|

市场调查报告书

商品编码

1639389

纺织化学品:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Textile Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

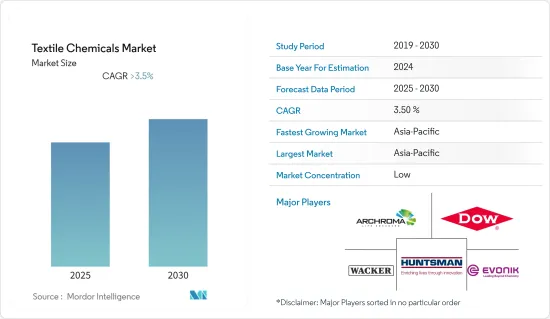

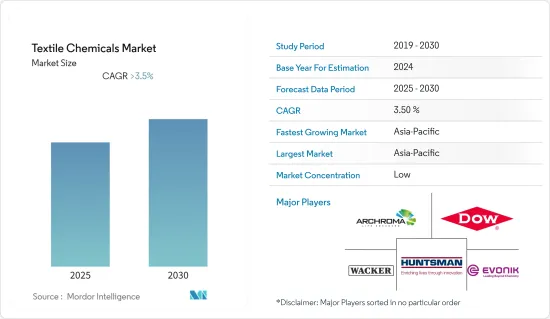

预测期内,纺织化学品市场预计将以超过 3.5% 的复合年增长率成长。

2020年和2021年上半年COVID-19疫情的零星爆发导致政府采取禁令和限制措施,严重抑制了纺织业活动,并限制了纺织化学品市场的成长。由于原材料供应稀缺、工作时间/资金实力有限以及资金限制阻止了向下游纺织业的委託流动,纺织化学品行业陷入瘫痪。此外,由于人们被困在家中,对纺织品的需求急剧下降。然而,自2021年中疫情消退以来,各行各业已步入復苏轨道。 2022年,家居、工业和运动服装纺织产品的需求预计将復苏,从而导致纺织品合约復苏和纺织化学品下游消费增加,从而重新激发市场相关人员的兴趣。

主要亮点

- 从中期来看,新兴经济体纺织品产量的强劲成长以及对工业纺织品的需求不断增长是推动该市场成长的关键因素。

- 另一方面,纺织染整产业的不利环境影响预计将在预测期内抑制该产业的成长。

- 然而,智慧纺织品的持续研发活动以及在纺织品製造中使用低 VOC 和生物分解性材料的日益增长的需求,在不久的将来为全球市场创造了丰厚的成长机会。

- 预计亚太地区将成为最大的纺织化学品市场,并预计在预测期内实现最高的复合年增长率。亚太地区占据主导地位的原因是中国和印度等发展中经济体对服装、家居、工业和汽车纺织应用领域的纺织化学品需求旺盛。

纺织化学品市场趋势

服装应用占市场主导地位

- 服饰是人类的基本需求之一。服装部门包括经济服饰、办公服装、商务服饰、运动服装和奢侈品等各种产品。纺织化学品用于服装生产的每个阶段,从纤维製造、漂白、染色、在织物上印刷图案等,并且在服装领域非常受欢迎。

- 服装生产中使用各种各样的化学品,包括稳定剂、染料、黏合剂、柔软剂、匀染剂、丝光剂等。整理化学品在服装设计和开发中也具有很高的渗透率,以满足特定的最终用途要求。例如,抗菌和防尘性能对于运动服来说非常重要。同样,抗皱家居和商务服饰(透过与木糖醇柠檬酸盐交联实现)在高所得服饰中变得越来越普遍。

- 由于创新设计的不断发展、获得优选时尚选择的机会不断增多以及纺织行业参与者采用了卓越的营销策略,当代服装行业正呈现高速增长趋势。网路和电子商务的普及使得消费者更加重视时尚,更容易接触到高端品牌和限量版产品。服装业的进化压力正透过刺激消费使纺织化学品市场受益。

