|

市场调查报告书

商品编码

1627142

中东和非洲的3D 4D技术:市场占有率分析、产业趋势和成长预测(2025-2030)Middle East and Africa 3D 4D Technology - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

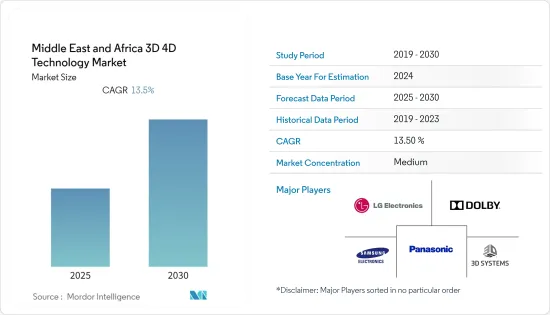

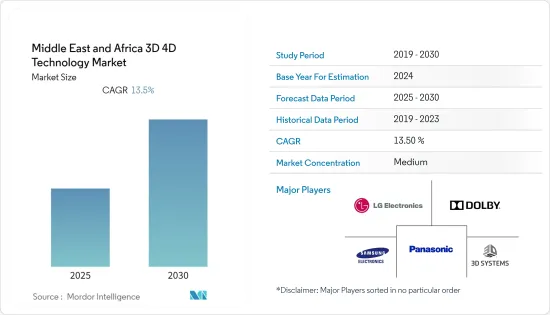

中东和非洲 3D 4D 技术市场预计在预测期内复合年增长率为 13.5%

主要亮点

- 在过去的一年里,研究人员一直在后处理步骤纳入 4D 列印过程本身,扩大使用的材料,包括形状记忆聚合物、液晶合成橡胶和水凝胶。

- 这些材料可用于维护困难的情况,例如在生物医学工程中,可以使用该技术製造支架。透过3D列印列印人体器官和组织已经很普遍,因此先进的医疗保健具有最大的潜在应用前景。

- 3D列印不断与机器人结合,製造机器人零件,製造出可以操作3D列印机的机器人。软机器人技术利用某些软性材料,例如合成橡胶,充当机器人与其环境之间的互动介面。与传统机器人相比,这种柔软的材料可以更温和地与易碎物体相互作用,并能更好地抵抗破坏力。

- 阿联酋政府也积极支持创建先进製造和设计中心。最近推出了倡议,旨在推动阿联酋,特别是杜拜,在 2030 年之前成为 3D 列印技术的领先中心。

- 苏州的大楼是一栋五层多用户住宅,很高。杜拜大楼高 31 英尺,体积达 6,900 平方英尺。它将用于杜拜市政府的行政业务。据杜拜未来基金会称,杜拜还计划到 2025 年 3D 列印 25% 的新建筑。在众多领域中,首当其衝的是建筑业。这预示着 3D 重建的未来成长。

中东和非洲3D 4D技术市场趋势

医疗保健预计将占据很大份额

- 杜拜卫生局正在努力监管和製定医疗保健领域技术的使用标准,预计将重点开发 3D 生物列印牙齿、骨骼、药物、人造器官、手术设备和助听器。预计这将有助于预测期内积极探索的市场的成长。

- 此外,2020 年,杜拜卫生局研发中心的医学专家与 Sinterex O 合作推出了 3D 列印。 DHA 医疗专业人员获得患者特定的解剖模型。工作流程首先从 CT 或 MRI 扫描中撷取患者资料,然后将资料输入医学影像分割软体,以便医生能够隔离感兴趣的特定解剖区域。

- 此外,全膝关节关节重建在该地区的关节手术中很常见,术前计划是实现高精度和成功率的最重要因素。骨科医生通常会进行术前计划,这既昂贵又耗时,而且可用的手段(CT、MRI)很少。为了克服这一障碍,公司正在引入创新的新技术来改善医生的工作流程。

