|

市场调查报告书

商品编码

1636560

东南亚充电电池:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Southeast Asia Rechargeable Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

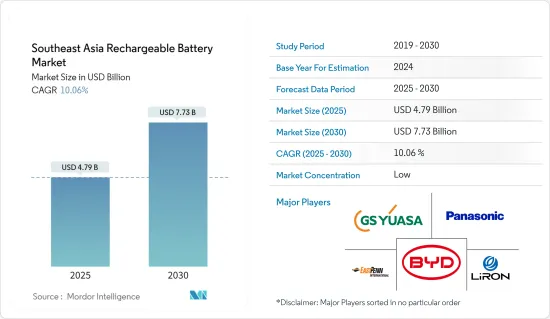

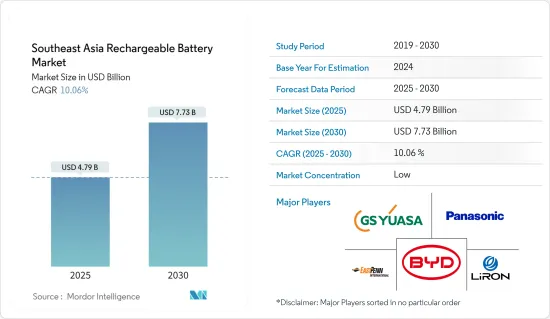

东南亚可充电电池市场规模预计到2025年为47.9亿美元,预计2030年将达到77.3亿美元,预测期内(2025-2030年)复合年增长率为10.06%。

主要亮点

- 从中期来看,锂离子电池价格的下降、电动车渗透率的提高以及可再生能源领域的扩张预计将在预测期内推动东南亚二次电池市场的发展。

- 另一方面,当地电池生产所需的原材料蕴藏量稀缺预计将阻碍预测期内的市场成长。

- 随着新电池技术和先进电池化学材料的不断发展,东南亚二次电池市场可能会创造巨大的商机。

- 其中,泰国预计在预测期内将出现显着成长。

东南亚二次电池市场趋势

汽车领域预计将主导市场

- 在东南亚,汽车应用预计将在不久的将来成为二次电池(尤其是锂离子电池)的主导领域。电动车(EV)在该地区越来越受欢迎,预计将显着增加对二次电池的需求。这种转变主要是由于汽油和天然气等燃料价格的波动,以及各国对排放法规的日益关注,促使人们放弃传统汽车。

- 此外,铅酸电池在汽车行业的启动、照明和点火(SLI)配件中发挥着重要作用。这些 SLI 电池提供强劲的初始启动能力,这对于启动汽车引擎至关重要。由于它比深迴圈电池更小、更轻,因此其需求预计将持续存在,从而在短期内加强东南亚的二次电池市场。

- 根据东协汽车联合会的资料,印尼、马来西亚和泰国在汽车销售方面领先东南亚。就2023年汽车销售而言,印尼将以超过100万辆的销量领先,其次是马来西亚,约80万辆,泰国约77.5万辆。如此强劲的汽车销售预计将促进二次电池的普及。

- 电动车(EV)最近在东南亚越来越受欢迎。几个主要国家已经制定或更新了 2025 年至 2050 年期间的电动车指令。例如,菲律宾专注于发展公共交通,目标是到 2030 年让所有车辆中 21% 为电动车辆,到 2040 年让这一比例达到 50%。菲律宾电动车协会 (EVAP) 将 2030 年电动车普及率的预测从 30 万辆提高到 100 万辆,主要依靠行业奖励、监管清晰度以及对电动车优势认识的提高。

- 印尼的目标是到 2025 年电动车占汽车销量的 20%,并计划在 2030 年国内生产 60 万辆电动车。这些目标将成为整个电动车供应链(包括销售、生产和充电站)的里程碑,并将刺激对充电电池的需求。

- 马来西亚正在积极发展电动车製造业,并吸引大量电动车电池生产投资。例如,2023年8月,Eve Energy Malaysia在吉打居林投资4.223亿美元(19.3亿令吉)的电池製造工厂破土动工,该工厂是国际圆柱形电池工业的一部分。该工厂计划生产电动摩托车用21700型圆柱形锂离子电池,计划于2026年开始运作。

