|

市场调查报告书

商品编码

1636513

东南亚国协电动车用VRLA电池:市场占有率分析、产业趋势与成长预测(2025-2030年)ASEAN Electric Vehicle VRLA Batteries - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

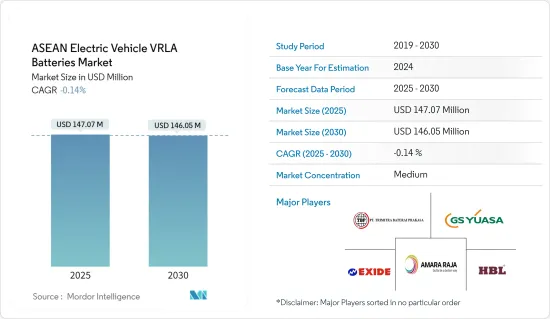

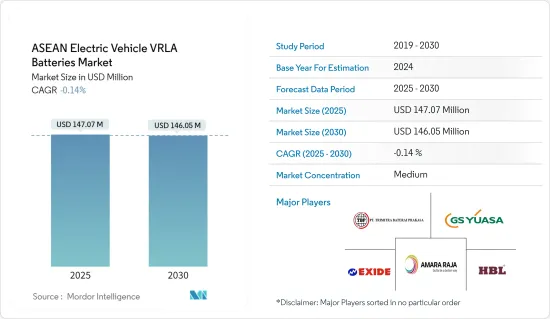

预计2025年东南亚国协电动车VRLA电池市场规模为1.4707亿美元,预计2030年将下降至1.4605亿美元。

主要亮点

- 未来几年,VRLA 电池的成本效益,特别是与锂离子电池相比,加上电动Scooter和电动两轮车在该地区的激增,预计将加强电动车对 VRLA 电池的需求在预测期内。

- 相反,向高性能锂离子电池的快速过渡降低了VRLA电池在高性能电动车中的相关性,对电动车VRLA电池市场的成长构成了重大挑战。

- 然而,VRLA 电池正在作为辅助电源和备用解决方案发挥效用,特别是在可靠性胜过能量密度的电动车中。这个利基市场在不久的将来为电动车 VRLA 电池市场提供了巨大的成长机会。

- 泰国已成为东协电动车 VRLA 电池市场的领跑者,越来越多地采用具有成本效益且易于维护的电动两轮车。

东协电动车VRLA电池市场趋势

吸收性玻璃毡电池大幅成长

- 由于越来越多地采用吸收式玻璃纤维毡(AGM)电池技术,东南亚国协的电动车 VRLA 电池市场正在显着成长。 AGM 电池是阀控式铅酸电池 (VRLA) 的一种,具有明显的优势。其密封设计不仅最大限度地降低了洩漏风险,而且还减少了维护,特别是与传统电解型铅酸电池相比。这一特性使得 AGM 电池对该地区的电动车 (EV) 特别有利。

- AGM 电池还提供比标准铅酸电池更高的功率密度。对于需要快速爆发能量来加速的电动车来说,这是一个基本特征。如此卓越的性能不仅增加了车辆续航里程,而且使 AGM 电池成为某些电动车领域(尤其是电动摩托车和Scooter)中锂离子电池的可行替代品。

- 随着该地区两轮和三轮电动车行业 AGM 电池的采用迅速增加,需求只会不断增加。东协汽车联合会的资料凸显了这个趋势。 2023年,东南亚摩托车和Scooter销量为1,272万辆,较2022年成长3.67%,较2019年大幅成长2.2倍。在这些销量中,电动摩托车和Scooter占据了相当大的比例,鑑于政府采取区域性措施促进电动车的采用,这一份额预计还会扩大。

- 东协各国政府正在支持电气化,旨在减少对石化燃料的依赖并应对环境挑战。这些措施的重点是加强包括电池在内的电动车零件的本地生产,以服务国内和出口市场。

- 例如,印尼政府的 2023 年低碳排放汽车 (LCEV) 计划推广混合动力汽车和电动车,并促进 AGM 等 VRLA 技术的发展。在新加坡,政府的《绿色计画 2030》旨在到 2040 年逐步淘汰内燃机汽车,并支持推广电动车技术,包括用于小型汽车的 AGM 电池。预计这些努力将在不久的将来提高电动车的产量和需求。