- 2020 年,以色列公司 RSIP Vision 宣布推出基于人工智慧的创新解决方案,用于根据 X 光影像对膝盖进行 3D 重建。该技术为医生提供了每个骨骼的丰富 3D 模型,为手术规划和植入安装提供了关键资料,改善了医生的工作流程,并消除了目前使用的高成本和高辐射方法,从而减少了对手术的需求。医生会收到患者膝盖的准确 3D 解剖模型,从而实现最佳的术前计划和精确的植入对准。

- 该公司正在投资最新的医疗保健技术,这将推动该地区的市场成长。例如,2021 年 11 月,Bypass 筹集了 100 万美元的种子前融资,以扩大其在埃及的健康科技产品。新公司正试图在完全不同的类别中建立自己的声誉,像 Vezeeta、Chefaa 和 Yodawy 这样的公司透过提供远端医疗、诊断和药物而发展壮大。

3D列印机预计将显着成长

- 埃及的医疗产业正受惠于3D列印技术。 Fablab Egypt 等实验室提供公共3D 列印医疗保健服务。还有 Project Nitrous,这是埃及的着名应用,允许残障人士製作自己的义肢。医疗模型和工具由 Amtech 3D 列印埃及公司设计和製造。

- 2021 年 8 月,迪拜水电局的 3D 列印建筑计划据称耗时五年多才完成,现已开业。该研发中心位于杜拜以南 50 公里的穆罕默德·本·拉希德·阿勒马克图姆太阳能园区,预计将拥有四个子实验室,包括专用的电子、软体、机械和原型设计能力。

- 此外,2018 年 2 月,杜拜医疗保健局 (DHA) 和阿拉伯健康展览与大会宣布建立策略伙伴关係,为该地区的医疗专业人员提供对 3D 生物列印未来的更深入的了解。杜拜计划在一个致力于 3D 生物列印的新中心容纳多达 700 家公司,作为其到 2030 年成为全球技术中心的目标的一部分。

- 2021 年 8 月,Pantheon Development Company 是一家豪华住宅、别墅、公寓和顶层公寓开发商,总部位于杜拜 Umm Al Sheikh住宅郊区。该公司通常使用传统的施工方法来建造这些豪华多用户住宅,但据报道,该公司现在正在首次考虑使用 3D 列印。

- 阿拉伯联合大公国正迅速崛起,成为增材领域的领先参与者之一。儘管该地区的小国家不一定提倡有影响力的增材製造 (AM) 硬体系统,但它们已在各个领域采用了该技术,特别是在医疗保健领域。

中东和非洲3D 4D技术产业概况

随着国际参与者的出现和新参与者的进入,中东和非洲 3D 4D 技术市场适度分散。此外,建筑等终端用户产业快速成长,市场竞争加剧,也推动了成长。

- 2021 年 11 月,以色列商业公司 Redefine Meat 将开始向欧洲多家高级餐厅销售 3D 列印的植物来源「肉」。为了「列印」牛排,Redefine Meat 使用 3D 列印机和「墨水」。该公司计划将其印表机和墨盒出售给世界各地的肉类分销商,后者将在生产后列印和分销肉类。

- 2021 年 3 月:Imensa Technology 加入跨国企业 Sandvik 和 BEAMIT Group,巩固其作为中东地区积层製造专家的地位。 Imensa 拥有 30 多名内部积层製造工程师,目前在杜拜、沙迦、科威特、利雅德和达曼开展业务。这种合作以及政府的支持预计将显着促进市场成长。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 消费者议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 技术简介

- 3D技术的趋势

- 4D技术趋势

- 3D/4D技术应用

- 市场驱动因素

- 扩大3D列印在建筑领域的应用

- 研发投资的增加预计将支持市场成长

- 市场限制因素

- 原料成本和可用性

- 地区经济不稳定

- 市场机会

- 3D 技术在医疗保健领域的使用增加

第五章市场区隔

- 按用途

- 电气/电子零件(IC、电晶体、感测器等)

- 3D印表机

- 3D游戏机

- 3D成像

- 3D显示

- 其他用途

- 按最终用户

- 卫生保健

- 娱乐与媒体

- 教育

- 政府机构

- 产业

- 家用电子产品

- 按国家名称

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

第六章 竞争状况

- 公司简介

- 3D Systems Corporation

- Dolby Laboratories, Inc.