- 2023年8月,印尼透露,美国电动车巨头特斯拉正在考虑在该国投资生产锂电池材料。预计很快就会发布正式公告。印尼正在与特斯拉进行谈判,以利用其丰富的镍蕴藏量(这对电动车电池至关重要),并吸引对电池製造和汽车生产的投资。

- 随着这些新兴市场的发展,汽车产业很可能在未来几年推动东南亚二次电池市场的发展。

泰国正在经历显着的成长

- 泰国是汽车领域的投资目的地。 50年来,泰国已从一个简单的汽车零件组装国家发展成为东南亚首屈一指的汽车生产和出口中心。随着电动车(EV)产量快速成长,在汽车製造商增加投资的支持下,泰国二次电池产业有望实现稳定成长。

- 根据泰国电动车协会(EVAT)的报告,泰国註册的电池式电动车(BEV)数量大幅增加,2023年达到约100,219辆,较2022年增长380%,增幅惊人。这一势头仍在持续,截至 2024 年 2 月底,泰国註册了约 22,278 辆新纯电动车,进一步增加了对二次电池的需求。

- 政府对电动车购买者的激励措施和对製造商的支持措施极大地刺激了泰国电动车的引进。例如,新推出的国内电动车购买补贴计画凸显了泰国成为东南亚电动车生产中心的野心。根据将于 2024 年至 2027 年实施的 EV3.5 计划,政府将为每辆车提供 50,000泰铢(1,397.02 美元)至 100,000泰铢(2,794.04 美元)的补贴,以培育电动汽车行业并吸引外国投资。

- 泰国的目标是到 2030 年电动车占汽车销售的 30%,这与其成为区域电动车生产强国的愿景一致。这种雄心壮志使泰国成为未来二次电池市场的中心,并为电池製造商带来了利润丰厚的机会。

- 此外,根据泰国4.0计划,泰国政府正在整合云端运算和巨量资料等尖端技术,这表明对资料中心以及电池的需求将会增加。

- 电池製造商正在积极扩大在泰国的业务。一个着名的例子是宝马集团,该集团于 2024 年 3 月开始在罗勇建造「第五代」高压电池工厂。这座占地 4,000平方公尺的组装厂整合到宝马现有的汽车工厂中,将加强该公司的电气化策略,特别是计划于 2025 年底推出的纯电动车。 BMW在该项目上投资超过 4,200 万欧元。

- 鑑于这些动态,泰国预计在未来几年内引领东南亚二次电池市场。

东南亚二次电池产业概况

亚太地区充电电池市场已缩减一半。市场主要企业包括(排名不分先后)松下公司、比亚迪有限公司、GS汤浅公司、East Penn Manufacturing Co.和LiRON LIB Power Pte Ltd。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 电动车的扩张

- 锂离子电池成本下降

- 抑制因素

- 缺乏本地生产电池所需的原料

- 促进因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品/服务的威胁

- 竞争公司之间的敌对关係

- 投资分析

第五章市场区隔

- 科技

- 铅酸电池

- 锂离子

- 其他技术(NiMh、Nicd 等)

- 目的

- 汽车电池

- 工业电池(用于电源、固定电池(电信、UPS、能源储存系统(ESS) 等)

- 可携式电池(家用电子电器产品等)

- 其他的

- 地区

- 泰国

- 印尼

- 越南

- 马来西亚

- 菲律宾

- 新加坡

- 缅甸

- 其他东南亚地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Panasonic Corporation

- BYD Co.Ltd.

- GS Yuasa Corporation

- East Penn Manufacturing Co.

- LiRON LIB Power Pte Ltd.

- Samsung SDI Co. Ltd

- LG Chem Ltd.

- Clarios, LLC.

- Exide Industries Ltd

- Tianjin Lishen Battery Joint-Stock Co. Ltd.

