|

市场调查报告书

商品编码

1639477

拉丁美洲的合约包装:市场占有率分析、行业趋势和成长预测(2025-2030 年)Latin America Contract Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

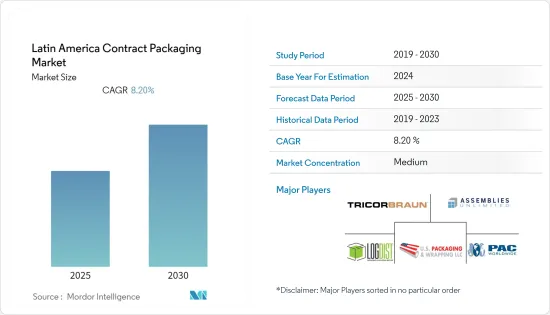

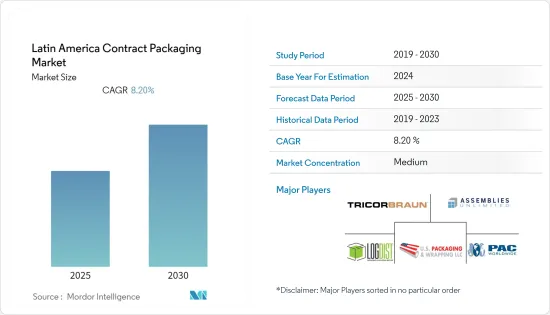

拉丁美洲合约包装市场预计在预测期内复合年增长率为 8.2%

主要亮点

- 由于疫情限制和社交距离规则,电子商务市场蓬勃发展。因此,许多公司转向外包端到端封装解决方案,以满足指数级成长的需求。

- 越来越多的公司采用最新的创新包装解决方案并专注于其核心业务,预计也将推动市场成长,因为公司透过部署最新技术来增加其包装基础设施,并不断升级它,从而最大限度地减少建立所需的投资。

- 随着药品和药物变得更加专业化,对专业化生产的需求也增加。此外,对于大多数严格监管的包装要求,最终用户更愿意与拥有经验、专业知识并有能力满足客户大批量要求的包装供应商签订合约。由于公司无法安装符合药品包装高标准的内部包装设备,该地区对合约包装的需求正在增加。

- 该地区製药业的成长也是推动市场的因素之一。製药公司委託包装业务外包给巴西和墨西哥等新兴国家的第三方。此外,製药公司日益增加的定价压力也推动了业界对合约包装服务的需求。然而,最终用户产业越来越多地采用内部包装设备正在阻碍市场成长。

- COVID-19 大流行增加了对食品、饮料和药品的需求,促使公司委託包装业务外包给联合包装商,从而增加了该地区的合约包装需求。例如,墨西哥城的主要批发市场每天都会发现几起冠状病毒病例,这产生了对卫生和安全包装服务的需求。此外,由于原材料和能源价格上涨,俄罗斯和乌克兰之间的战争正在影响整个包装生态系统。

拉丁美洲合约包装市场趋势

电子商务产业的需求不断增长

- 随着提供消费品的公司需求的变化,客製化以及供应链的速度正在成为透过电子商务提供产品的公司面临的挑战,从而提高灵活性、敏捷性和合约包装公司对客製化电子商务的要求越来越高围绕灵活性构建的包装解决方案。

- 消费者在杂货店购物的频率降低,导致消费者的任务和购物篮改变。向电子商务和数位管道的转变正在加速,相当一部分消费者首次尝试宅配,或者在疫情期间更频繁地使用宅配,这增加了对更安全包装的需求,製造商越来越多地委託包装外包给他们。

- 此外,电子商务公司正在与巴西等国家的当地包裹递送服务合作,以适应销售量的成长。例如,2022年11月,亚马逊与Azul Cargo合作,加速了巴西北部航空货运电商包裹的递送速度。此类合作伙伴关係预计将进一步推动对三级包装解决方案的需求。

食品工业预计将显着成长

- 由于食品製造公司对合约包装商的稳定性、不断增长的需求和偏好的变化,食品公司越来越关注成本优化和核心业务;我们将包装和履约服务活动外包给第三方合约食品包装商。

- 该地区食品製造公司投资的增加以及食品销售的增加进一步推动了市场的成长。例如,全球食品公司嘉吉公司于 2021 年 9 月宣布,将在巴西贝维杜罗开设一座新的最先进的果胶生产设施,大幅扩大产能以满足不断增长的需求。

- 一些国家的政府对药品和食品的标籤和包装实施了严格的法律法规,扩大了合约包装市场的范围。例如,2022年9月,阿根廷政府宣布了最全面的食品政策法,要求钠、糖、脂肪和卡路里含量超标的超加工产品在包装正面贴有黑色八角形警告。

