|

市场调查报告书

商品编码

1636606

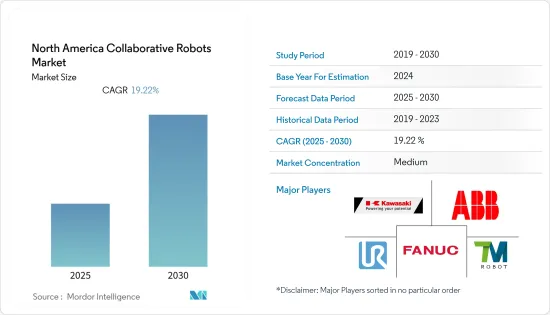

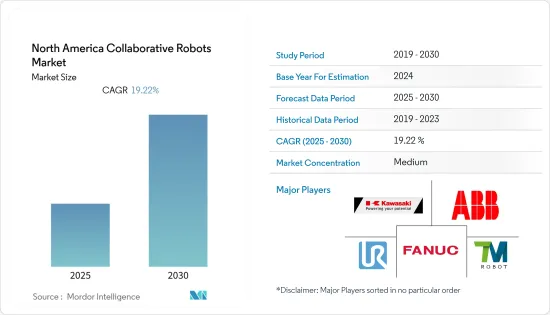

北美协作机器人市场占有率分析、产业趋势、统计及成长趋势预测(2025-2030)North America Collaborative Robots - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

北美协作机器人市场预计在预测期内复合年增长率为19.22%

主要亮点

- 随着该地区继续对抗新冠肺炎 (COVID-19) 疫情的迅速蔓延,机器人和自动化技术在保障人们安全并在人们转向远距工作和家庭学习时提供所需物资方面发挥着重要作用。自动化被认为是对抗疫情的最前线。机器人正在帮助医院消毒。自主送货机器人正在向保持社交距离的人运送物资。此外,自动化工作站正在加快製药公司的工作速度。

- 此外,在加拿大,协作机器人在工业领域的采用正在增加,特别是在汽车领域。例如,麦格纳国际公司和利纳马公司等世界各地的公司正在使用协作机器人来执行对人类来说可能乏味的任务,例如在组装上目视检查零件或对零件进行分类。太复杂了。

- 此外,优傲机器人于2020年7月举办了美国最大的虚拟协作机器人展览和会议。该公司表示,由于社交距离的需要、避免长供应链的回流、快速生产线转换的需要以及协作机器人如何在帮助製造企业方面发挥关键作用,多个客户对协作机器人的兴趣日益浓厚。 19 大流行。

- 此外,机器人、数控系统、机器人机器和工业IoT解决方案的知名供应商之一FAANUC America在2020年1月举行的国际生产加工展览会(IPPE)上推出了其新型食品Delta机器人DR-3iB 。该公司的新型食品Delta机器人DR-3iB/8L主要使用2D iRVision和iRPickTool线路追踪软体从连续切割输送机上挑选随机方向的鸡肉包装。该机器人还配备了多拾取夹具,可以拾取三个包裹并将其在固定的出料站装箱,模拟装箱。

北美协作机器人市场趋势

物料输送预计将出现显着成长

- 由于物料输送在许多最终用途行业中的采用,预计将占据全球协作机器人市场的大部分份额。例如,协作机器人对高速、高精度工作的需求正在为电子和半导体产业带来显着的效益。

- 在美国,电子商务的与前一年同期比较成长率是所有零售业中最高的。该地区正在建造的仓库空间比预计需要填补的仓储业还要多。

- 近年来,网路退货的趋势也在加速,每个假期季节都有所增加。受美国假期退货最繁忙的国家退货日影响,联合包裹服务公司预计 2020 年 1 月 2 日处理了创纪录的 190 万件包裹,为 2018 年最多,较假期季节年1 月2 日之后增加了26% 。这些趋势凸显了对物料输送协作机器人的需求。

