|

市场调查报告书

商品编码

1693611

欧洲机器状态监测:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Europe Machine Condition Monitoring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

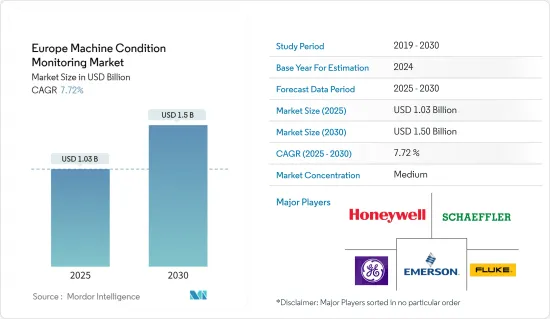

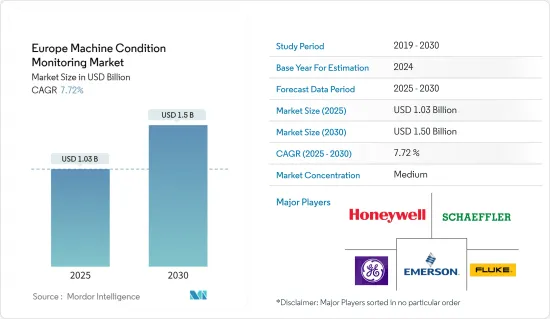

预计 2025 年欧洲机器状态监测市场规模为 10.3 亿美元,到 2030 年将达到 15 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.72%。

低成本、大量生产的前景使得维修专业人员转向状态监测。主动的机器状态监控可以帮助多个行业防止机器故障。

主要亮点

- 任何企业的主要目标之一是延长其资产的生命週期并确保其长期有效运作。这可以透过使用状态监测来实现。对于机械来说,维护保养极为重要。由于许多公司都专注于提高资产利用率和生产力,因此机器状态监测是维护的重要组成部分。

- 预测维修系统可以透过状态监控工具帮助组织追踪任何设备或机械在空閒、正常和尖峰时段的表现。从各种条件下运作的机器获得的数据有助于规划未来的维护,以防止突然故障和停机。

- 自动化机器监控是实现智慧工厂的第一步。在智慧工厂中,机器与基于物联网和网路的感测器互连,以促进即时机器资料提取。互联机器网路可协助您深入了解机器效能,从而提高连续生产能力并分析预计产量与实际产量的比率。

- 智慧製造和工业4.0的兴起增加了监控工厂生产设备状况的可能性。可以部署实体感测器来收集工厂车间的数据,然后在工作站的仪表板上进行处理和视觉化。这可以让您概览机器的状况并提高正常运作和效率。

- 所有欧洲企业都拥有生产商品和服务以创造收益的关键资产,但由于新冠疫情,这些资产都在迅速下滑。这类公司经营团队感受到了极度的危机感和恐慌,越来越重视削减成本。由于製造业活动疲软,公司可能会倾向于跳过维护,这可能会导致预测期内高成本。

欧洲机器状态监测市场趋势

工业 4.0 和製造业及製程工业的新兴产业应用

- 工业 4.0 将改变企业製造、改进和分销产品的方式。製造商越来越多地将物联网、云端运算和分析、人工智慧和机器学习等新兴技术融入他们的生产设施和业务中。

- 此外,过去,预防性维护有助于减少机器停机时间并避免意外停机。工业 4.0 带来了一种确保机器可用性的新方法,称为状态监控。它持续监控机器数据以检测磨损情况,从而更容易安排维修并减少停机时间。由于只需要更换磨损的零件,因此它还具有降低维护成本的潜力。

- 工业 4.0 将使工厂从旧有系统转变为智慧组件和智慧机器,实现数位化工厂并最终实现工厂和企业生态系统的互联。这种智慧工厂通常配备先进的感测器、嵌入式软体和机器人,可以收集和分析数据,从而做出更好的决策。

- 自动化机器状态监测是实现智慧工厂的第一步。在智慧工厂中,机器与基于物联网和网路的感测器互连,以促进即时机器资料提取。互联机器网路可协助您深入了解机器效能,从而提高连续生产能力并分析预计产量与实际产量的比率。根据ETNO预测,到2027年,欧洲汽车产业将拥有2.23亿个活跃的物联网(IoT)连接,工业领域将拥有1,900万个活跃的物联网(IoT)连接。

