|

市场调查报告书

商品编码

1637830

亚太地区气雾罐:市场占有率分析、产业趋势和成长预测(2025-2030 年)Asia Pacific Aerosol Cans - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

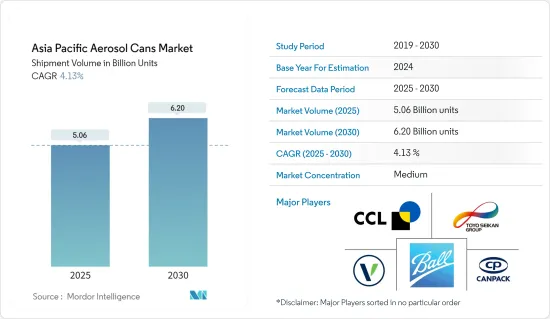

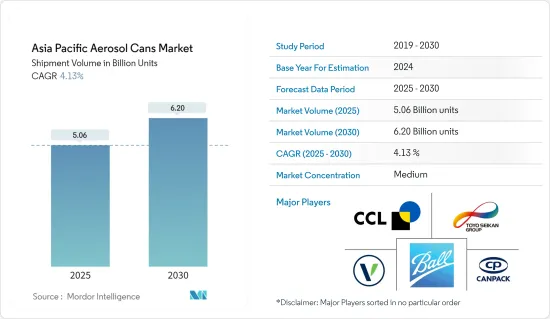

根据出货量计算,亚太地区气雾罐市场规模预计将从 2025 年的 50.6 亿个扩大到 2030 年的 62 亿个,预测期内(2025-2030 年)的复合年增长率为 4.13%。的。

气雾罐是自足式的分配系统,它将物质储存在一个小的金属罐内,然后以细雾、泡沫或喷雾的形式喷出。它的便利性、精确的剂量以及最小的洩漏风险正在推动它在各个行业中的应用。

预计预测期内气雾罐市场将稳定成长。消费者偏好的变化影响产品包装,更重视美观、储运价值、使用者的便利性。便携性、可回收性、安全性、弹性以及美观度的提高等因素推动了气雾罐的需求。

气雾罐的再生性和可回收性极大地推动了市场的成长。这些罐子符合环境法规的要求,为使用者提供了经济高效的包装解决方案,同时减轻了处理方面的担忧。这种合作使用户受益并帮助供应商实现其永续性目标。

此外,家庭护理行业的持续进步也将促进需求的成长。人们对家庭清洁意识的不断提高已成为市场的主要推动力。各种家用清洁剂的供应,尤其是具有不同香味的清洁剂,进一步推动了市场的成长。

随着当地消费者偏好转向便利且永续的产品,对气雾罐的需求将会增加。除了个人护理外,製药业对气雾罐的需求也在增加。印度投资局预测,到 2030 年,製药业的规模将达到 1,300 亿美元,这一成长轨迹为该地区的气雾罐供应商带来了丰厚的利润。

该行业也面临挑战。由于环境和健康问题日益严重,具有成本效益的替代包装的兴起以及对气雾罐中有害化学物质的担忧构成了巨大的障碍。然而软分配系统的出现解决了传统气雾罐带来的挑战,开创了创新包装解决方案的新时代。

亚太气雾罐市场趋势

居家护理品类推动气雾罐市场成长

- 受访市场的家庭护理领域预计将随着一系列专为清洁和维护目的而设计的家用气雾剂而成长。其中包括空气清新剂、清洗产品、擦洗液、防静电喷雾、气雾胶、杀虫剂、除草剂等。

- 随着生活方式的改变和可支配收入的增加,家庭在产品上的支出不断增加,从而对包装市场,尤其是气雾罐市场产生了影响。根据世界银行的报告,印度家庭和非营利机构的最终消费支出将从 2022 年的 1.81 兆美元增加到 2023 年的 1.88 兆美元。