- 技术进步正在提高物料输送协作机器人的能力。人类工人不仅可以与物料输送机器人并肩协作,而且新的外骨骼技术现在也可以由人类工人佩戴。

- 全身外骨骼设计用于举起重达 200 磅的重物,供人类佩戴,为涉及重型工具和部件的重复性任务提供额外的力量和耐力。外骨骼采用先进的致动器、感测器和材料以及高度复杂的软体控制演算法进行控制。

- 最初,协作机器人通常与小型有效载荷和轻量级应用联繫在一起,但协作机器人日益强大,以前被认为超出了协作机器人能力的重载已经存在,一些可以处理有效载荷和用途。

- 2020 年 3 月,安川美国公司 Motoman 机器人部门宣布推出一款新型协作机器人,型号 HC20XP,工作范围为 1700 毫米,承重能力为 20 公斤。 HC20XP 是业界首款 IP67 级协作机器人,非常适合执行各种任务,包括物料输送、Machine Tending和组装。即使在容易潮湿和溅水的环境中也可以连续使用。 NSF H1 食品级润滑脂是标准润滑脂,可用于可能与食品接触的环境。

美国预计将占据主要市场占有率

- 北美地区是机器人技术实施的主要创新者和先驱,也是最大的市场之一。市场成长的关键原因是许多行业越来越多地采用协作机器人。

- 此外,机器人手术在美国的引进也是引人注目的。美国每年进行超过 500 万例机器人手术。为了建立品牌形象和竞争优势,机器人手术已成为过去 20 年来采用最快的医疗设备。这可能会刺激该地区医疗领域对机器人的需求。

- 根据国际机器人联合会统计,美洲地区机器人成长率与前一年同期比较成长20%,连续第六年创历史新高。

- 根据 HMC Investment Securities 的数据,美国协作机器人的销售量预计在预测期内将大幅成长,从 2018 年的 11,550 台达到 2025 年的 134,400 台。协作机器人透过整合机器人技术和自动化来协助人类,有助于提高生产力并延长运转率。

- 该地区机器人成长的主要驱动力是美国製造业。美国目前正在实现生产流程自动化,以加强美国工业在国内和国际市场的地位。

- 该地区各国政府也采取倡议协助开发机器人市场的最新技术,鼓励采用机器人技术。例如,美国联邦政府启动了一项名为「国家机器人倡议」(NRI)的计划,以加强国内机器人製造能力并鼓励该领域的研究活动。

北美协作机器人产业概况

协作机器人市场细分,多家企业在竞争激烈的市场空间中竞争。此外,公司的策略决策,例如新产品发布、投资和联盟,预计将改变竞争格局。例如,2020年4月,欧姆龙自动化美洲公司发表了新的协作机器人产品TM系列。预测期内,新进业者的可能性较高,市场竞争将进一步加剧。由于上述因素,竞争公司之间的敌对关係被评为“高”,预计这种趋势在预测期内将保持不变。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- 产业价值链分析

- COVID-19 对市场的影响

- 市场驱动因素

- 得益于边缘运算的进步,收益报酬率高且易于实施

- 各种工业製程对自动化的需求不断增加

- 市场问题

第五章市场区隔

- 按有效载荷

- 5公斤以下

- 5-9公斤以下

- 10公斤以上

- 按最终用户产业

- 电子/半导体/FPD

- 车

- 其他的

- 按用途

- 物料输送

- 拾取和放置

- 组装

- 其他(堆迭/卸垛、焊接、喷漆、分类、定位等)

第六章 供应商排名分析(展示服务于北美地区的各个供应商的相对定位;这个定位是根据公司的成长策略和能力来决定的。北美各公司的收益是由调查方法的。请注意该排名并不一定代表每个供应商的收益占有率。

第七章 竞争格局

- 公司简介

- Universal Robots AS

- Fanuc Corp.

- TechManRobot Inc.

- Rethink Robotics GmbH

- AUBO Robotics USA

- ABB Ltd

- Kawasaki Heavy Industries Ltd

- Precise Automation Inc.

