|

市场调查报告书

商品编码

1639397

亚太地区炭黑 -市场占有率分析、产业趋势、成长预测(2025-2030 年)Asia-Pacific Carbon Black - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

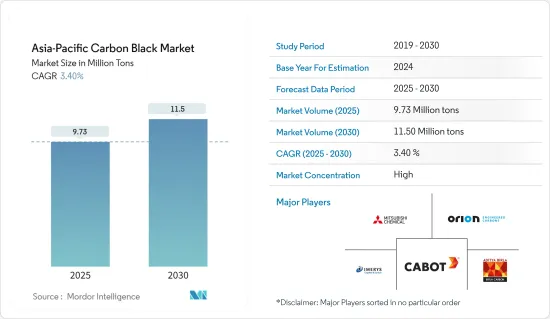

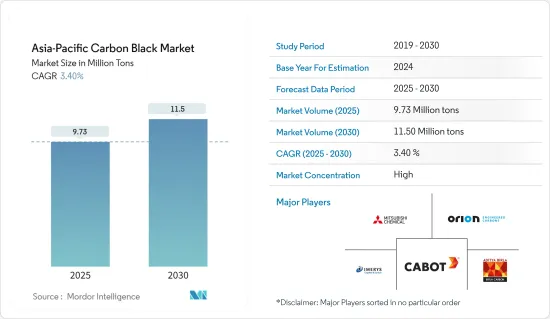

预计2025年亚太地区炭黑市场规模为973万吨,2030年将达1,150万吨,预测期间(2025-2030年)复合年增长率为3.4%。

市场受到 COVID-19 的负面影响。受疫情影响,亚太地区多个国家已进入封锁状态,以遏止病毒传播。许多公司和工厂关闭,扰乱了全球供应链,影响了生产、交货时间和产品销售。目前,市场已从 COVID-19 大流行中恢復并正在显着增长。

主要亮点

- 纺织业应用的扩大、专门食品炭黑市场渗透率的扩大以及轮胎行业需求的快速增长是推动市场的主要因素。

- 原材料价格波动和绿色轮胎的崛起预计将阻碍市场成长。

- 电动和自动驾驶汽车的日益普及以及印刷应用炭黑需求的快速成长将为未来几年的市场提供机会。

亚太地区炭黑市场趋势

对轮胎和工业橡胶製品的需求增加

- 橡胶化合物中添加炭黑可改善散热性能、操控性、胎面磨损和燃油效率。它还具有提高的耐磨性。炭黑主要用作橡胶产业填料,以产生补强效果,例如改变弹性模量和拉伸强度。用于改善产品中的分子间力或内聚力,并赋予橡胶黏合剂、密封剂和被覆剂导电性。

- 汽车产业的表现是炭黑需求的重要指标。根据国际汽车工业协会 (OICA) 的数据,亚太地区的汽车产量到 2022 年将增加 7%,达到 5,000 万辆,而 2021 年的产量为 4,600 万辆。

- 中国和印度在亚太地区橡胶和轮胎行业中占据主导地位。中国是该地区最大的橡胶轮胎生产国和消费国。充足的原料供应和政府的支持措施为这些国家的轮胎和橡胶产业做出了积极贡献。

- 根据中国橡胶工业协会(CRIA)正式发布的橡胶工业「十四五」发展规划指引,预计到2025年我国轮胎年产量将达7.04亿条。其中,乘用车子午线轮胎5.27亿条,卡车、客车子午线轮胎1.48亿条,斜交卡车轮胎2900万条,超大型工业轮胎2万条,农用轮胎1200万条,航空轮胎5.4万条。这一扩张标誌着国际市场对中国轮胎产品的需求不断增长,使中国轮胎产业成为全球市场的主要参与企业。

- 此外,印度汽车製造业的不断增长导致各轮胎製造商在该国投资新建生产设施。例如,Yokohama Rubber于2022年4月开始在安得拉邦维沙卡帕特南生产越野轮胎,日产能为69吨橡胶。该公司还正在进行第二阶段的扩建,计划于 2024 年开始,这将使 Nissan 产能增加至 132 吨。

- 因此,考虑到上述因素,预计在预测期内轮胎和工业橡胶製品领域对炭黑的需求将会增加。

中国主导市场

- 中国是亚太市场最大的炭黑消费国。这是由于汽车业对炭黑的需求增加。轮胎应用占据中国炭黑市场的最大份额。

- 中国是亚太地区最大的轮胎生产国。不过,根据国家统计局统计,2022年轮胎产量为8.56亿条,与前一年同期比较下降5%。这一下降被认为是由于西方国家能源成本上升和交通量下降导致 2022 年下半年出口需求下降。

