|

市场调查报告书

商品编码

1637774

印尼石油和天然气 -市场占有率分析、行业趋势、成长预测(2025-2030)Indonesia Oil And Gas - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

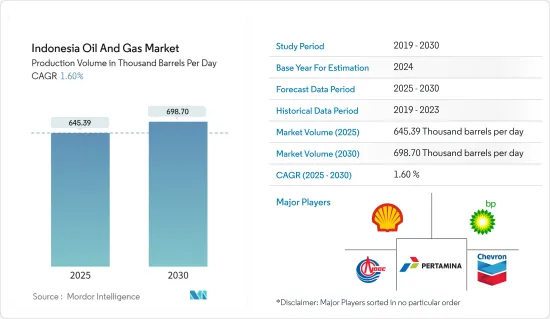

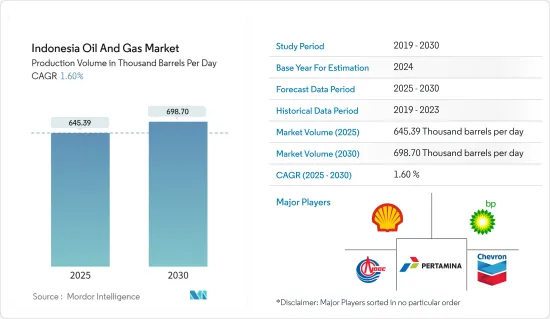

根据产量,印尼石油和天然气市场规模预计将从2025年的645,390桶/日增长至2030年的698,700桶/日,预测期内(2025-2030年)的复合年增长率预计为1.6%。

主要亮点

- 从中期来看,由于地区经济成长以及政府扩大原油和天然气产量的倡议,预计市场将受到石油产品需求增加的推动。

- 另一方面,市场预计将受到多种因素导致的原油价格飙升以及可再生能源部署扩大的抑制。

- 印尼是东南亚国家中探明石油蕴藏量最大的国家之一。该国经济也正在快速成长,因此未来对石油和石油衍衍生的需求可能会激增。这些新兴市场的发展被认为是参与企业的重大商机。

印尼油气市场趋势

上游产业可望大幅成长

- 印尼是东南亚开发中国家,也是该地区原油和天然气蕴藏量最大的国家之一。

- 2022年该国原油产量达61.2万桶/日。政府正在活性化上游产业的活动,以应对成熟油田产量下降的影响。

- 2022 年 1 月,Pertamina 位于东加里曼丹海上 Mahakam 油田的 Manapatu 1x 探井在达到 3,776 公尺后报告石油和天然气净输送量为 207 公尺。钻桿测试证实每天产出 1500 万立方英尺天然气,每天产出 500 桶冷凝油。进一步的油井开发工作正在进行中,为开始商业生产做准备。

- 到 2022 年 4 月,该国的目标是每天开采 66 万桶石油和 61.6 亿立方英尺 (mmscfd) 天然气。

- 综上所述,预计上游产业在预测期内将出现强劲成长。

可再生能源的采用增加预计将抑制市场

- 印尼开始将可再生能源添加到其能源结构中,以减少该国煤炭和石油的份额,以实现更低的排放和更绿色的经济。因此,政府设定了2025年可再生能源使用率达到23%、2050年达到31%的目标。

- 这一目标以及政府的措施和计划导致了全国多个可再生能源计划的发展。

- 2022年4月,Quantum Power Asia Pte Ltd和ib Vogt GmbH共同投资50亿美元开发容量超过3.5吉瓦的太阳能园区。该计划将建在印尼廖内群岛,并将向新加坡出口电力。

- 2022年4月,印尼主要能源公司之一的Quantum Power Asia Pte Ltd与德国太阳能发电工程开发商Ib Vogt GmbH宣布在印尼廖内群岛宣布建设发电量超过350万千瓦的太阳能发电工程。 50亿美元来开发它。

- PT Pertamina 是一家国家石油和天然气公司,总部位于雅加达。该公司计划在2022年至2026年在可再生能源领域投资110亿美元。

- 此外,印尼还有 17,000 多个岛屿、100 个水库和 520 个天然湖泊。政府计划在这些领域安装近60个浮体式太阳能发电工程。

- 因此,该国快速采用可再生能源产能可能会在预测期内抑製印尼石油和天然气市场。

印尼石油和天然气产业概况

印尼石油和天然气市场适度一体化。市场上一些主要企业(排名不分先后)包括壳牌公司、英国石油公司、中国海洋石油总公司、PT Pertamina 和雪佛龙公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 2028 年之前的天然气产量预测

- 2028年之前的原油产量预测

- 炼油厂装置容量及预测至2028年

- 2028年LNG接收站装置容量及预测

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 地区经济成长导致石油产品需求增加

- 政府扩大石油和天然气生产的倡议

- 抑制因素

- 增加可再生能源的部署

- 促进因素

- 供应链分析

- PESTLE分析

第五章市场区隔:依行业

- 上游

- 中产阶级

- 下游

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- ConcoPhillips Company

- Shell PLC

- Chevron Corporation

- ExxonMobil Corporatoin

- PT Pertamina

- PT Perusahaan Gas Negara Tbk

- Petroliam Nasional Berhad

- PT. Connusa Energindo

- China National Offshore Oil Corporation

- BP PLC

第七章 市场机会及未来趋势

- 拥有最大的探明蕴藏量和快速的经济成长

简介目录

Product Code: 46964

The Indonesia Oil And Gas Market size in terms of production volume is expected to grow from 645.39 thousand barrels per day in 2025 to 698.70 thousand barrels per day by 2030, at a CAGR of 1.6% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as increasing demand for petroleum products due to the growth of the local economy coupled with government initiatives to boost the production of crude oil and natural gas are likely to drive the market.