- LG Electronics Inc.

- Barco NV

- Samsung Electronics Co., Ltd.

- Autodesk, Inc.

- Stratasys, Inc.

- Panasonic Corporation

- Sony Corporation

- Dreamworks Animation SKG, Inc.

第七章 投资分析

第八章市场的未来

简介目录

Product Code: 50100

The Middle East and Africa 3D 4D Technology Market is expected to register a CAGR of 13.5% during the forecast period.

Key Highlights

- For the past year, researchers have incorporated the post-processing step in the 4D printing process itself, and the materials used are expanded to shape memory polymers, liquid crystal elastomers, and hydrogels.

- These materials can be used in cases where maintenance is difficult, such as in biomedical engineering, where stents can be manufactured using this technology. Advanced healthcare has the maximum application since printing organs and tissues for the human body using 3D printing is already prevalent; hence, much more can be achieved using 4D printing.

- As 3D printing continues to be paired with robots, whether in making parts for them or in creating robots that can operate 3D printers, the next level in soft robotics can be attained with 4D printing. Soft robotics utilize certain soft materials, such as elastomers, which act as the interaction interface between robots and their environment. These soft materials allow for a gentle interaction with fragile objects and allow for a better tolerance toward damaging forces when compared to traditional robotics.

- The UAE government has also been actively supporting the creation of advanced manufacturing and design hubs. An initiative, known as Dubai 3D Printing Strategy, was recently launched to promote the status of the United Arab Emirates, specifically Dubai, as the leading hub of 3D printing technology by the year 2030.

- The Suzhou building, a five-story apartment complex, is taller; the 31-foot-tall Dubai building is larger by volume at 6,900 square feet. Its purpose is a bit less exciting than its construction; it will be used for administrative work by the Dubai Municipality. Also, according to the Dubai Future Foundation, Dubai plans to 3D print 25% of every new building by 2025. Among the many sectors, the initial focus is on the construction sector. This exhibits the growth of 3D reconstruction in the coming future.

MEA 3D 4D Technology Market Trends

Healthcare is Expected to Hold SIgnificant Share

- Dubai Health Authority has committed to regulating and setting the standards of the use of the technology in the healthcare sector and is expected to focus on developing 3D bioprinted teeth, bones, medical, artificial organs and surgical devices, and hearing aids. This is expected to contribute to the growth of the market positively studied over the forecast period.

- Further, in 2020, medical experts from the Dubai Health Authority's Innovation Centre collaborated with Sinterex O to bring 3D printing to the point. It provides medical professionals at DHA with, patient-specific anatomical model, where workflows start with the patient data acquisition from a CT or MRI scan where the data is brought into medical image segmentation software, allowing the physician to isolate the specific anatomical region of interest.

- Furthermore, knee replacement surgeries are common in the region, among other joint surgeries, and the most important factor for achieving high accuracy and success rates is preoperative planning, during which the orthopedic surgeon normally uses expensive, time-consuming, scarcely available modalities (CT, MRI). To overcome the obstacle, players are announcing new innovative technologies to improve the physician workflow.

- In 2020, RSIP Vision, Israel, announced a new innovative AI-based solution for 3D reconstruction of knees from X-ray Images. This technology provides physicians a rich 3D modeling of each bone, which could help in providing critical data for surgery planning and implant fitting, improving physicians' workflow and reducing the need for high-cost and high-radiation currently used methods. Physicians will receive a precise 3D anatomical model of the patient's knee, enabling optimal pre-op planning and precise implant tailoring.

- The companies are investing in the latest healthcare technology, which will drive market growth in the region. For Instance, In November 2021, Bypass raises a pre-seed round of USD1 million to grow its health-tech offering across Egypt. Newer companies are attempting to build names for themselves in wholly different categories as companies like Vezeeta, Chefaa, and Yodawy grow by supplying telemedicine, diagnostics, and pharmaceutical items.