- 此外,泰国、马来西亚、印尼和越南等东南亚国协正在加强其电动车基础设施,进一步推动对 AGM 电池等经济型能源储存解决方案的需求。许多公司已采取措施加速电动车的生产,以满足快速成长的需求。

- 例如,TVS Motor 计划于 2024 年 8 月从印尼开始,加强在东协的业务。我们计划从印尼生产基地向东东南亚国协市场出口电动车。 TVS Motor 推出了 iQube 系列中的五款电动Scooter。此外,该公司还准备在年终前推出一款价格实惠的电动Scooter和一款新型电动三轮车。预计此类措施不仅将满足电动车不断增长的需求,还将在预测期内增加对 AGM 电池的需求。

- 随着这些新兴市场的发展,该地区的电动车产量预计将增加,从而创造适合市场分析的环境。

泰国正在经历显着的成长

- 泰国对电动车 (EV) 的推动推动了对阀控式铅酸电池 (VRLA) 的需求。这一激增主要是由于政府对电气化的坚定承诺、本地製造计划以及对具有成本效益的电动车解决方案日益增长的需求。

- 成本在向电动车的过渡中起着至关重要的作用。虽然豪华电动车主要使用锂离子电池,但 VRLA 电池,尤其是 AGM(吸收玻璃毡)电池,代表了更经济的选择。这些常见于泰国流行的电动Scooter和三轮车等小型电动车。

- 东协地区的电动车 (EV) 销量大幅成长。例如,根据泰国汽车实验室的报告,2023 年註册的纯电动车 (BEV) 数量达到 76,360 辆。这比 2022 年增长了 6.89 倍,比 2019 年增长了 47.6 倍。由于电动车销量预计将继续成长,该地区对 VRLA 电池的需求预计将增加。然而,锂离子等替代电池技术的出现以及 VRLA 电池的额外优势可能会影响未来几年电动车产业的市场成长。

- 泰国拥有庞大的电动两轮车、Scooter和嘟嘟车市场,所有这些车辆通常都使用 VRLA 电池。这些车辆对于短途旅行至关重要,价格实惠,可供广大人群使用。为了满足对电动车快速成长的需求,许多本地公司正在推出电动摩托车。

- 例如,在 2024 年 4 月举行的 2024 年车展上,STROM 宣布了泰国电动两轮车领域的三款创新车型,成为头条新闻。 STROM APE AP-400L 专为在远距旅行中寻求速度的运动骑手而设计。同时,新款 Panther V2 号称“点燃电动车的未来”,承诺敏捷性和灵活性。此类产品的推出预计将满足不断增长的电动车需求并提高 VRLA 电池的产量。

- 此外,泰国被定位为东南亚电动车电池製造中心。部分得益于政府的激励措施,国内外公司正在提高 VRLA 电池的产量,以满足电动车快速成长的需求。

- BMW宣布计划于 2024 年 2 月在泰国罗勇建设一家专门的电动车电池工厂,这是一项引人注目的倡议。这项策略决策旨在加强泰国的电池供应链。 BMW的目标是将泰国打造成电动车电池的主要出口基地,瞄准广阔的亚太市场。这些努力不仅将提高泰国的电池产量,还将增加未来几年对 VRLA 电池的需求。

- 因此,这些倡议可能会提高该地区的电动车产量并支持市场研究。

东南亚国协电动车VRLA电池产业概况

东南亚国协电动车VRLA电池市场规模适中。主要企业(排名不分先后)包括 GS Yuasa Corporation、Exide Industries、HBL Power Systems Ltd.、PT Trimitra Baterai Prakasa 和 Amara Raja Batteries Limited。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- VRLA 电池的成本效益

- 电动Scooter和电动摩托车的成长

- 抑制因素

- 技术过时

- 促进因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品/服务的威胁

- 竞争公司之间的敌对关係

- 投资分析

第五章市场区隔

- 按类型

- 吸收玻璃垫电池

- 胶体电池

- 按车型

- 摩托车

- 低速电动车

- 工业电动车

- 按地区

- 印尼

- 越南

- 寮国

- 泰国

- 缅甸

- 菲律宾

- 其他东南亚国协

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- GS Yuasa Corporation

- Amara Raja Batteries Ltd

- Exide Technologies

- HBL Power Systems Ltd

- PT. Trimitra Baterai Prakasa

- Global Power Source Co., Ltd

- Panasonic Corporation

- CSB Battery

- Leoch International Technology Limited

- Narada Power Source Co., Ltd.

