|

市场调查报告书

商品编码

1637900

碳管理系统 -市场占有率分析、产业趋势/统计、成长预测(2025-2030)Carbon Management System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

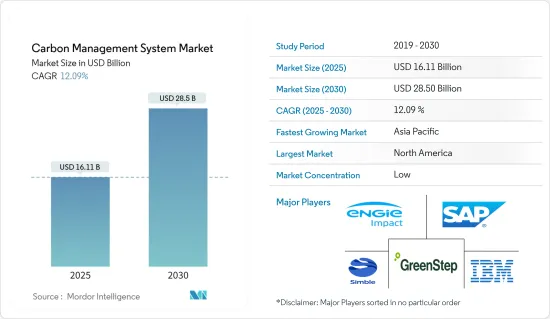

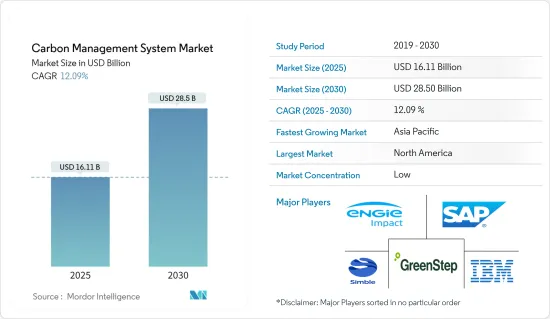

碳管理系统市场规模预计到 2025 年为 161.1 亿美元,预计到 2030 年将达到 285 亿美元,预测期内(2025-2030 年)复合年增长率为 12.09%。

由于更严格的气候变迁法规、碳排放成本的增加以及碳管理相关技术的进步,对碳管理系统的需求持续增加。

采取碳排放措施是全球对碳管理系统需求不断增长的关键因素。这些措施为碳管理系统的实施创造了有利的环境,包括排放目标、碳定价和课税、合规性和监管要求。

将先进技术融入碳管理平台,可即时追踪碳排放并有效采取必要措施,带动碳管理系统的市场销售。

此外,随着企业越来越意识到永续性和企业社会责任的重要性,许多组织正在製定碳减排目标,并致力于实现碳中和,以符合国际气候变迁承诺。因此,为了追踪进展并确定要开发的领域,公司对碳管理系统的采用已大大增加。

不断变化的法规环境使得公司很难比较和实施不同的系统。技术变革正在挑战碳管理系统供应商跟上最新的技术趋势,这限制了市场的成长。

为了保持永续性,市场参与企业正在透过碳管理领域的伙伴关係和联盟来扩大其能力和影响力。例如,根据国际能源总署(IEA)的预测,为了在2050年实现净零排放,全球每年对清洁能源的投资必须在2030年之前增加两倍以上,达到约4兆美元。这项措施预计将创造许多新的就业机会,显着提振全球经济,并确保到本十年末每个人都能用上电力和清洁的烹饪方法。

由于 COVID-19 大流行,包括气候变迁在内的全球环境挑战变得更加明显。随着组织和政府专注永续性并减少环境足迹,对碳管理解决方案的需求不断增加。此外,随着疫情期间远距工作成为必需,公司正在采用数位解决方案来管理环境资料并在永续性进行有效协作。

碳管理系统市场趋势

石油和天然气产业确认成长

- 石油和天然气行业预计将为市场成长做出重大贡献。作为世界上最大、碳排放最密集的行业之一,减少碳排放并迈向更永续的未来的压力越来越大。

- 随着石油公司製定更严格的排放目标,数位技术可能有利于范围 1 和范围 2 的排放。追踪油井和管道的有害甲烷排放至关重要,机器学习可以帮助提高能源使用效率。来自无人机、感测器、卫星和摄影机的资料也很重要。

- 多家公司正在努力减少其工业营运的碳排放并加速向净零过渡。例如,AVEVA 与 Aker Carbon Capture 密切合作,后者为水泥、钢铁、石油和天然气等碳密集型产业的公司设计和建造设施。

- 随着投资者要求增加温室气体排放,越来越多的数位公司正在发布石油和天然气生产商可以用来评估其碳排放的软体。 2024年7月,加州资源公司宣布完成与Aera Energy LLC(Aera)的全股票合併。这项变革性的交易创造了巨大的规模和资产耐久性,以满足加州不断增长的能源需求,并提供先进的技术来帮助实现加州雄心勃勃的碳管理平台。

北美占最大市场占有率

- 北美启动多项碳管理计划,是机场碳认证成为机场碳管理全球标准的重要一步。该倡议启动后,西雅图-塔科马国际机场成为北美第一个获得认证的机场。

- 政府措施预计将推动市场需求。美国能源局(DOE) 启动了负碳计划,以响应政府在 2050 年实现净零排放的目标。这是对碳去除途径创新的集体呼吁,这些途径从大气中捕获二氧化碳并将其以十亿吨规模储存,成本低于每净吨二氧化碳当量 100 美元。