- On the other hand, the high volatility of crude oil prices due to many factors and the increasing adoption of renewable energy are expected to restrain the market.

- Nevertheless, Indonesia has one of the largest proven oil reserves among Southeast Asian countries. The country is also seeing rapid economic growth, as a result, demand for petroleum and derived petroleum products will likely shoot up in the future. Such developments will likely present significant opportunities for players involved in the market.

Indonesia Oil and Gas Market Trends

Upstream Sector Expected to Witness Significant Growth

- Indonesia is a developing country in Southeast Asia, having one of the region's largest proven crude oil and natural gas reserves.

- The crude oil production in the country stood at 612 thousand barrels per day in 2022. The government is witnessing increased activity in the upstream sector to counter the declining production from maturing fields.

- In January 2022, Pertamina's Manapatu 1x exploration well in the Mahakam Block offshore East Kalimantan reported 207 meters of oil and gas net pay after reaching 3,776 meters. The drill stem test saw well-flowing gas at 15 million cubic feet per day and condensate at 500 barrels per day. Further well development works are underway to start commercial production.

- In April 2022, the country's oil lifting was targeted at 660 thousand barrels, and gas lifting was at 6,160 million standard cubic feet per day (mmscfd).

- Due to the above points, the upstream sector will likely witness significant growth during the forecast period.

Increasing Adoption of Renewable Energy Expected to Restrain the Market

- Indonesia has started to add renewables to its energy mix to reduce the share of domestic coal and petroleum to have lesser emissions and a green economy. As a result, the government has set a target to achieve 23% renewable energy use by 2025 and 31% by 2050.

- This target and government policies and programs have resulted in several renewable energy projects being developed nationwide.

- In April 2022, Quantum Power Asia Pte Ltd and ib Vogt GmbH were jointly developing a solar park of over 3.5 GW capacity with an investment of USD 5 billion. The project will be built on Indonesia's Riau Islands and export electricity to Singapore.

- In April 2022, one of the leading energy companies in Indonesia, Quantum Power Asia Pte Ltd, and German solar energy project developer Ib Vogt GmbH announced to invest of more than USD 5 billion to develop a solar energy project with a power generation capacity of more than 3.5 GW in Indonesia's Riau Islands.

- PT Pertamina is a state-owned oil and natural gas corporation based in Jakarta. The company plans to invest USD 11 billion in the renewable energy sector, which is expected in 2022-2026.

- Moreover, Indonesia has more than 17,000 islands, 100 reservoirs, and 520 natural lakes. The government plans to install nearly 60 floating PV solar energy projects in these fields.

- Thus, the country's rapid adoption of renewable energy capacity may restrain the Indonesian Oil and Gas market during the forecast period.

Indonesia Oil and Gas Industry Overview

The Indonesian Oil and Gas Market is moderately consolidated. Some major players involved in the market (not in particular order) include Shell PLC, BP PLC, China National Offshore Oil Corporation, PT Pertamina, and Chevron Corporation., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Natural Gas Production Forecast, till 2028

- 4.3 Crude Oil Production Forecast, till 2028

- 4.4 Refinery Installed Capacity and Forecast, till 2028

- 4.5 LNG Terminal Installed Capacity and Forecast, till 2028

- 4.6 Recent Trends and Developments

- 4.7 Government Policies and Regulations

- 4.8 Market Dynamics

- 4.8.1 Drivers

- 4.8.1.1 Increasing Demand for Petroleum Products Due to the Growth of the Local Economy

- 4.8.1.2 Government Initiatives to Boost the Production of Crude Oil and Natural Gas

- 4.8.2 Restraints

- 4.8.2.1 Increasing Adoption of Renewable Energy

- 4.8.1 Drivers

- 4.9 Supply Chain Analysis

- 4.10 PESTLE Analysis

5 MARKET SEGMENTATION - BY SECTOR

- 5.1 Upstream

- 5.2 Midstream

- 5.3 Downstream

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 ConcoPhillips Company

- 6.3.2 Shell PLC

- 6.3.3 Chevron Corporation

- 6.3.4 ExxonMobil Corporatoin

- 6.3.5 PT Pertamina

- 6.3.6 PT Perusahaan Gas Negara Tbk

- 6.3.7 Petroliam Nasional Berhad

- 6.3.8 PT. Connusa Energindo

- 6.3.9 China National Offshore Oil Corporation

- 6.3.10 BP PLC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Presence of Largest Proven Oil Reserves Along with Rapid Economy Growth

02-2729-4219

+886-2-2729-4219