- 其他知名公司名单

- 市场排名/份额分析

第七章 市场机会及未来趋势

- 备份和辅助应用程式

简介目录

Product Code: 50003856

The ASEAN Electric Vehicle VRLA Batteries Market size is estimated at USD 147.07 million in 2025, and is expected to decline to USD 146.05 million by 2030.

Key Highlights

- In the coming years, the cost-effectiveness of VRLA batteries, especially when compared to lithium-ion counterparts, coupled with the surging popularity of electric scooters and bikes in the region, is poised to bolster the demand for electric vehicle VRLA batteries during the forecast period.

- Conversely, the swift transition towards advanced lithium-ion batteries is diminishing the relevance of VRLA batteries for high-performance EVs, posing a significant challenge to the growth of the electric vehicle VRLA batteries market.

- However, VRLA batteries find utility as auxiliary power sources or backup solutions in electric vehicles, especially where reliability trumps energy density. This niche presents substantial growth opportunities for the electric vehicle VRLA batteries market in the near future.

- Thailand is set to emerge as the frontrunner in the ASEAN electric vehicle VRLA batteries market, driven by the increasing adoption of cost-efficient and low-maintenance electric two-wheelers.

ASEAN Electric Vehicle VRLA Batteries Market Trends

Absorbed Glass Mat Battery to Witness Significant Growth

- The ASEAN market for EV VRLA batteries has seen significant growth, largely fueled by the rising adoption of Absorbed Glass Mat (AGM) battery technology. AGM batteries, a type of Valve-Regulated Lead-Acid (VRLA) battery, come with distinct advantages. Their sealed design not only minimizes leakage risks but also cuts down on maintenance, especially when compared to traditional flooded lead-acid batteries. This feature makes AGM batteries especially beneficial for the region's electric vehicles (EVs).

- AGM batteries also deliver a higher power density than standard lead-acid batteries. This is a vital trait for EVs, which require quick energy bursts for acceleration. Such superior performance not only enhances vehicle range but also positions AGM batteries as a viable alternative to lithium-ion batteries in certain EV segments, particularly in electric bikes and scooters.

- As the adoption of AGM batteries surges in the region's two-wheeler and three-wheeler EV industries, demand continues to rise. Data from the ASEAN Automotive Federation highlights this trend: in 2023, Southeast Asia saw sales of 12.72 million motorcycles and scooters, marking a 3.67% increase from 2022 and a 2.2-fold surge since 2019. With a notable portion of these sales being EV motorcycles and scooters, and given the government's regional policies promoting EV adoption, this share is set to grow.

- Governments throughout the ASEAN region are championing electrification, aiming to lessen reliance on fossil fuels and tackle environmental challenges. Their policies emphasize boosting local production of EV components, batteries included, to cater to both domestic and export markets.

- Take, for example, the Indonesian government's 2023 Low Carbon Emission Vehicle (LCEV) program, which promotes hybrid and electric vehicles, thereby nurturing the growth of VRLA technologies like AGM. In Singapore, the government's Green Plan 2030 is set to phase out internal combustion engine vehicles by 2040, bolstering the push for EV technologies, including AGM batteries for compact vehicles. Such endeavors are poised to elevate both EV production and demand in the near future.

- Moreover, countries in the ASEAN, including Thailand, Malaysia, Indonesia, and Vietnam, are ramping up their EV infrastructure, further driving the demand for economical energy storage solutions like AGM batteries. Numerous companies are launching initiatives to boost electric vehicle production, aiming to meet the surging demand.

- For instance, in August 2024, TVS Motor is set to bolster its presence in ASEAN, kicking off in Indonesia. The automaker plans to export electric vehicles to ASEAN markets from its Indonesian manufacturing base. TVS Motor has rolled out five electric scooter variants from its iQube lineup. Furthermore, the company is gearing up to launch a budget-friendly electric scooter and a novel electric three-wheeler by year-end. Such initiatives are anticipated to not only meet the growing EV demand but also amplify the need for AGM batteries during the forecast period.