- 从积极的一面来看,中国汽车产量显着增长,有助于该国的轮胎需求。根据OICA统计,2022年中国汽车产量较2021年成长3%。

- 随着下游需求的增加,中国涂料市场正在快速成长。蓬勃发展的建筑、汽车和工业领域预计将推动油漆和涂料市场的发展。反过来,预计这将增加预测期内对炭黑的需求。

- 根据欧洲涂料协会统计,中国有近万家涂料生产公司。全球领先的涂料製造商大多在中国设有製造地,包括立邦涂料、阿克苏诺贝尔、中国船舶涂料、PPG工业、BAF SE、艾仕得涂料等。油漆和涂料公司越来越多地在中国投资。

- 例如,2022年7月,BASF欧洲公司透过子公司BASF涂料(广东)(BCG)扩大了位于中国南方广东省江门市的涂料基地的汽车重涂涂料生产能力。透过本次扩建计划,公司的生产能力已增加到每年30吨。

- 由于各个最终用户行业的需求不断增加,炭黑製造商正在建立新的生产设施或扩大现有的生产设施。因此,预计这种趋势将在未来几年增加中国对炭黑的需求。

亚太地区炭黑产业概况

亚太炭黑市场具有综合性。主要企业(排名不分先后)包括卡博特公司、三菱化学集团公司、Orion Engineered Carbons、Imerys 和 Birla Carbon。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 扩大在纺织业的应用

- 提高专门食品炭黑的市场渗透率

- 轮胎产业需求快速成长

- 抑制因素

- 原物料价格不稳定

- 绿色轮胎的兴起

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模(基于数量))

- 工艺类型

- 炉黑

- 气黑

- 灯黑

- 热感黑

- 目的

- 轮胎及工业橡胶製品

- 塑胶

- 墨粉和印刷油墨

- 涂层

- 纤维

- 其他应用(电力、绝缘、建筑等)

- 地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 其他亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率分析**/排名分析

- 主要企业策略

- 公司简介

- Birla Carbon

- Bridgestone Corporation

- Cabot Corporation

- Cancarb Limited

- Continental Carbon Company

- Epsilon Carbon Private Limited

- Himadri Specialty Chemical Ltd

- Imerys

- Longxing Chemical Stock Co. Ltd

- Mitsubishi Chemical Group Corporation

- OCI COMPANY Ltd

- Orion Engineered Carbons

- PCBL(Phillips Carbon Black Limited)

- Shandong Huadong Rubber Materials Co., Ltd.

- Tokai Carbon Co. Ltd

第七章 市场机会及未来趋势

- 电动车和自动驾驶汽车的扩张

- 印刷油墨应用需求快速成长

The Asia-Pacific Carbon Black Market size is estimated at 9.73 million tons in 2025, and is expected to reach 11.50 million tons by 2030, at a CAGR of 3.4% during the forecast period (2025-2030).

The market was negatively impacted due to COVID-19. Owing to the pandemic scenario, several countries in Asia-Pacific went into lockdown to curb the spread of the virus. The shutdown of numerous companies and factories disrupted worldwide supply networks and harmed production, delivery schedules, and product sales. Currently, the market recovered from the COVID-19 pandemic and is increasing significantly.

Key Highlights

- Major factors driving the market studied are growing application in fiber and textile industries, increasing market penetration of specialty black, and surge in demand from the tire industry.

- Volatile raw material prices and the rising prominence of green tires are expected to hinder the studied market's growth.

- Growth in the adoption of electric and self-driving cars and the surge in demand for carbon black in printing applications will likely create opportunities for the market in the coming years.

Asia-Pacific Carbon Black Market Trends

Increasing Demand for Tires and Industrial Rubber Products

- Carbon black improves heat-dissipation capabilities and handling, tread wear, and fuel mileage when added to rubber compounds. It also provides abrasion resistance. Carbon black is mostly used as a rubber sector filler to generate reinforcing effects, such as changing the modulus or tensile strength. It is used to improve the intermolecular or cohesive forces of the product and to provide conductivity to rubber-based adhesives, sealants, and coatings.

- The automotive industry's performance is an important indicator of the demand for carbon black. According to the International Organization of Motor Vehicle Manufacturers (OICA), automotive production in the Asia-Pacific region increased by 7% to 50 million units in 2022, compared to 46 million units recorded in 2021.

- China and India dominate the rubber and tire industry in the Asia-Pacific region. China is the largest producer and consumer of rubber tires in the region. Sufficient availability of raw materials and supporting government initiatives positively contribute to these countries' tire and rubber industries.

- As per the officially released guiding outline for the "14th Five-Year" Development Plan for the Rubber Industry by China Rubber Industry Association (CRIA), China is projected to produce 704 million tires annually by 2025. It includes 527 million passenger radial tires, 148 million truck/bus radial tires, 29 million bias truck tires, 20 thousand extra-large industrial tires, 12 million agricultural tires, and 54 thousand aircraft tires. This expansion suggests the international market's growing demand for China's tire products, positioning China's tire industry as a major player in the global market.