- 透过机器监控还可以改善车间和工厂车间的沟通。生产车间的製造商和操作员可以透过分析、警报和其他通知来了解机器行为,从而扩大生产过程的可见性,激发相关人员更好的意识和参与。机器监控对于为所有相关人员创造机会连接独立的车间操作至关重要,以考虑智慧工厂所必需的更广泛的性能和流程结果。

- 总体而言,当生产过程中的机器或资产受到即时监控且人工干预最少时,智慧工厂是有效的。透过追踪压力、振动、温度和噪音等几个参数,机械监控可以确定资产的健康状况。也会识别机器性能指标,并立即报告任何劣化或有缺陷的零件。

德国拥有庞大的市场占有率

- 汽车工业是德国最大的工业之一。该公司在自动驾驶技术等高科技汽车产品方面也拥有世界领先的实力。据德国贸易投资署 (GTAI) 称,德国是欧洲最大的汽车市场,占所有乘用车产量的 25% 左右,占新註册汽车的 20% 左右。

- 据 GTAI 称,德国汽车製造商去年生产了超过 1560 万辆汽车。德国工厂生产了超过310万辆乘用车和351,000辆商用车。因此,该行业对状态监测解决方案的需求庞大,以确保车辆的安全运作。

- 根据OICA的数据,德国新车销售和註册量有所成长,2019年达到402万辆。疫情期间製造业停摆导致隔年销售量降至约327万辆。新车销量和註册量下降,2021 年年比 2019 年下降 26% 至 297 万辆。

- 该市场也受益于该国强大的海运业。德国是世界上最大的航运国家之一。据联邦数位事务和运输部称,该国在货柜航运领域的国际份额约为 30%。德国航运业的年营业额超过500亿欧元(525.1亿美元)。

- 在船舶的日常运作中,结构和机械故障可能导致严重事故,损坏船舶,危及船员和乘客安全,威胁环境并造成重大经济损失。状态监测作为一种经济高效且可以使船舶免受此类风险的维护策略,在船舶工业中越来越受欢迎。船上状态监测有助于监测关键船上资产,如主引擎、推进器、发电机、压缩机、泵浦等。

- 此外,2022 年 4 月,总部位于德国的旋转机械状态监测解决方案全球供应商 Bruel&Kjaer Vibro(B&K Vibro)宣布对其 VCM-3/SETPOINT 产品进行一系列增强,以提供单一、整合的 SETPOINT 状态监测系统 (CMS) 解决方案。 VCM-3 资料与 VC-8000 资料完全集成,可以直接汇入 SETPOINT CMS。

欧洲机器状态监测产业概况

欧洲机器状态监测市场较为分散,包括Honeywell国际公司、舍弗勒技术股份公司、通用电气公司、艾默生电气公司和福禄克公司。市场参与者正在采取伙伴关係、创新、合併和收购等策略来增强其产品供应并获得永续的竞争优势。

2022年7月,通用电气宣布计画成为三家独立的上市公司,专注于医疗保健、能源和航空。 GE的医疗保健业务将被称为GE医疗集团。 GE现有的能源组合,包括可再生能源、电力、数位和能源金融服务,将合併到GE Vernova品牌下。 GE Aerospace 将成为 GE 航空业务的名称。

2022年5月,NI宣布推出ActiveUptime,这是一款用于测试设备和设施状态监控和预测性维护的即服务解决方案。此承包解决方案根据您的环境进行客製化,并提供您所需的资讯以主动监控系统健康状况并防止关键测试设备发生故障。作为持续服务的一部分,NI 维护团队的专职技术人员将远端监控系统健康状况、提供支援并根据客户需求调整解决方案。此解决方案可主动预测故障发生之前的情况。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 透过预测性维护提高设备性能和生产力

- 工业4.0及製造业及製程工业的新兴产业应用

- 市场挑战/限制

- 改装的成本影响

- 欧洲宏观经济与地缘政治因素

第六章市场区隔

- 按类型

- 硬体

- 振动状态监测装置

- 热成像设备

- 润滑剂分析

- 软体

- 服务

- 硬体

- 按行业

- 石油和天然气

- 发电

- 工艺与製造

- 航太与国防

- 汽车与运输

- 其他产业(海洋、采矿、金属等)

- 按国家

- 英国

- 德国

- 法国

- 义大利

- 其他欧洲国家国家(东欧和西欧)

第七章竞争格局

- 公司简介

- Honeywell International Inc.

- Schaeffler Technologies AG & Co. KG

- General Electric Company

- Emerson Electric Co.

- Fluke Corporation

- Ametek Spectro Scientific

- Parker Hannifin Corporation

- Rockwell Automation Inc.

