|

市场调查报告书

商品编码

1639505

欧洲合约包装:市场占有率分析、行业趋势和成长预测(2025-2030 年)Europe Contract Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

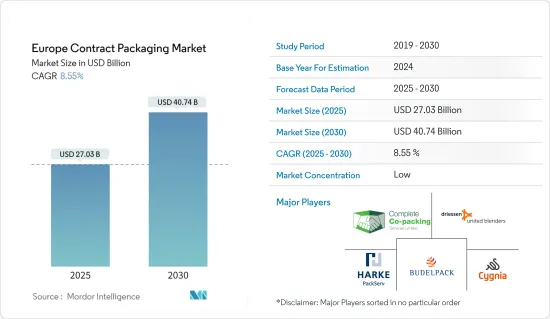

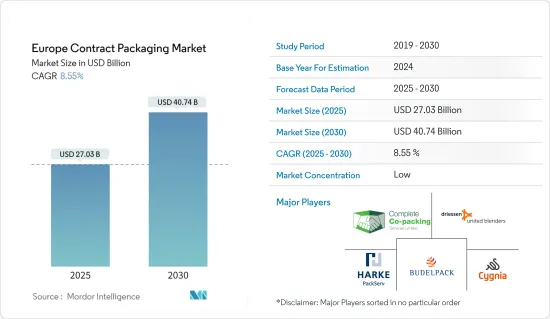

预计2025年欧洲合约包装市场规模为270.3亿美元,预计到2030年将达到407.4亿美元,预测期内(2025-2030年)的复合年增长率为8.55%。

主要亮点

- 有效的产品包装对于实体商品的安全储存和运输至关重要。然而,产品包装需要大量的前期成本和资源配置。因此,为了确保效率和成本效益,製造商常常将产品包装的管理委託给合约包装公司,也称为第三方包装公司。这些公司提供您所需的专业知识和工具以实现最佳包装解决方案。中小企业的崛起,加上合约包装公司提供的优势,预计将推动合约包装市场的成长。

- 此外,电子商务行业的扩张也促进了该地区对三级包装的需求增加,对合约包装业务产生了积极影响。此外,许多国家的可支配收入不断提高、人口不断增长以及政府的商业友好型法规正在推动欧洲各地对各种包装密集型行业的需求,包括製药、消费品、食品和饮料以及电子产品。因此,上述行业的成长预计将对合约包装市场产生积极影响。

- 此外,越来越多的协会和组织正在涌现,以提高所研究市场的知名度。欧洲联合包装协会(ECPA)和合约包装协会就是例子。欧洲约有 1,000 家合约包装供应商,其中 40-50% 是小型企业。根据Pharmapack Europe的调查,2024年製药服务的前景看好:94%的产业相关人员对合约包装的成长持「中等正面」(37%)或「非常正面」(37%)的态度。 「是的「」。

- 消费者对环境问题的认识不断提高以及生产商对经济型包装选择的需求迫使合约包装商采用生态友好的替代品和具有环保意识的包装设计。永续性和客製化可能会继续对合约包装市场产生积极影响。在预测期内,这些趋势可能会对个人护理用品、食品和饮料等消费包装商品产生最大影响。

- 首次采用一项创新可能会很有挑战性,特别是因为它需要大量的资本支出来购买和安装设备。为了应对这些挑战,越来越多的製药公司正在与被称为合约包装组织(CPO)的包装专家建立策略伙伴关係。透过这样做,这些公司无需进行大量的单独投资即可利用最新的包装创新。这些策略联盟正在改变产业的发展轨迹、提高效率并改善患者体验。

- 然而,严格的监管合规要求(尤其是在製药和食品行业)阻碍了市场成长。这些行业受到有关包装材料、标籤和卫生标准的严格规定,迫使企业在品管系统、认证和资源上投入大量资金以满足这些严格的要求。

欧洲合约包装市场的趋势

製药业推动市场成长

- 在欧洲,製药业在研发上的支出不断增加,推动了开发新药的显着成长。这种快速成长越来越依赖欧洲各地合约包装商的支援。根据欧洲製药工业协会联合会(EFPIA)和美国药品研究与工业协会(PhRMA)的资料,2014年至2018年,欧洲医药研发成长率为3.7%。然而,从2019年到2023年,这一年成长率将跃升至6.7%。

- 该地区的製药业正在加速采用技术进步。人们对监控储存和温度条件的智慧包装的认识不断提高,正在推动合约包装服务的创新。此外,感测器技术的进步和物联网 (IoT) 的发展正在透过云端平台为智慧包装提供支援。