- 此外,服饰是一些国家的重要出口商品。根据国际劳工组织(ILO)的数据,全球服饰出口的60%以上来自新兴国家,其中亚太地区占32%。中国海关总署数据显示,作为亚太地区最大的服饰市场,服饰出口成长17.35%,至1,893.5亿美元。

- 同时,儘管人事费用和原材料成本高昂,但美国的时尚和服饰仍然蓬勃发展。全国时装设计师企业总数较去年同期成长了5%左右。此外,该国多年来一直在加强服饰贸易,2021 年出口额达 850.7 亿美元(根据美国商务部和 OTEXA 报告),比 2020 年的服装出口增长 21.07%。

- 服装贸易的成长和时尚趋势的上升是引发纺织化学品大量消费的关键因素,预计将在预测期内刺激研究市场的需求成长。

亚太地区可望主导市场

- 由于中国、印度、孟加拉和越南等国家拥有成熟的下游纺织製造业,亚太地区在全球纺织化学品市场中占据主导地位。廉价劳动力和低生产成本支撑了这些国家纺织业的成长。

- 此外,消费者对价格实惠且舒适的服饰的看法发生变化,以及工业和汽车製造业的扩张,正在推动该地区对高价值和功能性布料的需求。

- 中国是世界上最大的纺织品生产国和出口国。中国工业与资讯化部资料显示,2022年1-9月,中国纺织业持续保持平稳扩张态势。中国主要纺织企业营业收入达3.86兆元(5,700亿美元),比去年同期成长3.1%。

- 中国的人口结构支持了时尚、职业服装和运动服装的强劲销售势头。该国的可支配收入一直在上升,导致过去历史时期服饰平均支出激增。到2022年,约60%的中国消费者将从国内服饰品牌购买时尚服饰。

- 根据IBEF预测,到2025-2026年,印度纺织服装产业规模将达到1,900亿美元。印度占全球纺织品和服装贸易的份额为4%。印度22财年的纺织品和服装出口额为444亿美元,与前一年同期比较成长了41%,幅度惊人。

- 由于政府积极实施国家综合纺织园区(SITP)和技能升级基金计划等计划,印度纺织业正经历巨大的转变。此外,预计到 2025 年,各种天然和合成纤维及纱线的供应将吸引 1,200 亿美元的外国投资。

- 因此,纺织业的投资增加和进步预计将有利于纺织製造业,从而推动研究市场的成长。

纺织化学品产业概况

纺织化学品市场较为分散,既有国际参与者,也有国内参与者。市场的主要企业(不分先后顺序)包括 Archroma、Huntsman International LLC、Dow、Wacker Chemie AG 和 Evonik Industries AG。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 新兴经济体纺织品产量强劲成长

- 技术纺织品需求不断成长

- 限制因素

- 纺织印染加工业造成的环境污染

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章 市场区隔(以金额为准的市场规模)

- 按类型

- 涂料和施胶化学品

- 着色剂和助剂

- 整理加工剂

- 退浆剂

- 其他类型(线润滑剂、漂白水等)

- 按应用

- 服饰

- 家居布置

- 汽车用纺织品

- 技术纺织品

- 其他用途(医用纺织品、运动纺织品等)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Achitex Minerva SpA

- Archroma

- Arkema Group

- Chemipol(Kothari Group Of Industries)

- CHT Group

- Covestro AG

- Croda International PLC

- Dow

- Evonik Industries AG

- Formosa Organic Chemical Industry Co. Ltd

- Giovanni Bozzetto SpA

- Huntsman International LLC

- Kemira Oyj

- K-tech(India)Limited

- LN Chemical Industries

- Kiri Industries Ltd

- Nouryon

- Rudolf GmbH

- Sarex

- Tanatex Chemicals BV

- The Lubrizol Corporation

- Wacker Chemie AG

第七章 市场机会与未来趋势

- 在智慧纺织品领域持续研发

- 纺织品製造对低 VOC 和生物分解性材料的需求不断增加

The Textile Chemicals Market is expected to register a CAGR of greater than 3.5% during the forecast period.

