|

市场调查报告书

商品编码

1685969

马来西亚石油和天然气 -市场占有率分析、行业趋势和成长预测(2025-2030 年)Malaysia Oil And Gas - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

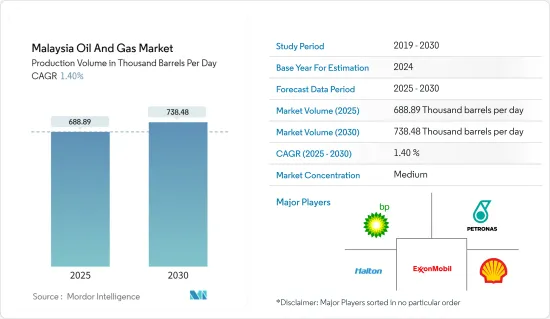

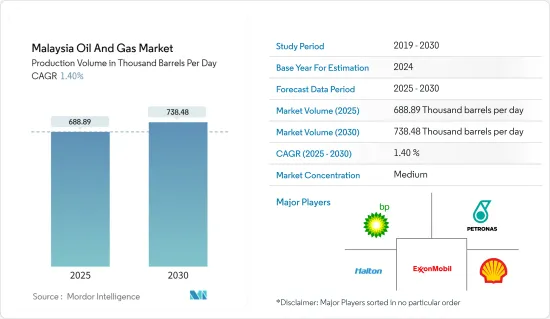

以产量计算,马来西亚石油和天然气市场规模预计将从 2025 年的每天 688,890 桶增长至 2030 年的每天 738,480 桶,预测期内(2025-2030 年)的复合年增长率为 1.4%。

主要亮点

- 从中期来看,政府支持政策、国内石油、天然气和液化天然气产量成长、成品油需求激增、即将上马的石油和天然气计划及升级等因素预计将推动市场发展。

- 另一方面,多种因素导致的原油价格上涨以及可再生能源的扩大引入可能会抑制市场。

- 然而,最近的发现和正在进行的勘探活动预计将为该国石油和天然气市场的公司带来重大机会。

马来西亚石油和天然气市场趋势

中游产业预计将占据主要市场占有率

- 马来西亚国内和周边地区对天然气的需求日益增加。大多数国家都希望减少二氧化碳排放来控制环境空气质量,这导致各个终端用户领域的天然气消费量增加。

- Satu Malaysia Terminals 是位于马来西亚沙捞越州的LNG接收站。该公司拥有三条液化天然气生产线,年产能为 810 万吨(MTPA)。它是马来西亚液化天然气综合体(又称马来西亚国家石油民都鲁液化天然气综合设施)的一部分。

- 截至2022年,马来西亚天然气进口量约为每天38亿立方公尺。 2022 年的进口量与 2021 年相比有所增加。

- 例如,2022 年 1 月,马来西亚沙巴州和马来西亚国家石油公司宣布计划建造一个年产 200 万吨液化天然气 (LNG) 终端。该新工厂计划位于西必丹石油天然气工业,是马来西亚国家石油公司和沙巴州合作的一部分,旨在增加该州工业和商业企业清洁能源的供应。

- 此外,2021 年 8 月,印度石油公司 (IOC) 与马来西亚国有石油公司 Petronas 成立合资企业,建造液化天然气 (LNG) 终端、零售燃料和发行天然气,推动该领域的成长。

精製石油产品需求激增推动市场成长

- 由于化工、石化和运输业对精製产品的需求不断增加,马来西亚的精製业正在经历显着成长。

- 马来西亚是东南亚第二大石油和天然气生产国,截至2021年,也是全球第五大液化天然气(LNG)出口国。马来西亚位于海上能源贸易重要通道上的战略位置。

- 过去几年,马来西亚精炼石油产品的销售量稳定成长。精炼石油产品的成长主要是由于液化石油气作为家庭烹饪燃料,特别是作为运输燃料的需求不断增长。

- 根据马来西亚统计局的数据,2021 年马来西亚生产了约 270 万吨液化石油气 (LPG)。该国的液化石油气产量自 2013 年以来一直呈上升趋势,当年产量为 253 万吨。

