|

市场调查报告书

商品编码

1740836

复合纺织生产设备市场机会、成长动力、产业趋势分析及2025-2034年预测Composite Textile Production Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

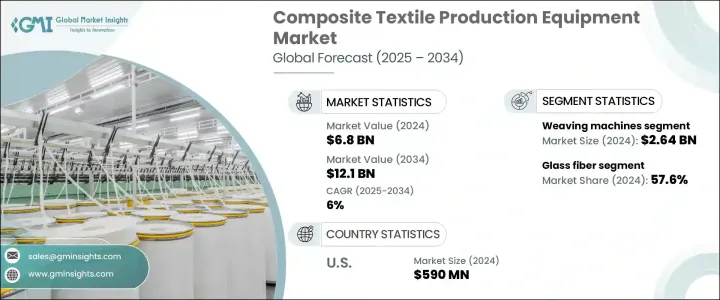

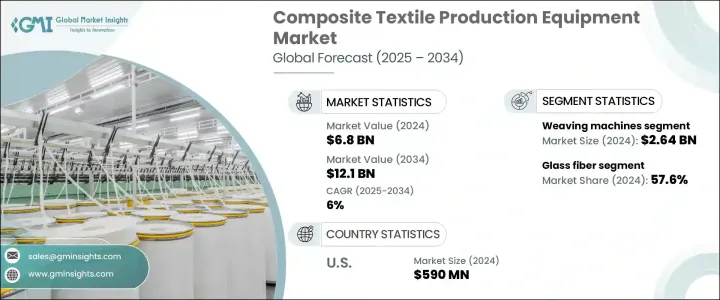

2024 年全球复合纺织品生产设备市场价值为 68 亿美元,预计到 2034 年将以 6% 的复合年增长率增长至 121 亿美元。各行各业越来越注重提高燃油效率和减轻结构重量,这推动了对复合纺织品的需求,进而推动了生产设备的成长。航太、汽车、风能和体育等行业正在采用这些先进材料,因为它们具有出色的强度重量比和耐腐蚀性。这些特性有助于製造商提高性能、提高能源效率并减少排放。在交通运输和航空等领域,更轻的材料与更好的燃油经济性和更低的碳排放直接相关,使复合纺织品成为现代製造业的关键组成部分。用于製造这些材料的设备也在快速发展,并整合了自动化和智慧技术,可提高生产率和精度。

现代复合纺织机械越来越多地融入数控功能和自动化机器人技术。这些系统能够减少人为错误,提高生产效率,并维持稳定的产品品质。它们还支援不同纺织图案或结构之间的快速转换,使製造商能够快速适应不断变化的生产需求。随着客製化和复杂复合材料需求的不断增长,这种灵活性尤其重要。随着各行各业对精度和可扩展性的重视,自动化解决方案对于满足市场预期至关重要。即时微调操作的能力使这些系统在不牺牲一致性或效率的情况下扩大生产规模至关重要。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 68亿美元 |

| 预测值 | 121亿美元 |

| 复合年增长率 | 6% |

就设备类型而言,市场细分为织布机、针织机、编织机、预浸机等。织布机在2024年成为主导细分市场,营收达26.4亿美元,预计到2034年将以约6.4%的复合年增长率成长。织造仍然是复合纺织品生产的核心过程之一,因为它能够将纱线转化为高强度、结构稳定的织物。与针织或非织造方法相比,机织纺织品具有更好的耐用性和抗应力性,使其成为高要求应用的理想选择。它们能够使用碳纤维、玻璃纤维和芳纶等材料来处理复杂的纤维交织图案,这进一步增强了它们在性能关键型环境中的重要性。对能够确保精度和速度的先进织造设备的需求日益增长,尤其是在生产高性能复合织物方面。

依纤维类型,市场可分为碳纤维、玻璃纤维、芳纶、天然纤维和其他纤维。 2024年,玻璃纤维占据了该细分市场的主导地位,占据了57.6%的市场。由于其价格实惠且在各种应用中性能可靠,玻璃纤维将继续广泛应用。与更昂贵的纤维不同,玻璃纤维兼具成本效益、强度和耐用性,非常适合汽车、船舶和建筑等行业的大规模生产。它能够适应各种纺织加工工艺,例如机织、针织和不织布,这进一步提升了它的吸引力。製造商受益于其与现有机械的兼容性,从而减少了对专用生产设备的需求,并最大限度地减少了资本投入。

