|

市场调查报告书

商品编码

1639501

欧洲下一代储存:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Europe Next Generation Storage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

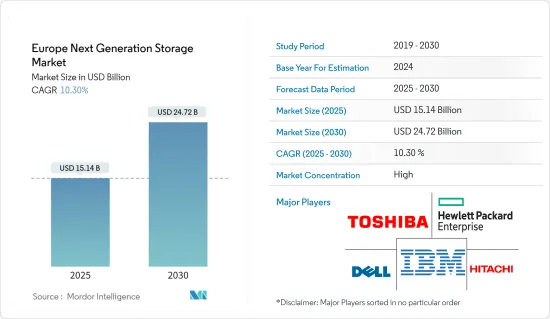

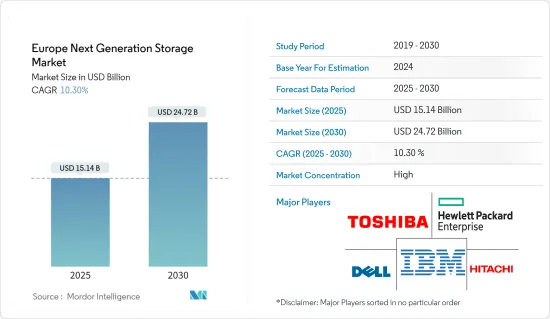

欧洲下一代储存市场规模预计在 2025 年为 151.4 亿美元,预计到 2030 年将达到 247.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 10.3%。

主要亮点

- 欧盟正在该地区投资并快速推动人工智慧和企业数位化。根据数位经济和社会指数(DESI)发布的报告,2021年ICT专业人员的数量为890万,而欧盟的目标是到2030年将这一数字增加到至少2000万。为了实现数位十年的目标,到2030年,至少90%的欧盟中小企业必须达到基本的数位化强度水准。到2030年,至少75%的公司将使用巨量资料、云端和人工智慧技术,欧盟希望80%的个人至少具备基本的数位能力。 IT 领域对数位化的日益增长的需求将会产生对大容量储存平台的需求。

- 欧盟提案的资料法和针对连网设备的具体法规。整体而言,连网机器和设备会产生大量资料,欧盟计画将这些资料用于商业和社会的生产用途。

- 可用的资料量非常巨大,而且还在不断增长。管理资料的主要挑战之一是将资料储存在各种资料孤岛中。如果资料储存在某个地方,第三方就可以存取它。可以透过采取各种安全措施(例如加密和依赖第三方供应商)来控制不必要的访问,从而避免这种情况。

- 新冠疫情为企业如何在困难时期适应和发展提供了新的视野。这种见解彻底改变了数位化。欧洲企业透过自动化流程、削减开支、提高识别资料风险的能力以及注重提供最佳客户体验,正在经历復苏。在困难时期,尖端技术和解决方案可以增加收益并降低风险。

欧洲下一代储存市场趋势

预计 IT 和通讯产业将实现高成长

- 在欧洲的下一代储存市场中,受数位资料量增加的推动,IT和通讯产业预计将呈现最高的成长。欧洲各国政府正在对科技进行监管,欧盟各地的组织也正在进行投资以数位化。根据欧洲投资银行(EIB)投资调查(EIBIS),46% 的公司声称已采取措施实现数位化。欧洲投资银行与 Ormazabal 之间达成的价值 4,239 万美元的协议将帮助这家巴斯克工业公司製定未来四年在西班牙研发活动的投资策略。

- 法国、德国、荷兰和英国是欧洲最重要的资料中心市场,这显示这些国家的储存市场潜力巨大。资料安全领域的外国公司也在进行投资。中国社群媒体公司 TikTok 正在寻找扩大在欧洲的资料储存的方法,并宣布将在那里开设一个资料中心。

- 这家瑞士银行已经实施了由 Temenos 开发的核心银行和支付解决方案 Alpian App。该应用程式可让您快速组装银行功能并根据业务需求进行扩展,从而让您在提供一流客户服务的同时实现盈利增长。

网路附加储存 (NAS) 将占据主要份额

- 远端资讯处理服务的需求急剧增长,推动用户采用网路附加储存 (NAS)。网路附加储存 (NAS) 的速度、扩充性和安全功能在提供基本基础架构和服务方面发挥关键作用。到2024年,近45%的业务流程外包、基础设施软体、应用软体和系统基础设施的IT支出将被云端基础的解决方案所取代。

- 欧盟统计局的报告证实,拥有10名或以上员工或合作者的欧盟公司中,超过98%的公司已接取互联网,41%的公司使用云端服务。这显示未来几年采用云端运算的可能性很高。此外,资讯和通讯产业以及专业、技术和科学领域的大型公司对云端服务的使用率最高。

