|

市场调查报告书

商品编码

1637850

机器状态监测:市场占有率分析、产业趋势与统计、2025-2030 年成长预测Machine Condition Monitoring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

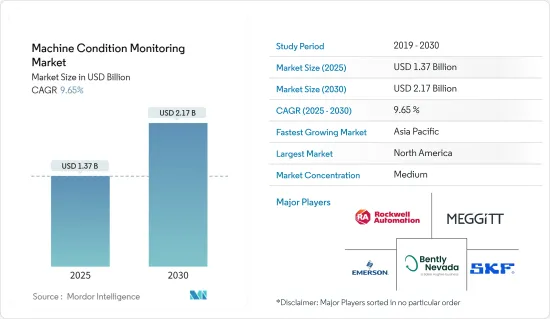

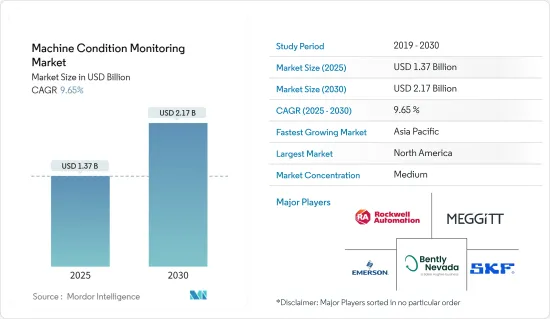

机器状态监测市场规模在 2025 年估计为 13.7 亿美元,预计到 2030 年将达到 21.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 9.65%。

预计在预测期内,工业 4.0 的日益普及、减少人为参与预测性维护的需求不断增长以及对实施机器状态监测解决方案的好处的认识不断提高将推动机器状态监测市场的发展。

主要亮点

- 工业 4.0 依靠自动化,包括即时资讯处理和电脑学习来实现工业工厂运作的现代化。这导致了电脑化生产技术的扩展,以提高营运效率,包括数位分析、自动化和商业物联网。此外,工业4.0中预测管理的引入为许多行业带来了巨大的前景。分析设备资料以确定和计划维护并减少运作是机器健康管理过程的一部分。这些进步使得分析设备功能和预测故障情况成为可能。因此,有关机器状态追踪的知识的不断增长有望开闢新的商业前景。

- 预计市场主要参与者的产品开发将促进市场成长。例如,2022年11月,透过诊断测试和服务(包括软体)为电气部门提供设备健康检查的Doble工程公司宣布了一种针对中高压电缆系统的新解决方案:Calisto电缆状况监测。创新的Callisto电缆可实现安全可靠的电缆运行,降低故障可能性,降低整体运营和解决方案成本,并提供近乎即时的电缆健康状况资讯。

- 自新冠疫情以来,对完全自主且极少人工监督的系统的需求推动了市场的发展,随着全球经济的逐步復苏和远端操作需求的增加,市场也在不断扩大。此外,由于对即时机器监控的需求不断增加,工业 4.0 的日益采用可能会产生具有吸引力的市场发展前景。

- 然而,需要短期投资,而且状态监控设备价格昂贵。此外,状态监测感测器可能无法在某些环境中生存,且机器表现出不可预测的维护期,这对市场成长构成了挑战。

机器状态监测市场趋势

汽车运输快速成长

- 在全球范围内,汽车产业是製造业的关键领域之一。随着技术的快速进步,汽车变得越来越复杂。这种复杂性的增加会导致潜在的生产错误,从而增加了对持续机器状态监控解决方案的需求。

- 汽车产业的市场相关人员正在竞相简化和升级其製造流程。生产线上安装的各种马达需要定期监控。马达电压模式分析方法有助于减少机器故障并延长机器寿命。汽车行业生产的汽车数量正在快速增长,预计将促进市场成长。例如,特斯拉2022年第三季的汽车产量为36.59万辆。特斯拉的生产水准较上季成长超过41.5%,2022年第三季的年化成长率达到近53.9%。为了缩短製造週期并提高产量,汽车组装厂的工厂车间必须采用相应的技术。

- 空气处理系统和帮浦是汽车领域状态监测最常见的应用。其他采用状态监测的重要领域包括马达和传动部件的耐久性测试、风洞、可靠性测试的电气故障和汽车测试台(人工道路)。