- Furthermore, due to the continuous increase in automotive manufacturing in India, various tire manufacturers are investing in new production facilities in the country. For instance, Yokohama Rubber Co. commenced production of off-road tires in Vishakhapatnam, Andhra Pradesh, in April 2022, with a daily manufacturing capacity of 69 tonnes in rubber weight. The company is also working on the second phase of expansion, expected to begin by 2024, increasing the daily capacity to 132 tonnes.

- Therefore, considering the factors above, the demand for carbon black is expected to rise from the tires and industrial rubber products segment during the forecast period.

China to Dominate the Market

- China is the largest consumer of carbon black in the Asia-Pacific market. It is due to the increasing demand for carbon black from the automotive sector. The tire application accounts for the largest share of the carbon black market in China.

- China is the largest producer of tires in the Asia-Pacific region. However, according to the statistics reported by the National Bureau of Statistics, the production of tires stood at 856 million units in 2022, showcasing a decline of 5% from the previous year. The decline is perceived as a consequence of the reduction in export demand in the second half of 2022 due to the rising energy cost and decline in traffic in Europe and American countries.

- On the positive front, automotive production in China witnessed a prominent rise which aided the demand for tires in the country. According to the OICA, automotive production in China in 2022 increased by 3% compared to 2021.

- The coatings market is growing rapidly in China, with increasing downstream demand. The booming construction, automotive, and industrial sectors will likely propel the paint and coatings market. It, in turn, is expected to boost the demand for carbon black during the forecast period.

- According to European Coatings, nearly 10,000 coatings manufacturers are located in China. Most leading global coating manufacturers, such as Nippon Paint, AkzoNobel, Chugoku Marine Paints, PPG Industries, BAF SE, and Axalta Coatings, contain their manufacturing bases in China. Paints and coatings companies are increasingly growing investments in the country.

- For instance, in July 2022, BASF SE, through its subsidiary BASF Coatings (Guangdong) Co., Ltd. (BCG), expanded its manufacturing capabilities for automotive refinish coatings at its coatings site in Jiangmen, Guangdong Province in South China. The company increased its production capacity to 30 kilotons annually through this expansion project.

- Due to the increasing demand of various end-user industries, carbon black manufacturers are setting up new production facilities and expanding existing manufacturing facilities. Hence, such trends are expected to increase the demand for carbon black in China in the upcoming years.

Asia-Pacific Carbon Black Industry Overview

The Asia-Pacific carbon black market is consolidated in nature. The major companies (in noy any particular order) include Cabot Corporation, Mitsubishi Chemical Group Corporation, Orion Engineered Carbons, Imerys, and Birla Carbon.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Application in Fiber and Textile Industries

- 4.1.2 Increasing Market Penetration of Specialty Black

- 4.1.3 Surge in Demand from Tire Industry

- 4.2 Restraints

- 4.2.1 Volatile Raw Material Prices

- 4.2.2 Rising Prominence of Green Tires

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Process Type

- 5.1.1 Furnace Black

- 5.1.2 Gas Black

- 5.1.3 Lamp Black

- 5.1.4 Thermal Black

- 5.2 Application

- 5.2.1 Tires and Industrial Rubber Products

- 5.2.2 Plastics

- 5.2.3 Toners and Printing Inks

- 5.2.4 Coatings

- 5.2.5 Textile Fibers

- 5.2.6 Other Applications (Power, Insulation, Construction, etc.)

- 5.3 Geography

- 5.3.1 China

- 5.3.2 India

- 5.3.3 Japan

- 5.3.4 South Korea

- 5.3.5 ASEAN Countries

- 5.3.6 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Birla Carbon

- 6.4.2 Bridgestone Corporation

- 6.4.3 Cabot Corporation

- 6.4.4 Cancarb Limited

- 6.4.5 Continental Carbon Company

- 6.4.6 Epsilon Carbon Private Limited

- 6.4.7 Himadri Specialty Chemical Ltd

- 6.4.8 Imerys

- 6.4.9 Longxing Chemical Stock Co. Ltd

- 6.4.10 Mitsubishi Chemical Group Corporation

- 6.4.11 OCI COMPANY Ltd

- 6.4.12 Orion Engineered Carbons

- 6.4.13 PCBL (Phillips Carbon Black Limited)

- 6.4.14 Shandong Huadong Rubber Materials Co., Ltd.

- 6.4.15 Tokai Carbon Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growth in the Adoption of Electric Cars and Self-driving Cars

- 7.2 Surge in Demand for Printing Inks Application