- Leoch International Technology Limited

- 其他知名公司名单(公司名称、总部地点、相关产品及服务、联络等)

- 市场排名/份额(%)分析

第七章 市场机会及未来趋势

- 新型电池技术与先进电池化学材料的开发进展

简介目录

Product Code: 50004066

The Southeast Asia Rechargeable Battery Market size is estimated at USD 4.79 billion in 2025, and is expected to reach USD 7.73 billion by 2030, at a CAGR of 10.06% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, declining lithium-ion battery prices, increasing adoption of electric vehicles, and the growing renewable energy sector are expected to drive the Southeast Asia rechargeable battery market during the forecast period.

- On the other hand, the lack of raw material reserves required for the local production of batteries is likely to hinder the market's growth during the forecast period.

- Nevertheless, the growing progress in developing new battery technologies and advanced battery chemistries will likely create vast opportunities for the Southeast Asia rechargeable battery market.

- Among the countries, Thailand is likely to witness significant growth during the forecast period.

Southeast Asia Rechargeable Battery Market Trends

Automotive Segment is Expected to Dominate the Market

- In Southeast Asia, automotive applications are poised to emerge as a dominant segment for rechargeable batteries, especially lithium-ion batteries, in the near future. The rising adoption of electric vehicles (EVs) in the region is set to significantly boost the demand for rechargeable batteries. This shift is largely driven by fluctuating fuel prices, including gasoline and natural gas, and an increasing emphasis on emission controls across various countries, prompting a move away from conventional vehicles.

- Furthermore, lead-acid batteries play a crucial role in the automotive industry's starting, lighting, and ignition (SLI) accessories. These SLI batteries deliver a powerful initial burst, essential for starting a vehicle's engine. Being smaller and lighter than deep-cycle batteries, their demand is projected to persist, bolstering the rechargeable battery market in Southeast Asia in the short term.

- Data from the ASEAN Automotive Federation highlights that Indonesia, Malaysia, and Thailand lead Southeast Asia in motor vehicle sales. In 2023, Indonesia topped the chart with over one million vehicle sales, trailed by Malaysia and Thailand with nearly 800,000 and 775,000 sales, respectively. Such robust vehicle sales are anticipated to bolster the uptake of rechargeable batteries.

- Recently, electric vehicles (EVs) have gained traction in Southeast Asia. Several key nations have set or updated EV mandates for 2025 to 2050. The Philippines, for instance, aims for EVs to constitute 21% of its total vehicles by 2030, emphasizing public transport, and 50% by 2040. The Electric Vehicle Association of the Philippines (EVAP) has upped its e-vehicle adoption forecast from 300,000 units in 2030 to a million, banking on sector incentives, clearer regulations, and heightened awareness of EV benefits.

- Indonesia targets 20% of car sales to be EVs by 2025, with a goal of producing 600,000 EVs domestically by 2030. These ambitions translate into milestones across the EV supply chain, including sales, production, and charging stations, likely spurring the demand for rechargeable batteries.

- Malaysia is actively fostering its EV manufacturing sector, attracting notable investments in EV battery production. For example, in August 2023, Eve Energy Malaysia broke ground on a USD 422.3 million (MYR 1.93 billion) battery manufacturing facility in Kulim, Kedah, part of the International Cylindrical Battery Industrial Park. Set to produce 21700-format cylindrical lithium-ion batteries for electric two-wheelers, the facility aims for a 2026 commissioning.

- In August 2023, Indonesia revealed that Tesla, the U.S. electric car giant, is contemplating an investment in lithium battery material production in the country. An official announcement is anticipated soon. Indonesia is in talks with Tesla, aiming to draw investments in battery manufacturing and automobile production, leveraging its rich nickel reserves, vital for EV batteries.

- Given these developments, the automotive sector is set to lead the rechargeable battery market in Southeast Asia in the coming years.

Thailand to Witness a Significant Growth

- Thailand stands out as a prime destination for investments in the automobile sector. Over the past 50 years, Thailand has evolved from merely assembling auto components to becoming Southeast Asia's foremost automotive production and export hub. With a surge in electric vehicle (EV) production, the Thai rechargeable battery industry is poised for steady growth, fueled by heightened investments from automakers.