- 过去二十年来,马来西亚在精製活动方面投入了大量资金,以满足国内对石油产品的需求。截至 2022 年,马来西亚全国 7 个设施的精製能力约为每天 955,000 桶 (b/d)。

- 作为马来西亚建造石油精製和储存中心以满足国内精製石油产品需求的目标的一部分,马来西亚国家石油公司已在柔佛州投资约 160 亿美元建设精製和石化综合开发计划(RAPID)。同时,也投资近110亿美元建设相关设施。该计划的额定产能为 279,000 桶/天,预计将于 2022 年底全面运作。 RAPID 设施将成为该国第一家生产符合欧盟 V 标准的柴油和汽油的炼油厂,从而降低二氧化碳排放量。

- 然而,随着石油产品需求的不断增长以及马来西亚注重自给自足以满足这一需求,预计未来几年该地区的下游基础设施将大幅增加。该国正在製定扩建现有炼油厂或建造新炼油厂的计画。

- 因此,由于上述因素,预计预测期内石油产品需求的增加将推动马来西亚石油和天然气市场的发展。

马来西亚石油和天然气产业概况

马来西亚的石油和天然气市场适度整合。主要公司包括 BP Plc、Shell Plc、Petronas Gas Bhd 和 Altus Oil &Gas Malaysia Sdn。 Bhd、以及埃克森美孚公司(排名不分先后)。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

- 市场定义

- 调查前提

第二章执行摘要

第三章调查方法

第四章 市场概述

- 介绍

- 至2028年原油消费量预测(单位:十亿立方英尺/天)

- 近期趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 精製石油产品需求激增

- 沉积盆地中巨大的未开发石油蕴藏量

- 限制因素

- 油价波动剧烈

- 驱动程式

- 供应链分析

- PESTLE分析

第五章市场区隔

- 上游

- 中游

- 下游

第六章竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- BP Plc

- Shell Plc

- Petronas Gas Bhd

- Chevron Corporation

- ExxonMobil Corporation

- Malaysiaian General Petroleum Corporation

- Altus Oil & Gas Malaysia Sdn. Bhd.

- Petro-Excel Sdn Bhd(PESB)

- Petro Teguh(M)Sdn. Bhd.

- Malaysiaian Natural Gas Holding Company

第七章 市场机会与未来趋势

- 近期的众多发现和正在进行的勘探活动

简介目录

Product Code: 50028

The Malaysia Oil And Gas Market size in terms of production volume is expected to grow from 688.89 thousand barrels per day in 2025 to 738.48 thousand barrels per day by 2030, at a CAGR of 1.4% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as supportive government policies, growing efforts to boost domestic oil and gas and LNG production, the surge in demand for refined petroleum products, and upcoming oil & gas projects and upgrades are expected to drive the market.

- On the other hand, the high volatility of crude oil prices due to many factors and the increasing adoption of renewable energy may restrain the market.

- Nevertheless, a high number of discoveries in recent years and ongoing exploration activities are expected to provide a significant opportunity for players in the country's oil and gas market.

Malaysia Oil and Gas Market Trends

Midstream Sector is Expected to Have Significant Market Share

- Malaysia has an increasing demand for natural gas in the country and neighboring regions. Most countries want to reduce their carbon emissions to control the air quality in the environment, which has increased natural gas consumption in various end-user segments.

- Satu Malaysia Terminal is an LNG terminal in Sarawak, Malaysia. It constitutes three LNG trains and has a capacity of 8.1 million metric tons per annum (MTPA). It is a part of the Malaysia LNG Complex, also known as the Petronas Bintulu LNG Complex.

- As of 2022, the natural gas imports in the country were around 3.8 billion cubic meters per day. The imports increased in 2022 compared to 2021.