- 由于包装创新、品牌发展和广告宣传,家用清洁剂的销售量预计将飙升。此外,主要企业正在加大对推出环保产品的投入,进一步加强产业销售。

- 2023 年 11 月,印度消费品领域主要企业Dabur India Ltd 推出“Odonil Exotic Room Spray”,扩大了其 Odonil 产品组合。这款创新的水性气雾剂可确保持久的香味。喷雾完全不含酒精,并带有自然香味,包括来自拉丁美洲的 Sensual Dahlia 和来自日本的 Sakura。此次发布彰显了 Dabur 致力于提高香水标准和为挑剔的印度消费者提供独特体验的承诺。

- 家庭清洁剂领域的新发展有望促进产业需求。个人卫生意识的增强、对洁净生活空间的渴望以及对奢侈品的偏好推动了空气清新剂和清洗产品市场的发展。预计这一趋势将对该地区的气雾罐市场产生重大影响。

- 越来越多的住宅开始使用气雾喷漆进行装饰、DIY计划和住宅维修。除了这些用途之外,气雾喷雾还可用于节日、聚会和特殊场合的装饰,并且在家庭中越来越重要。

铝製气雾罐是现代包装的良好选择

- 铝具有独特的强度、耐腐蚀性、可回收性和轻质等性能组合,是产品包装的最佳选择。具体来说,铝气雾剂可作为容纳加压液体或气体的金属容器。

- 在用于製作气雾罐的众多材料中,铝由于其优异的物理性能而成为首选。铝製气雾罐因其重量轻、易于运输和可无限回收而受到生产商、零售商和消费者的吸引。

- 区域性铝资源为气雾罐製造商提供了显着的优势,包括降低生产成本。中国原生铝,占全球总产量的55%以上。根据国际铝业协会的资料,中国原生铝产量正在增加,将从2022年的4,040万吨增加到2023年的4,170万吨。

- 铝製气雾罐的製造过程包括将一整块金属的小铝块製成圆柱形。产品标籤和说明采用胶印方式贴在金属罐上。值得注意的是,铝製气雾罐和铝瓶的製造流程类似。

- 铝製气雾罐已成为挥发性物品和化学品成熟的包装解决方案。它具有价格实惠、安全性和不渗透性等特点,非常适合用于从香水和消毒剂到髮胶喷雾和除臭剂等高端个人保健产品等各种产品。

- 在汽车、油漆和个人护理市场的推动下,铝製气雾罐因其可回收性、易于使用以及抗污染和溢出的特性而经历快速的需求增长。

亚太地区气雾罐产业概况

亚太地区气雾罐市场适度整合并由少数几家大公司主导,这主要是由于其价格敏感性。市场的主要企业包括 Ball Aerosol Packaging India Pvt. Ltd(Ball Corporation)、Toyo Seikan(Toyo Seikan Group Holdings)、CANPACK India Private Limited(CANPACK SA)、CCL Industries Inc.、Trivium Packaging BV 和 Casablanca Industries Pvt。 、印度斯坦锡业有限公司等这些供应商越来越注重永续性和产品增强,以期占领更大的市场占有率并盈利。

2024 年 9 月 - 卡萨布兰卡工业私人有限公司庆祝其位于马哈拉斯特拉邦的铝製整体式气雾罐製造工厂成立一周年。他致力于提高生产力和缩短交货时间,并采取积极的策略来扩展业务。我们努力不断进步,致力于扩大我们的业务和客户群。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场动态

- 市场驱动因素

- 化妆品产业需求不断成长

- 市场限制

- 替代包装的竞争加剧

- 市场机会

- 具有高成长潜力的新兴经济体

第六章 市场细分

- 依材料类型

- 铝

- 马口铁钢

- 其他材料类型

- 按最终用户产业

- 化妆品和个人护理

- 居家护理

- 药品/动物用药品

- 油漆和清漆

- 车

- 其他最终用户产业

- 按国家

- 中国

- 印度

- 日本

- 韩国

第七章 竞争格局

- 公司简介

- Ball Aerosol Packaging India Pvt. Ltd(Ball Corporation)

- Toyo Seikan Co. Ltd(Toyo Seikan Group Holdings)

- CANPACK India Private Limited(CANPACK SA)

- CCL Industries Inc.

