|

市场调查报告书

商品编码

1637894

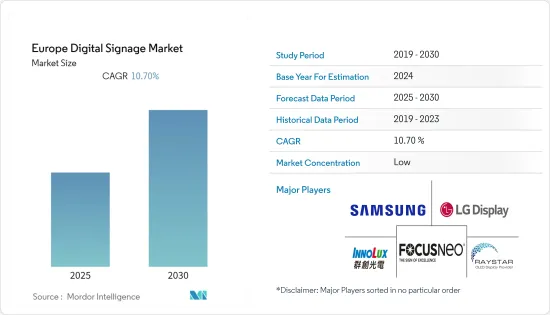

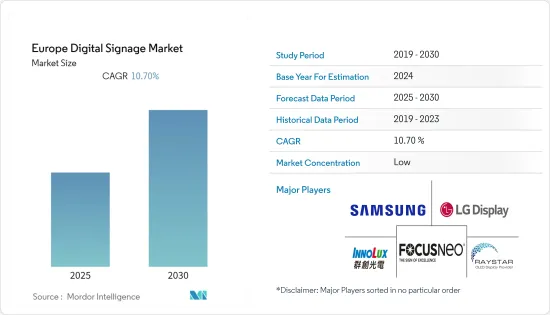

欧洲数位电子看板:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Europe Digital Signage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

预计预测期内欧洲数位电子看板市场的复合年增长率将达到 10.7%。

主要亮点

- 交通网络、公共基础设施和新商业建筑的成长,尤其是在新兴经济体中,为该市场创造了大量机会。数位电子看板应用于所有公共交通系统,以吸引旅途中观众的注意力,并为相关旅行者资讯和广告提供即时位置和情境察觉。此外,数位电子看板正迅速成为许多教育机构的标准,学校和企业园区都部署了数位看板系统。

- 数位电子看板的附加优势也推动了需求。此外,数位电子看板允许本地供应商更快、更有效地更改其显示和讯息。而且,它比传统广告更容易管理。数位数位电子看板提供即时产品和库存资讯、互动式资料以及视觉上吸引人的照片和影片。数位电子看板也是一种投资报酬率高的技术。用户可以透过基于浏览器的连结来控制指示牌,并且指示牌可以整合到现有的IT网路中,而无需更换设备。

- 各行业日益增长的需求也推动了数位电子看板技术的创新。例如,Tele2IoT 表示,与使用有限的 LAN 或 WiFi 连线相比,可以透过行动电话网路将内容传送到显示器,尤其是在 LAN 或 WiFi 存取受限的地区。利用这些想法,数位显示器可以放置在任何有行动电话网路的地方。支援 SIM 卡的显示解决方案还可以降低用户和最终客户的成本和复杂性。

- 此外,由于主要零售商和产品供应商增加对线上和广播广告的支出,全部区域使用网路的个人数量不断增加,预计将阻碍市场成长。

- 数位电子看板是减少人群密集场所感染 COVID-19 风险的最佳解决方案之一。这可以透过提供消毒凝胶来教育游客,透过引导人群来平衡场馆内的游客数量,或引入基于数位的网关以避免商店过度拥挤。

欧洲数位电子看板看板市场趋势

零售业可望占据主要市场占有率

- 该地区的零售商正在结合数位工具,在现场发布相关且盈利的材料,并将数位广告融入其零售店,以创造独特的店内用户体验并推动实际效果。 。据三星称,53% 的顾客对商店的第一印像是基于其外观。

- 数位电子看板位看板显示器用于零售商店显示广告、讯息和其他相关内容并传递客製化讯息。数位电子看板可使零售商最大限度地发挥讯息的影响力,从而有效率地、盈利进入目标市场。

- 例如,欧洲着名零售商家乐福集团最近改进了店内消费者沟通方式。这家零售巨头已在比利时的 25 家商店安装了 150 块萤幕。该网路还具有整合音讯系统、客製化内容管理系统和整合排队系统。

- 该地区在零售业的主导地位促使许多主要供应商开发专门针对零售业的解决方案。例如,NEC Display Solutions Europe 刚刚推出了一系列新型大尺寸UHD 显示器,具有超宽的萤幕宽度和出色的分辨率,无论近距离还是远距离观看都十分方便。

