|

市场调查报告书

商品编码

1636441

北美电动车电池分离器:市场占有率分析、产业趋势、成长预测(2025-2030)North America Electric Vehicle Battery Separator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

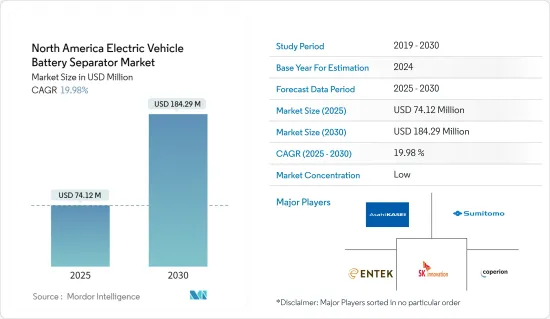

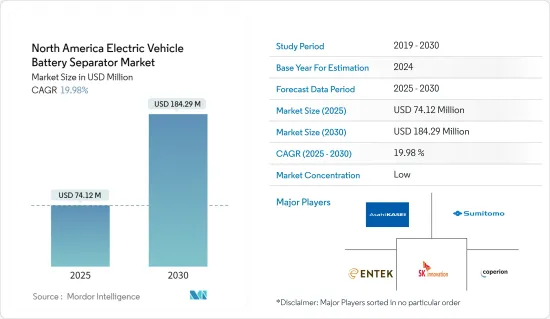

预计2025年北美电动车电池隔膜市场规模为7,412万美元,预计2030年将达1.8429亿美元,预测期内(2025-2030年)复合年增长率为19.98%。

主要亮点

- 从中期来看,市场预计将受益于电动车的普及和锂离子电池价格的下降。

- 相反,围绕电池的严重安全问题对市场扩张构成了潜在挑战。

- 然而,电动车电池技术的突破可能为未来市场的成长铺平道路。

- 研究期间,美国预计将主导北美电动车电池隔膜市场。

北美电动车电池隔膜市场趋势

锂离子电池类型主导市场

- 随着电动车的普及,锂离子电池的产量正在迅速增加。这种势头不仅推动创新,也吸引了电池技术的投资。锂离子电池在加强北美电动车市场和促进向永续交通解决方案过渡方面发挥关键作用。

- 2024年5月,中国电池组件製造商绿新能源材料宣布建设计画一座锂离子电池隔膜製造厂。同样,另一家中国电池製造商Gothion宣布将于2023年投资20亿美元在北美伊利诺州曼特诺兴建新厂。新工厂将生产40GWh容量的锂离子电池芯和10GWh电池组。

- 2024 年 2 月,EnerSys 指定南卡罗来纳州格林维尔作为其新的锂离子电池超级工厂。这项策略决策不仅确定了 EnerSys 的长期成长道路,还强调了其对客製化电池解决方案的奉献精神。透过调整电池尺寸,EnerSys 旨在减少对海外供应商的依赖。如此大规模的锂离子电池生产设施将在预测期内增强隔膜市场。

- 从历史上看,锂离子电池价格大幅下降,带动了对包括隔膜在内的相关零件的需求。根据彭博社NEF报道,2023年锂离子电池的平均价格为139美元/度,自2014年以来价格大幅下降了五倍。

- 如上所述,由于价格大幅下降,锂离子电池迅速普及,电动车电池隔膜市场预计在不久的将来将大幅成长。

美国正在经历显着成长

- 多年来,美国凭藉其紧密一体化的市场,巩固了其作为世界领先经济强国之一的地位。美国处于电池技术研究和创新的前沿,特别是锂离子电池隔膜(LIBS)。

- 虽然美国进口分离器,但像ENTEK这样的国内企业正在大步前进。例如,2023 年 3 月,ENTEK 宣布计划在印第安纳州特雷霍特占地 340 英亩的土地上建造一座耗资 15 亿美元的生产设施,并计划于 2027 年开始营运。

- 2023年11月,美国政府承诺投资最多35亿美元,以强化美国国内电池製造业。这项投资是《基础设施法案》的一部分,该法案旨在加强先进电池及其原材料的生产,并使美国成为快速成长的电动车电池隔离膜市场的主要企业。

- 此外,旭化成公司于2023年10月透露,计划在美国投资约2.64亿美元,安装锂离子电池隔膜涂布设备。这些努力将支持未来几年电动车电池隔膜市场的成长。

- 根据国际能源总署(IEA)预测,2023年美国电动车销量将达到约139万辆,与前一年同期比较增加40%。电动车销量的成长预计将在不久的将来增加对电池和正极等相关零件的需求。

- 基于这些趋势,北美电动车电池隔膜市场预计在未来几年将经历快速成长。

北美电动汽车电池隔膜产业概况

北美电动车电池隔膜市场适度细分,参与企业众多。主要参与企业(排名不分先后)包括旭化成株式会社、住友商事株式会社、Entek International LLC、SK Innovation 和 Coperion GmbH。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 至2029年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 电动车 (EV) 产量增加

- 锂离子电池价格下降

- 抑制因素

- 电池安全严重担忧

- 促进因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品/服务的威胁

- 竞争公司之间的敌对关係

- 投资分析

第五章市场区隔

- 电池类型

- 铅酸

- 锂离子

- 其他的

- 材料

- 聚丙烯

- 聚乙烯

- 其他的

- 地区

- 美国

- 加拿大

- 其他北美地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Asahi Kasei Corp.

