|

市场调查报告书

商品编码

1636516

中国电动车阀控密封铅酸电池:市场占有率分析、产业趋势与统计、成长预测(2025-2030)China Electric Vehicle Vrla Batteries - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

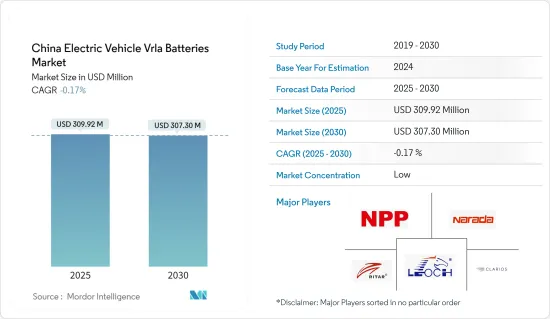

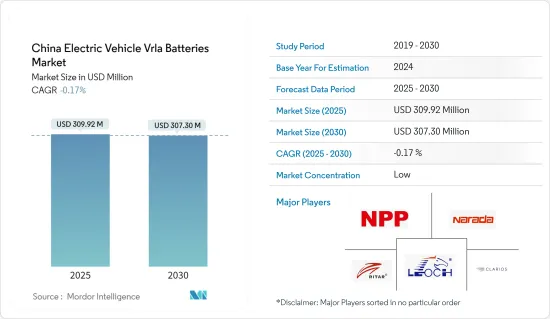

预计2025年中国电动车VRLA电池市场规模为3.0992亿美元,预计2030年将降至3.073亿美元。

主要亮点

- 电动车对 VRLA 电池的需求预计在未来几年将会增加。这是由于其与锂离子电池相比具有较高的成本效益,以及电动Scooter和电动摩托车在全国范围内的迅速普及。

- 相反,快速过渡到先进锂离子电池正在成为高性能电动车的标准,这对电动车 VRLA 电池市场的成长构成了挑战。

- 然而,VRLA 电池作为电动车的辅助电源或备用电源仍然具有价值,特别是在可靠性优先于能量密度的情况下。这个利基市场在不久的将来为电动车 VRLA 电池市场提供了巨大的成长潜力。

中国电动车VRLA电池市场趋势

吸收式玻璃毡电池大幅成长

- VRLA 电池,尤其是吸收式玻璃纤维毡 (AGM) 型电池,由于其经济高效、可靠且免维护的特点,在中国电动车产业中广泛使用。 AGM 电池比锂离子电池更便宜,这使其成为电动车的有吸引力的选择。

- 吸收式玻璃毡 (AGM) 电池是 VRLA 电池的子集,因其优于传统铅酸电池的性能而备受关注。 AGM 电池利用玻璃垫隔板吸收电解,具有独特的优势,特别适合某些电动车应用,特别是低成本电动车。

- 随着两轮和三轮电动车在中国的普及,该领域对 AGM 电池的需求正在迅速增加。然而,由于最近两轮车和三轮车的销量下降,AGM电池产业正感受到压力。国际能源总署(IEA)的资料显示,中国电动摩托车销量正在下降,从2021年的1,020万辆锐减至590万辆。展望未来,以锂离子为首的替代电池技术的兴起将为 AGM 市场带来挑战。

- 中国电动车电池市场主要受到新能源汽车(NEV)激增的推动,而政府的指令进一步加速了这一成长。例如,2023年6月,财政部宣布对2024年和2025年购买的新能源汽车每辆车免征3万元人民币(4,170美元)的销售税。 2026年至2027年期间购买的免税额将降至15,000元。此外,为进一步刺激电动车销售而于 2020 年 4 月推出的中国国家新能源汽车补贴计画原定于 2020年终结束,但因 COVID-19 疫情而延长至 2022 年。

- AGM 电池在电动车领域(尤其是在成本敏感地区)日益重要,凸显了 VRLA 技术的持续重要性。此外,政府协议和倡议强调了增加电动车采用和加强区域电动车基础设施的承诺。

- 因此,这些倡议不仅将提高该地区的电动车产量,还将增加未来几年电动车对 VRLA 电池的需求。

中国针对新能源汽车充电基础设施的倡议

- 根据中国电动车充电基础设施促进会(EVCIPA)统计,截至2023年8月,中国拥有充电基础设施(公共和私营)720.8万个。其中,2,272,000 个为公共充电站,4,936,000 个指定为私人使用。