- 此外,2022 年 7 月,布勒、嘉吉和奇华顿与拉丁美洲食品技术中心和义大利食品技术研究所合作,在巴西坎皮纳斯建立了研发中心,称为热带食品创新实验室。这个新中心是为拉丁美洲的永续食品和饮料产品而开发的。Start-Ups、企业、投资者、大学和研究机构都可以使用原型製作技术。预计这将导致拉丁美洲食品工业的进一步扩张。

拉丁美洲合约包装产业概况

拉丁美洲合约包装市场是半固化且竞争的激烈,有强大的参与企业进入市场。这些拥有重要市场份额的参与企业致力于扩大其在全部区域的基本客群。这些公司利用策略合作行动来增加市场占有率并提高盈利。

2022 年 6 月:随着市场动态的变化,儘管产业内成本不断上涨,但塑胶包装材料的需求仍然很高。 PET等广泛使用的包装树脂在2021年上涨了近50%,部分原因是不利的天气、基础设施问题、劳动力短缺和新冠疫情。大多数製造商依赖进口原料来生产树脂包装,聚乙烯和聚苯乙烯包装计划短期内价格无法缓解。根据荷兰合作银行的报告,2022 年开始生产的新工厂可能会在 2023 年降低聚乙烯价格。

此外,通膨并不是阻碍铝包装产业供应缺口的唯一因素。面对高昂的材料成本和罐头短缺的可能性,饮料製造商决定大幅提高包装成本,并表示通膨压力将使铝製饮料包装在2022年变得更加复杂。欧洲能源担忧也预计将推高玻璃包装的成本。作为主要玻璃进口国,拉丁美洲用户预计能源密集型产业将带来持续的价格上涨压力。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 工业价值/供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者/买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 工业措施

- COVID-19 市场影响评估

- 全球合约包装市场概况

第五章市场动态

- 促进因素

- 电商产业需求增加

- 零售连锁发展

- 抑制因素

- 与内部包装的竞争

第六章 市场细分

- 按服务

- 初级包装

- 二次包装

- 三级包装

- 按最终用户产业

- 食物

- 饮料

- 药品

- 家居用品/个人护理

- 其他的

- 按国家/地区

- 巴西

- 墨西哥

- 阿根廷

- 其他国家

第七章 竞争格局

- 公司简介

- TricorBraun

- Assemblies Unlimited, Inc.

- VMA LOGDIST

- US Packaging & Wrapping LLC

- PAC Worldwide Corporation

- Rangel

- Colep Consumer Products

第八章投资分析

第九章 市场未来展望

The Latin America Contract Packaging Market is expected to register a CAGR of 8.2% during the forecast period.

Key Highlights

- The e-commerce market grew rapidly owing to the restrictions and social distancing rules during the pandemic. It created significant demand, resulting in many businesses outsourcing their end-to-end packaging solutions to meet the sudden increase in demand.

- The increasing focus of companies on adopting the latest and innovative packaging solutions and focus on their core business is also anticipated to foster market growth helping the companies to minimize the investment required to set up packaging infrastructure with the latest technology deployment and the continuous need to upgrade it.

- The need for specialized production has increased as drugs and medications become more specialized. Further, in most of the packaging requirements where the regulations are stringent, the end-users like to engage with packaging vendors who have prior experience, expertise and equipped for handling the volume requirement of the clients. The region has witnessed a rise in demand for contract packaging owing to the inability of in-house packaging facilities to meet high standards needed for pharmaceutical packaging.

- The growing pharmaceutical industry in the region is another factor driving the market. Pharmaceutical companies outsource packaging activities to third parties in emerging countries such as Brazil, Mexico, etc. Further, rising pricing pressure on pharmaceutical companies is boosting the industry's demand for contract packaging services. However, the increasing adoption of in-house packaging facilities by the end-user industries is hampering the market growth.

- Due to the COVID-19 pandemic, there was increased demand for food, beverages, and pharmaceutical drugs, which led companies to outsource their packaging activities to co-packers, thus, increasing the demand for contract packaging in the region. For instance, Mexico City's primary wholesale market continuously detected several coronavirus cases daily, creating the need for hygienic and safe packaging services. Further, the Russia-Ukraine war has an impact on the overall packaging ecosystem with the increased raw materials and energy prices cost.

Latin America Contract Packaging Market Trends

Increasing Demand from E-commerce Industry

- With the changing requirements from the consumer processed goods providing businesses, customization, along with speed in the supply chain, creates a challenge for the product offering companies through e-commerce, thereby escalating the requirements from the contract packaging companies for a customized e-commerce packaging solution, as they are built around flexibility, agility, and resourcefulness.