- 2023 年,Pharmapack Europe 宣布计划在 2024 年的展会上推出两个新区域。该计划旨在满足对生技药品、mRNA 疗法和合约包装日益增长的需求。此外,为了帮助业界找到理想的合作伙伴并满足不断增长的需求,Pharmapack 将为参展开设专门针对这些解决方案的区域。

- 该市场的多家供应商已经建立了策略伙伴关係。例如,2024年1月,为製药业服务的合约包装组织SteriPack与先进药物输送系统供应商SHL Medical建立了策略合作伙伴关係。该合作伙伴关係将在 SteriPack 位于波兰的工厂建立预先检验的、灵活的最终组装和二次包装服务。该服务支援 SHL 的第二代 Molly 1.0ml 自动注射器平台,并增强了 SteriPack 在欧洲的小容量和中容量产品供应。

英国:预计大幅成长

- 由于製造业活动的增加,英国包装业正在经历显着的成长。此外,电子商务销售额的上升、食品和饮料製造商对环保和可回收包装的需求不断增长、对产品个性化的日益关注以及工业包装行业的扩张预计将推动该国的合约包装市场。被牵引。

- 根据英国国家统计局数据显示,2023年11月,英国网路零售网路零售零售总额的比重达30.7%,低于上月的26.30%。这种增长进一步刺激了该地区对合约包装的需求。

- 为了将自己定位为综合合约解决方案提供商,国内消费包装商品 (CPG) 供应商日益追求垂直整合。该策略包括提供包装解决方案、采购原材料和管理物流。OEM的生产能力受限以及食品製造商数量的增加正促使製造商转向外包。这种转变使得食品公司能够利用食品契约製造提供的附加价值服务(如包装、研究、咨询和仓储)迅速扩张。

- 在英国,药品的合约包装正在迅速多样化,以满足不断变化的消费者偏好。日益增长的环境问题促使製药业采用永续的合约包装解决方案。此外,药品合约包装自动化程度的提高减少了人为错误,从而推动了该国市场的成长。

- 此外,英国政府最高层目前致力于环境保护和永续发展。对于希望避免大量资本支出并专注于创新、永续实践、客户体验和上市速度的 CPG 公司来说,合约包装是效率和效益的成功组合。更有效率的供应链有助于降低成本、减少废弃物、优化生产週期并改善材料和施工。 2023 年 9 月的一份可持续塑胶报告发现,英国线上消费者显然更喜欢可回收或可重复使用的高品质包装,并儘量减少不必要的废弃物。

欧洲合约包装产业概况

欧洲合约包装市场分散,供应商众多。该报告提供了有关市场参与者竞争格局的资讯。主要参与者有Budelpack Poortvliet BV、Cygnia Logistics (Dalepak Ltd)、Complete Co-Packing Services Ltd.等。

- 2024 年 2 月,英国合约包装公司 WePack 在 Packaging Innovations & Empack 2024 上宣布与软体供应商 Nulogy 建立新的合作伙伴关係,以增强其敏捷性和应对力。 WePack 选择 Nulogy 的车间解决方案WePack 与各行各业的品牌合作,包括食品、化妆品、奢侈消费品和农业。该公司提供一系列服务,包括装瓶、小袋和小袋填充、手动组装计划、返工和修改。

- 2023 年 8 月,Miner, Weir & Willis (MWW) 宣布与德国 Konti-Frucht 续约合作,为 Aldi 沙拉进行合约包装。此次合作凸显了 MWW 的行业专业知识、坚定的承诺和卓越的品质标准。该公司建立这项合作关係是为了在业务的各个方面提供更好的质量,并为行业树立新的品质和效率标准。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- 评估微观经济因素对市场的影响

第五章 市场动态

- 市场驱动因素

- 电子商务产业需求增加

- 对尖端技术和创新包装的需求日益增长

- 市场限制

- 严格的政府法规

- 与内部包装衝突

第六章 市场细分

- 按服务

- 初级包装

- 二次包装

- 三级包装

- 按最终用户产业

- 饮料

- 食物

- 药品

- 居家及织物护理

- 美容护理

- 按国家

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 荷兰

- 其他欧洲国家

第七章 竞争格局

- 公司简介

- Budelpack Poortvliet BV

- Cygnia Logistics Ltd(Dalepak Ltd)

- Complete Co-Packing Services Ltd

- Driessen United Blenders BV

- Harke PackServ GmbH

- Kompak Co-Making & Co-Packing

- Marvinpac SA

- NOMI Co-Packing

- Boughey Distribution Ltd

- Total Pack BV

第八章投资分析

第九章:市场的未来

简介目录

Product Code: 50794

The Europe Contract Packaging Market size is estimated at USD 27.03 billion in 2025, and is expected to reach USD 40.74 billion by 2030, at a CAGR of 8.55% during the forecast period (2025-2030).