- 汽车领域对状态监测的需求不断增长,促使主要企业加强产品开发。例如,2022 年 4 月,OMRON推出了其创新的 K7TM 状态监控系统,主要用于汽车和快速消费品领域的加热设备。

预测期内欧洲将大幅成长

- 由于汽车、航太等终端使用产业的强劲发展,欧洲机器状态监测市场预计在未来五年内将大幅成长。此外,ABB、SKF AB 和 Meggitt PLC 等主要製造商在该地区的存在将进一步促进市场成长。

- 携带式监控过程难以在远端製造工厂中实施,从而增加了在线状态监控的需求。此外,技术进步以及对即时警报和指标的需求正在推动许多终端使用领域越来越多地采用线上状态监测流程。这促使主要参与者加大产品开发力道。例如,2021 年 6 月,ABB 宣布推出一项新型数位状态监测服务,专注于输送系统的预测性维护。预计这些发展将在预测期内推动机械状态监测市场的成长。

- 该国拥有43个汽车组装和生产厂,占欧洲汽车生产能力的三分之一以上。该国生产的汽车有四分之三以上销往国际市场。因此,预计高汽车产量将推动汽车产业对状态监测解决方案的需求,从而在预测期内促进机器状态监测市场的发展。例如,2022年4月,根据欧洲汽车工业协会(ACEA)的数据,2021年欧盟生产了约990万辆乘用车。

- 智慧製造的发展始于机器自动化监控。智慧工厂中的设备透过基于物联网的网路监视器连接,使机器能够即时提取资料。连接机器系统提供有关设备性能的宝贵信息,提高当前生产率并比较估计与实际生产率。根据ETNO预测,到2027年,汽车领域将有2.23亿个活跃的物联网(IoT)链接,整个欧洲将有1900万个活跃的物联网链接。因此,汽车产业智慧製造的部署正在增加,预计这将在预测期内推动区域市场的扩张。

机器状态监测产业概况

机器状态监测市场竞争适中,有多家参与者。该市场的一些参与者包括罗克韦尔自动化公司(Rockwell Automation, Inc)、美捷特公司(Meggitt PLC)、通用电气本特利内华达公司(GE Bently Nevada)、艾默生电气公司(Emerson Electric Co. ) 和SKF 集团。这些参与者正在采用产品发布、伙伴关係和合资企业等多种策略来增加客户群并扩大产品系列。

- 2022 年 11 月-研华和 Actility 宣布推出一种基于 AI 的新型组合解决方案,以协助机器操作团队进行机器预后诊断和状态监控。这使得使用者可以同时检查多个设备的状态。

- 2022 年 9 月 - ABB 与荷兰高成长公司、知名 ESA 技术供应商 Samotics 达成长期策略合作,以提供更好的状态监测服务。我们利用彼此的优势来更深入地了解设备健康和电力效率。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法与方法论

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响

第五章 市场动态

- 市场驱动因素

- 透过预测性维护提高设备性能和生产力

- 预测性维护的需求不断增加

- 工业 4.0 和製造业及製程工业的新兴产业应用

- 市场挑战

- 改装的成本影响

- 全球宏观经济与地缘政治因素

第六章 市场细分

- 机器状态监测

- 按类型

- 硬体

- 振动状态监测装置

- 热成像设备

- 润滑油分析

- 超音波发射监测

- 其他类型

- 软体

- 服务

- 远端监控服务

- 仪器维修服务

- 机器诊断服务

- 按类型

- 振动监测装置

- 最终用户产业

- 石油和天然气

- 发电

- 工艺与製造

- 航太和国防

- 汽车与运输

- 其他最终用户产业(海洋、采矿、金属等)

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 世界其他地区

- 供应商市场占有率分析

- 最终用户产业

- 热成像设备

- 按最终用户产业

- 石油和天然气

- 发电

- 工艺与製造

- 航太和国防

- 汽车与运输

- 其他产业(海洋、采矿、金属等)

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家(东欧和西欧国家)

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 世界其他地区(拉丁美洲及中东及非洲)

- 供应商市场占有率分析

- 按最终用户产业

- 润滑油分析仪

- 按最终用户产业

- 石油和天然气

- 发电

- 工艺与製造

- 航太和国防

- 汽车与运输

- 其他产业(海洋、采矿、金属等)

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 世界其他地区(拉丁美洲及中东及非洲)

- 供应商市场占有率分析

- 按最终用户产业

第七章 竞争格局

- 公司简介

- Meggitt Sensing Systems(Meggitt PLC)

- Rockwell Automation Inc.

