|

市场调查报告书

商品编码

1636256

废弃物回收服务 -市场占有率分析、产业趋势/统计、成长预测(2025-2030)Waste Recycling Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

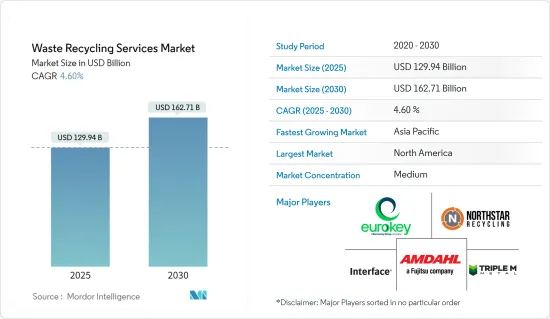

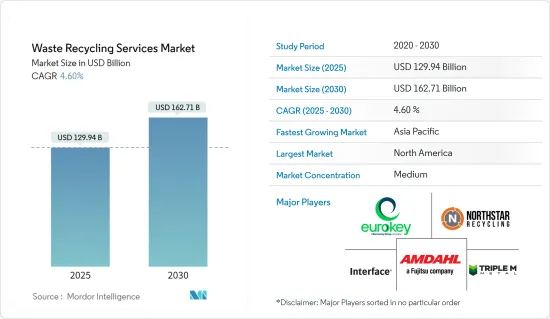

废弃物回收服务市场规模预计到 2025 年为 1,299.4 亿美元,预计到 2030 年将达到 1,627.1 亿美元,预测期内(2025-2030 年)复合年增长率为 4.6%。

主要亮点

- 对永续性的需求不断增长和人口的快速增长正在推动废弃物回收服务市场的发展。

- 现代经济中废物的数量和复杂性不断增加,日益使生态系统和人类健康面临风险。据估计,全球整体每年收集112亿吨固态废弃物,其有机物腐烂产生的温室气体排放量约占全球温室气体排放的5%。特别是,电气和电子设备排放的废弃物含有有害物质,这已成为已开发国家和开发中国家的首要问题。

- 从缺乏收集系统到处理方法不当,废弃物管理不善会导致空气污染、水源和土壤污染。不当的垃圾掩埋场进一步污染饮用水,造成健康风险和疾病传播。散落的碎片危害生态系统,电子废弃物和工业废弃物中的有害物质对城市健康和环境造成负担。

- 第一个解决方案在于最大限度地减少废弃物。当废弃物不可避免时,重点就会转移到材料和能源回收以及再製造和回收。尤其是回收利用可以节省大量资源。例如,回收一吨纸可以节省 17 棵树和 50% 的正常用水量。此外,回收业是重要的就业来源,在巴西、中国和美国僱用了超过 1,200 万人。

- 2024年3月15日,环境、森林和气候变迁部(MOEFCC)在印度官方公报上公布了《2024年塑胶废弃物管理(修订)规则》,该规则进一步细化了《2016年塑胶废弃物管理规则》 。这些修正案一宣布立即生效,突显了印度对抗塑胶污染的承诺。因此,地方政府机构正在加紧努力,尽量减少废弃物并推广回收服务。

废弃物回收服务的市场趋势

废弃物回收活动活性化的地方政府部门

根据联合国环境规划署 (UNEP) 的最新报告,预计城市产生的废弃物将猛增三分之二,相关成本将在一代人内几乎翻倍,确保永续且负担得起的未来。 ,迫切需要大幅减少废弃物的产生。

联合国环境规划署的报告预测,全球都市固态废弃物产生量将从2023年的23亿吨增加到2050年的38亿吨。如果考虑到废弃物管理不当的深远影响(污染、健康危害、气候变迁等),估计费用将上升至 3,610 亿美元。如果不迅速解决废弃物管理问题,到 2050 年,全球每年的成本可能飙升至惊人的 6,403 亿美元,各国将实施城市废弃物回收倡议,这凸显了优先考虑这一问题的紧迫性。

中国作为世界第二人口大国,面临工业、农业和生活部门每年排放超过100亿吨废弃物的巨大挑战。生态环境部于 2024 年 1 月发布的这项资料凸显了这个问题的严重性。不过,中国生活废弃物也有正面进展。为了改善生活条件并增强经济效益,像赵这样的公司正在采取创新方法。我们正在招募针对困难废弃物的独特方法,例如从特定地区收集废弃物,焚烧不可回收的废弃物为都市区提供电力,以及在焚烧前对果皮进行发酵和脱水。

沙乌地阿拉伯投资回收公司 (SIRC) 宣布计划投资垃圾焚化发电工厂,以符合该国在 2030 年实现 3GW垃圾焚化发电能力的野心。 SIRC 的一个重点是提高垃圾焚化发电过程的成本效率。因此,地方政府正在采取各种倡议来促进回收。