- 此外,零售商可以即时更新用户互动面板,以反映商店最新的性别和年龄人口趋势,促销特定产品,并从萤幕上移除售罄的商品。

比利时占有最大市场占有率

- 随着数位化需求的成长,我们正专注于在比利时寻找数位电子看板解决方案的客户,特别是在零售业。例如,一家法国跨国零售商在比利时的 25分店实施了全面的店内数位电子看板解决方案,以便让客户了解最新的促销和产品信息,并管理结帐队列。

- 本地Scala系统整合商DOBIT基于Scala技术部署和编排了整个网路。

- 同样,ZetaDisplay 于 2021 年 9 月与荷兰和比利时肯德基以及全通路 CRM 和订单管理平台 Booster Agency伙伴关係,在未来 12 个月内为 100 多家肯德基餐厅提供数位电子看板解决方案。此次合作预计将增强肯德基在荷兰和比利时各地的数位电子看板,包括新店和整修店。每个门市将配备六块萤幕作为数位菜单板。一些商店正在对面向路人的外向窗口数位萤幕进行测试。

- 此外,比利时拥有 209 家医院,是世界上最多元化的人口之一(自 2005 年以来增加了 100 万),人口来自 180 多个国家,使用 108 种语言。该医院拥有 64,000 张病床,每日有 64,000 名住院患者,平均住院日数约为 6.4 天,因此,在确保患者舒适健康的同时,与患者保持联繫至关重要。毫无疑问,AZ Sint-Jan Brugge-Oostende AV 就属于这一类。

欧洲数位电子看板产业概况

欧洲数位电子看板市场较为分散,群创光电、三星电子、东芝泰格欧洲公司和 FocusNeo AB 等全球主要公司占据硬体市场。同时,各类中小型企业也提供数位电子看板软体。此外,许多公司作为该领域的专业参与者进入市场,提供特定的产品应用。

- 2022 年 12 月 -数位电子看板位看板解决方案领导者 SpinetiX SA 今天宣布发布其数位看板数位电子看板即服务 (SaaS) SpinetiX ARYA 的新功能,提供超过 250 个资料驱动的与 Elementi、SpinetiX 的集成改进带有类型Widgets的高阶创作软体。这项创新使 SpinetiX ARYA 保持简单,同时为最终用户扩展了创新选择并为整合商提供了增值利益。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 分销通路分析

- 产业价值链分析

- COVID-19 疫情对市场的影响评估

第五章 市场动态

- 市场驱动因素

- 承包解决方案的演变

- 与传统方法相比,推动情境感知广告成长的趋势

- 欧洲数位户外媒体支出稳定成长,持续促进市场成长

- 市场限制

- 客户隐私问题

第六章 技术简介

- 英国数位电子看板解决方案的发展

- 电视墙、4K 和 8K 显示器、POS 系统和社交媒体的深度整合——有望推动采用的关键技术趋势

第七章 市场区隔

- 按类型

- 硬体

- LCD/LED 显示器

- 有机发光二极体显示屏

- 媒体播放机

- 投影机/投影萤幕

- 其他硬体

- 软体

- 服务

- 硬体

- 按最终用户产业

- 零售

- 运输

- 饭店业

- 企业

- 教育机构

- 政府

- 其他最终用户产业

- 按国家

- 英国

- 市场规模和趋势

- 系统整合商列表

- 德国

- 市场规模和趋势

- 系统整合商列表

- 法国

- 市场规模和趋势

- 系统整合商列表

- 义大利

- 市场规模和趋势

- 系统整合商列表

- 比利时

- 市场规模和趋势

- 系统整合商列表

- 其他欧洲国家

- 市场规模和趋势

- 系统整合商列表

- 英国

第八章 竞争格局

- 公司简介

- 基础设施提供者

- Samsung Display Solutions(Samsung Electronics Co. Ltd)

- LG Display Co. Ltd

- Innolux Corp.

- FocusNeo AB

- Raystar Optronics Inc.

- Adversign Media GmbH

- OSRAM OLED GmbH

- ST Digital

- Winstar Display Co. Ltd

- Visionbox Co. Ltd

- Leyard Europe Co. Ltd

- 系统整合商列表

- Allsee Technologies Ltd

- SpinetiX SA

- Tata Elxsi Ltd

- Toshiba Tec Europe

- AG Neovo

- Livewire Digital

- signageOS Inc.

- Creative Technology Group

- Signagelive

- Daktronics Dr.

- 基础设施提供者

第九章 主要数位电子看板软体供应商分析

第十章 投资分析

第 11 章:投资分析市场的未来

简介目录

Product Code: 48307

The Europe Digital Signage Market is expected to register a CAGR of 10.7% during the forecast period.