- Sumitomo Corporation

- Entek International LLC

- Coperion GmbH

- SK Innovation Co Ltd

- MIRWEC Coating

- Toray Industries

- Celgard

- 市场排名分析

- 其他知名公司名单

第七章 市场机会及未来趋势

- 电动车电池技术的进步

简介目录

Product Code: 50003708

The North America Electric Vehicle Battery Separator Market size is estimated at USD 74.12 million in 2025, and is expected to reach USD 184.29 million by 2030, at a CAGR of 19.98% during the forecast period (2025-2030).

Key Highlights

- In the medium term, the market is poised to benefit from the rising adoption of electric vehicles and the decreasing prices of lithium-ion batteries.

- Conversely, stringent safety concerns surrounding batteries pose a potential challenge to the market's expansion.

- However, breakthroughs in electric vehicle battery technology could pave the way for future market growth.

- During the study period, the United States is projected to dominate North America's Electric Vehicle Battery Separator market.

North America Electric Vehicle Battery Separator Market Trends

Lithium-ion battery type to Dominate the Market

- The rising adoption of electric vehicles drives a corresponding surge in lithium-ion battery production. This momentum not only fuels innovation but also attracts investments in battery technology. It highlights the crucial role lithium-ion batteries play in strengthening North America's electric vehicle market and advancing the broader transition to sustainable transportation solutions.

- In May 2024, Green New Energy Materials, a battery component manufacturer from China, unveiled plans for a USD 140 million lithium-ion battery separator manufacturing facility in Denver, North Carolina. In a similar vein, Gotion, another China-based battery manufacturer, declared in 2023 an investment of USD 2 billion for a new factory in Manteno, Illinois, North America. This new facility is set to produce lithium-ion battery cells with a capacity of 40 GWh and battery packs of 10 GWh.

- In February 2024, EnerSys pinpointed Greenville, South Carolina, for its new lithium-ion cell gigafactory, a move aimed at enhancing United States battery production. This strategic decision not only signals a substantial long-term growth avenue for EnerSys but also emphasizes its dedication to customizing battery solutions. By adjusting cell sizes, EnerSys aims to diminish its dependence on foreign suppliers. Such expansive lithium-ion battery production units are poised to bolster the separator market during the forecast period.

- Historically, lithium-ion battery prices have seen a notable decline, subsequently boosting the demand for related components, including separators. Bloomberg NEF reported that in 2023, the average price of lithium-ion batteries was USD 139 USD/KWh, marking a remarkable fivefold price drop since 2014.

- Thus, with the swift adoption of lithium-ion batteries driven by plummeting prices, the electric vehicle battery separator market stands to gain significantly in the foreseeable future.

United States to Witness Significant Growth

- Over the years, the United States has solidified its position as one of the world's leading economies, thanks to its tightly integrated markets. The United States stands at the forefront of research and innovation in battery technology, notably in Lithium-ion Battery separators (LIBS).

- While the United States does import separators, domestic companies like ENTEK are making significant strides. For example, in March 2023, ENTEK unveiled plans for a USD 1.5 billion production facility on a sprawling 340-acre site in Terre Haute, Indiana, with operations set to commence by 2027.

- In November 2023, the United States government pledged an investment of up to USD 3.5 billion to bolster the nation's domestic battery manufacturing sector. This investment, part of the Infrastructure law, aims to enhance the production of advanced batteries and their raw materials, positioning the United States as a key player in the burgeoning electric vehicle battery separator market.

- Moreover, in October 2023, Asahi Kasei revealed plans to invest around USD 264 million in the United States to set up coating equipment for lithium-ion battery separators, targeting a 2026 operational date. Such initiatives are poised to fuel the growth of the electric vehicle battery separator market in the coming years.

- According to the International Energy Agency, the United States saw electric vehicle sales reach approximately 1.39 million in 2023, marking a 40% surge from the previous year. This uptick in electric vehicle sales is set to drive demand for batteries and related components, like cathodes, in the near future.

- Given these trends, the North American Electric Vehicle Battery Separator Market is poised for rapid growth in the coming years.

North America Electric Vehicle Battery Separator Industry Overview

The North America electric vehicle battery separator market is moderately fragmented, with several players. Some of the major players (not in particular order) include Asahi Kasei Corp., Sumitomo Corporation, Entek International LLC, SK Innovation Co Ltd and Coperion GmbH.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 The Increasing Electric Vehicle (EV) Production

- 4.5.1.2 Declining Lithium-ion Battery Prices

- 4.5.2 Restraints

- 4.5.2.1 Strict Safety Concerns for Batteries

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lead Acid

- 5.1.2 Lithium-ion

- 5.1.3 Other Battery Types

- 5.2 Material

- 5.2.1 Polypropylene

- 5.2.2 Polyethylene

- 5.2.3 Other Materials Types

- 5.3 Geography

- 5.3.1 United States

- 5.3.2 Canada

- 5.3.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Asahi Kasei Corp.

- 6.3.2 Sumitomo Corporation

- 6.3.3 Entek International LLC

- 6.3.4 Coperion GmbH

- 6.3.5 SK Innovation Co Ltd

- 6.3.6 MIRWEC Coating

- 6.3.7 Toray Industries

- 6.3.8 Celgard

- 6.4 Market Ranking Analysis

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advancements in electric vehicle battery technology

02-2729-4219

+886-2-2729-4219