- 预计2024年终,中国电动车充电桩保有量将快速成长至958万台,大幅成长约84%。这种上升趋势凸显了电动车充电器市场的巨大潜力和机会。

- 中国正在推出一系列有针对性的措施来加强电动车充电市场,关键日期如下:

- 2023年6月(政策文件:关于进一步建造高品质充电基础设施体系的指导意见):该措施旨在建立覆盖都市区、高速公路和农村的统一充电网路。它强调标准化、监管和市场监控的必要性,并制定了到 2030 年主导全球充电技术的愿景。

- 2023年5月(政策文件:加速充电基础设施发展,更好支持新能源汽车普及和农村区域振兴):此措施旨在加速充电基础设施发展,更好支持新能源汽车普及和公共振兴地方政府,促进商业建筑、交通枢纽和高速公路停车场安装充电站。

- 2023年1月(政策文件:关于促进能源电子产业发展的指导意见):重点推动能源电子产品在5G基地台、新能源汽车充电站等新兴设备中的应用。

- 2022年12月(政策文件:「十四五」扩大内需实施方案):重点加强停车场、充电站、换电站、加氢站等配套设施建设。

- 例如,与「十四五」规划一致的《北京市城市管理与发展规划》目标是到2025年电动车充电桩总数达到70万个。

- 这些政府措施的重点是提高充电设施的安全性、智慧性和连接性,而不仅仅是数量。这些进步可能会在未来几年推动电动车产业的发展并加强电池市场。

中国电动汽车阀控密封铅酸蓄电池产业概况

中国电动车VRLA电池市场适度细分。主要企业(排名不分先后)包括NPP电力集团、雄芯电池集团、南都电源、理士电池公司等。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- VRLA 电池的成本效益

- 电动Scooter和电动摩托车的成长

- 抑制因素

- 替代电池技术的可用性

- 促进因素

- 供应链分析

- 产业吸引力PESTLE分析

- 投资分析

第五章市场区隔

- 按类型

- 吸收玻璃垫电池

- 胶体电池

- 按车型

- 摩托车

- 低速电动车

- 工业电动车

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- LEOCH Battery Corporation

- Zhejiang Narada Power Source Co., Ltd.

- NPP Power Group

- C&D Technologies

- Shenzhen Ritar Power Co Ltd

- Clarious LLC

- Ritar Power

- GS Yuasa Battery Ltd.

- JYC Battery Manufacturer Co. Ltd.

- Chilwee Battery

- 其他知名公司名单

- 市场排名/份额分析

第七章 市场机会及未来趋势

- 备份和辅助应用程式

简介目录

Product Code: 50003869

The China Electric Vehicle Vrla Batteries Market size is estimated at USD 309.92 million in 2025, and is expected to decline to USD 307.30 million by 2030.

Key Highlights

- In the coming years, the demand for electric vehicle VRLA batteries is projected to rise, driven by their cost-effectiveness compared to lithium-ion batteries and the surging popularity of electric scooters and bikes nationwide.

- Conversely, the swift transition to advanced lithium-ion batteries, which are becoming the standard for high-performance EVs, poses a challenge to the growth of the electric vehicle VRLA batteries market.

- However, VRLA batteries still hold value as auxiliary power sources or backups in electric vehicles, especially in scenarios prioritizing reliability over energy density. This niche presents substantial growth potential for the electric vehicle VRLA batteries market in the near future.

China Electric Vehicle Vrla Batteries Market Trends

Absorbed Glass Mat Battery Witness Significant Growth

- Due to their cost-effectiveness, reliability, and maintenance-free nature, VRLA batteries, particularly Absorbed Glass Mat (AGM) types, are frequently utilized in China's EV industry. AGM batteries, being more affordable than lithium-ion counterparts, present an attractive option for electric vehicles.

- AGM (Absorbed Glass Mat) batteries, a subset of VRLA batteries, have garnered attention for outperforming traditional lead-acid variants. By utilizing a glass mat separator to absorb the electrolyte, AGM batteries offer distinct advantages, making them particularly suited for certain EV applications, especially in budget-friendly electric mobility.

- As two and three-wheeler electric vehicles gain traction in China, the demand for AGM batteries in this segment has surged. Yet, with a recent downturn in two and three-wheeler sales, the AGM battery sector is feeling the pinch. Data from the International Energy Agency (IEA) reveals a drop in electric two-wheeler sales in China, plummeting from 10.2 million in 2021 to 5.9 million. Looking ahead, the rise of alternative battery technologies, notably lithium-ion, poses a challenge to the AGM market.