亚太地区市场将显着成长

亚洲经济的快速成长和都市化加剧了人们对固态废弃物产生和管理的担忧。使问题更加复杂的是,亚洲国家和地区儘管位于同一地理区域,但在废弃物管理和材料循环倡议方面拥有独特的方法。

随着世界走向循环经济,废弃物管理在亚太市场越来越受到关注。根据联合国区域发展中心的报告,2014年该地区产生的塑胶废弃物量为7,000万吨至1.04亿吨。预计由于原生塑胶消费量的不断增加,到2030年这数字可能飙升至1.4亿吨。

儘管对再生塑胶的需求不断增加,但该地区缺乏废弃物基础设施。然而,合作、监管和投资方面的共同努力正在克服这一障碍,实现循环经济的愿景。

机械回收在亚太地区,特别是在东北亚和印度半岛已占有一席之地。目前该地区机械回收装置容量超过每年1800万吨。其中,中国占该产能的66%,其次是印度,占比约8%。 2012年至2022年间,该地区机械回收能力翻了一番,并自2018年以来维持年均约4%的成长率。根据 ICIS 预测,机械回收产量预计将大幅飙升,从 2023 年的每年 1,200 万吨增至 2040 年的每年 3,500 万吨。这使得亚太地区需要付出巨大的努力来减少每天产生的废弃物。

废弃物回收服务业概况

废弃物回收服务市场分散。竞争格局多元化且充满活力。各种公司竞相提供回收服务、废弃物收集、分类、加工和处置。市场的主要企业包括 Eurokey Recycling Ltd、Northstar Recycling、Triple M Metal LP、Amdahl Corp. 和 Interface Inc.。

中小企业在废弃物回收服务市场中也发挥着重要作用,提供专业服务或针对特定地区或废弃物流。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

- 分析方法

- 调查阶段

第三章执行摘要

第四章市场动态与洞察

- 目前的市场状况

- 市场动态

- 促进因素

- 对永续性的需求不断增长推动市场

- 人们对环境问题的兴趣日益浓厚

- 抑制因素

- 影响市场的监管因素

- 影响市场的基础建设挑战

- 市场机会

- 市场驱动的技术进步

- 促进因素

- 价值链/供应链分析

- 政府法规、贸易协定和倡议

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 废弃物回收服务市场的技术开发

- COVID-19 对市场的影响

第五章市场区隔

- 副产品

- 纸/纸板

- 金属

- 塑胶

- 玻璃

- 电池/电子产品

- 其他的

- 按来源

- 地方政府(住宅和商业设施)

- 工业的

- 其他来源

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 中东/非洲

- 南美洲

第六章 竞争状况

- 市场集中度概览

- 公司简介

- Eurokey Recycling Ltd

- Northstar Recycling

- Triple M Metal LP

- Amdahl Corp.

- Interface Inc.

- Covanta

- Epson Inc.

- Collins & Aikman

- Xerox Corp.

- Fetzer Vineyards*

- 其他公司

第七章 市场的未来

第8章附录

The Waste Recycling Services Market size is estimated at USD 129.94 billion in 2025, and is expected to reach USD 162.71 billion by 2030, at a CAGR of 4.6% during the forecast period (2025-2030).

Key Highlights

- The increasing demand for sustainability and rapid population growth drives the waste recycling services market.

- The modern economy's escalating waste volume and complexity are increasingly endangering ecosystems and human health. Globally, an estimated 11.2 billion tonnes of solid waste are collected annually, with the decay of its organic fraction contributing to about 5% of the world's greenhouse gas emissions. Notably, waste from electrical and electronic equipment, laden with new and hazardous substances, is emerging as a top challenge in both developed and developing nations.

- Poor waste management, spanning from absent collection systems to inadequate disposal methods, leads to air pollution and contaminates water and soil. Improper landfills further contaminate drinking water, posing health risks and disease transmission. Debris dispersal harms ecosystems, while hazardous substances from electronic and industrial waste strain both urban health and the environment.

- The primary solution lies in waste minimization. When waste is inevitable, the focus shifts to material and energy recovery, alongside remanufacturing and recycling. Recycling, in particular, offers significant resource savings. For instance, recycling a tonne of paper saves 17 trees and 50% of the water typically used. Additionally, the recycling industry is a significant job creator, employing over 12 million individuals across Brazil, China, and the United States.

- On March 15, 2024, the Ministry of Environment, Forest and Climate Change (MOEFCC) announced the Plastic Waste Management (Amendment) Rules, 2024, in the Gazette of India, further refining the 2016 Plastic Waste Management Rules. Effective immediately upon publication, this amendment underscored India's commitment to combating plastic pollution. Hence, government bodies across various regions are intensifying efforts to minimize waste and promote recycling services.

Waste Recycling Services Market Trends

Municipal Segment Seeing an Upsurge in Waste Recycling Activities

With municipal waste projected to surge by two-thirds and its associated costs nearly doubling within a generation, a recent report by the UN Environment Programme (UNEP) highlights the urgent need for a significant reduction in waste generation to ensure a sustainable and affordable future.

