|

市场调查报告书

商品编码

1639516

亚太地区 3D 4D 技术 -市场占有率分析、产业趋势与统计、成长预测(2025-2030)Asia Pacific 3D 4D Technology - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

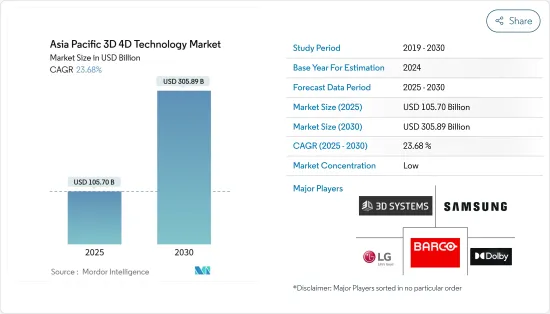

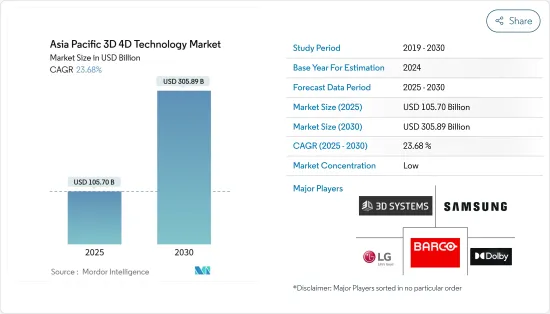

亚太地区3D/4D技术市场规模预估2025年为1,057亿美元,预估2030年将达3,058.9亿美元,预测期间(2025-2030年)复合年增长率为23.68%。

该地区在各行业采用和推进 3D 和 4D 技术方面发挥关键作用。

主要亮点

- 电影、游戏和动画产业正在利用 3D 和 4D 技术来改善用户体验。 3D和4D影像技术在医疗诊断和治疗计划中发挥重要作用。这些技术可以更好地可视化患者的解剖结构,并且在手术和医学研究中很有用。

- 3D技术的不断增加的应用极大地推动了市场的成长。随着3D技术的应用不断扩大,3D相机、软体、印表机、内容创作工具等相关产品和服务的市场预计也会扩大。

- 娱乐产业对 3D 和 4D 技术的需求正在推动市场成长。对电影、电玩游戏和主题乐园景点等娱乐内容的增强和沈浸式体验的需求导致了 3D 和 4D 技术的显着进步。

- 3D列印材料的高成本是限制3D和4D技术市场成长的主要因素,尤其是3D列印领域。材料成本可直接影响各产业采用3D列印技术的可行性与可扩充性。

亚太3D/4D技术市场趋势

3D列印机应用领域预计将占据主要市场占有率

- 3D列印机在边境3D/4D技术市场有许多应用。 3D 列印可为飞机、太空船和车辆生产复杂、轻质的零件。这些组件通常旨在优化性能和燃油效率。

- 医疗产业正受益于 3D 列印的各种应用,包括为手术规划创建特定于患者的解剖模型、自订义肢和植入、牙科设备,甚至在再生医学中列印组织和器官。 3D 列印广泛用于製造牙冠、牙桥和矫正器具。客製化的植入和假体可以根据相同的患者解剖结构进行客製化。

- 3D 列印在教育中用于教授与设计、工程和製造相关的概念。它还可以帮助研究人员创建物理模型来研究复杂的结构。艺术家和雕塑家依靠 3D 列印以新颖的创新方式实现创造性愿景。

- 建筑师使用 3D 列印来创建建筑物和结构的详细比例模型。在建筑行业中,它用于原型製作和创建详细的零件。

- 据SWZD称,到2022年,亚太地区约50%的公司计划在未来两年内实施3D列印技术。

预计中国将占较大市场占有率

- 中国定位为世界製造技术中心。这也延伸到了 3D 列印,该国在开发和采用增材製造技术用于各种应用方面取得了长足的进步。

- 该国已在各领域采用3D列印,包括航太、汽车、医疗和消费品。政府对技术和创新的关注正在鼓励当地工业探索和实施3D列印解决方案。

- 中国政府发起了一项促进技术创新的倡议,包括3D和4D技术。支持这些技术的研究、开发和采用的措施促进了相关产业的成长。中国正在投资3D和4D技术的教育和研究。

- 汽车产业也使用 3D/4D 技术进行设计、原型製作和模拟。随着乘用车产量的增加,对高效设计流程和快速原型製作的需求也在增加。 3D 建模和模拟工具可协助设计具有最佳性能和安全性的车辆。 OICA预计,2022年乘用车销售量约2,356万辆,中国仍是最大市场。

