|

市场调查报告书

商品编码

1851318

纺织化学品:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Textile Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

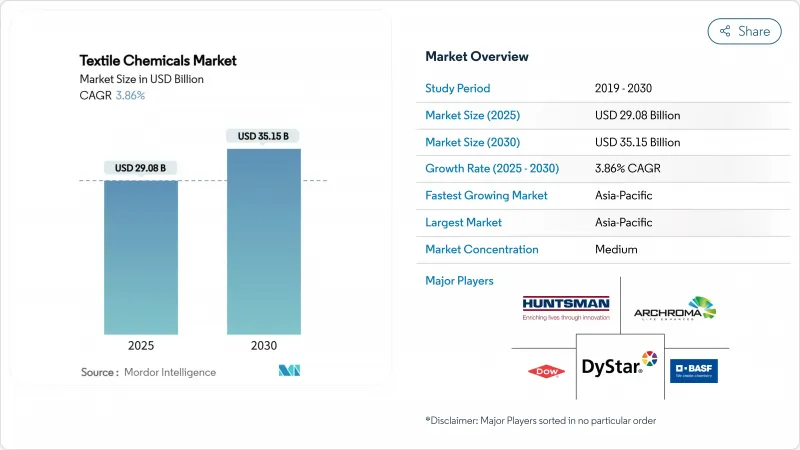

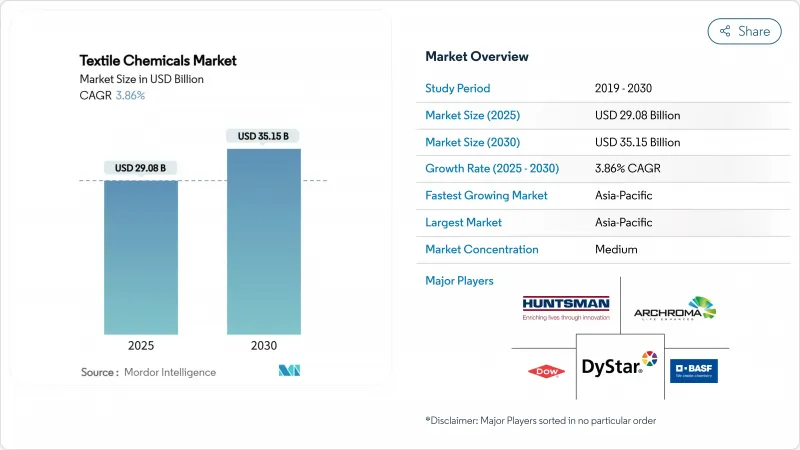

预计到 2025 年,纺织化学品市场规模将达到 290.8 亿美元,到 2030 年将达到 351.5 亿美元,预测期(2025-2030 年)复合年增长率为 3.86%。

这一温和增长反映出纺织化学品行业日益成熟,正在适应更严格的环境法规和日益增长的永续生产需求。亚太地区的强劲扩张、数位印花技术的日益普及以及对功能性整理剂的日益重视,正在再形成整个纺织化学品市场的竞争格局。儘管PFAS的逐步淘汰和石化产品价格的波动抑制了短期成长势头,但对生物酶和水基技术的持续投资有望维持纺织化学品市场的长期成长潜力。

全球纺织化学品市场趋势与洞察

亚太地区纺织品生产强劲成长

亚太地区纺织化学品市场正受益于产能的快速扩张和政府的支持措施。预计到2024年,中国纺织品出口额将成长5.7%,达到1,419.6亿美元,这将支撑涂料、浆料和染色剂等产业的大量化学品消费。印度累计人造纤维推出的1,068.3亿卢比的生产连结奖励计划,正在塑造对高性能整理加工剂的长期需求。亚太地区集中化的供应链促进了生物基和低VOC化学品的快速应用,进一步巩固了该地区在全球纺织化学品市场中的中心地位。

