|

市场调查报告书

商品编码

1637842

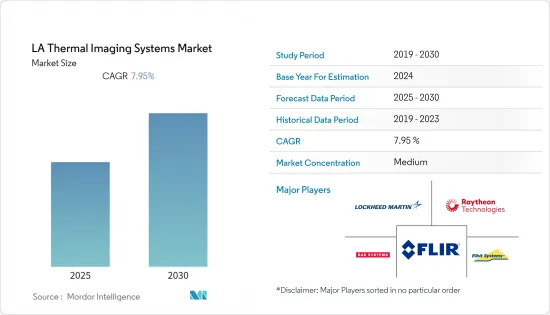

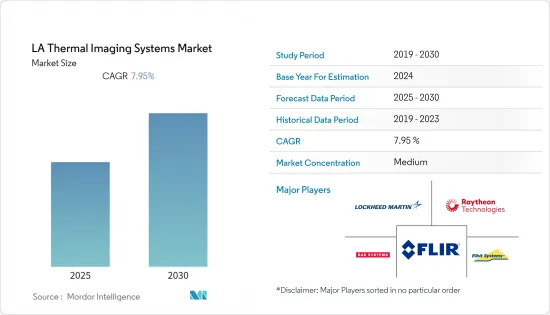

拉丁美洲热成像系统 -市场占有率分析、产业趋势、成长预测(2025-2030)LA Thermal Imaging Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

拉丁美洲热成像系统市场预计在预测期内复合年增长率为 7.95%

主要亮点

- 技术进步使许多公司能够将其红外线/热成像系统感测器小型化,从而提高效率且更易于使用。手持式红外线/热成像系统因其便携性而受到欢迎,并用于包括医院在内的各种企业,节省了维修时间和加热成本。

- 例如,去年3月,全球数位伤口护理技术公司Swift Medical推出了一项新技术,可以无线连接到智慧型手机摄像头,捕捉详细的临床资料,以帮助评估、治疗和监测皮肤和伤口我们发布了Swift Ray 1,一款革命性的硬体设备。 Swift Ray 1 足够小,适合临床医生和患者手中,使从医院到患者家中的任何地方都可以获得强大的医学影像。借助这种先进的成像技术,无论肤色如何,都可以为每位患者收集准确的临床资料,使创伤护理对每个人都更加公平。

- 此外,热成像系统也用作临床热成像系统,用于癌症、感染疾病、创伤和血管疾病的早期检测。热成像系统根据人体散发的热量产生影像,使其成为最好的预防性医疗检查之一。因此,随着热成像系统在医疗应用中的使用扩大,热成像系统市场可能会成长。

- 该地区国家出于多种原因积极投资军事。许多拉丁美洲国家正在增加用于边境管制、反海盗、打击组织犯罪和贩毒集团的军事预算。热感热感像仪以多种方式支援军事力量,包括追踪国界附近的微小征兆,无论是在陆地还是海上。

- 此外,根据 SIPRI 的数据,墨西哥的军事开支最近增至 86.808 亿美元,而上年度为 80.449 亿美元。洛佩斯·奥夫拉多尔总统领导下的墨西哥旨在扩大公民活动的军事化,从国家公园到国内反犯罪行动,併计划将国民警卫队置于军事控制之下。这些活动可能会进一步增加该地区对热热感仪的需求。

- 这个市场上的许多公司都在不断开发创新产品。例如,去年 11 月,FLIR Systems 发布了一款新型热感FLIR One Edge Pro。该产品作为现有 FLIR One Edge 的升级版本推出。它可以轻鬆连接到智慧型手机的后面板,因此您无需将镜头连接到智慧型手机即可获得输出。它还包括 MSX 模式,可迭加可见光摄影机的影像资料,使热成像系统更加可见。软体也得到了增强。

- 为了扩大热成像系统在突发公共卫生事件期间的可用性并缓解体温计短缺问题,FDA 制定了《2019 年冠状病毒感染疾病(COVID-19)公共卫生紧急情况热成像系统执行政策》指南。本指南规定了旨在适用于与 COVID-19 相关的公共卫生紧急情况期间为医疗目的设计的所有红外线成像系统的执法政策。

拉丁美洲热成像系统市场趋势

汽车应用推动市场成长

- 对无人驾驶、自主和先进车辆的需求正在推动对热成像技术的需求,以帮助为消费者提供优质体验。多个感测器用于侦测和利用车辆的系统。热感摄影机与接近感测器配合使用,支援车辆的整体功能。

- 去年 11 月,圣安德烈斯大学人工智慧机器人实验室的目标是让第一辆无人驾驶汽车获准在阿根廷道路上使用。首次测试在蓬塔奇卡校区进行,该大学在研发方面投资了 25 万美元。