The sporadic outbreak of the COVID-19 pandemic in 2020 and the first half of 2021 drastically curtailed textile industry activities due to imposed government bans and restrictions, thereby limiting the growth of the textile chemicals market. The textile chemical sector was paralyzed owing to scarce raw material supply, limited working hours/labor strength, and constrained financials, which halted the consignment flow to the downstream textile industry. Furthermore, the demand for textiles dropped drastically as people were confined to staying in their houses. However, the industries have been on track for recovery since the pandemic's retraction in mid-2021. The demand for home, industrial, and sportswear textiles rebounded in 2022, reinstating textile contracts which increased the downstream consumption of textile chemicals and revived the interests of market players.

Key Highlights

- Over the medium term, the robust growth in textile production in developing economies and the growing demand for industrial textiles are the major driving factors augmenting the growth of the market studied.

- On the flip side, the environmental harm caused by textile dyeing and finishing activities is anticipated to restrain the growth of the target industry over the forecast period.

- Nevertheless, the ongoing research and development activities in smart textiles and the growing urge to use low VOC and biodegradable materials for textile manufacturing will likely create lucrative growth opportunities for the global market soon.

- Asia-Pacific emerged as the largest market for textile chemicals and is expected to witness the highest CAGR during the forecast period. This dominance of Asia-Pacific is attributed to the bullish demand for textile chemicals in apparel, home furnishing, industrial, and automotive textile applications in growing economies like China and India.

Textile Chemicals Market Trends

Apparel Application to Dominate the Market

- Apparel is one of the fundamental needs of a human being. The apparel segment encompasses a diverse range of value clothing, office, and business clothing, sportswear, and statement luxury pieces. Textile chemicals are hugely popular in the apparel segment, where they are used at every stage of apparel production, starting from fiber manufacturing, bleaching, dyeing, and printing designs on fabrics.

- An extensive array of chemicals classified under stabilizers, dyes, binders, softeners, leveling agents, mercerizing agents, etc., are used in apparel production. Finishing chemicals are also finding high penetration in apparel design and development to address specific requirements of the intended end use. For instance, in sportswear, antibacterial and dust-repellent clothing are gaining high importance. Similarly, wrinkle-resistant home clothing and businesswear (obtained from crosslinking with citric acid xylitol) are becoming common among the upper-middle income population.

- The modern-day apparel industry is witnessing high growth trends owing to the development of innovative designs, growing accessibility to preferable fashion choices, and the adoption of good marketing strategies by textile industry players. The increased exposure to the internet and e-commerce among consumers has improved the fashion consciousness and availability of high-end brands and limited-edition products. The evolutionary pressure from the apparel segment benefits the textile chemical market by boosting their consumption.

- Furthermore, clothing is a crucial export commodity in several countries. According to the International Labour Organization, more than 60% of the world's clothing exports are manufactured in developing countries, with Asia-Pacific accounting for 32% of the share. China, the biggest apparel market in the Asia-Pacific region, registered a 17.35% hike in garment export shipments valued at USD 189.35 billion in the first seven months of 2022, as per the General Administration of Customs China.

- On the other hand, the United States boasts a thriving fashion and clothing industry despite costly labor and raw material. The country witnessed around a 5% y-o-y increase in the total number of fashion designer businesses. Furthermore, the country has strengthened its clothing trade over the years, closing the year 2021 with USD 85,007 million export value (revealed by the US Department of Commerce and OTEXA), up by 21.07% from the apparel export value obtained in 2020.

- The increase in apparel trade and growing fashion trends are significant factors that are expected to trigger large volume consumption of textile chemicals, thus fueling the growth in the demand for the studied market during the forecast period.