The UNEP report forecasts that global municipal solid waste generation, which stood at 2.3 billion tonnes in 2023, will reach 3.8 billion tonnes by 2050. When considering the broader impacts of inadequate waste management-such as pollution, health hazards, and climate change-the estimated cost escalates to a substantial USD 361 billion. Failing to address waste management issues promptly could see this annual global cost soar to a monumental USD 640.3 billion by 2050, underscoring the pressing need for nations to prioritize municipal waste recycling initiatives.

China, the world's second most populous country, faces a monumental challenge, producing over 10 billion tons of waste annually, spanning industrial, agricultural, and domestic sectors. This data, released by the Ministry of Ecology and Environment in January 2024, underscores the scale of the issue. However, there are positive strides in China's domestic waste treatment. In an effort to enhance living conditions and bolster economic gains, companies like Zhao's are adopting innovative approaches. They are gathering waste from specific zones, incinerating non-recyclables to power urban areas, and employing unique methods for challenging waste, like fermenting and dehydrating fruit peels before incineration.

Saudi Investment Recycling Company (SIRC) announced plans to invest in waste-to-energy plants, aligning with the nation's ambition to achieve a 3GW waste-to-energy capacity by 2030. A key focus for SIRC is enhancing the cost-efficiency of waste-to-energy processes. Hence, regional governments are spearheading various initiatives to promote recycling endeavors.

Asia-Pacific Observing Significant Growth in the Market

Asia's rapid economic growth and urbanization are amplifying concerns about solid waste generation and management. Adding complexity, each Asian country and region boasts unique approaches to waste management and material-cycle policies despite their shared geographic region.

As the world pushes toward a circular economy, the spotlight on waste management in the Asia-Pacific market intensifies. The United Nations Centre for Regional Development reported that in 2014, the region generated a staggering 70-104 million tonnes of plastic waste. Projections indicate this number could surge to 140 million tonnes by 2030, propelled by a relentless rise in virgin plastic consumption.

While the demand for recycled plastics is on the upswing, the region grapples with a glaring deficit in waste infrastructure. However, concerted efforts in collaboration, regulation, and investment are underway, aiming to surmount this hurdle and actualize the circular economy vision.

In Asia-Pacific, mechanical recycling, especially in Northeast Asia and the Indian subcontinent, has a well-established presence. The region's current installed capacity for mechanical recycling stands at over 18 million tonnes annually. Notably, China leads, accounting for 66% of this capacity, with India following with an approximately 8% share. From 2012 to 2022, the region's mechanical recycling capacity doubled, and it has maintained an average annual growth rate of about 4% since 2018. Projections from ICIS indicate a significant surge in mechanical recycling output, from 12 million tonnes in 2023 to an estimated 35 million tonnes annually by 2040. With this, Asia-Pacific is making a surmountable effort to reduce the waste generated every day.

Waste Recycling Services Industry Overview

The waste recycling services market is fragmented in nature. The competitive landscape is diverse and dynamic. Various companies compete to provide recycling services, waste collection, sorting, processing, and disposal. Some key players in the market include Eurokey Recycling Ltd, Northstar Recycling, Triple M Metal LP, Amdahl Corp., and Interface Inc.

Small and medium-sized enterprises also play a significant role in the waste recycling services market, offering specialized services or catering to specific regions or waste streams.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 Increasing Demand for Sustainability Driving the Market

- 4.2.1.2 Environmental Concerns Driving the Market

- 4.2.2 Restraints

- 4.2.2.1 Regulatory Factors Affecting the Market

- 4.2.2.2 Infrastructure Challenges Affecting the Market

- 4.2.3 Opportunities

- 4.2.3.1 Technological Advancements Driving the Market

- 4.2.1 Drivers

- 4.3 Value Chain/Supply Chain Analysis

- 4.4 Government Regulations, Trade Agreements, and Initiatives

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Technological Developments in the Waste Recycling Services Market

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 Paper & Paperboard

- 5.1.2 Metals

- 5.1.3 Plastics

- 5.1.4 Glass

- 5.1.5 Batteries & Electronics

- 5.1.6 Other Products

- 5.2 By Source

- 5.2.1 Municipal (Residential and Commercial)

- 5.2.2 Industrial

- 5.2.3 Other Sources

- 5.3 By Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.5 South America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Eurokey Recycling Ltd

- 6.2.2 Northstar Recycling

- 6.2.3 Triple M Metal LP

- 6.2.4 Amdahl Corp.

- 6.2.5 Interface Inc.

- 6.2.6 Covanta

- 6.2.7 Epson Inc.

- 6.2.8 Collins & Aikman

- 6.2.9 Xerox Corp.

- 6.2.10 Fetzer Vineyards*

- 6.3 Other Companies