Key Highlights

- The growth in transport networks, public infrastructure, and new commercial buildings, particularly in developing economies, creates more opportunities in this market. Digital signage is being used in and on all modes of public transportation to attract the attention of on-the-go viewers, providing real-time location and context awareness related to traveler information and advertising. Moreover, it is fast becoming a standard in many educational facilities, with schools and corporate campuses facilitating digital signage systems.

- The added benefits of digital signage are also driving its demand. Further, digital signage enables regional vendors to change displays and messages more quickly and effectively. Additionally, it is easy to manage when compared to traditional advertisements. Digital signs offer real-time information on products and availability, interactive data, and visually enticing photos and videos. Also, digital signage technology provides a high return on investments. It lets users control signage from any browser-based link and integrate signage into an existing IT network without replacing equipment.

- The growing demand across various industries also drives innovation in digital signage technology. For instance, according to Tele2IoT, delivering content to displays over cellular networks has become increasingly attractive compared to using limited LAN, and WiFiconnections, especially in areas where access to LAN or WiFi is limited. By empowering such ideas, digital displays can be installed anywhere cellular networks exist. A SIM-enabled display solution can also help reduce the cost and complexity for the user or end customer.

- Moreover, Increasing expenditure by leading retailers and product suppliers on online and broadcast advertisements is expected to hinder market growth, as the number of individuals using the internet across the region is increasing.

- Digital signage is one of the best solutions to reduce the risk of COVID-19 in crowded areas. It can be used for educating visitors, such as providing sanitizing gel or balancing the number of visitors in a venue by directing the crowd and implementing a headcount-based gateway to avoid crowded stores.

Europe Digital Signage Market Trends

Retail Industry is Expected to Hold Significant Market Share

- Retail operators in the area are combining digital tools to publish pertinent and profitable material at their premises and incorporate digital adverts into their retail stores to create a unique in-store user experience to gain an advantage over physical stores. Signage in retail is crucial for the operating vendors since, according to Samsung, 53% of customers base their initial perception of the store on the exterior of the business front.

- Digital signage displays are used in retail establishments to display advertising, information, or other pertinent content to transmit tailored messages. By maximizing the message's impact, digital signage enables retailers to efficiently and profitably reach their target market.

- For instance, the prominent European retail company Carrefour Group recently updated its in-store consumer communications. The retail behemoth installed 150 screens across 25 stores in Belgium; the network also features an integrated audio system, a customized content management system, and integrated queuing.

- Many important suppliers are creating retail-specific solutions due to the region's retail industry's dominance. For instance, NEC Display Solutions Europe just unveiled a new line of large-format UHD displays with enormous screen widths and excellent levels of resolution to allow close-up and distant viewing.

- Moreover, Retailers additionally work on updating user-interactive panels in real-time to reflect the most recent gender or age demographic trends in-store to promote particular items or remove sold-out products from the screen.

Belgium Accounts for the Largest Market Share

- With an increasing demand for digitalization, Belgium is more focused on customer acquisition regarding digital signage solutions, mainly in the retail sector. For instance, to promote the latest promotions and product information to customers and manage queuing at the tills, a French multinational retailer deployed a comprehensive in-store digital signage solution across 25 of its branches in Belgium, with more to follow.

- Local Scala systems integrator DOBIT rolled out and tailored the entire network based on Scala technology, which acts as a central backbone for managing all screens, templates, content, and audio.

- Similarly, in September 2021, ZetaDisplayentered a partnership with KFC Netherlands and Belgium, omnichannel CRM, and the order management platform Booster Agency to deliver digital signage solutions to more than 100 KFC restaurants in the 12 months that followed. This partnership is expected to boost KFC's digital signage, including new and remodelled restaurants across the Netherlands and Belgium. Each restaurant will feature six screens as digital menu boards; tests are underway at several restaurants with external-facing window digital screens aimed at passers-by.

- Further, Belgium is home to 209 hospitals and one of the world's most diverse populations (up by a million since 2005), with more than 180 nationalities and 108 spoken languages. With 64,000 beds, 64,000 admissions each day, and an average stay of about 6.4 days, it's critical to maintain constant contact while maintaining patients' comfort and well-being. Unquestionably, AZ Sint-Jan Brugge-Oostende AV falls under this category.