Asia-Pacific Region Expected to Dominate the Market

- The Asia-Pacific region dominates the global textile chemicals market owing to the presence of matured downstream textile manufacturing industries in countries like China, India, Bangladesh, and Vietnam. The availability of cheap labor and low production cost back the growth of the textile industry in these countries.

- Furthermore, the shift in consumer perception of affordable and comfortable clothing, as well as the expanding industrial and automotive manufacturing industries increase the demand for high-value and functional fabrics in the region.

- China owns the world's largest textile industry in terms of both production and export volumes. China's textile industry continued steady expansion in the first nine months of 2022, according to data from the country's Ministry of Industry and Information Technology. The combined operating revenue of major textile enterprises in China rose by 3.1% y-o-y reaching CNY 3.86 trillion (USD 570 billion) in that period.

- China's demographics support the attractive sales of fashion, professional and athletic apparel. The country's rising disposable income has resulted in a surge in average expenditure on clothes in the historical period. In 2022, around 60% of Chinese consumers purchased fashion apparel from domestic clothing brands.

- According to IBEF, the Indian textile and apparel industry is estimated to reach USD 190 billion by 2025-2026. India has a 4% share of the global trade in textiles and apparel. In FY 2022, India's textile and apparel exports amounted to USD 44.4 billion, registering a whopping 41% y-o-y increase.

- India's textile industry is undergoing a massive turnaround with the active enforcement of schemes such as Integrated Textile Parks (SITP) and the Technology Upgradation Fund Scheme by the government. Further, the country is expecting to attract USD 120 billion worth of foreign investments by 2025 supported by the availability of diverse natural and synthetic fibers and yarns.

- Thus, the rising investments and advancements in the textile industry are projected to benefit the textile manufacturing sector, thereby propelling the growth of the market studied.

Textile Chemicals Industry Overview

The textile chemicals market is fragmented, with both international and domestic companies. Some of the major players in the market (in no particular order) include Archroma, Huntsman International LLC, Dow, Wacker Chemie AG, and Evonik Industries AG, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Robust Growth in Textile Production in Developing Economies

- 4.1.2 Growing Demand for Industrial Textiles

- 4.2 Restraints

- 4.2.1 Environmental Pollution Caused by the Textile Dyeing and Finishing Industry

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Coating and Sizing Chemicals

- 5.1.2 Colorants and Auxiliaries

- 5.1.3 Finishing Agents

- 5.1.4 Desizing Agents

- 5.1.5 Other Types (Yarn Lubricant, Bleaching Agents, etc.)

- 5.2 Application

- 5.2.1 Apparel

- 5.2.2 Home Furnishing

- 5.2.3 Automotive Textile

- 5.2.4 Industrial Textile

- 5.2.5 Other Applications (Medical Textiles, Sports Textiles, etc.)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Achitex Minerva SpA

- 6.4.2 Archroma

- 6.4.3 Arkema Group

- 6.4.4 Chemipol (Kothari Group Of Industries)

- 6.4.5 CHT Group

- 6.4.6 Covestro AG

- 6.4.7 Croda International PLC

- 6.4.8 Dow

- 6.4.9 Evonik Industries AG

- 6.4.10 Formosa Organic Chemical Industry Co. Ltd

- 6.4.11 Giovanni Bozzetto SpA

- 6.4.12 Huntsman International LLC

- 6.4.13 Kemira Oyj

- 6.4.14 K-tech (India) Limited

- 6.4.15 L. N. Chemical Industries

- 6.4.16 Kiri Industries Ltd

- 6.4.17 Nouryon

- 6.4.18 Rudolf GmbH

- 6.4.19 Sarex

- 6.4.20 Tanatex Chemicals BV

- 6.4.21 The Lubrizol Corporation

- 6.4.22 Wacker Chemie AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Ongoing Research and Development in the Field of Smart Textiles

- 7.2 Growth in Demand for Low VOC and Biodegradable Materials for Textile Manufacturing