|

市场调查报告书

商品编码

1636259

电动汽车电池电解:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Electric Vehicle Battery Electrolyte - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

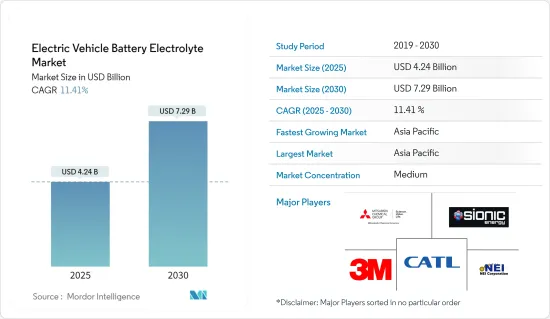

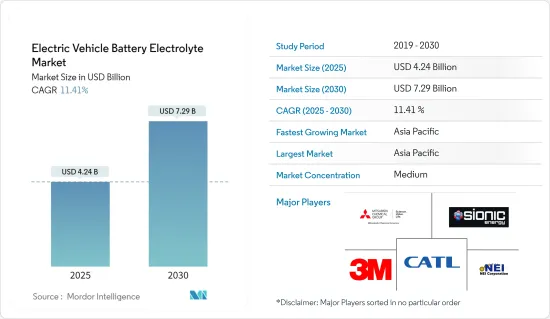

电动车电池电解市场规模预计到2025年为42.4亿美元,预计到2030年将达到72.9亿美元,预测期内(2025-2030年)复合年增长率为11.41%。

主要亮点

- 从中期来看,电动车需求增加和政府支持措施等因素预计将在预测期内推动市场发展。

- 另一方面,先进电解质的高成本和安全问题预计将阻碍预测期内的市场成长。

- 然而,技术创新和新兴电池材料的扩展预计将在未来几年为市场带来重大机会。

- 由于电动车在该地区各国的渗透率不断提高,预计亚太地区将主导市场。

电动汽车电池电解的市场趋势

锂离子电池领域占市场主导地位

- 锂离子电池传统上主要用于家用电子电器,例如行动电话和电脑。然而,由于它们对环境的影响较小,它们越来越多地被重新设计为混合动力汽车和全电动汽车 (EV) 的动力来源。电动车不排放任何温室气体,例如二氧化碳或氮氧化物。

- 2023年,电动车(EV)电池需求与前一年同期比较快速成长40%。中国在电池生产方面继续处于领先地位,尤其是大型电池,约12%的产量用于出口。同时,欧洲正在取得长足进步,彭博新能源财经预测,到 2030 年,欧洲在全球电池产量中的份额可能达到 31%。

- 随着世界各地对电动车的需求不断增加,有效、可靠的电池电解已变得至关重要,推动了电解配方和技术的重大进步。

- 影响锂离子电池电解市场的主要趋势之一是锂离子电池价格的持续下降。例如,到2023年,锂离子电池的平均价格将降至每千瓦时(kWh)约139美元,较2013年大幅下降82%以上。据预测,到 2025 年,价格可能会降至 113 美元/千瓦时以下,并在 2030 年达到 80 美元/千瓦时。这些价格下降趋势使电动车对消费者来说更加实惠,并鼓励製造商探索新的电解质成分并改进现有电解质成分,以提高电池性能和寿命。

- 新兴市场越来越多地采用电动车也推动了锂离子电池电解质领域的成长。世界各国政府正在采取措施和奖励来促进电动车的普及。

- 2023年,美国政府宣布目标是到2030年新车销量的50%为电动车。白宫也宣布了公共和私人承诺,支持美国在电动车加速挑战下向电动车历史性转型。

- 这将导致电池产量和电解需求激增。随着各国优先考虑减少温室气体排放并转向清洁能源来源,高效能电池电解在实现这些永续性目标方面的作用变得越来越重要。

- 因此,随着市场的发展,对永续性和替代技术的关注预计将塑造电池电解液领域未来的全球前景,为更绿色的汽车产业做出贡献。

亚太地区预计将主导市场

- 亚太电动车(EV)电池电解市场正在经历显着成长,这主要得益于中国在电动车生产和销售方面的主导地位。全球电动车销量将从2019年的106万辆激增至2023年的810万辆,增幅超过650%,而中国对电池电解的强劲需求将对这一扩张发挥关键作用。

- 中国企业走在电池技术创新的前沿,不断提高锂离子电池的性能和效率。 2024 年 3 月取得了重大突破,研究揭示了一种新的电解质设计,可显着提高电动车锂离子电池的充电速度并扩大动作温度范围。此创新设计可在室温下 10 分钟内完成完整的充电/放电循环,并确保电池在 -70°C 至 60°C 的宽温度范围内可逆性。这些进步提高了电动车锂离子电池的电池效率、安全性和可靠性。