- 热感热感像仪用于汽车行业,即使在恶劣的照明和天气条件下也能确保驾驶员的视野,避免事故并确保安全。汽车製造商和热成像解决方案供应商正在共同努力,为汽车产业开发创新的热解决方案。据INEGI称,墨西哥去年生产了3,480辆乘用车(单位:1,000辆),高于前一年的2,979辆。

- 在汽车产业,高科技自动驾驶汽车,也称为 ADAS(高级驾驶辅助系统)正变得越来越受欢迎。多种感测器,包括热感摄影机、无线电探测和测距感测器、光探测和测距感测器以及接近感测器,将取代这些汽车中的驾驶员,以实现自动驾驶、导航和更好的情境察觉。对这些车辆的需求不断增长可能会进一步推动市场成长。

- 例如,Owl Autonomous Imaging 在去年 1 月的 CES 2023 上宣布了其 Thermal Ranger ADAS 和自主导航开发平台的评估套件。此硬体和软体套件使一级汽车公司和OEM汽车公司能够轻鬆部署 Owl AI 的热感 Ranger 成像解决方案,以便与 PAEB 和其他支援 L2、L2+、L3/L4 Essentials 的 ADAS 功能一起使用。该公司的热感像仪解决方案可实现物件分类、3D 物件分割、RGB 热融合和高精度距离测量的 2D 和 3D 感知。

巴西占有很大的市场占有率

- 在巴西,由于军事和国防、石油和天然气以及汽车等各领域的支出增加,热感的市场规模正在显着扩大。根据Global Firepower统计,截至上年度,巴西的国防预算是拉丁美洲最高的,总计约187.9亿美元。

- 巴西的军事和国防工业是热感的早期采用者。随着国防部门增加监控投资,热热感仪的使用预计将扩大。例如,去年 3 月,巴西陆军开始接受其订购的用于情报、监视、目标获取和侦察 (ISTAR) 任务的诺鲁 1,000C 无人机 (UAV)。诺鲁 1,000C 是一款固定翼垂直起降 (VTOL) 无人机,能够全天候、白天和夜间执行多任务操作。预计此类协议将在预测期内提振该领域的成长前景。

- 拉丁美洲各国政府正在投资下一代技术,为军队提供更好、更准确的资讯。红外线热成像系统设备在军事工业领域的使用日益增多,影响红外线摄影机尤其是短波长红外线摄影机的崛起。

- 该地区的犯罪和暴力事件也有所增加。因此,国防安全保障部队的预算增加了,用于购买先进的保护系统和设备。现代战争变得越来越不对称,非致命和致命武器大量存在。例如,去年八月,美国国防安全合作局(DSCA)通知国会,向巴西对外军售(FMS)标枪飞弹及相关设备。作为此次销售的一部分,巴西政府要求购买最多 33 个标枪发射装置 (CLU) 和 222 枚 FGM-148 标枪反战车飞弹。合约金额约7400万美元。因此,增加先进武器系统和 C4ISR 系统的采购以增强军事能力正在推动该国的整体市场成长。

拉丁美洲热成像系统产业概况

拉丁美洲热成像系统市场部分细分,由几家主要公司组成。其中包括 Axis Communications、FLIR、Fluke Corporation、Bae Systems、Elbit Systems Ltd、Raytheon Co、Lockheed Martin 等。然而,许多公司正在透过赢得新合约和开拓新市场,利用新解决方案扩大市场份额。

- 2022 年 12 月 - Teledyne Technologies Incorporated 公司旗下 Teledyne FLIR 最近宣布推出全球首款完全免持、语音控制的热感相机模组,这使得辅助现实可穿戴解决方案的先驱 RealWear 成为最新的 Thermal by FLIR 合作伙伴。作为Ulefone与Thermal by FLIR合作,近期推出了搭载Lepton 3.5热感相机模组的5G行动电话Power Armor 18T。

- 2022 年 1 月 - Xenics 推出新型高性能、高解析度热成像系统长波红外线 (LWIR) 相机 Ceres T 1280。 Xenics 透过 Ceres T 1280 扩展了其高性能热成像系统相机系列。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 价值链/供应链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 热成像系统现已用于各种应用

- 热成像系统的技术改进

- 市场限制因素

- 缺乏定期的支援和服务

第六章 市场细分

- 按解决方案

- 硬体

- 软体

- 服务

- 依产品类型

- 固定式热成像系统

- 手持式热成像系统

- 按用途

- 安全与监控

- 监控/检查

- 检测/测量

- 按最终用户

- 航太/国防

- 车

- 医学生命科学

- 石油和天然气

- 饮食

- 其他的

- 按国家/地区

- 巴西

- 阿根廷

- 其他拉丁美洲

第七章 竞争格局

- 公司简介

- Flir Systems Inc.