亚太地区3D 4D技术产业概况

亚太地区 3D 4D 技术市场高度细分,主要企业包括 3D Systems Corporation、Dolby Laboratories, Inc、LG Electronics Inc、Barco NV 和 Samsung Electronics。市场参与企业正在采取联盟和收购等策略来加强其产品供应并获得可持续的竞争优势。

2023 年 7 月,3D Systems 宣布 Matrix Moon(专门从事积层製造的培训中心和印度 3D Systems 经销商)购买了一台 EXT 1070 Titan Pellet 3D 列印机。 Matrix Moon 选择的配置包括可选的铣床主轴工具头,可在一台机器上实现混合增材製造和减材增材製造。

2022 年 9 月,Autodesk 发布了 3DS Max 2023.2,这是其 3D 建模和渲染软体的最新更新。此更新新增了一个新的阵列修改器,用于从程式建模到动态图像创建等任务,并包括对倒角操作、网格重新三角化和 glTF 导出的改进。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 对市场的影响

第五章市场洞察

- 市场驱动因素

- 扩大3D技术在各终端用户产业的应用

- 娱乐产业对 3D 技术的需求不断增长

- 加大研发投入,推动高性价比3D技术发展

- 市场限制因素

- 产品相关成本高且 3D 列印材料的可用性

第六章 市场细分

- 按用途

- 电气/电子零件(IC、电晶体、感测器等)

- 3D印表机

- 3D游戏机

- 3D成像

- 3D显示

- 其他的

- 按行业分类

- 医疗保健

- 娱乐和媒体

- 教育

- 政府机构

- 产业

- 消费性电子产品

- 按国家/地区

- 中国

- 日本

- 印度

- 韩国

第七章 竞争格局

- 公司简介

- 3D Systems Corporation

- Dolby Laboratories, Inc.

- LG Electronics Inc.

- Barco NV

- Samsung Electronics Co., Ltd.

- Autodesk, Inc.

- Stratasys, Inc.

- Panasonic Corporation

- Sony Corporation

- Dreamworks Animation SKG, Inc.

第八章投资分析

第9章市场的未来

The Asia Pacific 3D 4D Technology Market size is estimated at USD 105.70 billion in 2025, and is expected to reach USD 305.89 billion by 2030, at a CAGR of 23.68% during the forecast period (2025-2030).

The region has been a significant player in the adoption and advancement of 3D and 4D technology across various industries.

Key Highlights

- The film, gaming, and animation industries have utilized 3D and 4D technology to enhance user experiences. 3D and 4D imaging technologies have played a crucial role in medical diagnosis and treatment planning. These technologies allow for better visualization of patient anatomy and can aid in surgeries and medical research.

- The increasing applications of 3D technology are significantly driving the growth of the market. As the applications of 3D technology continue to expand, the market for related products and services, such as 3D cameras, software, printers, and content creation tools, is expected to grow.

- The entertainment industry's demand for 3D and 4D technology has driven growth in the market. The demand for an enhanced and immersive experience in entertainment content, such as movies, video games, and theme park attractions, has led to significant advancements in 3D and 4D technologies.

- The high costs associated with 3D printing materials have been a significant factor limiting the growth of the 3D and 4D technology market, particularly in the context of 3D printing. The cost of materials can have a direct impact on the feasibility and scalability of adopting 3D printing technologies across various industries.

Asia Pacific 3D 4D Technology Market Trends

3D Printer Application Segment is Expected to Hold Significant Market Share

- 3D printers have many applications within the border 3D and 4D technology market. 3D printing manufactures complex and lightweight components for aircraft, spacecraft, and vehicles. These components are often designed to optimize performance and fuel efficiency.

