|

市场调查报告书

商品编码

1636511

南美洲电动车用 VRLA 电池:市场占有率分析、产业趋势与成长预测(2025-2030 年)South America Electric Vehicle VRLA Batteries - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

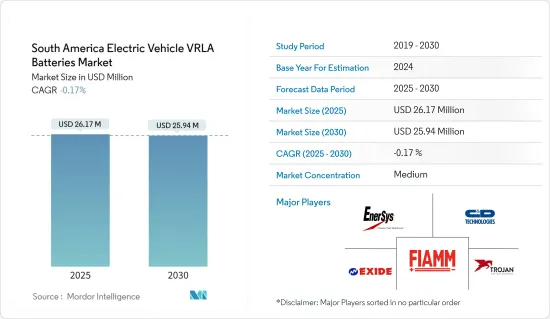

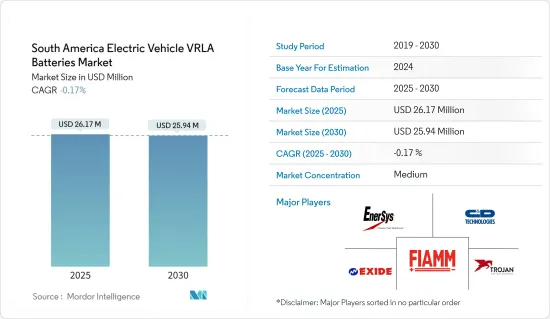

南美洲EV VRLA电池市场规模预计2025年为2,617万美元,预计2030年将下降至2,594万美元。

主要亮点

- 从中期来看,VRLA 电池的成本效益,特别是与锂离子电池相比,以及电动Scooter和电动机车在该地区的激增,预计将在预测期内增强电动汽车对 VRLA 电池的需求.

- 相反,向高性能锂离子电池的快速过渡使得VRLA电池不适合高性能电动车,这对电动车VRLA电池市场的成长构成了重大挑战。

- 然而,VRLA 电池可用作电动车的辅助电源或备用电源,特别是在可靠性胜过能量密度的情况下。这个利基市场在不久的将来为电动车 VRLA 电池市场带来了巨大的成长前景。

- 巴西正成为南美洲电动车 VRLA 电池市场的领导者。原因是,由于这些电池具有成本效益且维护要求极低,因此越来越多地在电动两轮车中采用。

南美洲电动车 VRLA 电池市场趋势

吸收式玻璃毡电池大幅成长

- 南美洲电动车产业青睐 VRLA 电池,尤其是吸收式玻璃毡 (AGM) 类型电池,因为它们具有成本效益、可靠性和免维护特性。 AGM 电池比锂离子电池更便宜,这使其成为电动车的有吸引力的选择。

- AGM 电池是 VRLA 技术的一个子集,因其优于传统铅酸电池的能力而受到关注。透过利用玻璃垫隔板吸收电解,AGM 电池具有明显的优势,尤其是在低成本电动车应用中。

- 随着混合动力汽车和纯电动车在南美洲越来越流行,对 AGM 电池的需求正在迅速增加。南美洲主要国家的电动车销售趋势持续成长。国际能源总署的资料显示,2023年巴西将以15.2万辆的销量领先,哥伦比亚以6,100辆紧随其后,智利以920辆紧随其后。随着政府推出促进电动车普及的政策,销售量预计将进一步增加。

- 在都市区,对微型电动车、电动机车和Scooter的需求正在显着增加。鑑于这些小型车辆的低功率要求,VRLA 电池(尤其是 AGM 型)的经济性和可靠性使它们成为理想的选择。

- 该地区各国政府正在积极推动有利于电动机车和Scooter的协议。一个着名的例子是 SUNRA 阿根廷经销商与当地政府于 2023 年 2 月建立的合作关係。此次合作旨在加强 SUNRA电动机车的促销,并加强该品牌在阿根廷以及更广泛的美洲地区的影响力。这些努力将扩大该地区的电动车市场,并在预测期内增加对 VRLA 电池(包括 AGM 类型)的需求。

- AGM 电池在电动车中日益重要,证实了 VRLA 技术的持续重要性,尤其是在成本敏感地区。协议和计划核准等政府措施正在进一步推动电动车市场的发展。

- 2024年7月,比亚迪外交部长宣布计画在秘鲁兴建电动车组装厂。该工厂计划于 2025 年初开始运营,年产能将达到 15 万辆。预计此类企业不仅将提高该地区的电动车产量,还将扩大未来几年对 AGM 电池的需求。

- 因此,市场前景依然强劲,而电动车产量预计将激增,对 VRLA 电池的需求也将随之增加。

巴西可望主导市场

- 巴西电动车 VRLA(阀控铅酸电池)市场规模虽小,但在电动车转型过程中扮演重要角色。在全球范围内,锂离子电池在电动车市场上处于领先地位。然而,在巴西,VRLA电池,尤其是AGM(吸收式玻璃纤维毡)型电池,在电动摩托车、混合动力电动车和工业应用等领域占据了一席之地。