- BAE Systems PLC

- Elbit Systems Ltd

- Raytheon Company

- Lockheed Martin Corporation

- L-3 Communications Holdings

- Fluke Corporation

- Axis Communications

- Leonardo SpA

第八章投资分析

第9章市场的未来

简介目录

Product Code: 47762

The LA Thermal Imaging Systems Market is expected to register a CAGR of 7.95% during the forecast period.

Key Highlights

- Most companies have miniaturized IR and thermal imaging sensors due to technological advancements, making them highly efficient, thereby raising their ease of use. Handheld IR and thermal imaging systems gain traction for their portability and find applications in various enterprise verticals, such as hospitals, saving repair times and heating costs.

- For instance, in March last year, Swift Medical, the global player in digital wound care technology, unveiled the Swift Ray 1, a game-changing hardware device that wirelessly attaches to a smartphone camera and captures detailed clinical data to aid in the assessment, treatment, and monitoring of skin and wound conditions. The Swift Ray 1 is small enough to fit in a clinician's or patient's hand, making powerful medical imaging obtainable anywhere, from the hospital to the patient's home. Because of this advanced imaging, accurate clinical data can be collected for every patient, regardless of skin tone, making wound care more equitable for all.

- In addition, thermal cameras are used in clinical thermography to identify cancer, infections, traumas, and vascular disease at an early stage. Thermal cameras create pictures depending on how much heat the human body radiates, making it one of the greatest preventative health screening approaches. As a result, the thermal imaging market will likely grow as prospects for thermal imaging in healthcare applications expand.

- The countries in the region are aggressively investing in their military for various reasons. Many Latin American countries are expanding their military budgets, including border management, anti-piracy procedures, and combatting organized crime and drug cartels. Thermal imaging aids armies in different ways, including tracing minor signs near borders, whether on land or sea.

- In addition, according to the SIPRI, military expenditure in Mexico increased to USD 8680.80 million recently compared previous year's recorded USD 8044.90 million. Mexico aims to increase the militarization of civilian activities, ranging from national parks to domestic anti-crime operations, with a plan under the premiership of President Lopez Obrador to bring the country's National Guard under military control. Such activities may further create demand for thermal imaging systems in the region.

- Many players in the market are continuously developing innovative products that may drive market demand. For instance, in November last year, FLIR announced its new thermal camera, FLIR One Edge Pro. It has been launched as an upgrade to the existing FLIR One Edge. It can easily be attached to the smartphone's rear panel, eliminating the need to connect the lens to a smartphone to get output. It also includes an MSX mode, which overlays image data from the visible camera to make thermal images simpler to read. There have also been some software enhancements.

- The FDA published the Enforcement Policy for Telethermographic Systems During the Coronavirus Disease 2019 (COVID-19) Public Health Emergency guidance to help expand the availability of thermal imaging systems and mitigate thermometer shortages during the public health emergency. The guidance sets forth an enforcement policy intended to apply to all thermal imaging systems designed for medical purposes during the public health emergency related to COVID-19.

Latin America Thermal Imaging Systems Market Trends

Automotive in Applications to Drive the Market's Growth

- The demand for advanced vehicles, which are driverless and autonomous, has expanded the need for thermal imaging techniques that help deliver a premium experience to the consumer. Multiple sensors are used to detect and utilize the vehicle's system. Thermal cameras are operated along with proximity sensors that help the entire vehicle's function.

- In addition, in November last year, the AI and Robotics Laboratory of the University of San Andres set the goal of obtaining authorization for the first driverless vehicle that circulates on Argentine roads. The first tests were carried out on the Punta Chica campus, and the university invested USD 250,000 in R&D.

- Thermal imaging cameras are used in the automobile industry to allow drivers to see in harsh lighting and weather situations to avoid accidents and assure safety. Automotive manufacturers and thermal imaging solution suppliers are working together to develop innovative thermal solutions for the automotive industry. According to INEGI, last year, the total production of passenger vehicles in Mexico was recorded at 3,480 (in thousands) from the previous year, which was registered at 2,979.

- The automobile industry is gaining traction with high-tech autonomous cars, also known as advanced driver-assistance systems. Multiple sensors, including thermal cameras, radio detection and ranging, light detection and ranging sensors, and proximity sensors, substitute drivers in these cars to enable automated driving, navigation, and better situational awareness. Increasing demand for these cars may further drive the market's growth.