- NCI Packaging(National Can Industries Pty Limited)

- Jamestrong Packaging

- Swan Industries(Thailand)Co. Ltd

- Trivium Packaging BV

- Euro Asia Packaging(Guangdong)Co. Ltd

- Hindustan Tin Works Ltd

- Casablanca Industries Pvt. Ltd

- ALUMATIC CANS PVT. LTD

第八章投资分析

第九章:市场的未来

The Asia Pacific Aerosol Cans Market size in terms of shipment volume is expected to grow from 5.06 billion units in 2025 to 6.20 billion units by 2030, at a CAGR of 4.13% during the forecast period (2025-2030).

An aerosol can is a self-contained dispensing system that stores a substance inside a small metal canister and pushes it out as a fine mist, a foam, or a spray. Its convenience, precise dosing, and minimal spillage risk are driving its adoption across diverse industries.

The aerosol cans market is anticipated to grow steadily during the forecast period. Shifting consumer preferences influence product packaging, emphasizing aesthetics, storage and transportation value, and user convenience. Factors like portability, recyclability, safety, resilience, and enhanced aesthetic appeal are fueling the demand for aerosol cans.

The reusability and recyclability of aerosol cans are significantly propelling the market's growth. Crafted in line with environmental regulations, these cans offer users cost-effective packaging solutions while alleviating disposal concerns. This alignment benefits users and aids vendors in achieving their sustainability objectives.

Moreover, ongoing advancements in the household care industry are poised to amplify demand. Heightened awareness about household cleanliness has emerged as a primary market driver. The availability of diverse household cleaners, especially with varied fragrances, further propels market growth.

As regional consumer preferences shift toward convenient and sustainable products, the demand for aerosol cans is set to rise. Beyond personal care, the pharmaceutical industry is also showing increased demand for these cans. With projections from Invest India estimating the pharmaceutical industry to hit USD 130 billion by 2030, this growth trajectory presents lucrative opportunities for aerosol can vendors in the region.

Challenges persist in the industry. The rise of cost-effective packaging alternatives and worries about harmful chemicals in aerosol cans, driven by heightened environmental and health concerns, present formidable obstacles. However, the advent of soft dispensing systems addresses the challenges posed by traditional aerosol cans, heralding a new era of innovative packaging solutions.

Asia Pacific Aerosol Cans Market Trends

The Household Care Segment Drives Growth in the Aerosol Cans Market

- The household care segment in the market studied is poised for growth, driven by various household aerosols tailored for cleaning and maintenance. These include air fresheners, cleaning agents, polishing solutions, anti-static sprays, aerosol starches, insecticides, and herbicides.

- As lifestyles evolve and disposable incomes rise, households spend more on products, influencing the packaging market, notably aerosol cans. The World Bank reported that India's final consumption expenditure by households and NPISHs climbed to USD 1.88 trillion in 2023, up from USD 1.81 trillion in 2022.

- Sales of household cleaning products are expected to surge, fueled by innovative packaging, brand development, and advertising. Moreover, key players are increasingly investing in eco-friendly product launches, further bolstering industry sales.

- In November 2023, Dabur India Ltd, a prominent player in India's consumer goods sector, expanded its Odonil portfolio with the debut of 'Odonil Exotic Room Spray.' This innovative, water-based aerosol promises a superior, long-lasting fragrance. The sprays are completely alcohol-free and boast nature-inspired scents, featuring flowers like the Sensual Dahlia from Latin America and Sakura from Japan. The launch underscores Dabur's commitment to enhancing fragrance standards and delivering unique experiences to discerning Indian consumers.

- New developments in the household cleaner landscape are poised to drive up industry demand. Heightened awareness about personal hygiene, the desire for pristine living spaces, and a preference for luxury are driving the market for air fresheners and cleaning products. This trend is poised to significantly influence the aerosol cans market in the region.

- Homeowners are increasingly utilizing aerosol spray paints for decorating, DIY projects, and home improvements. Beyond these uses, aerosol sprays are also used to decorate items during holidays, parties, and special occasions, underscoring their growing significance in households.