- SiasunRobot & Automation Co. Ltd

- StaubliInternational AG

- OMRON Corporation

- Epson Robots(Seiko Epson)

- Festo Group

- KUKA AG

第八章投资分析

第九章 协作机器人市场未来前景

The North America Collaborative Robots Market is expected to register a CAGR of 19.22% during the forecast period.

Key Highlights

- As the region is continuously fighting the rapid spread of the COVID-19 pandemic, robotics and automation play a crucial role in safeguarding the people and processing the supplies that people need as they are shifting toward remote working and home learning. Automation is considered to be on the front lines in the battle against the pandemic. The robots are helping in disinfecting the hospitals. Autonomous deliveries from the robots are bringing supplies to people as they are adopting social distancing. Moreover, automated workstations are speeding up the work of pharmaceutical companies.

- Moreover, Canada is witnessing the significant deployment of collaborative robots in its industrial sector, especially in the automotive sector. For instance, collaborative robots are being employed by global companies, such as Magna International Inc. and Linamar Corp., where they perform tasks, such as visual inspection of parts or picking out components on an assembly line, tasks that might be boring to humans but until now were far too complex for machines.

- Furthermore, Universal Robots conducted America's largest virtual collaborative robot expo and conference in July 2020. The company said that it is witnessing an uptick in the interest for collaborative robots by multiple clients, owing to the social distancing requirements, reshoring to avoid long supply chains and the need for rapid production line change-overs, thus showcasing how these collaborative robots can play a crucial role in helping manufacturers successfully navigate through the COVID-19 pandemic.

- Moreover, in January 2020, FANUC America, one of the prominent suppliers of robotics, CNCs, Robomachines, and Industrial IoT solutions, demonstrated the new DR-3iB food-grade delta robot and the M-410iC/110 palletizing robot at the International Production and Processing Expo (IPPE) held in January 2020. The company's new DR-3iB/8L food-grade delta robot primarily uses 2D iRVision and iRPickTool line tracking software to pick randomly oriented packages of chicken from a continuous infeed conveyor. The robot is also equipped with a multi-pick gripper that can pick up three packages and place them into a box on a fixed outfeed station to simulate case packing.

North America Collaborative Robots Market Trends

Material Handling is Expected to Witness Significant Growth

- Material handling is forecast to occupy a majority share of the global collaborative robot market since it is implemented in many end-use industries. For instance, demand for high speed and precision work fulfilled by collaborative robots benefits the electronics and semiconductors industry on a large scale.

- With e-commerce generates the greatest Y-o-Y growth of all retail industries in the United States. More warehousing space is being built in the region than projected warehousing jobs are required to fill that space.

- The trend of online returns has also been accelerated in recent years and is increasing each holiday season, impacting the National Returns Day, which is known as the busiest day for holiday returns in the United States, United Parcel Services estimated handling a record 1.9 million packages on January 2, 2020, a 26% increase over the 2018 post-holiday season. Such trends are highlighting the demand for material handling cobots.

- Technological advancements enhance the capabilities of material handling cobots. Not only are human workers able to work side-by-side with material handling cobots in collaboration, new exoskeleton technologies allow them to be worn by human workers.

- Full-body exoskeletons, designed to lift heavy payloads of up to 200 pounds, are worn by humans to provide additional strength and endurance for repetitive tasks involving heavy tools or components. The exoskeleton is controlled using advanced actuators, sensors, and materials coupled with highly-sophisticated software control algorithms.

- Initially, cobots were typically associated with small payloads and lightweight applications, but they are getting stronger every day, and some are already capable of handling the heavy-duty payloads and applications that were traditionally thought of as being beyond cobot capabilities.

- In March 2020, the Motoman Robotics Division of Yaskawa America Inc. released the new 20-kg payload Model HC20XP collaborative robot with 1700-mm reach. It is the industry's first IP67-rated collaborative robot, which makes it ideal for a broad range of material-handling, machine-tending or assembly tasks. It can provide continuous use in damp or splash-prone environments. NSF H1 food-grade grease is included as standard, enabling use in settings where there is a possibility of incidental food contact.