工业纺织品需求不断成长

轻量化汽车和医疗卫生领域的要求正在为阻燃、抗菌和耐热化学品製定新的规范标准。技术纺织品领域以4.11%的复合年增长率成长,凸显了纺织化学品市场正从大宗商品转向价格高昂、针对特定应用的配方。奈米技术赋能的整理过程进一步提高了性能阈值,加剧了专业供应商之间的研发竞争。

染色和整理过程中的污染控製成本。

目前,污水处理升级改造正消耗大量资本支出,因为业者都在努力降低化学需氧量(COD)和生物需氧量(BOD)的排放限值。一些规模较小的加工企业无力负担生物和膜技术改造的费用,因此选择退出市场或进行合併,并将化学品需求集中到规模更大、符合规范的买家身上。这种整合提高了纺织化学品市场的进入门槛,并增加了转换成本。

细分市场分析

到2024年,涂层和浆料化学品将占总收入的28.54%,为织造和针织生产线的加工能力提供支援。它们的广泛应用确保了稳定的基础需求,即使在时尚週期放缓时期也能稳定纺织化学品市场。然而,技术创新在整理加工剂最为显着,预计到2030年,整理剂的复合年增长率将达到4.35%,这主要得益于客户对集防水、弹性和抗菌功能于一体的整理剂的需求。

环保性能正使产品平臺脱颖而出,多功能硅酮聚合物混合正在取代含氟防水剂,而脱脂剂也转向可减少污水排放的生物酵素替代品。这些进步在保持核心收入来源的同时,推动了利润成长,为纺织化学品市场创造了大量机会。

区域分析

预计到2024年,亚太地区将占据全球71.25%的收入份额,这主要得益于中国3011亿美元的出口规模以及印度预计到2030年将达到3500亿美元的产业规模。区域各国政府持续津贴产能扩张与技术纺织品丛集,支撑全球纺织化学品市场以4.01%的复合年增长率成长。从纤维纺丝到服装组装的健全供应链,使得新型绿色化学品能够快速应用,从而确保亚太地区持续保持领先地位。

北美市场占有率虽小,但战略意义重大,尤其在防护、航太和医用纺织品领域,这些领域更注重规格合规性而非单位成本。美国品牌在墨西哥的近岸外包趋势正在重新激发对当地染厂的投资,并为高价值助剂开闢新的管道。加州和纽约州的 PFAS 法规正在加速水性防水剂的普及,使北美成为纺织化学品市场下一代永续解决方案的试验场。

欧洲成熟的纺织化学品产业受益于先进的机械设备和强大的法规结构,从而推动了循环经济发展。对纤维到纤维回收化学品的投资正在不断增长,德国和义大利率先建造了聚酯解聚合工厂。蓬勃发展的奢侈品和科技业正在资助低影响整理剂的研发,从而保持了欧洲在全球标准中的影响力。南美和中东等新兴地区正在扩大生产规模,但仍受制于基础设施不足,这延缓了它们全面融入纺织化学品市场的进程。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 亚太地区纤维产量强劲成长

- 技术/工业纺织品需求不断成长

- 全球监管日益严格,有利于低挥发性有机化合物(VOC)化学品。

- 数位纺织印花油墨及助剂的蓬勃发展

- 生物酶加工解决方案的快速应用

- 市场限制

- 染色和加工过程中的污染控製成本

- 石油化工原料价格波动剧烈

- 逐步淘汰 PFAS 和其他物质将增加修復成本。

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 供应商的议价能力

第五章 市场规模与成长预测

- 按类型

- 涂料和上浆化学品

- 着色剂和助剂

- 整理加工剂

- 退浆剂

- 其他类型(螺纹润滑剂、漂白剂等)

- 按原料

- 天然纤维

- 合成纤维

- 生物基

- 特种化学品

- 透过使用

- 服饰

- 家居布置

- 汽车纺织品

- 技术纺织品

- 其他用途(医用/卫生纺织品、运动纺织品等)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Achitex Minerva SpA

- Albemarle Corporation

- Archroma

- BASF

- Bozzetto Group

- CHT Group

- Clariant AG

- Covestro AG

- Croda International PLC

- Dow Inc.