- 近年来,在消费者需求、环保意识不断增强以及税额扣抵和退税等政府激励措施的推动下,巴西电动车销量大幅成长。随着电动车的普及,电动车电池(包括 VRLA 电池)的需求也增加。

- 根据国际能源总署(IEA)预测,2023年巴西电动车销量将达到15.2万辆,比2022年成长惊人的1.81倍,比2019年成长25.8倍。由于政府的支持政策,预计未来销售将进一步成长。

- 巴西增强电动车和减少碳排放的倡议间接促进了 VRLA 电池在低功率电动车领域的采用。对于优先考虑良好公共交通和清洁能源解决方案的城市来说尤其如此。

- 2024年5月,由雷电网路、大型汽车租赁公司MOVIDA和中国汽车製造商比亚迪组成的财团将电动车的目标数提高到2万辆。该合作伙伴关係旨在加强巴西的城市交通,最初的目标是到 2025年终将 10,000 辆电动车与 99 个应用程式连接起来。这些努力预计将刺激需求,特别是采用 VRLA 技术的电动车电池。

- 虽然锂离子电池对于电动车的普及变得越来越重要,但 VRLA 电池(尤其是 AGM 类型)预计将在利基市场中保持立足点。这包括巴西的电动摩托车、多用途车、工业应用等。

- 一种新的电动摩托车製造体係正在出现。例如,2024年5月,在摩托车领域拥有压倒性实力的Hero MotoCorp计画在巴西设立第一个海外製造工厂。该公司正准备在本财年上半年扩大其Scooter系列。明年电动车领域预计将实现重大飞跃,推出针对中檔和经济实惠细分市场的产品。此类措施将增加该地区对 VRLA 电池的需求。

- 因此,这些计划和倡议将扩大巴西的电动车产量,并在预测期内推动对电动车电池电解的需求。

南美洲电动车 VRLA 电池产业概况

南美洲电动车 VRLA 电池市场规模不大。主要企业(排名不分先后)包括 FIAMM Energy Technology SpA、EnerSys、Exide Technologies、Trojan Battery Company 和 C&D Technologies。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- VRLA 电池的成本效益

- 电动Scooter和电动机车的成长

- 抑制因素

- 替代电池技术的可用性

- 促进因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品/服务的威胁

- 竞争公司之间的敌对关係

- 投资分析

第五章市场区隔

- 按类型

- 吸收玻璃垫电池

- 胶体电池

- 按车型分类

- 摩托车

- 低速电动车

- 工业电动车

- 按地区

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- FIAMM Energy Technology SpA

- EnerSys

- Exide Technologies

- Trojan Battery Company

- Acumuladores Moura

- C&D Technologies

- Hoppecke Batteries

- Ritar Power

- 其他知名企业名单

- 市场排名/份额分析

第七章 市场机会及未来趋势

- 备份和辅助应用程式

简介目录

Product Code: 50003841

The South America Electric Vehicle VRLA Batteries Market size is estimated at USD 26.17 million in 2025, and is expected to decline to USD 25.94 million by 2030.

Key Highlights

- Over the medium term, the cost-effectiveness of VRLA batteries, especially when compared to lithium-ion counterparts, coupled with the surging popularity of electric scooters and bikes in the region, is poised to bolster the demand for electric vehicle VRLA batteries during the forecast period.

- Conversely, the swift transition towards advanced lithium-ion batteries is rendering VRLA batteries less pertinent for high-performance EVs, posing a significant challenge to the growth of the electric vehicle VRLA batteries market.

- However, VRLA batteries find utility as auxiliary power sources or backups in electric vehicles, especially where reliability trumps energy density. This niche presents substantial growth prospects for the electric vehicle VRLA batteries market in the near future.

- Brazil is set to emerge as the frontrunner in the South American electric vehicle VRLA batteries market, driven by the increasing adoption of these batteries in electric two-wheelers, thanks to their cost-efficiency and minimal maintenance needs.

South America Electric Vehicle VRLA Batteries Market Trends

Absorbed Glass Mat Battery Witness Significant Growth

- Across the South American EV industry, VRLA batteries, particularly Absorbed Glass Mat (AGM) types, are favored for their cost-effectiveness, reliability, and maintenance-free nature. AGM batteries, being more affordable than lithium-ion counterparts, present an attractive option for electric vehicles.

- AGM batteries, a subset of VRLA technology, have garnered attention for outpacing traditional lead-acid batteries in performance. By utilizing a glass mat separator to absorb the electrolyte, AGM batteries offer distinct advantages, especially in low-cost electric mobility applications.

- As hybrid and battery-electric vehicles gain traction in South America, the demand for AGM batteries is surging. Sales of EVs in key South American nations have shown a consistent upward trend. Data from the International Energy Agency indicates that in 2023, Brazil led with 152,000 electric vehicle sales, trailed by Colombia at 6,100 and Chile at 920. With the government rolling out policies to bolster EV adoption, sales are poised for further growth.