- 微软宣布面向欧盟公共和商业客户推出欧盟资料边界解决方案,并计划扩大其云端服务的资料中心。微软计划在欧洲 17 个国家建立资料中心。

- 欧盟计画建造基于RISC-V指令集架构的运算基础设施,并宣布将投资至少2.86亿美元。该计划旨在建构基于RISC-V硬体和软体的高效能电脑。

- Google Cloud 加入欧洲合作伙伴网路 Catena-X 汽车网路协会。透过资料分析、先进人工智慧技术的原生整合以及开放原始码承诺,Google将帮助 CatenaX 成功实现成为资料驱动型企业的使命。

欧洲下一代储存产业概况

几家下一代储存供应商之间存在着激烈的竞争。主要参与者不胜枚举,包括日立、IBM、戴尔、东芝、惠普和 Netgear。由于竞争激烈,市场集中度较低。为了保持竞争力,製造商透过投资併购来利用技术增强其产品并扩大其地理覆盖范围。

- 2022 年 5 月 - NetApp 和 Kindrill 合作加速客户在云端和边缘运算环境中的数位转型。两家公司正在合作设计尖端的储存基础设施即服务解决方案,为非结构化资料带来更高的适应性、价值和灵活性,帮助企业从资料中获得更多收益。 。

- 2022 年 3 月-乐天欧洲银行与银行软体公司 Temenos 合作,在 Temenos 银行云端提供其解决方案。透过此次合作,乐天银行将了解客户体验,加速新产品的开发并进入新市场。其中包括先前建立的 Temenos 支付和帐户金融服务。

- 2022 年 2 月-Credit Europe Bank (CEB) 采用 Red Hat OpenShift 应用程式来摆脱传统的基于 Java 的方法。该应用程式可帮助您更快地处理客户请求。客户不再需要前往分店开设帐户,一切都将透过该平台处理。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- COVID-19 的影响

第五章 市场动态

- 市场驱动因素

- 数位资料量不断增加

- 固态设备的应用日益广泛

- 智慧型手机、笔记型电脑和平板电脑日益普及

- 市场限制

- 云端和基于伺服器的服务缺乏资料安全性

第六章 市场细分

- 按储存系统

- 直接附加储存 (DAS)

- 网路附加储存 (NAS)

- 储存区域网路 (SAN)

- 依储存架构

- 基于檔案物件的储存 (FOBS)

- 区块储存

- 按最终用户产业

- BFSI

- 零售

- 资讯科技和电讯

- 卫生保健

- 媒体与娱乐

- 按国家

- 英国

- 德国

- 其他欧洲国家

第七章 竞争格局

- 公司简介

- Dell Inc.

- Hewlett Packard Enterprise Company

- NetApp Inc.

- Hitachi Ltd.

- IBM Corporation

- Toshiba Corp.

- Pure Storage Inc.

- DataDirect Networks.

- Scality Inc.

- Fujitsu Ltd.

- Netgear Inc.

第八章投资分析

第九章:市场的未来

The Europe Next Generation Storage Market size is estimated at USD 15.14 billion in 2025, and is expected to reach USD 24.72 billion by 2030, at a CAGR of 10.3% during the forecast period (2025-2030).

Key Highlights

- Europen Union is investing and taking quick steps towards the AI and digitalizing the region's businesses. In comparison to 8.9 million ICT professionals in 2021, the EU wants to expand this number to at least 20 million by 2030, according to a report published by The Digital Economy and Society Index (DESI). At least 90% of SMEs in the EU must have a fundamental level of digital intensity by 2030 to meet the Digital Decade goal. By 2030, at least 75% of businesses should be using big data, cloud, and AI technology, and the EU hopes that at least 80% of individuals will have at least basic digital abilities. This growing demand in the IT sector for digitalization will create a need for high storage platforms.

- European Union proposed Data Act, specific regulations for connected devices. There is a lot of typically generated data by connected machines or connected devices, and the EU plans to put such data into productive use to benefit companies and society.

- A vast amount of data is available, and it is increasing. One of the major difficulties in data management is storing this data in various silos. If data is stored somewhere, a third party can access it. This can be avoided by keeping checks on unwanted access by using a variety of security measures, such as encryption and relying on third-party suppliers.

- Covid-19 gave businesses a new direction that firms can adapt and prosper even in challenging conditions. This insight brought a revolution in digitalization. European organizations are making a comeback by automating processes, reducing expenses, improving the ability to identify data dangers, and concentrating on providing the best possible customer experience. In challenging times, cutting-edge technologies and solutions increase revenue and reduce risks.

Europe Next Generation Storage Market Trends

IT and telecom segment is expected to grow at a higher pace.