- 由于政府采取措施减少老化公共设施的能源排放,市场需求也增加。例如,美国总务管理局与 IBM 公司签订的合约将在州和联邦政府拥有的 50 栋能源最密集的建筑中安装高效、智慧的建筑技术。

- 根据美国能源资讯署 (EIA) 的数据,2023 年美国与能源相关的二氧化碳排放较 2022 年略有下降。儘管许多经济产业的排放有所下降,但 2023 年美国能源相关二氧化碳排放量的 80% 以上发生在电力产业。这些减少主要是由于天然气和太阳能发电在发电组合中所占的比例越来越大,燃煤发电量下降。因此,政府对减少能源产业二氧化碳排放的关注可能在未来几年积极支持市场需求。

碳管理系统产业概况

碳管理系统市场分散,许多参与企业提供管理和监控软体。数量的快速增长是由于云端服务使用的增加。提供咨询服务的企业预计在预测期内将呈现类似的模式并稳定成长。

- 2024 年 6 月 - Workiva 是一家强大的综合彙报解决方案全球供应商,透过推出 Workiva Carbon 扩展了其技术组合。加强我们的环境、社会和管治(ESG) 以及永续发展平台,以有效遵守严格的全球气候变迁法规。

- 2024 年 3 月 - SLB 宣布达成协议,将其碳捕集业务与 Aker Carbon Capture (ACC) 合併,以协助加速大规模工业脱碳。该协议有可能汇集互补的技术组合、尖端的工艺设计专业知识和已建立的专案提供平台。此次整合将利用 ACC 和 SLB 的新技术开发和工业化能力提供的商业碳捕集产品。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 人们对环境议题的兴趣日益浓厚,并专注于减少碳足迹

- 市场问题

- 管理波动的能源和资源需求

第六章 市场细分

- 按服务

- 软体

- 按服务

- 按用途

- 活力

- 温室气体管理

- 空气品质管理

- 永续性

- 其他的

- 按最终用户产业

- 石油和天然气

- 製造业

- 医疗保健

- 资讯科技和电讯

- 由其他最终用户

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲/纽西兰

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Simble Solutions Ltd

- IBM Corporation

- ENGIE Impact

- GreenStep Solutions Inc.

- SAP SE

- Enablon SA

- IsoMetrix

- Schneider Electric SE

- Salesforce.com Inc.

- Greenstone+Ltd

- Microsoft Corporation

- Sphera

第八章投资分析

第九章 市场未来展望

The Carbon Management System Market size is estimated at USD 16.11 billion in 2025, and is expected to reach USD 28.50 billion by 2030, at a CAGR of 12.09% during the forecast period (2025-2030).

The demand for carbon management systems is continuously increasing due to the increasing stringency of climate change regulations, the growing cost of carbon emissions, and evolving technologies related to carbon management.

The introduction of carbon emission policies is a key driver of the increasing demand for carbon management systems globally. These policies create a favorable environment for adopting carbon management systems with emission reduction targets, carbon pricing and taxation, compliance, and regulatory requirements.

The integration of advanced technologies with carbon management platforms enables real-time tracking of carbon emissions to take effective necessary prevention, driving the sales of carbon management systems in the market.

In addition, with growing awareness among businesses about the importance of sustainability and corporate social responsibility, many organizations are setting targets for carbon reduction, aiming for carbon neutrality that aligns with international climate commitments. In this way, the adoption of carbon management systems by companies is increasing considerably to track progress and identify areas for development.

The continuously evolving regulatory environment makes it difficult for businesses to compare different systems for implementation. Technological changes present challenges for carbon management system providers to keep up with the latest technology trends, which are some factors challenging market growth.

In order to preserve sustainability, market players are expanding their capacities and reach through partnerships and alliances in the area of carbon management. For instance, according to the International Energy Agency, to reach net zero emissions by 2050, annual clean energy investment worldwide will demand more than triple by 2030 to approximately USD 4 trillion. This initiative is expected to generate a multitude of new employment opportunities, substantially boost the worldwide economy, and ensure everyone has access to electricity and clean cooking methods by the decade's end.

Global environmental challenges, including climate changes, have become more visible because of the COVID-19 pandemic. The demand for carbon management solutions has grown as organizations and governments focus on sustainability and reducing their environmental footprint. In addition, businesses have been adopting digital solutions for the management of their environmental data and effective collaboration on sustainability initiatives, as remote work was the compulsion during the pandemic.