- For instance, in January 2022, the Malaysian State of Sabah and Petronas announced plans for a two million metric tons/year (mmty) liquefied natural gas (LNG) terminal. The new facility planned for the Sipitang Oil and Gas Industrial Park is a part of Petronas's collaboration with the state to expand Sabah's distribution of cleaner energy to industrial and commercial businesses.

- Furthermore, in August 2021, the Indian Oil Corporation (IOC) entered a joint venture with Malaysia's state-run Petronas to include building liquefied natural gas (LNG) terminals, fuel retailing, and gas distribution, driving the segment's growth.

Surging Demand For Refined Petroleum Products to Boost the Growth of the Market

- Malaysia's refining sector is witnessing significant growth due to the increasing demand for refined products from chemical, petrochemical, and transport industries.

- Malaysia is Southeast Asia's second-largest oil and natural gas producer and the fifth-largest exporter of liquefied natural gas (LNG) in the world as of 2021. It is strategically located on essential routes for seaborne energy trade.

- Malaysia has witnessed a steady growth in manufactured, refined petroleum product sales for several years. The increase in refined petroleum products can be mainly attributed to the growing demand for LPG as cooking fuel in homes, particularly as a transport fuel.

- As per the Department of Statistics Malaysia, in 2021, Malaysia produced approximately 2.7 million metric tons of liquefied petroleum gas (LPG). The production of LPG in the country has been increasing since 2013, with 2.53 million metric tons produced.

- Malaysia has invested heavily in refining activities during the past two decades to meet its demand for petroleum products with domestic supplies. As of 2022, Malaysia had about 955 thousand barrels per day (b/d) refining capacity in seven facilities spread across the country.

- As part of Malaysia's goal to construct the oil refining and storage hub to meet the domestic demand for refined petroleum products, Petronas has invested about USD16 billion in the Refining and Petrochemicals Integrated Development Project (RAPID) in Johor. At the same time, an investment of nearly USD11 billion for associated facilities. The project has a nameplate capacity of 279,000 b/d and is expected to be fully commissioned by the end of 2022. The RAPID facility will be the country's first refinery to produce diesel and gasoline that meet the Euro V standard, which lowers carbon dioxide emission levels.

- However, with the growing demand for petroleum products and Malaysia's focus on self-reliance to meet the demand, the downstream infrastructure in the region is expected to increase significantly in the coming years. The country has formulated plans to either expand the current refineries or construct new ones.

- Therefore, owing to the abovementioned factors, the growing demand for petroleum products is expected to drive the Malaysia oil and gas market during the forecast period.

Malaysia Oil and Gas Industry Overview

The Malaysia oil and gas market is moderately consolidated. Some of the key players are (in no particular order) BP Plc, Shell Plc, Petronas Gas Bhd, Altus Oil & Gas Malaysia Sdn. Bhd, and ExxonMobil Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Crude oil Consumption Forecast in billion cubic feet per day, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Surging Demand For Refined Petroleum Products

- 4.5.1.2 Significant Untapped Petroleum Reserves in the Sedimentary Basins

- 4.5.2 Restraints

- 4.5.2.1 High Volatility of Crude Oil Prices

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Upstream

- 5.2 Midstream

- 5.3 Downstream

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BP Plc

- 6.3.2 Shell Plc

- 6.3.3 Petronas Gas Bhd

- 6.3.4 Chevron Corporation

- 6.3.5 ExxonMobil Corporation

- 6.3.6 Malaysiaian General Petroleum Corporation

- 6.3.7 Altus Oil & Gas Malaysia Sdn. Bhd.

- 6.3.8 Petro-Excel Sdn Bhd (PESB)

- 6.3.9 Petro Teguh (M) Sdn. Bhd.

- 6.3.10 Malaysiaian Natural Gas Holding Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 A High Number of Discoveries in Recent Years and Ongoing Exploration Activities

02-2729-4219

+886-2-2729-4219