Key Highlights

- Effective product packaging is essential for the secure storage and transportation of tangible goods. However, product packaging involves significant upfront costs and resource allocation. As a result, manufacturers often rely on contract packaging firms, also called third-party packaging companies, to manage their product packaging, ensuring efficiency and cost-effectiveness. These firms provide the necessary expertise and tools for optimal packaging solutions. The increase in small and medium-sized enterprises, coupled with the benefits offered by contract packaging companies, is expected to drive growth in the contract packaging market.

- The expansion of the e-commerce industry has also contributed to an increase in the need for tertiary packaging in the region, which favors the contract packaging business. Additionally, due to increased disposable incomes, population growth, and business-friendly government regulations in many countries, demand for various packaging-intensive industries, including pharmaceutical, consumer goods, food and beverage, and electronics, is rising across Europe. Thus, the growth of the abovementioned industries is projected to impact the contract packaging market favorably.

- Furthermore, associations and organizations are increasingly emerging to enhance awareness in the market studied. The European Co-Packers Association (ECPA) and the Contract Packaging Association are among a few examples. Europe hosts approximately 1,000 active contract packaging vendors, with 40-50% being small companies. According to Pharmapack Europe, the 2024 outlook for pharma services has been promising: 94% of industry players are either 'moderately positive' (37%) or 'highly positive' (37%) about growth in contract packaging.

- The increasing consumer awareness about environmental concerns, along with producers' demand for economical packaging options, is compelling contract packagers to adopt eco-friendly alternatives and eco-sensitive package designs. Sustainability and customization are likely to continue to positively impact the contract packaging market. These trends are most likely to influence consumer-packaged goods, such as personal care items and food and beverages, over the forecast period.

- Adopting innovations for the first time becomes challenging, particularly due to the significant capital expenditure required for equipment acquisition and installation. To address these challenges, an increasing number of pharmaceutical companies are forming strategic partnerships with expert contract packaging organizations (CPOs). By doing so, these companies are leveraging the latest packaging innovations without substantial individual investments. These strategic alliances are transforming the industry's trajectory, enhancing efficiency, and delivering improved patient experiences.

- However, stringent regulatory compliance requirements, particularly in the pharmaceutical and food industries, are impeding market growth. These industries are subjected to rigorous regulations governing packaging materials, labeling, and hygiene standards, requiring companies to invest heavily in quality control systems, certifications, and resources to meet these stringent requirements.

Europe Contract Packaging Market Trends

Pharmaceutical Industry to Propel Market Growth

- In Europe, increased pharmaceutical spending on research and development (R&D) is driving significant growth in new medicine development. This surge is increasingly relying on support from contract packagers across various European nations. According to data from the European Federation of Pharmaceutical Industries and Associations (EFPIA) and the Pharmaceutical Research and Manufacturers of America (PhRMA), from 2014 to 2018, pharmaceutical R&D in Europe grew at a rate of 3.7%. However, between 2019 and 2023, this annual growth rate surged to 6.7%.

- Pharmaceutical industries in the region are accelerating their adoption of technological advancements. Increasing awareness of smart packaging, which monitors storage and temperature conditions, is driving innovation in contract packaging services. Additionally, advancements in sensor technologies and the development of the Internet of Things (IoT) are enhancing smart packaging through cloud platforms.

- In 2023, Pharmapack Europe announced plans to launch two new zones at its 2024 event. This initiative is aimed at meeting the increasing demand for biologics, mRNA therapeutics, and contract packaging. Additionally, to help the industry find ideal partners and sustain demand growth, Pharmapack is introducing dedicated zones for exhibitors specializing in these solutions.

- Several vendors operating in the market are engaging in strategic partnerships. For instance, in January 2024, SteriPack, a contract packing organization serving the pharmaceutical industry, strategically partnered with SHL Medical, a provider of advanced drug delivery systems. This collaboration establishes a pre-validated, highly flexible final assembly and secondary packing service at SteriPack's facility in Poland. This service will support SHL's second-generation Molly 1.0 ml autoinjector platform, enhancing SteriPack's small to mid-volume offerings in Europe.