United States is Expected to Account for Major Market Share

- The North American region is among the leading innovators and pioneers in terms of the adoption of robotics, as well as one of the largest markets. The primary reason for the growth of the market is the increasing adoption of these collaborative robots across numerous industries.

- Moreover, there has been significant adoption of robotic surgery in the United States. The annual procedure volume for robotic surgery is greater than 5,00,000 in the United States. In order to build brand image and competitive advantage, robotic surgery has become the most rapidly adopted medical device over the past two decades. This is likely to fuel the need for robots in the medical and healthcare sector in the region.

- According to the International Federation of Robotics, in the American region, the growth rate of robots witnessed an increase of 20% compared to the previous year, which marked a new record level for the sixth consecutive year.

- According to HMC Investment Securities, the sales of collaborative robots in the United States will witness significant growth during the forecast period, which is expected to reach 134.40 thousand units in 2025 from 11.55 thousand units in 2018, owing to the widespread of adoption of collaborative robots in various fields, especially in the industrial segment where the Industry 4.0 is gaining transformation in the country for industrial operation and smart factory. The collaborative robots help in increasing productivity and improving utilization by integrating robotics and automation to assist humans.

- The primary driver for the growth of robots in the region is the manufacturing industries in the United States that are currently under the ongoing trend to automate their production processes, in order to strengthen the US industries in both domestic and international markets.

- The government in the region is also encouraging the adoption of robotics by taking initiatives to support the development of modern technologies in the robotics market. For instance, the US Federal Government has commenced a program called the National Robotics Initiative (NRI) to bolster the capabilities of building domestic robots in the country and encourage the research activities in the field.

North America Collaborative Robots Industry Overview

The collaborative robotics market is fragmented and comprises several companies vying for attention in a fairly contested market space. Further, companies' strategic decisions, such as new product launches, investments, and collaborations, are expected to change the competitive landscape. For instance, in April 2020, Omron Automation Americas released the new TM Series Collaborative Robot. The probability of new players entering the market is moderately high during the forecast period, further intensifying the market competition. Due to all the factors mentioned above, the intensity of competitive rivalry is rated high, and it is expected to remain the same during the forecast period

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness -Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

- 4.5 Market Drivers

- 4.5.1 High Return on Investment and Advancements in Edge Computing Leading to Easier Implementation

- 4.5.2 Increasing Demand for Automation in Various Industrial Processes

- 4.6 Market Challenges

5 MARKET SEGMENTATION

- 5.1 By Payload

- 5.1.1 Less than 5 kg

- 5.1.2 5-9 kg

- 5.1.3 10 kg and Above

- 5.2 By End-user Industry

- 5.2.1 Electronics/Semiconductor & FPD

- 5.2.2 Automotive

- 5.2.3 Other End-user Industries

- 5.3 By Application

- 5.3.1 Material Handling

- 5.3.2 Pick and Place

- 5.3.3 Assembly

- 5.3.4 Other Applications (Palletizing/De-palletizing, Welding, Painting, Sorting, Positioning, etc.)

6 VENDOR RANKING ANALYSIS (Indicates the relative positioning of various vendors serving the North American region and this positioning is determined based on the company's growth strategies and capabilities. Please note that the revenue of each company for North America doesn't form part of our ranking methodology and hence, the positioning does not necessarily indicate the revenue share of each vendor)

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Universal Robots AS

- 7.1.2 Fanuc Corp.

- 7.1.3 TechManRobot Inc.

- 7.1.4 Rethink Robotics GmbH

- 7.1.5 AUBO Robotics USA

- 7.1.6 ABB Ltd

- 7.1.7 Kawasaki Heavy Industries Ltd

- 7.1.8 Precise Automation Inc.

- 7.1.9 SiasunRobot & Automation Co. Ltd

- 7.1.10 StaubliInternational AG

- 7.1.11 OMRON Corporation

- 7.1.12 Epson Robots (Seiko Epson)

- 7.1.13 Festo Group

- 7.1.14 KUKA AG