- Consumers are shopping at grocery stores less frequently, which has resulted in changes in shopper missions and baskets. The shift toward e-commerce and digital channels has accelerated, with a significant proportion of consumers either trying home delivery for the first time or using it more frequently during the pandemic, increasing the need for safer packaging and leading manufacturers to outsource packaging to third-party vendors.

- Moreover, e-commerce companies are undergoing partnerships with local package delivery services in the countries like Brazil to cater to growing sales delivery. For instance, in November 2022, Amazon and Azul Cargo partnered to speed up the delivery of air cargo e-commerce packages in North Brazil. Such partnerships will further boost the demand for tertiary packaging solutions.

Food Industry is Expected to Add Significant Growth

- With the stability, rising demand, and changing preference of food production firms toward contract packagers, and the food companies increasingly focusing on cost optimization and their core business, most of them have been outsourcing their packaging and fulfillment services activities to third-party contract food packagers, owing to the rising demand.

- The growing investment by food manufacturing companies in the region with rising food sales is further augmenting the market growth. For instance, in September 2021, Cargill, a global food corporation, announced the opening of its new, cutting-edge pectin production facility located in Bebedouro, Brazil, to significantly expand the company's ability to meet growing demand.

- Several countries' governments are enforcing strict laws and regulations governing the labeling and packaging of drugs and food products, which is broadening the scope of the contract packaging market. For instance, in September 2022, the government of Argentina announced most comprehensive food policy laws, requiring ultra-processed products with excess levels of sodium, sugar, fats and calories to include black octagonal warnings on the front of the package.

- Moreover, in July 2022, Buhler, Cargill, and Givaudan collaborated with the Food Tech Hub LATAM and Ital Food Technology Institute to build an innovation center called the Tropical Food Innovation Lab in Campinas, Brazil. This new hub is developed for sustainable food and beverage products in Latin America. Startups, companies, investors, universities, and research institutions can access prototyping technologies. This will further add to the expansion of the food industry in Latin America.

Latin America Contract Packaging Industry Overview

The Latin America contract packaging market is semi-consolidated is competitive, with some influential players operating in the market. These players with a noticeable share in the market are concentrating on expanding their customer base across the region. These businesses leverage strategic collaborative actions to improve their market percentage and enhance profitability.

In June 2022: With the changing market dynamics, plastic packaging materials remain in high demand even as costs climb within the industry. Attributed in part to weather events, infrastructure problems, labor shortages, and the pandemic, widely used packaging resins such as PET saw price increases of nearly 50% in 2021. Most of the makers rely on imported materials for resin packaging production, and short-term price relief is not expected for polyethylene and polystyrene packaging projects. The Rabobank report indicates new plants set to begin production in 2022 may ease polyethylene prices in 2023.

Moreover, Inflation isn't the sole factor for the supply gap that has thwarted the aluminum packaging industry, but the cost of the familiar material is up 40% over the past two years. Faced with high materials costs and the possibility of can shortages, beverage producers have taken massive packaging cost increases as inflationary pressure complicates aluminum beverage packaging in 2022. Energy uncertainty in Europe is expected to inflate the cost of glass packaging, as well. As a major glass importer, the users in Latin America can expect continued upward pricing pressure from the energy-intensive industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industrial Value/Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's 5 Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers/Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Industry Policies

- 4.5 Assessment of COVID-19 Impact on the Market

- 4.6 Overview of Global Contract Packaging Market

5 MARKET DYNAMICS

- 5.1 Drivers

- 5.1.1 Increasing Demand from E-commerce Industry

- 5.1.2 Development in the Retail Chain

- 5.2 Restraints

- 5.2.1 Competition from In-house packaging

6 MARKET SEGMENTATION

- 6.1 By Service

- 6.1.1 Primary Packaging

- 6.1.2 Secondary Packaging

- 6.1.3 Tertiary Packaging

- 6.2 By End-user Industry

- 6.2.1 Food

- 6.2.2 Beverages

- 6.2.3 Pharmaceutical

- 6.2.4 Household and Personal Care

- 6.2.5 Other End-user Industries

- 6.3 By Country

- 6.3.1 Brazil

- 6.3.2 Mexico

- 6.3.3 Argentina

- 6.3.4 Other Countries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 TricorBraun

- 7.1.2 Assemblies Unlimited, Inc.

- 7.1.3 VMA LOGDIST

- 7.1.4 U.S. Packaging & Wrapping LLC

- 7.1.5 PAC Worldwide Corporation

- 7.1.6 Rangel

- 7.1.7 Colep Consumer Products