Carbon Management System Market Trends

The Oil and Gas Industry to Witness Growth

- The oil and gas industry is expected to contribute significantly to market growth. As one of the largest and most carbon-intensive industries worldwide, it is facing increased pressure to reduce its carbon footprint and transition toward a more sustainable future.

- Digital technologies could benefit scope 1 and 2 emissions as oil firms set more challenging targets for emissions reduction. Tracking harmful methane emissions from oil wells and pipelines is crucial, and machine learning helps refine energy use more efficiently. Drones, sensors, satellite, and camera data are also vital.

- Several companies are working on mitigating the carbon dioxide emissions of industrial operations and accelerating the transition to net zero. For instance, AVEVA is working closely with Aker Carbon Capture, which designs and builds facilities for companies in carbon-intensive industries, such as cement, steel, and oil and gas.

- Due to growing investor demand to reduce greenhouse gas emissions, more digital companies are releasing software that oil and gas producers may use to assess their carbon emissions. In July 2024, California Resources Corporation introduced the completion of the all-stock combination with Aera Energy LLC (Aera). This transformational deal creates significant scale and asset durability to meet California's growing energy needs and expands its leading carbon management platform to help the state meet its ambitious climate goals.

North America Accounts for Largest Market Share

- The launch of several Carbon Management Programmes in North America represents a significant step toward making Airport Carbon Accreditation the global standard for airport carbon management. At the initiative's launch ceremony, Seattle-Tacoma International Airport received certification for the first time in North America.

- Several government initiatives regarding net-zero emissions are anticipated to fuel demand in the market. In response to the government's goal of net-zero emissions by 2050, the Department of Energy (DOE) in the United States launched the Carbon Negative Shot, an all-hands-on-deck call for innovation in CO2 removal pathways that will capture carbon dioxide from the atmosphere and store it at gigaton scales for less than USD 100/net tonne of carbon dioxide-equivalent.

- Market demand is also increasing due to government measures to reduce energy emissions from several outdated public buildings. For instance, thanks to a contract signed by the US General Services Administration with IBM Corporation, the 50 most energy-intensive buildings owned by the state and federal governments will have efficient and smart building technology installed.

- According to the Energy Information Administration (EIA), US energy-related CO2 emissions decreased slightly in 2023 compared to 2022. Although emissions decreased across many economic industries, more than 80% of US energy-related CO2 emissions reductions in 2023 occurred in the electric power industry. These reductions were caused largely by reduced coal-fired electricity generation, as natural gas and solar power made up a larger portion of the generation mix. Therefore, the government's focus on reducing carbon emissions generated by the energy industry is likely to support the market demand positively in the coming years.

Carbon Management System Industry Overview

The carbon management system market is fragmented, as many players are offering software for management and monitoring. This surge in numbers is being caused by greater uptake of cloud services. Businesses that offer consultation services are expected to grow steadily and exhibit a similar pattern during the forecast period.

- June 2024 - Workiva, a global provider of assured integrated reporting solutions, expanded its tech portfolio with the launch of Workiva Carbon. This new addition enhances its Environmental, Social, and Governance (ESG) and Sustainability platforms, enabling businesses to adhere to stringent global climate regulations effectively.

- March 2024 - SLB announced an agreement to combine its carbon capture business with Aker Carbon Capture (ACC) to support accelerated industrial decarbonization at scale. The agreement may bring together complementary technology portfolios, leading process design expertise, and an established project delivery platform. The combination will utilize ACC's commercial carbon capture product offering and SLB's new technology developments and industrialization capability.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products and Services

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Environmental Concerns and Focus on Reducing Carbon Footprints

- 5.2 Market Challenges

- 5.2.1 Managing Variable Energy and Resource Demand

6 MARKET SEGMENTATION

- 6.1 By Offering

- 6.1.1 Software

- 6.1.2 Services

- 6.2 By Application

- 6.2.1 Energy

- 6.2.2 Greenhouse Gas Management

- 6.2.3 Air Quality Management

- 6.2.4 Sustainability

- 6.2.5 Other Applications

- 6.3 By End-user Verticals

- 6.3.1 Oil and Gas

- 6.3.2 Manufacturing

- 6.3.3 Healthcare

- 6.3.4 IT and Telecom

- 6.3.5 Other End-user Verticals

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Simble Solutions Ltd

- 7.1.2 IBM Corporation

- 7.1.3 ENGIE Impact

- 7.1.4 GreenStep Solutions Inc.

- 7.1.5 SAP SE

- 7.1.6 Enablon SA

- 7.1.7 IsoMetrix

- 7.1.8 Schneider Electric SE

- 7.1.9 Salesforce.com Inc.

- 7.1.10 Greenstone+ Ltd

- 7.1.11 Microsoft Corporation

- 7.1.12 Sphera