- GE Bently Nevada

- Emerson Electric Co.

- SKF AB

- Bruuel & Kjaer Vibro

- FLIR Systems Inc.

- Fluke Corporation

- Nippon Avionics Co., Ltd.

- Thermo Fisher Scientific Inc.

- Perkin Elmer Inc.

- AMETEK Spectro Scientific

- Parker Kittiwake(PARKER HANNIFIN CORP.)

- Gastops Ltd

第八章投资分析

第九章:市场的未来

The Machine Condition Monitoring Market size is estimated at USD 1.37 billion in 2025, and is expected to reach USD 2.17 billion by 2030, at a CAGR of 9.65% during the forecast period (2025-2030).

Increasing adoption of industry 4.0, increasing demand for reducing human involvement in predictive maintenance, and rising awareness regarding the benefits of installing machine condition monitoring solutions are expected to drive the machine condition monitoring market over the forecast period.

Key Highlights

- Industry 4.0 relies on automation and computer learning, including real-time information processing, to modernize industrial plant operations. This has expanded computerized production technology to enhance operating efficiencies, including digital analytics, automation, and commercial IoT. Furthermore, implementing predictive management in Industry 4.0 provides substantial prospects for numerous industries. Analyzing equipment data to identify and plan maintenance and decrease outage is part of the machine condition management process. Such progress enables the analysis of equipment functioning and the prediction of breakdown scenarios. As a result, rising knowledge of machine status tracking is projected to open up new business prospects.

- Product developments by key players operating in the market are expected to contribute to market growth. For instance, in November 2022, Doble Engineering Company, which provides equipment health inspections for the electric sector via diagnostic tests and services, including software, introduced a new solution, Calisto cable condition monitoring, for moderate and higher voltage cable systems. The innovative Calisto cable provides safe and reliable cable operation, cutting the chance of failure, decreasing the overall cost of operations and solutions, and providing near-real-time information on cable health.

- Post COVID-19 requirement for fully autonomous systems with minimum human administration is propelling the market, which is expanding in line with the gradual recovery of the economies worldwide and the growth in demand for distant operations. Furthermore, the growing adoption of Industry 4.0 due to the increased need for real-time machine monitoring is likely to generate attractive market development prospects.

- However, short-term investment is required, and the equipment for condition monitoring is costly. Moreover, the condition monitoring sensors may not survive depending on the environment, and the machine exhibits unpredictable maintenance periods-such a factor challenges market growth.

Machine Condition Monitoring Market Trends

Automotive Transportation to Witness Significant Growth

- Globally, the automotive sector is one of the significant segments of the manufacturing industry. With rapid advances in technology, automobiles are becoming more complex. This increased complexity is leading to possible production errors, which in turn is increasing the need for continuous machine condition monitoring solutions.

- The automobile industry's market players are driven to streamline and upgrade their manufacturing processes. The various motors placed on the production lines need periodic monitoring. The motor voltage pattern analysis approach helps to reduce machine breakdowns and boost machine lifespan. The number of units manufactured in the vehicle industry is rapidly growing, which in turn is expected to contribute to market growth. For instance, Tesla Inc.'s 3rd quarter 2022 car manufacturing output was 365,900 units. Tesla's production level climbed by more than 41.5% quarter on quarter and reached nearly 53.9 % yearly in the third period of 2022. The technology on the car assembly facility's plant floor must be adequately serviced to provide an enhanced manufacturing cycle and output.

- Air-handling systems and pumps are the most common uses of condition monitoring in the automobile sector. Other critical areas wherein condition monitoring is employed include motor and transmission part endurance testing, wind tunnels, electrical breakdowns for reliability testing, automotive test benches (artificial roadways), and others.