- SKF AB

- Als Limited

- National Instruments Corporation

- Flirn Systems Inc.

第八章投资分析

第九章:市场的未来

The Europe Machine Condition Monitoring Market size is estimated at USD 1.03 billion in 2025, and is expected to reach USD 1.50 billion by 2030, at a CAGR of 7.72% during the forecast period (2025-2030).

An outlook toward low-cost mass production has led maintenance professionals to turn to condition monitoring. With active machine condition monitoring, multiple industries can prevent machine failures, which is an added capital investment.

Key Highlights

- One of the primary goals of any business is to prolong an asset's lifecycle and ensure that the asset functions efficiently for an extended period. This can be accomplished through the use of condition monitoring. Maintenance is crucial to machines. Machine condition monitoring is an important part of maintenance, and thus, many companies have been focusing more on asset utilization and increasing productivity.

- Predictive maintenance systems can help organizations with condition-monitoring tools to track the performance of any equipment or machine in idle, normal, and peak performances. The data from machines operating at different conditions helps plan maintenance in the future to prevent sudden failure or downtime.

- Automated machine monitoring forms the first step toward achieving smart factories. In a smart factory, machines are interconnected with IoT-enabled, web-based sensors that facilitate real-time machine data extraction. The network of connected machines helps obtain valuable insights into machine performance, enhances ongoing production, and analyzes estimated versus actual production ratios.

- The rise of smart manufacturing and Industry 4.0 increased the possibility of monitoring the condition of the production equipment in a factory. Physical sensors can be deployed to collect data from the factory floor, and they can be processed and visualized on a dashboard on a workstation. This provides an overview of the condition of the machines and enables increased uptime and efficiency.

- All European businesses have crucial assets for manufacturing goods and services offering revenue, experiencing a rapid decline due to the COVID-19 pandemic. The management of such companies has been feeling extreme urgency and panic, increasing the emphasis on cutting costs. Since manufacturing activity is low, companies are tempted to eliminate maintenance, which can result in high costs during the forecast period.

Europe Machine Condition Monitoring Market Trends

Industry 4.0 and Emerging Industrial Applications Across Manufacturing and Process Industries

- Industry 4.0 transforms how organizations manufacture, improve, and distribute their products. Manufacturers are increasingly integrating emerging technologies, such as IoT, cloud computing and analytics, and AI and machine learning, into their production facilities and operations.

- Moreover, in the past, preventive maintenance helped reduce machine downtime and avoid unscheduled outages. Industry 4.0 brought a new method of ensuring machine availability called condition monitoring. It involves continuous monitoring of machine data to detect wear, making it easier to schedule repairs and reduce downtime. The method also has the potential to lower maintenance costs, as only worn-out parts need replacing.

- Industry 4.0 is transitioning factories from legacy systems to smart components and machines, enabling digital factories and, eventually, an ecosystem of connected factories and enterprises. These smart factories are commonly equipped with advanced sensors, embedded software, and robotics that collect and analyze data, allowing for better decision-making.

- Automated machine monitoring forms the first step toward achieving smart factories. In a smart factory, machines are interconnected with IoT-enabled, web-based sensors that facilitate real-time machine data extraction. The network of connected machines helps obtain valuable insights into machine performance, enhances ongoing production, and analyzes estimated versus actual production ratios. According to ETNO, the active Internet of Things (IoT) connections in the automotive sector would be 223 million, and industries would be 19 million across Europe by 2027.

- Shop or factory floor communications can also be improved with machine monitoring. Manufacturers and operators across the shop floor are informed on machine behavior through analytics, warnings, and other notifications that expand production process visibility, creating a catalyst for better stakeholder awareness and engagement. Machine monitoring is vital for creating an opportunity for all stakeholders to connect individual, independent shop floor operations to account for broader performance and process outcomes that are essential for a smart factory.

- Overall, a smart factory is effective when machines or assets in the production process are monitored in real-time with minimal manual intervention. By tracking several parameters like pressure, vibration, temperature, and noise, machine monitoring determines asset health conditions. Machine performance metrics are also identified, and any deterioration or faulty part is immediately reported.

Germany Holds the Highest Market Share

- The automotive sector is one of the largest industries in Germany. The country is also one of the strongest in the world when it comes to high-tech automotive products, including autonomous driving technology. Germany is Europe's largest automotive market, accounting for around 25% of all passenger cars manufactured and almost 20% of all new registrations, according to the Germany Trade and Invest (GTAI).