- For instance, in January last year, Owl Autonomous Imaging announced Evaluation Kit for its Thermal Ranger ADAS & Autonomous Navigation Development Platform at CES 2023. This hardware and software kit enables Tier-1 and OEM automotive companies to easily evaluate Owl AI's Thermal Ranger imaging solution for use in their PAEB and other ADAS functions supporting L2, L2+, and L3/L4 essentials. The company's thermal camera solution enables 2D and 3D perception for object classification, 3D segmentation of objects, RGB-to-thermal fusion, and highly precise distance measurements.

Brazil to Experience Significant Market Share

- The country has significant growth of thermal imaging systems due to increasing spending on military and defense, oil and gas, automotive, and many other sectors. In addition, according to Global Firepower, Brazil had the highest defense budget in Latin America as of the previous year, totaling approximately USD 18.79 billion.

- The military and defense industries in the country are among the first to use infrared and thermal imaging devices. With the defense sector's increased investment in surveillance, the use of infrared and thermal imaging equipment is projected to grow. For instance, in March last year, the Brazilian Army started receiving the Nauru 1000C unmanned aerial vehicles (UAVs), ordered for intelligence, surveillance, target acquisition, and reconnaissance (ISTAR) missions. The Nauru 1000C is a fixed-wing vertical take-off and landing (VTOL) drone capable of operating in all-weather daylight and night-capable multi-missions. Such contracts are expected to propel the growth prospects of the segment during the forecast period.

- Governments across Latin America are investing in next-generation technology by giving better and more accurate information to military troops. The use of IR thermography equipment in the military industry has grown, influencing the rise of infrared cameras, particularly short-wavelength IR cameras, which may further drive the market's growth.

- The region also has a significant trend of increasing crime and violence. As a result, the homeland security forces' budgets have increased to purchase advanced protection systems and devices. Modern combat has grown increasingly asymmetric with numerous non-lethal and deadly weapons. For instance, in August last year, the US Defence Security Cooperation Agency (DSCA) notified Congress of a foreign military sale (FMS) of Javelin missiles and associated equipment to Brazil. As a part of the sale, the Brazilian government requested purchasing up to 33 Javelin command launch units (CLU) and 222 FGM-148 Javelin anti-tank missiles. The value of the contract was nearly USD 74 million. Thus, growing procurement of advanced weapon systems and C4ISR systems for enhancing military capabilities drive the market's growth across the country.

Latin America Thermal Imaging Systems Industry Overview

The Latin American thermal imaging systems market is partially fragmented and consists of several major players. Some of these players include Axis Communications, FLIR, Fluke Corporation, Bae Systems, Elbit Systems Ltd, Raytheon Co., and Lockheed Martin. However, many companies are increasing their market presence with innovative solutions by securing new contracts and tapping new markets.

- December 2022 - Teledyne FLIR, part of Teledyne Technologies Incorporated, received RealWear, the pioneer in assisted reality wearable solutions, as its latest Thermal by FLIR collaborator with the recent launch of the world's first fully hands-free, voice-controlled thermal camera module. Thermal by FLIR cohort Ulefone recently launched the Power Armor 18T 5G Android phone, which features the Lepton 3.5 thermal camera module.

- January 2022 - Xenics launched the Ceres T 1280, a new high-performance, high-resolution thermographic long-wave infrared (LWIR) camera. Xenics expanded its high-performance thermographic camera line with the Ceres T 1280.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain/Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Thermal Imaging Increasingly Used in Various Applications

- 5.1.2 Technological Upgradations in Thermal Imaging Systems

- 5.2 Market Restraints

- 5.2.1 Lack of Regular Support and Services

6 MARKET SEGMENTATION

- 6.1 By Solutions

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Services

- 6.2 By Product Type

- 6.2.1 Fixed Thermal Cameras

- 6.2.2 Handheld Thermal Cameras

- 6.3 By Application

- 6.3.1 Security and Surveillance

- 6.3.2 Monitoring and Inspection

- 6.3.3 Detection and Measurement

- 6.4 By End User

- 6.4.1 Aerospace and Defense

- 6.4.2 Automotive

- 6.4.3 Healthcare and Life Sciences

- 6.4.4 Oil and Gas

- 6.4.5 Food and Beverage

- 6.4.6 Other End Users

- 6.5 By Country

- 6.5.1 Brazil

- 6.5.2 Argentina

- 6.5.3 Rest of Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Flir Systems Inc.

- 7.1.2 BAE Systems PLC

- 7.1.3 Elbit Systems Ltd

- 7.1.4 Raytheon Company

- 7.1.5 Lockheed Martin Corporation

- 7.1.6 L-3 Communications Holdings

- 7.1.7 Fluke Corporation

- 7.1.8 Axis Communications

- 7.1.9 Leonardo SpA

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219