的主导产品类型。据透露,60%的受访者强烈倾向于透过国际线上平台购买此类产品。相较之下,家用电子电器产品则位居第二,只有27%的受访者更喜欢从海外采购。

义大利正成为货柜运输服务中心

义大利港口在国家港口生态系统中拥有独特的双重功能。与许多国家一样,港口主要促进进出口活动,但义大利港口因其作为南欧重要枢纽的角色而脱颖而出。

从地理上看,义大利半岛不仅是欧洲与东马格里布之间的桥樑,也是通往地中海心臟地带的重要门户。特别是苏伊士运河出口至直布罗陀海峡之间的地中海主要海上航线靠近义大利海岸。

此外,义大利港口与匈牙利、奥地利和瑞士等中欧内陆国家建立了密切的联繫。尤其是的里雅斯特,是通往奥地利和匈牙利的门户。

义大利有20个港口,分布在当地半岛、撒丁岛和西西里岛。 2023年,主要港口管理总合运力为1,103万个标箱,较2022年下降6.3%。然而,这个数字超过了 2020 年和 2021 年的运输量。值得注意的是,这种下降反映了整个欧洲的趋势,几乎所有主要货柜港口在 2023 年都面临挫折。

2023 年,义大利的货柜运输量几乎是法国的两倍,吞吐量约为 500 万标准箱。令人惊讶的是,儘管义大利的港口数量相似,但其表现却优于法国。值得注意的是,焦亚陶罗、热那亚和拉斯佩齐亚这三个义大利港口已加入专属「百万富翁俱乐部」。焦亚陶罗作为主要港口而蓬勃发展,而热那亚和拉斯佩齐亚则主要充当通往内陆的重要纽带。

Gioia Tauro 在 2023 年尤其表现出色,流量增加了 5%。港口当局将这一激增归因于 MSC 在码头的大量存在。焦亚陶罗码头最初由康世集团开发,经历了一系列变化,包括被马士基收购,最终成为 MSC 集团的关键枢纽,此举巩固了这家瑞士公司在地中海的地位。

欧洲货柜运输业概况

欧洲货柜运输市场由几家主要企业主导。我们拥有多元化的员工群体,从全球主要物流公司到区域公司和中小企业。着名的公司包括 DHL、DB Schenker 和 Kuehne+Nagel,以及 CMA CGM 和 Maersk Line 等业界巨头。

欧洲货柜货运市场的主要趋势包括向数位化营运的转变、对环保实践的兴趣日益浓厚、物联网和远端资讯处理的即时监控整合以及对多式联运解决方案的日益偏好。这些趋势正在大幅改变市场格局。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

- 分析方法

- 调查阶段

第三章执行摘要

第四章市场动态与洞察

- 目前的市场状况

- 市场动态

- 促进因素

- 国际贸易带动市场成长

- 环境永续性的重要性日益增加正在推动市场发展

- 抑制因素

- 影响市场的监管因素

- 影响市场的基础建设挑战

- 机会

- 市场驱动的技术进步

- 促进因素

- 价值链/供应链分析

- 政府法规、贸易协定与倡议

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 地缘政治与 COVID-19 大流行对市场的影响

第五章市场区隔

- 透过交通工具

- 铁路

- 路

- 其他交通工具

- 按国家/地区

- 德国

- 法国

- 英国

- 西班牙

- 欧洲其他地区

第六章 竞争状况

- 市场集中度概览

- 公司简介

- DHL

- DB Schenker

- Kuehne+Nagel

- CMA CGM

- Maersk Line

- Hapag-Lloyd

- MSC(Mediterranean Shipping Company)

- COSCO Shipping

- Evergreen Marine

- Yang Ming*

- 其他公司

第七章 市场的未来

第8章附录

- GDP 分布(依活动、地区)

- 资本流动洞察

The Europe Container Drayage Market size is estimated at USD 7.70 billion in 2025, and is expected to reach USD 10.07 billion by 2030, at a CAGR of 5.5% during the forecast period (2025-2030).

Key Highlights

- The European container drayage market is driven by trade growth, infrastructure development, technological advancements, and sustainable initiatives.

- The increasing volume of international trade and containerized cargo moving through European ports is a significant driver for the container drayage market. Europe is poised for a robust recovery, with export growth projected to surge by 2.2% in 2024, marking a significant uptick from the 0.4% growth in 2023. Correspondingly, after a dip in 2023, import trade volumes have been forecast to rebound by 1.6% in 2024.

- Challenges, including elevated interest rates, surging inflation, the prolonged conflict in Ukraine, and weakened global demand, weighed heavily on European trade volumes in 2023. However, with a projected easing of interest rates in 2024, economic activity is anticipated to rebound, spurring demand for European exports.

- In 2023, the European cross-border e-commerce market surged, hitting a turnover of EUR 237 billion (USD 256.54 billion), a remarkable 32% leap from 2022. European online retailers have been instrumental in contributing EUR 107 billion (USD 115.82 billion) to this cross-border total. The broader European B2C e-commerce market also flourished, culminating in a turnover of EUR 741 billion (USD 802.09 billion), up by a notable 13%. Cross-border transactions notably comprised 32% of all online sales in Europe.

- Investments in infrastructure, particularly in road networks, ports, and intermodal facilities, are pivotal for ensuring the seamless operation of container drayage services, thereby driving the market forward.