The United Kingdom Expected to Witness Significant Growth

- The packaging industry in the United Kingdom has been experiencing significant growth due to increased manufacturing activities. Additionally, rising e-commerce sales, higher demand from food and beverage producers for eco-friendly and recyclable packaging, a growing interest in product personalization, and an expanding industrial packaging sector are driving the country's contract packaging market forward.

- According to the Office of National Statistics (United Kingdom), in November 2023, internet sales as a percentage of total retail sales in Great Britain stood at 30.7%, indicating a significant increase compared with the previous month when online retail sales accounted for 26.30% of total retail sales. The rise further boosts the demand for contract packaging in the region.

- To establish themselves as comprehensive contract solution providers, vendors of consumer-packaged goods (CPG) in the country are increasingly pursuing vertical integration. This strategy includes offering packaging solutions, acquiring raw materials, and managing logistics. Due to constraints in OEMs' manufacturing capacities and the rise in food producers, manufacturers are turning to outsourcing. This shift enables food enterprises to expand rapidly, leveraging the value-added services provided by food contract manufacturers, such as packaging, research, consulting, and warehousing.

- In the United Kingdom, pharmaceutical contract packaging is rapidly embracing diverse methods to meet shifting consumer preferences. Growing environmental concerns are prompting the pharmaceutical industry to adopt sustainable contract packaging solutions. Additionally, the increasing use of automation in pharmaceutical contract packaging is reducing human errors, thereby driving market growth in the country.

- The United Kingdom is also now committed to environmental conservation and sustainable development at the highest levels of government. Contract packaging is a good combination of efficiency and effectiveness for CPG companies aiming to avoid significant capital expenditure and instead focus on innovation, sustainable practices, customer experience, and speed-to-market. Supply chain efficiencies contribute to material and structural improvements such as cost reduction, waste reduction, and production cycle optimization. According to a report by Sustainable Plastics in September 2023, online shoppers across the United Kingdom showed a clear preference for high-quality packaging that is recyclable or reusable while also minimizing unnecessary waste.

Europe Contract Packaging Industry Overview

The contract packaging market in Europe is fragmented due to the presence of many vendors. The report offers information about the competitive environment among players in this market. Major players include Budelpack Poortvliet BV, Cygnia Logistics (Dalepak Ltd), and Complete Co-Packing Services Ltd.

- In February 2024, WePack, a UK-based contract packaging provider, announced a new partnership with software provider Nulogy at Packaging Innovations & Empack 2024 to enhance its agility and responsiveness. WePack opted for Nulogy's Shop Floor Solution. WePack works with brands across the food, cosmetics, high-end consumer goods, and agriculture industries. The firm offers various services, including bottling, sachet and pouch filling, hand assembly projects, rework, and rectification.

- In August 2023, Minor, Weir & Willis (MWW) Ltd announced the renewal of its collaboration with Conti-Frucht in Germany for Aldi Salad contract packaging. This partnership highlighted MWW's industry expertise, unwavering commitment, and superior quality standards. The company initiated this collaboration to offer better quality in all aspects of operations and set new standards for quality and efficiency in the industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of Microeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand from the E-commerce Industry

- 5.1.2 Increasing Need for Latest Technologies and Innovative Packaging

- 5.2 Market Restraints

- 5.2.1 Stringent Government Regulations

- 5.2.2 Competition from In-house Packaging

6 MARKET SEGMENTATION

- 6.1 By Service

- 6.1.1 Primary Packaging

- 6.1.2 Secondary Packaging

- 6.1.3 Tertiary Packaging

- 6.2 By End-user Industry

- 6.2.1 Beverages

- 6.2.2 Food

- 6.2.3 Pharmaceuticals

- 6.2.4 Home and Fabric Care

- 6.2.5 Beauty Care

- 6.3 By Country

- 6.3.1 United Kingdom

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Italy

- 6.3.5 Spain

- 6.3.6 Netherlands

- 6.3.7 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Budelpack Poortvliet BV

- 7.1.2 Cygnia Logistics Ltd (Dalepak Ltd)

- 7.1.3 Complete Co-Packing Services Ltd

- 7.1.4 Driessen United Blenders BV

- 7.1.5 Harke PackServ GmbH

- 7.1.6 Kompak Co-Making & Co-Packing

- 7.1.7 Marvinpac SA

- 7.1.8 NOMI Co-Packing

- 7.1.9 Boughey Distribution Ltd

- 7.1.10 Total Pack BV

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219