从最终用途的角度来看,交通运输业在2024年引领了市场,预计到2034年仍将保持领先地位。该行业对轻质高强度复合材料的需求尤其高,因为结构效率的提高直接转化为燃油经济性和安全性能的提升。车辆、火车和轮船正在更广泛地采用纤维增强纺织品,尤其青睐耐腐蚀和能量吸收性能优异的材料。随着全球排放法规的日益严格,运输业的製造商越来越多地转向复合材料及其规模化生产所需的专用机械。

在北美,美国以5,900亿美元的估值(2024年)引领区域市场,复合年增长率达5.9%。国防、汽车和航太领域轻质复合材料应用的兴起,持续推动美国国内纺织生产技术的创新。自动化、永续性和数位化领域的投资,正在支持旨在降低能耗和减少浪费的下一代设备的开发。

产业参与者正专注于节能工艺,例如无溶剂系统和精准纤维铺放。此外,他们也正在努力提高投入品的可回收性,并整合环保材料。对透明度、可追溯性和符合国际环境标准的日益重视,正在影响製造商的采购决策,推动市场朝向更清洁、更负责任的生产方式迈进。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 供应商格局

- 贸易分析

- 利润率分析

- 技术概述

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 对轻质和节能材料的需求不断增长

- 自动化和智慧技术的进步

- 航太和国防应用领域的扩展

- 再生能源领域的使用增加

- 产业陷阱与挑战

- 初始资本投入高

- 环境和监管压力

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依设备类型,2021-2034

- 主要趋势

- 织布机

- 针织机

- 编织机

- 预浸料机

- 其他的

第六章:市场估计与预测:依纤维类型,2021-2034

- 主要趋势

- 碳纤维

- 玻璃纤维

- 芳纶纤维

- 天然纤维

- 其他的

第七章:市场估计与预测:按最终用途产业,2021-2034 年

- 主要趋势

- 航太与国防

- 运输

- 建造

- 运动与休閒

- 医疗的

- 其他的

第八章:市场估计与预测:依技术水平,2021-2034 年

- 主要趋势

- 手动设备

- 半自动化系统

- 全自动设备

第九章:市场估计与预测:按配销通路,2021-2034

- 主要趋势

- 直接的

- 间接

第十章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Changzhou Run Feng Yuan Textile Machinery Manufacturing Co., Ltd.

- Cygnet Texkimp

- Dashmesh Jacquard And Powerloom Pvt. Ltd.

- Griffith Textile Machines

- Hangzhou Dengte Textile Machinery Co., Ltd

- IMESA Srl

- Itema Group

- KARL MAYER Holding SE & CO2 KG

- Lamiflex SpA

- Lindauer DORNIER GmbH

- McCO2 Machinery Company, Inc.

- Optima3D Ltd

- Sino Textile Machinery

- Trutzschler Nonwovens GmbH

- TSUDAKOMA Europe srl

The Global Composite Textile Production Equipment Market was valued at USD 6.8 billion in 2024 and is estimated to grow at a CAGR of 6% to reach USD 12.1 billion by 2034. Increasing focus on improving fuel efficiency and reducing structural weight across multiple industries is driving the demand for composite textiles, which, in turn, fuels the growth of production equipment. Industries like aerospace, automotive, wind energy, and sports are adopting these advanced materials due to their exceptional strength-to-weight ratio and resistance to corrosion. These characteristics help manufacturers enhance performance, improve energy efficiency, and reduce emissions. In sectors like transportation and aviation, lighter materials are directly tied to better fuel economy and lower carbon emissions, making composite textiles a critical component in modern manufacturing. The equipment used to manufacture these materials is also evolving rapidly, integrating automation and smart technologies that improve productivity and precision.

Modern composite textile machinery increasingly incorporates CNC capabilities and automated robotics. These systems reduce human error, boost output efficiency, and maintain consistent product quality. They also support quick transitions between different textile patterns or structures, enabling manufacturers to adapt quickly to shifting production needs. This agility is especially important as demand for customized and complex composite materials continues to rise. As industries prioritize precision and scalability, automated solutions are becoming essential for meeting market expectations. The ability to fine-tune operations in real-time makes these systems vital in scaling production without sacrificing consistency or efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.8 Billion |

| Forecast Value | $12.1 Billion |

| CAGR | 6% |

In terms of equipment type, the market is segmented into weaving machines, knitting machines, braiding machines, prepreg machines, and others. Weaving machines emerged as the dominant segment in 2024, accounting for USD 2.64 billion in revenue and projected to grow at a CAGR of approximately 6.4% through 2034. Weaving remains one of the core processes in composite textile production due to its ability to transform yarn into high-strength, structurally stable fabric. Compared to knitted or nonwoven methods, woven textiles offer better durability and stress resistance, making them ideal for demanding applications. Their capability to handle complex fiber interlacing patterns using materials like carbon, glass, and aramid reinforces their importance in performance-critical environments. The need for advanced weaving equipment that ensures accuracy and speed is growing, particularly for producing high-performance composite fabrics.