Europe Container Drayage Market Trends

Demand for Containers Driven by Cross-border E-commerce

In 2023, the European cross-border e-commerce market witnessed a significant surge, reaching a turnover of EUR 237 billion (USD 256.54 billion), marking a notable 32% leap over 2022. European online retailers played a pivotal role, contributing EUR 107 billion (USD 115.82 billion) to this cross-border total. The broader European B2C e-commerce market also thrived, achieving a turnover of EUR 741 billion (USD 802.09 billion), reflecting a substantial 13% increase. Notably, cross-border transactions accounted for 32% of all online sales in Europe.

German online retailers led the way, achieving a substantial 28% increase in cross-border sales, totaling EUR 43 billion (USD 46.54 billion). In contrast, the United Kingdom experienced a slight dip of 1.8%, with cross-border sales amounting to EUR 27.5 billion (USD 29.77 billion), down from EUR 28 billion (USD 30.31 billion) in 2022.

French online stores saw a notable 30% surge, reaching EUR 32 billion (USD 34.64 billion) in cross-border sales. Additionally, Spanish platforms witnessed a significant 50% rise, reaching EUR 18 billion (USD 19.48 billion), while Dutch platforms also experienced a substantial uptick, hitting EUR 7 billion (USD 7.58 billion), marking a 45% increase.

In 2023, clothing and footwear emerged as the dominant product category in European cross-border e-commerce. A significant 60% of respondents surveyed extensively revealed a strong preference for purchasing items from this category through international online platforms. In contrast, consumer electronics secured the second spot, with only 27% of respondents opting to procure these goods from overseas.

Italy Emerging as a Lucrative Hub for Container Drayage Services

Italian ports boast a unique dual function within the nation's port ecosystem. While, like in most countries, they primarily facilitate import and export activities, Italian ports distinguish themselves by assuming a pivotal role as key hubs in southern Europe.

Geographically, Italy's peninsula not only bridges Europe with the eastern Maghreb but also serves as a prominent gateway to the heart of the Mediterranean. Notably, the primary maritime route in the Mediterranean, linking the Suez Canal's exit with the Strait of Gibraltar, runs near Italy's coast.

Furthermore, Italian ports have cultivated strong ties with Central European landlocked nations like Hungary, Austria, and Switzerland. Among these connections, Trieste emerges as the premier port, serving as the gateway to Austria and Hungary.

Italy boasts 20 ports spread across its mainland peninsula and the islands of Sardinia and Sicily. In 2023, the primary ports collectively managed 11.03 million TEUs, marking a 6.3% dip over 2022. However, this figure still surpassed the volumes seen in both 2020 and 2021. Notably, this decline mirrors a broader European trend, with nearly all major container ports facing setbacks in 2023.

In 2023, Italy managed nearly double the container traffic of France, handling around 5 million TEUs. Surprisingly, despite having a similar number of ports, Italy outpaced France. Notably, three Italian ports - Gioia Tauro, Genoa, and La Spezia - joined the exclusive 'millionaire club.' While Gioia Tauro thrives as a primary hub, Genoa and La Spezia primarily serve as crucial links to the hinterland.

Gioia Tauro, in particular, shone in 2023, boasting a 5% growth in its traffic. The port's authority attributed this surge to the significant presence of MSC at the terminal. Originally developed by Contship, the terminal at Gioia Tauro saw a transition, with Maersk acquiring a stake before it eventually became a pivotal hub for the MSC group, a move that solidified the Swiss company's foothold in the Mediterranean.

Europe Container Drayage Industry Overview

The European container drayage market is dominated by some key players. It boasts a diverse mix, ranging from major global logistics firms to regional players and a host of small to medium-sized enterprises. Noteworthy names include DHL, DB Schenker, and Kuehne + Nagel, alongside industry behemoths like CMA CGM and Maersk Line.

Key trends in the European container drayage market encompass a shift toward digital operations, a growing focus on eco-friendly practices, the integration of IoT and telematics for real-time monitoring, and a rising preference for intermodal transportation solutions. These trends are significantly altering the market's landscape.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 Increasing International Trade Driving the Market

- 4.2.1.2 Increasing Importance of Environmental Sustainability Driving the Market

- 4.2.2 Restraints

- 4.2.2.1 Regulatory Factors Affecting the Market

- 4.2.2.2 Infrastructure Challenges Affecting the Market

- 4.2.3 Opportunities

- 4.2.3.1 Technological Advancements Driving the Market

- 4.2.1 Drivers

- 4.3 Value Chain/Supply Chain Analysis

- 4.4 Government Regulations, Trade Agreements, and Initiatives

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact of Geopolitics and the COVID-19 Pandemic on the Market

5 MARKET SEGMENTATION

- 5.1 By Mode of Transport

- 5.1.1 Rail

- 5.1.2 Road

- 5.1.3 Other Modes of Transport

- 5.2 By Country

- 5.2.1 Germany

- 5.2.2 France

- 5.2.3 United Kingdom

- 5.2.4 Spain

- 5.2.5 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 DHL

- 6.2.2 DB Schenker

- 6.2.3 Kuehne + Nagel

- 6.2.4 CMA CGM

- 6.2.5 Maersk Line

- 6.2.6 Hapag-Lloyd

- 6.2.7 MSC (Mediterranean Shipping Company)

- 6.2.8 COSCO Shipping

- 6.2.9 Evergreen Marine

- 6.2.10 Yang Ming*

- 6.3 Other Companies

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 GDP Distribution, by Activity and Region

- 8.2 Insights into Capital Flows