- Given these developments, the projected increase in EV production across the region creates a conducive environment for market analysis.

Thailand to Witness Significant Growth

- Thailand's push towards electric vehicles (EVs) is driving up the demand for valve-regulated lead-acid (VRLA) batteries. This surge is largely due to the government's strong commitment to electrification, local production initiatives, and a growing appetite for cost-effective EV solutions.

- Cost plays a pivotal role in the shift to electric mobility. While higher-end EVs predominantly use lithium-ion batteries, VRLA batteries, especially Absorbed Glass Mat (AGM) variants, offer a more economical alternative. These are frequently found in smaller EVs, like electric scooters and three-wheelers, which enjoy popularity in Thailand.

- Sales of electric vehicles (EVs) have seen a significant uptick in the ASEAN region. For instance, the Thailand Automotive Institute reported that in 2023, registered battery electric vehicles (BEVs) reached 76.36 thousand units. This marks a 6.89-fold increase from 2022 and a staggering 47.6-fold rise since 2019. With EV sales projected to continue their upward trajectory, the region's demand for VRLA batteries is expected to increase. However, the availability of alternate battery technology like lithium-ion, with the added advantages of VRLA batteries, is likely to impact the market growth in the EV industry in the upcoming years.

- Thailand boasts a substantial market for electric motorcycles, scooters, and tuk-tuks, all of which commonly utilize VRLA batteries. These vehicles, vital for short-distance travel, are affordable and accessible to a broad demographic. In response to the surging demand for EVs, numerous regional companies have introduced EV two-wheelers.

- For example, at the 2024 Motor Show in April 2024, STROM made headlines by launching three innovative models in Thailand's electric motorcycle sector. The STROM APE AP-400L is designed for sporty riders eyeing speed on long journeys. In contrast, the All-New Panther V2, branded as 'Igniting the Future of Electric Mobility,' promises agility and flexibility. Such launches are anticipated to meet the growing EV demand and subsequently boost VRLA battery production.

- Moreover, Thailand is positioning itself as Southeast Asia's EV battery manufacturing hub. With government incentives driving the initiative, both domestic and international firms are ramping up VRLA battery production to cater to the surging EV demand.

- In a notable move, BMW announced in February 2024 its plans for a dedicated EV battery factory in Rayong, Thailand. This strategic decision aims to strengthen the nation's battery supply chains. BMW has set its sights on making Thailand a central export hub for its EV batteries, with ambitions targeting the expansive Asia Pacific market. Such endeavors are not only set to elevate battery production in Thailand but also heighten the demand for VRLA batteries in the coming years.

- Consequently, these initiatives are poised to boost EV production in the region and are likely to support the market study.

ASEAN Electric Vehicle VRLA Batteries Industry Overview

The ASEAN Electric Vehicle VRLA Batteries market is moderate. Some of the key players (not in particular order) are GS Yuasa Corporation, Exide Industries, HBL Power Systems Ltd., PT Trimitra Baterai Prakasa, and Amara Raja Batteries Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Cost-Effectiveness of VRLA batteries

- 4.5.1.2 Growth in Electric Scooters and Bikes

- 4.5.2 Restraints

- 4.5.2.1 Technological Obsolescence

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Absorbed Glass Mat Battery

- 5.1.2 Gel Battery

- 5.2 By Vehicle Type

- 5.2.1 Two-Wheelers

- 5.2.2 Low-Speed EVs

- 5.2.3 Industrial Evs

- 5.3 Geography

- 5.3.1 Indonesia

- 5.3.2 Vietnam

- 5.3.3 Laos

- 5.3.4 Thailand

- 5.3.5 Myanmar

- 5.3.6 Philippines

- 5.3.7 Rest of ASEAN Countries

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 GS Yuasa Corporation

- 6.3.2 Amara Raja Batteries Ltd

- 6.3.3 Exide Technologies

- 6.3.4 HBL Power Systems Ltd

- 6.3.5 PT. Trimitra Baterai Prakasa

- 6.3.6 Global Power Source Co., Ltd

- 6.3.7 Panasonic Corporation

- 6.3.8 CSB Battery

- 6.3.9 Leoch International Technology Limited

- 6.3.10 Narada Power Source Co., Ltd.

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/ Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Backup and Auxiliary Applications

02-2729-4219

+886-2-2729-4219