Europe Digital Signage Industry Overview

The European digital signage market is fragmented with major global players, like Innolux Corp., Samsung Electronics Co. Ltd, Toshiba Tec Europe, and FocusNeo AB, the hardware end of the spectrum is covered. Various medium-sized and smaller players offer software for digital signage at the same time. Additionally, many businesses are entering the market as specialized players in the sector, offering specific product applications.

- December 2022 - SpinetiX SA, one of the leaders in digital signage solutions, has announced the release of new features in its digital signage SaaS (software-as-a-service), SpinetiX ARYA increasing the integration with Elementi, the SpinetiX advanced authoring software with its 250+ data-driven widgets. This innovation expands the creative options of end users while keeping SpinetiX ARYA simple and provides value-added benefits to integrators.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Distribution Channel Analysis

- 4.4 Industry Value Chain Analysis

- 4.5 Assessment of the Impact of the COVID-19 Pandemic on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Evolution of Turnkey Solutions

- 5.1.2 Trends Favoring the Growth of Context-aware Advertising as Opposed to Conventional Modes of Advertising

- 5.1.3 Steady Increase in DOOH Spending in Europe to Continue to Supplement Market Growth

- 5.2 Market Restraints

- 5.2.1 Concerns Over Invasion of Customer Privacy

6 TECHNOLOGY SNAPSHOT

- 6.1 Evolution of Digital Signage Solutions in the United Kingdom

- 6.2 Key Technological Trends Expected to Drive Adoption - Video Walls, 4K and 8K Displays, Deep Integration of POS Systems and Social Media

7 MARKET SEGMENTATION

- 7.1 By Type

- 7.1.1 Hardware

- 7.1.1.1 LCD/LED Display

- 7.1.1.2 OLED Display

- 7.1.1.3 Media Players

- 7.1.1.4 Projectors/Projection Screens

- 7.1.1.5 Other Hardware

- 7.1.2 Software

- 7.1.3 Services

- 7.1.1 Hardware

- 7.2 By End-user Vertical

- 7.2.1 Retail

- 7.2.2 Transportation

- 7.2.3 Hospitality

- 7.2.4 Corporate

- 7.2.5 Education

- 7.2.6 Government

- 7.2.7 Other End-user Verticals

- 7.3 By Country

- 7.3.1 United Kingdom

- 7.3.1.1 Market Sizing and Trends

- 7.3.1.2 List of System Integrators

- 7.3.2 Germany

- 7.3.2.1 Market Sizing and Trends

- 7.3.2.2 List of System Integrators

- 7.3.3 France

- 7.3.3.1 Market Sizing and Trends

- 7.3.3.2 List of System Integrators

- 7.3.4 Italy

- 7.3.4.1 Market Sizing and Trends

- 7.3.4.2 List of System Integrators

- 7.3.5 Belgium

- 7.3.5.1 Market Sizing and Trends

- 7.3.5.2 List of System Integrators

- 7.3.6 Rest of Europe

- 7.3.6.1 Market Sizing and Trends

- 7.3.6.2 List of System Integrators

- 7.3.1 United Kingdom

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Infrastructure Providers

- 8.1.1.1 Samsung Display Solutions (Samsung Electronics Co. Ltd)

- 8.1.1.2 LG Display Co. Ltd

- 8.1.1.3 Innolux Corp.

- 8.1.1.4 FocusNeo AB

- 8.1.1.5 Raystar Optronics Inc.

- 8.1.1.6 Adversign Media GmbH

- 8.1.1.7 OSRAM OLED GmbH

- 8.1.1.8 ST Digital

- 8.1.1.9 Winstar Display Co. Ltd

- 8.1.1.10 Visionbox Co. Ltd

- 8.1.1.11 Leyard Europe Co. Ltd

- 8.1.2 List of System Integrators

- 8.1.2.1 Allsee Technologies Ltd

- 8.1.2.2 SpinetiX SA

- 8.1.2.3 Tata Elxsi Ltd

- 8.1.2.4 Toshiba Tec Europe

- 8.1.2.5 AG Neovo

- 8.1.2.6 Livewire Digital

- 8.1.2.7 signageOS Inc.

- 8.1.2.8 Creative Technology Group

- 8.1.2.9 Signagelive

- 8.1.2.10 Daktronics Dr.

- 8.1.1 Infrastructure Providers

9 ANALYSIS OF THE KEY DIGITAL SIGNAGE SOFTWARE VENDORS

10 INVESTMENT ANALYSIS

11 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219