- The healthcare industry benefits from 3D printing for various applications, including creating patient-specific anatomical models for surgical planning, custom prosthetics and implants, dental devices, and even tissue and organ printing in regenerative medicine. 3D printing is widely used in creating dental crowns, bridges, and orthodontic devices. Customized implants and prosthetics can be tailored to the patient's identical anatomy.

- 3D printing is used in educational settings to teach concepts related to design, engineering, and manufacturing. It also aids researchers in creating physical models for studying complex structures. Artists and sculptors utilize 3D printing to bring their creative vision to life in new and innovative ways.

- Architects use 3D printing to create detailed scale models of buildings and structures. In construction, it's used for prototyping and creating detailed components.

- According to SWZD, in 2022, approximately 50 percent of businesses across the Asia-Pacific region planned to adopt 3D Printing technology within the next two years.

China is Expected to Hold Significant Market Share

- China is positioned as a global manufacturing and technology hub. This extends to 3D printing, where the country has made strides in developing and adopting additive manufacturing technologies for various applications.

- The country has embraced 3D printing across various sectors, including aerospace, automotive, healthcare, and consumer goods. The government's emphasis on technology and innovation has encouraged local industries to explore and implement 3D printing solutions.

- The Chinese government has launched initiatives to promote technological innovation, including 3D and 4D technologies. Policies supporting these technologies' research, development, and adoption have fostered growth in related industries. China has been investing in education and research related to 3D and 4D technologies.

- The automotive industry also utilizes 3D and 4D technologies for design, prototyping, and simulation. As the production of passenger cars increases, there's greater demand for efficient design processes and rapid prototyping. 3D modeling and simulation tools can aid in designing vehicles with optimal performance and safety. According to OICA, with approximately 23.56 million units, China remained the largest market for passenger car sales in 2022.

Asia Pacific 3D 4D Technology Industry Overview

The Asia Pacific 3D 4D technology market is highly fragmented, with the presence of major players like 3D Systems Corporation, Dolby Laboratories, Inc., LG Electronics Inc., Barco N.V., and Samsung Electronics Co., Ltd. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In July 2023, 3D Systems announced that Matrix Moon, an additive manufacturing-focused training center and 3D Systems reseller in India, purchased an EXT 1070 Titan Pellet 3D printer. Matrix Moon has chosen the configuration that includes the optional milling spindle tool head to enable hybrid additive and subtractive manufacturing processes on the same machine.

In September 2022, Autodesk released 3DS Max 2023.2, the latest update to the 3D modeling and rendering software. The update adds a new Array Modifier for tasks ranging from procedural modeling to creating motion graphics and improves chamfer operations, mesh re-triangulation, and glTF export.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Market

5 MARKET INSIGHTS

- 5.1 Market Drivers

- 5.1.1 Increasing Applications of 3D Technology Across Various End-User Industries

- 5.1.2 Increasing Demand for 3D Technology in the Entertainment Industry

- 5.1.3 Increased Investment in R&D to Drive Development of Cost-Effective 3D Technology

- 5.2 Market Restraints

- 5.2.1 High Product Associated Costs and Availability of 3D Printing Materials

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Electrical & Electronic Components (IC, Transistors, Sensors Etc)

- 6.1.2 3D Printer

- 6.1.3 3D Gaming Console

- 6.1.4 3D Imaging

- 6.1.5 3D Displays

- 6.1.6 Other Applications

- 6.2 By Vertical

- 6.2.1 Healthcare

- 6.2.2 Entertainment and Media

- 6.2.3 Education

- 6.2.4 Government

- 6.2.5 Industrial

- 6.2.6 Consumer Electronics

- 6.3 By Country

- 6.3.1 China

- 6.3.2 Japan

- 6.3.3 India

- 6.3.4 South Korea

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 3D Systems Corporation

- 7.1.2 Dolby Laboratories, Inc.

- 7.1.3 LG Electronics Inc.

- 7.1.4 Barco N.V.

- 7.1.5 Samsung Electronics Co., Ltd.

- 7.1.6 Autodesk, Inc.

- 7.1.7 Stratasys, Inc.

- 7.1.8 Panasonic Corporation

- 7.1.9 Sony Corporation

- 7.1.10 Dreamworks Animation SKG, Inc.