- 锂离子电池的大规模生产有助于降低製造成本,并使电动车更容易为消费者所接受。人事费用的降低和製造商之间竞争的加剧提高了整体盈利并实现了更广泛的市场渗透。这些成本效率对于鼓励更多消费者转向电动车至关重要,从而推动对电解的需求。

- 除中国外,日本、韩国等亚太国家也在电动车电池电解液市场取得重大进展。日本正专注于开发固体和钠离子电池,预计它们能够以更低的成本提供更好的性能,而韩国则在电池生产和创新方面投入了大量资金。

- 例如,2024 年 4 月,日本研究人员发现了一种稳定、高导电性的材料,适合用作固体锂离子电池的电解质。这种新材料比以前已知的氧化物固体电解质具有更高的离子电导率,并且可以在很宽的温度范围内有效运作。

- 由于技术进步、政府的大力支持、成本效率和基础设施扩张,亚太地区电动汽车电池电解液市场预计将持续成长。随着这些因素的融合,该地区预计将保持其在电动车电池电解市场的主导地位,并塑造永续交通的未来。

电动汽车电池电解产业概况

电动车电池电解市场正变得半固体。主要参与企业包括(排名不分先后)三菱化学集团、Sionic Energy、3M、宁德时代新能源科技有限公司(CATL)和NEI Corporation。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 至2029年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 电动车需求增加

- 政府支持措施

- 抑制因素

- 先进电解质成本高

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 投资分析

第五章市场区隔

- 电池类型

- 锂离子电池

- 铅蓄电池

- 其他电池类型

- 电解质类型

- 液体电解质

- 凝胶电解质

- 固体电解质

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 西班牙

- 北欧的

- 土耳其

- 俄罗斯

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 泰国

- 印尼

- 越南

- 马来西亚

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 埃及

- 奈及利亚

- 卡达

- 其他中东/非洲

- 北美洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Mitsubishi Chemical Group

- 3M Co.

- Contemporary Amperex Technology Co. Limited(CATL)

- NEI Corporation

- Sionic Energy

- BASF SE

- Solvay SA

- UBE Industries Ltd

- LG Chem Ltd

- Targray Industries Inc.

- 市场排名/份额分析

- 其他知名公司名单

第七章 市场机会及未来趋势

- 新兴电池材料的扩展

简介目录

Product Code: 50003540

The Electric Vehicle Battery Electrolyte Market size is estimated at USD 4.24 billion in 2025, and is expected to reach USD 7.29 billion by 2030, at a CAGR of 11.41% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the increasing demand for electric vehicles and supportive government initiatives are expected to drive the market during the forecast period.

- On the other hand, high costs of advanced electrolytes and safety concerns are expected to hinder the market growth during the forecast period.

- However, technological innovations and expansion in emerging battery materials are expected to provide significant opportunities for the market in the coming years.

- Asia-Pacific is estimated to dominate the market due to the increasing adoption rate of electric vehicles across the various countries in the region.

Electric Vehicle Battery Electrolyte Market Trends

The Lithium-ion Batteries Segment to Dominate the Market

- Lithium-ion batteries have traditionally been used mainly in consumer electronic devices like mobile phones and personal computers. Still, due to low environmental impact, they are increasingly being redesigned as the power source of choice in hybrid and the complete electric vehicle (EV) range. EVs do not emit any CO2, nitrogen oxides, or other greenhouse gases.

- In 2023, the demand for electric vehicle (EV) batteries surged by 40% compared to the previous year, driven by rising EV sales across all markets, particularly in Europe and the United States. China continues to lead in battery production, especially for heavy-duty batteries, with approximately 12% of its production being exported. Meanwhile, Europe is making significant strides, with forecasts from BloombergNEF suggesting that its share of global battery production could reach 31% by 2030.

- As the demand for electric vehicles escalates worldwide, effective and reliable battery electrolytes have become paramount, fostering significant advancements in electrolyte formulations and technologies.

- One of the primary trends influencing the lithium-ion battery electrolyte market is the continuous decline in the price of lithium-ion batteries. For instance, the average price of lithium-ion batteries fell to around USD 139 per kilowatt-hour (kWh) in 2023, representing a significant decrease of over 82% since 2013. Projections indicate that prices could decline to below USD 113/kWh by 2025 and reach USD 80/kWh by 2030. This downward pricing trend makes electric vehicles more affordable for consumers and encourages manufacturers to explore new electrolyte compositions and improve existing ones, enhancing battery performance and longevity.