- As reported by the Electric Vehicle Association of Thailand (EVAT), Thailand saw a remarkable surge in battery electric vehicle (BEV) registrations, hitting approximately 100,219 units in 2023, marking an impressive 380% jump from 2022. Continuing this momentum, by the end of February 2024, Thailand registered around 22,278 new BEVs, further amplifying the demand for rechargeable batteries.

- Government incentives for EV buyers and supportive measures for manufacturers have significantly spurred the adoption of EVs in Thailand. For instance, the newly introduced purchase subsidy scheme for domestically produced EVs underscores Thailand's ambition to be a Southeast Asian EV production hub. Under the EV3.5 scheme, running from 2024 to 2027, the government offers subsidies between THB 50,000 (USD 1,397.02) and THB 100,000 (USD 2,794.04) per vehicle, highlighting its commitment to nurturing the EV industry and drawing foreign investments.

- Thailand aims to have EVs make up 30% of all vehicle sales by 2030, aligning with its vision of becoming a regional EV production powerhouse. Such ambitions position Thailand as a future hub for the rechargeable battery market, presenting lucrative opportunities for battery manufacturers.

- Additionally, under the Thailand 4.0 Programme, the government is integrating advanced technologies like cloud computing and big data, signaling a rising demand for data centers and, consequently, batteries.

- Battery manufacturers are actively expanding their operations in Thailand. A notable example is BMW Group, which in March 2024, began constructing its 'Gen-5' high-voltage battery facility in Rayong. This 4,000 square meter assembly, integrated into BMW's existing car plant, is set to bolster the company's electrification strategy, especially with BEV rollouts planned for the latter half of 2025. BMW has committed over EUR 42 million to this venture.

- Given these dynamics, Thailand is poised to lead the rechargeable battery market in Southeast Asia in the coming years.

Southeast Asia Rechargeable Battery Industry Overview

The Asia-Pacific rechargeable battery market is semi-fragmented. Some of the key players in the market (not in any particular order) include Panasonic Corporation, BYD Company Ltd., GS Yuasa Corporation, East Penn Manufacturing Co., and LiRON LIB Power Pte Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Adoption of Electric Vehicles

- 4.5.1.2 Declining Lithium-ion Battery Cost

- 4.5.2 Restraints

- 4.5.2.1 Lack of Raw Material Reserves Required For Local Production Of Batteries

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Lead-Acid

- 5.1.2 Lithium-Ion

- 5.1.3 Other Technologies (NiMh, Nicd, etc.)

- 5.2 Application

- 5.2.1 Automotive Batteries

- 5.2.2 Industrial Batteries (Motive, Stationary (Telecom, UPS, Energy Storage Systems (ESS), etc.)

- 5.2.3 Portable Batteries (Consumer Electronics, etc.)

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 Thailand

- 5.3.2 Indonesia

- 5.3.3 Vietnam

- 5.3.4 Malaysia

- 5.3.5 Philippines

- 5.3.6 Singapore

- 5.3.7 Myanmar

- 5.3.8 Rest of Southeast Asia

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Panasonic Corporation

- 6.3.2 BYD Co.Ltd.

- 6.3.3 GS Yuasa Corporation

- 6.3.4 East Penn Manufacturing Co.

- 6.3.5 LiRON LIB Power Pte Ltd.

- 6.3.6 Samsung SDI Co. Ltd

- 6.3.7 LG Chem Ltd.

- 6.3.8 Clarios, LLC.

- 6.3.9 Exide Industries Ltd

- 6.3.10 Tianjin Lishen Battery Joint-Stock Co. Ltd.

- 6.3.11 Leoch International Technology Limited

- 6.4 List of Other Prominent Companies (Company Name, Headquarter, Relevant Products & Services, Contact Details, etc.)

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Progress in Developing New Battery Technologies and Advanced Battery Chemistries

02-2729-4219

+886-2-2729-4219