- China's electric vehicle battery market is primarily propelled by the uptake of new energy vehicles (NEVs), a momentum further fueled by government mandates. For example, in June 2023, The Ministry of Finance announced a sales tax exemption of CNY 30,000 (USD 4,170) per vehicle for NEVs purchased in 2024 and 2025. This exemption will taper to CNY 15,000 for purchases made between 2026 and 2027. Additionally, China's national New Energy Vehicle Subsidy Program, initiated in April 2020 to further stimulate EV sales, was originally set to conclude at the end of 2020 but received an extension until 2022 due to the COVID-19 pandemic.

- The growing prominence of AGM batteries in the EV domain, especially in cost-sensitive regions, underscores the sustained significance of VRLA technology. Furthermore, government agreements and initiatives underscore a commitment to bolster EV adoption and enhance the region's EV infrastructure.

- Consequently, these initiatives are poised to not only boost EV production in the region but also elevate the demand for EV VRLA batteries in the coming years.

Chinese Policies Targeting Charging Infrastructure for New Energy Vehicles

- As of August 2023, China boasted 7,208,000 charging infrastructure units (both public and private), according to the China Electric Vehicle Charging Infrastructure Promotion Alliance (EVCIPA). Out of these, 2,272,000 were public charging stands, while 4,936,000 were designated for private use.

- Projections for the end of 2024 suggest that the number of EV chargers in China will surge to 9.58 million units, representing a substantial growth rate of approximately 84 percent. This upward trajectory underscores the immense potential and opportunities within the EV charging market.

- China has introduced a series of targeted policies to strengthen its EV charging market, with the following key dates:

- June 2023 (Policy Document: Guiding Opinions on Further Constructing a High-Quality Charging Infrastructure System): The policy aims to establish a unified charging network across urban, highway, and rural areas. It emphasizes the need for standardization, regulation, and market oversight, with a vision to dominate global charging technologies by 2030.

- May 2023 (Policy Document: Accelerating the Development of Charging Infrastructure to Better Support the Deployment of New Energy Vehicles in Rural Areas and Rural Revitalization): This initiative supports local governments in setting up public charging networks at the county level and facilitates the installation of charging points in commercial buildings, traffic hubs, and highway parking areas.

- January 2023 (Policy Document: Guiding Opinions on Promoting the Development of Energy Electronics Industry): Focuses on boosting the application of energy electronic products in emerging facilities, including 5G base stations and new energy vehicle charging stations.

- December 2022 (Policy Document: Implementation Plan for Expanding Domestic Demand in the 14th Five-Year Plan): Emphasizes the enhancement of supporting facilities like parking lots, charging stations, battery swapping stations, and hydrogen refueling stations.

- For example, the Beijing Urban Management Development Plan, aligned with the 14th Five-Year Plan, targets a cumulative total of 700,000 electric vehicle chargers by 2025.

- These governmental efforts are not just about numbers; they focus on elevating the safety, intelligence, and connectivity of charging facilities. Such advancements are poised to propel the EV industry forward, potentially bolstering the battery market in the coming years.

China Electric Vehicle Vrla Batteries Industry Overview

The China Electric Vehicle VRLA Batteries market is moderately fragmented. Some of the key players (not in particular order) are NPP Power Group., Vision Battery Group, Zhejiang Narada Power Source Co., Ltd., and LEOCH Battery Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Cost-Effectiveness of VRLA batteries

- 4.5.1.2 Growth in Electric Scooters and Bikes

- 4.5.2 Restraints

- 4.5.2.1 Availability of Alternate Battery Technology

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Absorbed Glass Mat Battery

- 5.1.2 Gel Battery

- 5.2 By Vehicle Type

- 5.2.1 Two-Wheelers

- 5.2.2 Low-Speed EVs

- 5.2.3 Industrial Evs

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 LEOCH Battery Corporation

- 6.3.2 Zhejiang Narada Power Source Co., Ltd.

- 6.3.3 NPP Power Group

- 6.3.4 C&D Technologies

- 6.3.5 Shenzhen Ritar Power Co Ltd

- 6.3.6 Clarious LLC

- 6.3.7 Ritar Power

- 6.3.8 GS Yuasa Battery Ltd.

- 6.3.9 JYC Battery Manufacturer Co. Ltd.

- 6.3.10 Chilwee Battery

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/ Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Backup and Auxiliary Applications

02-2729-4219

+886-2-2729-4219