The market is also categorized based on fiber type into carbon fiber, glass fiber, aramid fiber, natural fibers, and others. Glass fiber dominated this segment in 2024, representing 57.6% of the market share. It continues to be widely used due to its affordability and reliable performance across a range of applications. Unlike more expensive fibers, glass fiber offers an ideal combination of cost-efficiency, strength, and endurance. It suits large-scale production in sectors such as automotive, marine, and construction. Its adaptability to various textile processing techniques-such as weaving, knitting, and nonwoven formats-adds to its appeal. Manufacturers benefit from its compatibility with existing machinery, reducing the need for specialized production equipment and minimizing capital investment.

From an end-use perspective, the transportation sector led the market in 2024 and is expected to maintain its leadership through 2034. Demand for lightweight, high-strength composite materials is particularly high in this industry, where structural efficiency translates directly into improved fuel economy and safety performance. Vehicles, trains, and ships are incorporating fiber-reinforced textiles more extensively, favoring materials that offer corrosion resistance and energy absorption. As emissions regulations tighten globally, manufacturers in the transportation sector are increasingly turning to composite materials and the specialized machinery required to produce them at scale.

In North America, the United States led the regional market with a valuation of USD 590 billion in 2024, growing at a CAGR of 5.9%. The rise in lightweight composite applications across defense, automotive, and aerospace sectors continues to drive domestic innovation in textile production technologies. Investments in automation, sustainability, and digitalization are supporting the development of next-generation equipment designed for minimal energy use and waste reduction.

Industry players are focusing on energy-efficient processes such as solvent-free systems and precision-based fiber placement. Efforts are also being made to enhance the recyclability of inputs and integrate eco-friendly materials. Growing emphasis on transparency, traceability, and compliance with international environmental standards is influencing the purchasing decisions of manufacturers, pushing the market toward cleaner, more responsible production methods.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.2 Price volatility in key materials

- 3.2.2.3 Supply chain restructuring

- 3.2.2.4 Production cost implications

- 3.2.2.5 Demand-side impact (selling price)

- 3.2.2.6 Price transmission to end markets

- 3.2.2.7 Market share dynamics

- 3.2.2.8 Consumer response patterns

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Trade Analysis

- 3.5 Profit margin analysis

- 3.6 Technological overview

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising demand for lightweight and fuel-efficient materials

- 3.9.1.2 Advancements in automation and smart technologies

- 3.9.1.3 Expansion in aerospace and defense applications

- 3.9.1.4 Increasing use in renewable energy sector

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High initial capital investment

- 3.9.2.2 Environmental and regulatory pressures

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Equipment Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Weaving machines

- 5.3 Knitting machines

- 5.4 Braiding machines

- 5.5 Prepreg machines

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Fiber Type, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Carbon fiber

- 6.3 Glass fiber

- 6.4 Aramid fiber

- 6.5 Natural fibers

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Aerospace & defense

- 7.3 Transportation

- 7.4 Construction

- 7.5 Sports & leisure

- 7.6 Medical

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Technology Level, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Manual equipment

- 8.3 Semi-automated systems

- 8.4 Fully automated equipment

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Changzhou Run Feng Yuan Textile Machinery Manufacturing Co., Ltd.

- 11.2 Cygnet Texkimp

- 11.3 Dashmesh Jacquard And Powerloom Pvt. Ltd.

- 11.4 Griffith Textile Machines

- 11.5 Hangzhou Dengte Textile Machinery Co., Ltd

- 11.6 IMESA S.r.l.

- 11.7 Itema Group

- 11.8 KARL MAYER Holding SE & CO2 KG

- 11.9 Lamiflex S.p.A.

- 11.10 Lindauer DORNIER GmbH

- 11.11 McCO2 Machinery Company, Inc.

- 11.12 Optima3D Ltd

- 11.13 Sino Textile Machinery

- 11.14 Trutzschler Nonwovens GmbH

- 11.15 TSUDAKOMA Europe s.r.l.