- DyStar Group

- Evonik Industries AG

- Huntsman International LLC

- Kemira Oyj

- Kiri Industries Ltd

- K-Tech(India)Ltd

- LN Chemical Industries

- Nouryon

- Rudolf GmbH

- Sarex

- Sumitomo Chemical Co. Ltd

- Tanatex Chemicals BV

- Wacker Chemie AG

第七章 市场机会与未来展望

The Textile Chemicals Market size is estimated at USD 29.08 billion in 2025, and is expected to reach USD 35.15 billion by 2030, at a CAGR of 3.86% during the forecast period (2025-2030).

This moderate growth reflects a maturing sector that is adapting to stricter environmental regulations and rising demand for sustainable manufacturing. Robust expansion in Asia Pacific, escalating adoption of digital printing, and heightened focus on functional finishes are together reshaping competitive priorities across the textile chemicals market. Ongoing PFAS phase-outs and petrochemical price swings are tempering near-term momentum, yet sustained investment in bio-enzymatic and water-based technologies is expected to preserve long-run growth visibility within the textile chemicals market.

Global Textile Chemicals Market Trends and Insights

Robust Growth in Asia Pacific Textile Production

Rapid capacity additions and supportive government incentives are lifting the textile chemicals market across Asia Pacific. China's 2024 textile exports grew 5.7% to USD 141.96 billion, sustaining large-scale chemical consumption in coating, sizing, and colorant operations. India's Production Linked Incentive program earmarking INR 10,683 crore for man-made fibres is steering long-run demand for high-performance finishes. Concentrated regional supply chains enable swift adoption of bio-based and low-VOC chemistries, reinforcing Asia Pacific's centrality within the global textile chemicals market.

Rising Demand for Technical/Industrial Textiles

Automotive lightweighting and medical hygiene requirements are setting new specification baselines for flame-retardant, antimicrobial, and thermally resilient chemistries. The industrial textiles segment's 4.11% CAGR highlights how the textile chemicals market is transitioning from commodity volumes toward application-specific formulations that command premium pricing. Nanotechnology-enabled finishes are further elevating performance thresholds, intensifying R&D competition among specialty suppliers.

Pollution Control Costs in Dyeing and Finishing

Wastewater treatment upgrades now absorb significant capital outlays as operators strive to meet lower COD and BOD discharge limits. Smaller processors that cannot finance biological and membrane technologies are exiting or merging, consolidating chemical demand among larger, compliance-ready buyers. This restructuring raises entry barriers and raises switching costs within the textile chemicals market.

Other drivers and restraints analyzed in the detailed report include:

- Stricter Global Regulations Favouring Low-VOC Chemistries

- Boom in Digital-Textile Printing Inks and Auxiliaries

- Volatile Petrochemical Feedstock Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Coating and sizing chemicals commanded 28.54% of 2024 revenue, underpinning throughput across weaving and knitting lines. Their ubiquity secures steady baseline demand, stabilising the textile chemicals market even during fashion-cycle downturns. Innovation, however, is most visible in finishing agents, expected to grow at 4.35% CAGR through 2030 as customers request water-repellent, stretch-retentive, and antimicrobial functionalities in a single bath.

Environmental performance is differentiating product pipelines, with multifunctional silicone-polymer hybrids displacing fluorinated repellents. Desizing agents have shifted toward bio-enzymatic alternatives that reduce effluent load. Collectively these advances preserve the revenue core while elevating margins, reinforcing the wealth of opportunity in the textile chemicals market.

The Textile Chemicals Market Report is Segmented by Type (Coating and Sizing Chemicals, Colorants and Auxiliaries, and More), Raw Material (Natural Fibres, Synthetic Fibres, and More), Application (Apparel, Home Furnishing, and More), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific captured 71.25% revenue in 2024, supported by China's USD 301.1 billion export base and India's projected USD 350 billion industry by 2030. Regional governments continue to subsidise capacity expansion and technical-textile clusters, maintaining a 4.01% CAGR that anchors the global textile chemicals market. Supply-chain depth, from fibre spinning to garment assembly, allows rapid qualification of new green chemistries, ensuring Asia Pacific's sustained leadership.