- In Europe Next Generation Storage Market, It and Telecom segment is expected to show highest growth on the back of increasing Volume of Digital Data will drive the market. European Govt. regulates technology, and organizations in the EU are investing to become more digital. According to EIB's (Europen Investment Bank) Investment Survey (EIBIS), 46% of businesses claimed to have taken steps towards digitalization. A 42.39 million USD agreement between the EIB and Ormazabal will help the Basque industrial company develop its investment strategy for R&D operations in Spain during the subsequent four years.

- France, Germany, the Netherlands, and the UK are Europe's most significant data center markets, showing a high potential for Storage markets in these countries. Foreign players in data security are making investments. Chinese social media company TikTok is looking for a way to expand its European data storage and announced opening data centers in Europe.

- Switzerland bank introduced Alpian App, developed by Temenos, for core banking and payments solutions. The app will quickly assemble banking capabilities and scale them by business demand, enabling it to expand profitably while providing top-notch customer service.

Network Attached Storage (NAS) to Gain significant market share

- Demand for telematic services has grown dramatically, urging users to adopt Network Attached Storage (NAS). The Network Attached Storage (NAS)'s speed, scalability, and security features play a crucial role in supplying the infrastructure and services needed. Almost 45% of IT spending on cloud-based solutions will replace traditional ones by 2024 for business process outsourcing, infrastructure software, application software, and system infrastructure.

- Eurostat's report confirmed that although more than 98% of EU businesses with ten or more employees or collaborators have internet access, 41% use cloud services. This shows a high potential for cloud adaptation in the coming years. Moreover, the usage of cloud services is highest among large companies such as the information and communication industry and professional, technical, and scientific sectors.

- Microsoft announced the rollout of an EU Data Boundary solution for public and commercial customers in the European Union and planned to expand its data centers for its cloud services. Microsoft intends to construct data centers in more than 17 countries in Europe.

- European Union plans to create a computing infrastructure based on RISC-V instruction set architecture, for which it has announced an investment of at least 286 million. The project will target building high-performance computers based on RISC-V hardware and software.

- Google Cloud joined the European partner network, Catena-X Automotive Network Association. Through its data analytics and native integration of advanced AI technologies, and open source efforts, Google will help Catena-X to succeed in its mission to become a data-driven business.

Europe Next Generation Storage Industry Overview

There is intense competition with several providers of Next Generation Storage. The major players include Hitachi, IBM, Dell, Toshiba, Hewett Packard, Netgear, and the list continues. Due to high competency, the market concentration will be low. To keep the competition on, manufacturers enhance products with technologies and invest in mergers and acquisitions to broaden their geographic reach.

- May 2022 - NetApp and Kyndryl partnered to accelerate customers' digital transformation through cloud and edge computing environments. The companies want to assist businesses in getting more value out of their data by co-designing cutting-edge storage infrastructure-as-a-service solutions that would give clients more adaptability, value, and flexibility when using unstructured data.

- March 2022 - Rakuten Europe Bank collaborated with the banking software company Temenos to provide solutions on Temenos Banking Cloud. Through this partnership, the bank will gain knowledge about customer experience, speed up the development of new products, and enter new markets. Earlier created, Temenos Financial Services for Payments and Accounts will be included in this.

- February 2022 - Credit Europe Bank (CEB) adopted to Red Hat OpenShift application to shift from its Java-based legacy approach. This application will help to process customer requests faster. Customers will not have to visit a branch for account opening, and everything will be handled through this platform.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Volume of Digital Data

- 5.1.2 Rising Adoption of Solid-state Devices

- 5.1.3 Increasing Proliferation of Smartphones, Laptops, and Tablets

- 5.2 Market Restraints

- 5.2.1 Lack of Data Security in Cloud- and Server-based Services

6 MARKET SEGMENTATION

- 6.1 Storage System

- 6.1.1 Direct Attached Storage (DAS)

- 6.1.2 Network Attached Storage (NAS)

- 6.1.3 Storage Area Network (SAN)

- 6.2 Storage Architecture

- 6.2.1 File and Object-based Storage (FOBS)

- 6.2.2 Block Storage

- 6.3 End-User Industry

- 6.3.1 BFSI

- 6.3.2 Retail

- 6.3.3 IT and Telecom

- 6.3.4 Healthcare

- 6.3.5 Media and Entertainment

- 6.4 Country

- 6.4.1 United Kingdom

- 6.4.2 Germany

- 6.4.3 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Dell Inc.

- 7.1.2 Hewlett Packard Enterprise Company

- 7.1.3 NetApp Inc.

- 7.1.4 Hitachi Ltd.

- 7.1.5 IBM Corporation

- 7.1.6 Toshiba Corp.

- 7.1.7 Pure Storage Inc.

- 7.1.8 DataDirect Networks.

- 7.1.9 Scality Inc.

- 7.1.10 Fujitsu Ltd.

- 7.1.11 Netgear Inc.