Aluminum Aerosol Cans are the Preferred Choice for Modern Packaging

- Aluminum is a top choice for product packaging, boasting a unique blend of strength, corrosion resistance, recyclability, and lightweight properties. Specifically, an aluminum aerosol can serve as a metal container to hold pressurized liquids or gases.

- Among the myriad materials used for aerosol cans, aluminum's superior physical qualities make it a favored choice. Producers, retailers, and consumers gravitate toward aluminum aerosol cans for their lightweight nature, easy shipping, and infinite recyclability.

- Regional access to aluminum provides aerosol can manufacturers with significant advantages, notably reduced production costs. Dominating the landscape, China leads global primary aluminum production, contributing over 55% to the world's total production. The data from the International Aluminium Institute highlighted a rise in China's primary aluminum production, climbing from 40.4 million metric tonnes in 2022 to 41.7 million metric tonnes in 2023.

- The manufacturing process of aluminum aerosol cans involves shaping a small aluminum slug into a cylinder from a single metal piece. Product labels and instructions are applied using offset printing on the metal cans. Notably, both aluminum aerosol cans and bottles share a similar production journey.

- Aluminum aerosol cans have become a go-to packaging solution for volatile goods and chemicals. Their affordability, security, and impermeability make them perfect for items ranging from scents and sanitizers to high-end personal care products like hair sprays and deodorants.

- Driven by the automotive, paints, and personal care markets, aluminum aerosol cans are witnessing a surge in demand thanks to their recyclability, user-friendliness, and resistance to contamination and spills

Asia Pacific Aerosol Cans Industry Overview

The Asia-Pacific aerosol cans market is moderately consolidated and dominated by a few significant players, largely due to its price-sensitive nature. The key players in the market include Ball Aerosol Packaging India Pvt. Ltd (Ball Corporation), Toyo Seikan Co. Ltd (Toyo Seikan Group Holdings), CANPACK India Private Limited (CANPACK SA), CCL Industries Inc., Trivium Packaging BV, Casablanca Industries Pvt. Ltd, and Hindustan Tin Works Ltd. These vendors are increasingly focusing on sustainability and product enhancements, aiming to capture a larger market share and boost profitability.

September 2024- Casablanca Industries Pvt. Ltd celebrated the first anniversary of its aluminum monobloc aerosol can manufacturing facility in Maharashtra. The company is dedicated to boosting productivity and reducing turnaround times, employing a proactive strategy for business expansion. Committed to continuous improvement, the company seeks to broaden its operations and clientele.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand from the Cosmetic Industry

- 5.2 Market Restraints

- 5.2.1 Increasing Competition from Substitute Packaging

- 5.3 Market Opportunities

- 5.3.1 Emerging Economies Offer High Growth Potential

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Aluminum

- 6.1.2 Steel-tinplate

- 6.1.3 Other Material Types

- 6.2 By End-user Industry

- 6.2.1 Cosmetic and Personal Care

- 6.2.2 Household Care

- 6.2.3 Pharmaceutical/Veterinary

- 6.2.4 Paints and Varnishes

- 6.2.5 Automotive

- 6.2.6 Other End-user Industries

- 6.3 By Country

- 6.3.1 China

- 6.3.2 India

- 6.3.3 Japan

- 6.3.4 South Korea

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Ball Aerosol Packaging India Pvt. Ltd (Ball Corporation)

- 7.1.2 Toyo Seikan Co. Ltd (Toyo Seikan Group Holdings)

- 7.1.3 CANPACK India Private Limited (CANPACK S.A.)

- 7.1.4 CCL Industries Inc.

- 7.1.5 NCI Packaging (National Can Industries Pty Limited)

- 7.1.6 Jamestrong Packaging

- 7.1.7 Swan Industries (Thailand) Co. Ltd

- 7.1.8 Trivium Packaging BV

- 7.1.9 Euro Asia Packaging (Guangdong)Co. Ltd

- 7.1.10 Hindustan Tin Works Ltd

- 7.1.11 Casablanca Industries Pvt. Ltd

- 7.1.12 ALUMATIC CANS PVT. LTD