- Increasing demand for condition monitoring in the automotive sector has led to increasing product development by key players. For instance, in April 2022, OMRON launched the innovative K7TM condition monitoring for heating equipment, which is utilized mainly in the automotive and FMCG sectors.

Europe to Grow Considerably Over The Forecast Period

- The machine condition monitoring market in Europe is anticipated to grow significantly over the next five years due to the presence of strong end-use industries such as automobile and aerospace. Furthermore, the presence of significant manufacturers across the region, including ABB, SKF AB, and Meggitt PLC, among others, will further contribute to market growth.

- Since portable monitoring processes are challenging to utilize in remote manufacturing plants, the need for online condition monitoring has increased. Furthermore, technological advancements and the need for real-time alerts and metrics have increased the adoption of online condition monitoring processes across numerous end-use sectors. This has led to increasing product developments by key players. For instance, in June 2021, ABB introduced a novel digital condition monitoring service designed specifically for conveyor system predictive maintenance. Such developments are expected to boost the Machine Condition Monitoring Market growth over the forecast period.

- The country homes 43 automobile assemblies and production plants, with more than 1/3rd of Europe's automobile production capacity. More than 3/4th of the cars produced in this country are destined for international markets. Thus, high automobile manufacturing will propel the need for condition-monitoring solutions in the automotive sector, boosting the market for machine condition monitoring over the forecast period. For instance, in April 2022, according to ACEA, around 9.9 million passenger vehicles were made in the European Union in 2021.

- Developing smart manufacturing begins with automated machine monitoring. Equipment in an intelligent factory is linked via IoT-enabled, web-based monitors that allow for real-time machine extracting data. The linked machine system provides useful information about equipment performance, improves current output, and compares estimated to real output ratios. According to ETNO, by 2027, there will be 223 million active Internet of Things (IoT) links in the automotive sector and 19 million businesses throughout Europe. Thus, increasing smart manufacturing deployment across the automobile industry is expected to boost regional market expansion over the forecast period.

Machine Condition Monitoring Industry Overview

The Machine Condition Monitoring Market is moderately competitive, with several players. Some of the players operating in the market include Rockwell Automation, Inc., Meggitt PLC, GE Bently Nevada, Emerson Electric Co., and SKF Group, among others. These players are adopting several strategies, such as product launches, partnerships, and joint ventures, among others, to increase their customer base and expand their product portfolios.

- November 2022 - Advantech and Actility have announced a novel combined AI-based solution to assist machine operation teams in implementing machine prognostics and condition monitoring. It enables users to check the status of several devices at the same time.

- September 2022 - ABB and Samotics, a high-growth scaleup business in the Netherlands and a prominent vendor of ESA technology have formed a long-term strategic cooperation to deliver better condition monitoring services. The method will use each company's strengths to provide more insights into equipment health and power efficiency.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH APPROACH AND METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness Porters Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Equipment Performance and Productivity through Predictive Maintenance

- 5.1.2 Rising Predictive Maintenance Requirements

- 5.1.3 Industry 4.0 and Emerging Industrial Applications across Manufacturing and Process Industries

- 5.2 Market Challenges

- 5.2.1 Cost Implications in Line with Retrofits

- 5.2.2 Global Macroeconomic and Geopolitical Factors

6 MARKET SEGMENTATION

- 6.1 MACHINE CONDITION MONITORING

- 6.1.1 Type

- 6.1.1.1 Hardware

- 6.1.1.1.1 Vibration Condition Monitoring Equipment

- 6.1.1.1.2 Thermography Equipment

- 6.1.1.1.3 Lubricating Oil Analysis

- 6.1.1.1.4 Ultrasound Emission Monitoring

- 6.1.1.1.5 Other Types

- 6.1.1.2 Software

- 6.1.1.3 Services

- 6.1.1.3.1 Remote Monitoring Services

- 6.1.1.3.2 Instrumentation Maintenance Services

- 6.1.1.3.3 Machinery Diagnostics Services

- 6.1.1 Type

- 6.2 VIBRATION MONITORING EQUIPMENT

- 6.2.1 End User Industry

- 6.2.1.1 Oil and Gas

- 6.2.1.2 Power Generation

- 6.2.1.3 Process and Manufacturing

- 6.2.1.4 Aerospace and Defense

- 6.2.1.5 Automotive and Transportation

- 6.2.1.6 Other End-user Industries (Marine, Mining, Metal, etc.)