3D printer is Expected to Witness Significant Growth

- The medical sector in Egypt has reaped the benefits of 3D printing technology. Public 3D printing healthcare services are being offered by labs such as Fablab Egypt. Then there's Project Nitrous, which has a remarkable application in Egypt that allows disabled people to build their own prosthetics. Medical models and tools are designed and manufactured by Amtech 3D printing Egypt.

- In August 2021, DEWA's 3D printing construction project has reportedly taken more than five years to complete, but it is now open for business. The R&D Centre, located 50 kilometers south of Dubai in the Mohammed bin Rashid Al Maktoum Solar Park, is believed to have four sub-laboratories, including dedicated electronics, software, mechanics, and prototype capabilities.

- Additionally, the Dubai Health Authority (DHA) and Arab Health Exhibition and Congress, in February 2018, announced a strategic partnership to give the healthcare professionals in the region an insight into the future of 3D bioprinting. Dubai plans to host up to 700 companies in the new center dedicated to 3D bioprinting as part of its aim to become the global hub for technology by 2030.

- In August 2021, Pantheon Development is a luxury home, villa, apartment, and penthouse developer based on the outskirts of Dubai's Umm Al Sheif residential district. Typically, the company uses traditional building methods to create these opulent housing complexes, but it is now reportedly considering employing 3D printing for the first time.

- The United Arab Emirates is quickly rising as one of the strong players in the additive landscape. Though the small country in the region has not necessarily put forward influential additive manufacturing (AM) hardware systems, it has been adopting the technology across a range of sectors (most notably, in the medical field).

MEA 3D 4D Technology Industry Overview

The Middle East and Africa 3D 4D Technology Market is moderately fragmented due to the presence of international players as well as the entry of new players in the market. The growth is further supported by rapidly growing end-user industries such as construction that will further make the market more competitive.

- November 2021: Redefine Meat, an Israeli business, will start selling 3D-printed plant-based "meat" to a few high-end restaurants in Europe. To "print" the steaks, Redefine Meat uses 3D printers and "ink." The company intends to sell the printers and cartridges to meat distributors all across the world, who will print and distribute the Meat after it has been made.

- March 2021: Immensa Technology joined global players Sandvik and the BEAMIT Group to strengthen its position as an additive manufacturing specialist across the Middle East. With more than 30 AM engineers in-house, Immensa currently operates in Dubai and Sharjah, Kuwait, Riyadh, and Dammam. Such collaborations, along with government support, are expected to aid in the growth of the market significantly.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Consumers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technology Snapshot

- 4.4.1 Trends in 3D Technology

- 4.4.2 Trends in 4D Technology

- 4.4.3 Applications of 3D/4D Technology

- 4.5 Market Drivers

- 4.5.1 Increasing Applications of 3D Printing in Construction

- 4.5.2 Increased investment in R&D expected to boost market growth

- 4.6 Market Restraints

- 4.6.1 Costs and availability of Raw Material

- 4.6.2 Economic Instability of The Region

- 4.7 Market Opportunities

- 4.7.1 Increasing usage of 3D Technology in Healthcare

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Electrical & Electronic Components (IC, Transistors, Sensors Etc)

- 5.1.2 3D Printer

- 5.1.3 3D Gaming Console

- 5.1.4 3D Imaging

- 5.1.5 3D Displays

- 5.1.6 Other Applications

- 5.2 End-User

- 5.2.1 Healthcare

- 5.2.2 Entertainment & Media

- 5.2.3 Education

- 5.2.4 Government

- 5.2.5 Industrial

- 5.2.6 Consumer Electronics

- 5.3 Country

- 5.3.1 United Arab Emirates

- 5.3.2 Saudi Arabia

- 5.3.3 South Africa

- 5.3.4 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 3D Systems Corporation

- 6.1.2 Dolby Laboratories, Inc.

- 6.1.3 LG Electronics Inc.

- 6.1.4 Barco N.V.

- 6.1.5 Samsung Electronics Co., Ltd.

- 6.1.6 Autodesk, Inc.

- 6.1.7 Stratasys, Inc.

- 6.1.8 Panasonic Corporation

- 6.1.9 Sony Corporation

- 6.1.10 Dreamworks Animation SKG, Inc.

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219