- The increasing penetration of electric vehicles in emerging markets is also driving the growth of the lithium-ion battery electrolyte segment. Governments worldwide are implementing policies and incentives to promote electric vehicle adoption.

- In 2023, the US government announced a goal to have 50% of all new vehicle sales electric by 2030. The White House also announced public and private commitments to support America's historic transition to electric vehicles under the EV Acceleration Challenge.

- This leads to a surge in battery production and electrolyte demand. As countries prioritize reducing greenhouse gas emissions and transitioning to cleaner energy sources, the role of efficient battery electrolytes becomes increasingly critical in achieving these sustainability goals.

- Hence, as the market evolves, the focus on sustainability and alternative technologies is expected to shape the future landscape of the battery electrolyte segment globally, contributing to a greener automotive industry.

Asia-Pacific is Expected to Dominate the Market

- The Asia-Pacific electric vehicle (EV) battery electrolyte market is witnessing remarkable growth, primarily driven by China's leading EV production and sales position. With global electric vehicle sales skyrocketing from 1.06 million in 2019 to 8.1 million in 2023, an increase of over 650%, China's robust demand for battery electrolytes plays a pivotal role in this expansion.

- Chinese companies are at the forefront of battery innovation, continually enhancing the performance and efficiency of lithium-ion batteries. A significant breakthrough occurred in March 2024, as researchers unveiled a new electrolyte design that greatly enhances the charging speed and expands the operational temperature range of lithium-ion batteries for electric vehicles. This innovative design allows for full charge and discharge cycles within 10 minutes at room temperature and ensures battery reversibility across a wide temperature span from -70°C to 60°C. Such advancements enhance battery efficiency and improve safety, making lithium-ion batteries more reliable for electric vehicles.

- The large-scale production of lithium-ion batteries has contributed to the decline in manufacturing costs, making electric vehicles more accessible to consumers. Lower labor costs and increased competition among manufacturers have enhanced overall profitability, enabling broader market reach. These cost efficiencies are critical in encouraging more consumers to transition to electric vehicles, thereby driving demand for electrolytes.

- In addition to China, other countries in Asia-Pacific, such as Japan and South Korea, are making significant strides in the electric vehicle battery electrolyte market. Japan's focus on developing solid-state and sodium-ion batteries promises to deliver better performance at lower costs, while South Korea is investing heavily in battery production and innovation.

- For instance, in April 2024, Japanese researchers identified a stable, highly conductive material suitable for use as an electrolyte in solid-state lithium-ion batteries. This new material boasts ionic conductivity surpassing that of any previously known oxide solid electrolytes and operates effectively over a wide temperature range.

- The Asia-Pacific electric vehicle battery electrolyte market is poised for continued growth, fueled by technological advancements, strong government support, cost efficiencies, and an expanding infrastructure. As these factors converge, the region is expected to maintain its dominance in the market for EV battery electrolytes, shaping the future of sustainable transportation.

Electric Vehicle Battery Electrolyte Industry Overview

The electric vehicle battery electrolyte market is semi-consolidated. Some of the major players include (not in particular order) Mitsubishi Chemical Group, Sionic Energy, 3M Co., Contemporary Amperex Technology Co. Limited (CATL), and NEI Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Demand of Electric Vehicles

- 4.5.1.2 Supportive Government Initiatives

- 4.5.2 Restraints

- 4.5.2.1 High Costs of Advanced Electrolytes

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Batteries

- 5.1.2 Lead-acid Batteries

- 5.1.3 Other Battery Types

- 5.2 Electrolyte Type

- 5.2.1 Liquid Electrolyte

- 5.2.2 Gel Electrolyte

- 5.2.3 Solid Electrolyte

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Spain

- 5.3.2.5 NORDIC

- 5.3.2.6 Turkey

- 5.3.2.7 Russia

- 5.3.2.8 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Thailand

- 5.3.3.6 Indonesia

- 5.3.3.7 Vietnam

- 5.3.3.8 Malaysia

- 5.3.3.9 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Egypt

- 5.3.5.5 Nigeria

- 5.3.5.6 Qatar

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Mitsubishi Chemical Group

- 6.3.2 3M Co.

- 6.3.3 Contemporary Amperex Technology Co. Limited (CATL)

- 6.3.4 NEI Corporation

- 6.3.5 Sionic Energy

- 6.3.6 BASF SE

- 6.3.7 Solvay SA

- 6.3.8 UBE Industries Ltd

- 6.3.9 LG Chem Ltd

- 6.3.10 Targray Industries Inc.

- 6.4 Market Ranking/Share Analysis

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Expansion in Emerging Battery Materials

02-2729-4219

+886-2-2729-4219