- 6.2.2 Geography

- 6.2.2.1 North America

- 6.2.2.1.1 United States

- 6.2.2.1.2 Canada

- 6.2.2.2 Europe

- 6.2.2.2.1 Germany

- 6.2.2.2.2 United Kingdom

- 6.2.2.2.3 France

- 6.2.2.2.4 Rest of Europe

- 6.2.2.3 Asia Pacific

- 6.2.2.3.1 China

- 6.2.2.3.2 Japan

- 6.2.2.3.3 India

- 6.2.2.3.4 Rest of Asia Pacific

- 6.2.2.4 Rest of the World

- 6.2.3 Vendor Market Share Analysis

- 6.2.1 End User Industry

- 6.3 THERMOGRAPHY EQUIPMENT

- 6.3.1 End User Vertical

- 6.3.1.1 Oil and Gas

- 6.3.1.2 Power Generation

- 6.3.1.3 Process and Manufacturing

- 6.3.1.4 Aerospace and Defense

- 6.3.1.5 Automotive and Transportation

- 6.3.1.6 Other End-user Verticals (Marine, Mining, Metal, etc.)

- 6.3.2 Geography

- 6.3.2.1 North America

- 6.3.2.1.1 United States

- 6.3.2.1.2 Canada

- 6.3.2.2 Europe

- 6.3.2.2.1 Germany

- 6.3.2.2.2 United Kingdom

- 6.3.2.2.3 France

- 6.3.2.2.4 Rest of Europe (Eastern Europe and Other Western European Countries)

- 6.3.2.3 Asia Pacific

- 6.3.2.3.1 China

- 6.3.2.3.2 Japan

- 6.3.2.3.3 India

- 6.3.2.3.4 Rest of Asia Pacific

- 6.3.2.4 Rest of the World (Latin America and Middle East and Africa)

- 6.3.3 Vendor Market Share Analysis

- 6.3.1 End User Vertical

- 6.4 LUBRICATING OIL ANALYSIS EQUIPMENT

- 6.4.1 End User Vertical

- 6.4.1.1 Oil and Gas

- 6.4.1.2 Power Generation

- 6.4.1.3 Process and Manufacturing

- 6.4.1.4 Aerospace and Defense

- 6.4.1.5 Automotive and Transportation

- 6.4.1.6 Other End-user Verticals (Marine, Mining, Metal, etc.)

- 6.4.2 Geography

- 6.4.2.1 North America

- 6.4.2.1.1 United States

- 6.4.2.1.2 Canada

- 6.4.2.2 Europe

- 6.4.2.2.1 Germany

- 6.4.2.2.2 United Kingdom

- 6.4.2.2.3 France

- 6.4.2.2.4 Rest of Europe

- 6.4.2.3 Asia Pacific

- 6.4.2.3.1 China

- 6.4.2.3.2 Japan

- 6.4.2.3.3 India

- 6.4.2.3.4 Rest of Asia Pacific

- 6.4.2.4 Rest of the World (Latin America and Middle East and Africa)

- 6.4.3 Vendor Market Share Analysis

- 6.4.1 End User Vertical

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Meggitt Sensing Systems (Meggitt PLC)

- 7.1.2 Rockwell Automation Inc.

- 7.1.3 GE Bently Nevada

- 7.1.4 Emerson Electric Co.

- 7.1.5 SKF AB

- 7.1.6 Bruuel & Kjaer Vibro

- 7.1.7 FLIR Systems Inc.

- 7.1.8 Fluke Corporation

- 7.1.9 Nippon Avionics Co., Ltd.

- 7.1.10 Thermo Fisher Scientific Inc.

- 7.1.11 Perkin Elmer Inc.

- 7.1.12 AMETEK Spectro Scientific

- 7.1.13 Parker Kittiwake (PARKER HANNIFIN CORP.)

- 7.1.14 Gastops Ltd