- Also, as per GTAI, German automobile manufacturers produced more than 15.6 million vehicles the previous year. Over 3.1 million passenger cars and 351,000 commercial vehicles were manufactured in German plants. Consequently, there was a significant demand for condition monitoring solutions from this sector to ensure the safe operation of vehicles.

- According to OICA, new car sales and registrations in Germany increased, reaching 4.02 million in 2019. Due to the manufacturing halt during the pandemic, the sales decreased to approximately 3.27 million the following year. New sales and registrations decreased, with 2.97 million in 2021, a 26% decrease from 2019.

- The market also benefits from a strong maritime industry in the country. Germany is among the largest seafaring nations globally. According to the Federal Ministry for Digital and Transport, the country has an international market share of around 30% in the container shipping sector. The German shipping industry generates an annual turnover of over EUR 50 billion (USD 52.51 billion).

- In day-to-day ship operations, structural and mechanical failures might result in serious accidents, inflicting ship damage, placing the crew and passengers on board in danger, posing a threat to the environment, and causing substantial financial losses. As a cost-efficient and effective maintenance strategy that can save ships from such risks, condition monitoring is gaining popularity in the marine industry. Condition monitoring in onboard ships helps monitor critical onboard assets, such as main engines, thrusters, generators, compressors, and pumps.

- Moreover, in April 2022, Germany-based Bruel& Kjaer Vibro(B&K Vibro), a global supplier of condition monitoring solutions for rotating machinery, introduced an array of product enhancements for its VCM-3/SETPOINT offerings to provide a single, integrated SETPOINT condition monitoring system (CMS) solution. The data from VCM-3 can be fully integrated with VC-8000 data and fed directly into SETPOINT CMS, creating a plant-wide solution that encompasses machine protection and condition monitoring for critical and BOP machinery assets.

Europe Machine Condition Monitoring Industry Overview

The European machine condition monitoring market is moderately fragmented, with key players like Honeywell International Inc., Schaeffler Technologies AG & Co. KG, General Electric Company, Emerson Electric Co., and Fluke Corporation, among others. Players in the market are adopting strategies such as partnerships, innovations, mergers, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In July 2022, GE announced plans to become three independent and publicly traded businesses focusing on healthcare, energy, and aviation, where new names also reflect a new beginning. GE's healthcare business would be called GE HealthCare. GE's existing portfolio of energy businesses, including renewable energy, power, digital, and energy financial services, would sit together under the brand name GE Vernova. GE Aerospace would be the name of GE's aviation business.

In May 2022, NI announced the launch of ActiveUptime, its maintenance-as-a-service solution for condition monitoring and predictive maintenance of test equipment and facilities. This turnkey solution is tailored to the user's environment and provides the information needed to proactively monitor system health and prevent critical test equipment from failing. As part of the ongoing service, a dedicated technician from NI's maintenance team is expected to remotely monitor system health, provide support, and adapt the solution based on the customer's needs. This solution advances the user's capabilities to predict outages before they happen proactively.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Equipment Performance and Productivity through Predictive Maintenance

- 5.1.2 Industry 4.0 and Emerging Industrial Applications Across Manufacturing and Process Industries

- 5.2 Market Challenges/Restraints

- 5.2.1 Cost Implications In Line With Retrofits

- 5.2.2 European Macroeconomic and Geopolitical Factors

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Hardware

- 6.1.1.1 Vibration Condition Monitoring Equipment

- 6.1.1.2 Thermography Equipment

- 6.1.1.3 Lubricating Oil Analysis

- 6.1.2 Software

- 6.1.3 Services

- 6.1.1 Hardware

- 6.2 By End-user Vertical

- 6.2.1 Oil and Gas

- 6.2.2 Power Generation

- 6.2.3 Process and Manufacturing

- 6.2.4 Aerospace and Defense

- 6.2.5 Automotive and Transportation

- 6.2.6 Other End-user Verticals (marine, Mining, Metal, Etc.)

- 6.3 By Country

- 6.3.1 United Kingdom

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Italy

- 6.3.5 Rest of Europe (Eastern Europe and Western European Countries)

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Honeywell International Inc.

- 7.1.2 Schaeffler Technologies AG & Co. KG

- 7.1.3 General Electric Company

- 7.1.4 Emerson Electric Co.

- 7.1.5 Fluke Corporation

- 7.1.6 Ametek Spectro Scientific

- 7.1.7 Parker Hannifin Corporation

- 7.1.8 Rockwell Automation Inc.

- 7.1.9 SKF AB

- 7.1.10 Als Limited

- 7.1.11 National Instruments Corporation

- 7.1.12 Flirn Systems Inc.