- Urban areas are witnessing a notable uptick in demand for micro-EVs, electric bikes, and scooters. Given that these smaller vehicles require less power, the affordability and reliability of VRLA batteries, especially AGM types, position them as an ideal choice.

- Governments in the region have actively pursued agreements to champion electric bikes and scooters. A notable instance is the February 2023 partnership between SUNRA Argentina distributors and the local government. This alliance aims to elevate the promotion of SUNRA's electric motorcycles, enhancing the brand's footprint in Argentina and the broader Americas. Such endeavors are set to amplify the electric vehicle market in the region, subsequently boosting the demand for VRLA batteries, including AGM types, during the forecast period.

- The growing prominence of AGM batteries in the EV landscape underscores the sustained importance of VRLA technology, especially in cost-sensitive regions. Government initiatives, including signed agreements and project endorsements, further bolster the EV landscape.

- Highlighting this momentum, BYD's announcement in July 2024, as relayed by the Minister of Foreign Affairs, unveiled plans for an EV assembly plant in Peru. Set to kick off in early 2025, the plant boasts an impressive annual production capacity of 150,000 cars. Such ventures are anticipated to not only elevate EV production in the region but also amplify the demand for AGM batteries in the coming years.

- Consequently, with the projected surge in EV production and the corresponding demand for VRLA batteries, the market outlook remains robust.

Brazil Expected to Dominate the Market

- The Brazilian market for EV VRLA (Valve-Regulated Lead-Acid) batteries, while modest, plays a crucial role in the nation's shift towards electric mobility. Globally, lithium-ion batteries lead the EV market. However, in Brazil, VRLA batteries, especially Absorbed Glass Mat (AGM) types, find their niche in sectors like electric two-wheelers, hybrid electric vehicles, and industrial applications.

- Driven by consumer demand, heightened environmental awareness, and government incentives such as tax credits and rebates, Brazil has seen a notable uptick in EV sales over recent years. As EV adoption rises, so does the demand for EV batteries, including VRLA batteries.

- According to the International Energy Agency, electric vehicle sales in Brazil reached 152,000 units in 2023, marking a 1.81-fold increase from 2022 and a staggering 25.8-fold jump from 2019. With the government rolling out supportive policies, sales are poised to climb further in the coming years.

- Brazil's initiatives to bolster electric mobility and curtail its carbon footprint indirectly favor the uptake of VRLA batteries in low-power EV segments. This is especially true in cities prioritizing enhanced public transportation and clean energy solutions.

- In May 2024, a consortium comprising Raizen, car rental giant Movida, and Chinese automaker BYD, ramped up its electric vehicle target to 20,000. This collaboration, aimed at bolstering urban transport in Brazil, originally set a goal of linking 10,000 electric cars to the 99 app by the end of 2025. Such endeavors are anticipated to boost the demand for EV batteries, particularly those utilizing VRLA technology.

- Despite the growing emphasis on lithium-ion batteries for widespread EV adoption, VRLA batteries, especially AGM variants, are expected to maintain their foothold in niche markets. These include electric two-wheelers, utility vehicles, and industrial applications within Brazil.

- New manufacturing setups for electric two-wheelers are emerging. For example, in May 2024, Hero MotoCorp, a dominant player in the two-wheeler sector, is set to launch its first overseas manufacturing unit in Brazil. The company is gearing up to expand its scooter range in the fiscal year's first half. The upcoming year promises significant strides in the EV domain, with product launches aimed at the mid-range and budget-friendly segments. Such initiatives are poised to bolster the demand for VRLA batteries in the region.

- Consequently, these projects and initiatives are set to amplify EV production in Brazil, driving up the demand for EV battery electrolytes during the forecast period.

South America Electric Vehicle VRLA Batteries Industry Overview

The South America Electric Vehicle VRLA Batteries market is moderate. Some of the key players (not in particular order) are FIAMM Energy Technology S.p.A., EnerSys, Exide Technologies, Trojan Battery Company, C&D Technologies, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Cost-Effectiveness of VRLA batteries

- 4.5.1.2 Growth in Electric Scooters and Bikes

- 4.5.2 Restraints

- 4.5.2.1 Availability of Alternate Battery Technology

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Absorbed Glass Mat Battery

- 5.1.2 Gel Battery

- 5.2 By Vehicle Type

- 5.2.1 Two-Wheelers

- 5.2.2 Low-Speed EVs

- 5.2.3 Industrial Evs

- 5.3 Geography

- 5.3.1 Brazil

- 5.3.2 Argentina

- 5.3.3 Colombia

- 5.3.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 FIAMM Energy Technology S.p.A.

- 6.3.2 EnerSys

- 6.3.3 Exide Technologies

- 6.3.4 Trojan Battery Company

- 6.3.5 Acumuladores Moura

- 6.3.6 C&D Technologies

- 6.3.7 Hoppecke Batteries

- 6.3.8 Ritar Power

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/ Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Backup and Auxiliary Applications

02-2729-4219

+886-2-2729-4219