North America holds a smaller yet strategically important share, specialising in protective, aerospace, and medical fabrics where specification compliance trumps unit cost. Mexico's near-shoring momentum to US brands is reigniting regional yarn dyehouse investments, opening fresh routes for high-value auxiliaries. California and New York PFAS rules accelerate adoption of water-based repellents, positioning North America as a testbed for next-wave sustainable options within the textile chemicals market.

Europe's mature sector benefits from advanced machinery and a robust regulatory framework that favours circularity. Investment in textile-to-textile recycling chemicals is climbing, with Germany and Italy pioneering polyester depolymerisation plants. Strong luxury and technical segments fund R&D in low-impact finishes, upholding Europe's influence on global standards. Emerging regions in South America and the Middle East are scaling output but remain constrained by infrastructure gaps, delaying their fuller integration into the textile chemicals market.

- Achitex Minerva SpA

- Albemarle Corporation

- Archroma

- BASF

- Bozzetto Group

- CHT Group

- Clariant AG

- Covestro AG

- Croda International PLC

- Dow Inc.

- DyStar Group

- Evonik Industries AG

- Huntsman International LLC

- Kemira Oyj

- Kiri Industries Ltd

- K-Tech (India) Ltd

- L. N. Chemical Industries

- Nouryon

- Rudolf GmbH

- Sarex

- Sumitomo Chemical Co. Ltd

- Tanatex Chemicals BV

- Wacker Chemie AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Robust growth in Asia Pacific textile production

- 4.2.2 Rising demand for technical/industrial textiles

- 4.2.3 Stricter global regulations favouring low-VOC chemistries

- 4.2.4 Boom in digital-textile printing inks and auxiliaries

- 4.2.5 Rapid adoption of bio-enzymatic processing solutions

- 4.3 Market Restraints

- 4.3.1 Pollution control costs in dyeing and finishing

- 4.3.2 Volatile petrochemical feedstock prices

- 4.3.3 PFAS and other substance phase-outs raising reformulation costs

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.1.1 Bargaining Power of Buyers

- 4.5.1.2 Threat of New Entrants

- 4.5.1.3 Threat of Substitutes

- 4.5.1.4 Degree of Competitive Rivalry

- 4.5.1 Bargaining Power of Suppliers

5 Market Size and Growth Forecasts

- 5.1 By Type

- 5.1.1 Coating and Sizing Chemicals

- 5.1.2 Colorants and Auxiliaries

- 5.1.3 Finishing Agents

- 5.1.4 Desizing Agents

- 5.1.5 Other Types (Yarn Lubricant, Bleaching Agents, etc.)

- 5.2 By Raw Material

- 5.2.1 Natural Fibres

- 5.2.2 Synthetic Fibres

- 5.2.3 Bio-Based

- 5.2.4 Speciality Chemicals

- 5.3 By Application

- 5.3.1 Apparel

- 5.3.2 Home Furnishing

- 5.3.3 Automotive Textiles

- 5.3.4 Industrial Textiles

- 5.3.5 Other Applications (Medical and Hygiene Textiles, Sports Textiles, etc.)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Achitex Minerva SpA

- 6.4.2 Albemarle Corporation

- 6.4.3 Archroma

- 6.4.4 BASF

- 6.4.5 Bozzetto Group

- 6.4.6 CHT Group

- 6.4.7 Clariant AG

- 6.4.8 Covestro AG

- 6.4.9 Croda International PLC

- 6.4.10 Dow Inc.

- 6.4.11 DyStar Group

- 6.4.12 Evonik Industries AG

- 6.4.13 Huntsman International LLC

- 6.4.14 Kemira Oyj

- 6.4.15 Kiri Industries Ltd

- 6.4.16 K-Tech (India) Ltd

- 6.4.17 L. N. Chemical Industries

- 6.4.18 Nouryon

- 6.4.19 Rudolf GmbH

- 6.4.20 Sarex

- 6.4.21 Sumitomo Chemical Co. Ltd

- 6.4.22 Tanatex Chemicals BV

- 6.4.23 Wacker Chemie AG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment