|

市场调查报告书

商品编码

1639473

3D 和 4D 技术:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)3D & 4D Technology - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

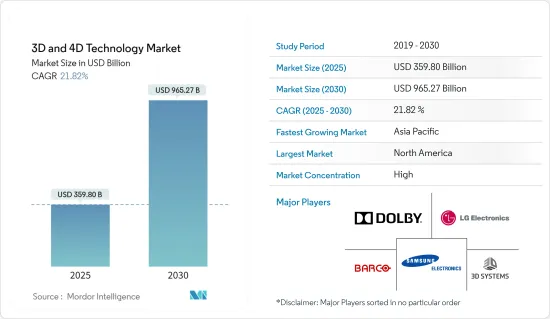

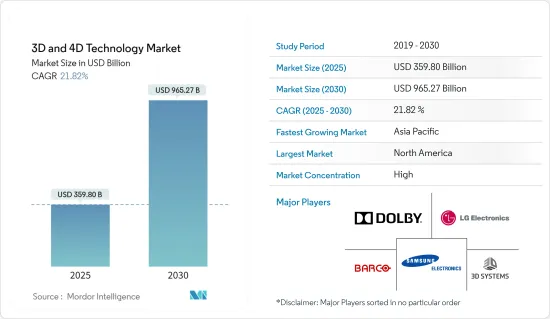

3D 和 4D 技术市场规模预计在 2025 年将达到 3,598 亿美元,预计到 2030 年将达到 9,652.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 21.82%。

3D 和 4D 技术因其先进的视觉效果、动画和图形功能,正在医疗保健、娱乐、教育、製造和汽车等各个行业中迅速普及。 3D和4D技术为手绘动画和物理影响提供了全面的平台。由于其技术优势,3D和4D技术的采用正在加速,这可能会推动市场成长。

主要亮点

- 在预计预测期内,消费性电子产品对 3D 感测器的需求不断增加以及汽车行业对 3D 感测器的采用日益增多将推动市场成长。家庭游戏产业为消费者提供了 3D 感测的首批实际应用之一,其中飞行时间 (ToF) 感测器可捕捉玩家的动作和手势,从而创造新的互动式游戏体验。

- 然而,3D 感应的出现在当今的智慧型手机技术中最为明显。为使用者提供 3D 扫描,透过脸部辨识增强安全性,而为世界提供 3D 感应,为强大的深度感应摄影和扩增实境创造了新的机会。随着对 3D 相机技术的需求不断增长,照明源、LAS 滤光片和人工扩散器的产量预计将飙升。

- 此外,生物识别扫描和其他 3D 感测应用正在重新定义家用电子电器世界。平板电脑和笔记型电脑正在行动装置 AR/VR、运动感应和安全创新方面不断扩展。例如,Microsoft Kinect 的手势姿态辨识功能彻底改变了家庭游戏产业,并扩展到包括多人 3D 位置感应、脸部表情侦测和非接触式心率监测。

- 3D 感测应用程式中已添加脸部辨识,以增强笔记型电脑和行动装置的安全性,并提高数位照片的影像品质和解析度。此外,生物辨识扫描和其他 3D 感测应用正在重新定义消费性电子世界。平板电脑和笔记型电脑正在扩大行动装置中 AR/VR、运动感应和安全性的创新。例如,微软Kinect的手势姿态辨识功能已转变为多人3D位置感应、脸部表情侦测和非接触式心率监测。

- 使用混合材料和技术产品(例如电路基板)的製造至今仍在进行。由于 3D 列印产品是分层製成的,因此它们不如采用射出成型等传统技术製成的零件坚固。製造商现在要求使用 3D 列印机生产的产品具有更大的规模。这项技术何时能彻底改变大规模生产製造方式仍不得而知。即使在今天,3D列印机仍然主要用于一次性原型和小规模列印。因此,与 3D 列印技术相关的成本、可用性和材料问题阻碍了市场的成长。

- 然而,采用 3D 和 4D 技术可能需要大量的前期成本,包括硬体、软体、内容创建和培训。这种成本障碍可能会限制采用,特别是对于预算紧张的小型企业和行业。

3D 和 4D 技术的市场趋势

3D 列印应用在一系列终端用户产业中日益流行

- 3D列印机应用于许多行业,包括教育、航太、医疗保健和非自订原型製作。此外,3D列印技术还可用于开发新的製造流程。市场预计将受益于创新的 3D 和 4D 製鞋技术。该款鞋的 4D 缓衝技术是专为专业运动员和日常运动消费者打造的现代创意。

- 此外,金属基 3D 列印的潜力将使得能够为许多应用製造稀有和已停产的替换零件。维修店可以满足不同的客户群,而线上零售商可以列印独特的零件并透过准时库存方式提供更多产品。

- 汽车行业正在迅速采用 3D 列印来製作新车型的原型。它们也用于航太工业製造备件和替换零件。此外,在医疗保健领域,3D 列印具有广泛的应用,从牙模到义肢,再到复杂手术的 3D 列印模型。它还有望防止 POS 系统和 ATM 上的信用卡诈骗。例如,银行现在正在使用 3D 列印来设计和製造防止信用卡盗刷的 ATM 零件。

- 例如,3D列印机製造商Anycubic最近推出了Anycubic Kobra系列和Anycubic Photon M3系列3D列印机,采用了先进的Anycubic LeviQ自动平整技术和Anycubic LighTurbo矩阵光源。 Kobra Max 3D 列印机的建造体积为 17.7 x 15.7 x 15.7。其建造体积为 45 x 40 x 40 公分(高、宽、长),甚至大型物件都可以轻鬆列印。

- 此外,美国3D 列印机製造商 3D Systems 最近与人工智慧 (AI) 医疗公司 Enhatch伙伴关係,以更有效地设计和交付针对特定患者的医疗设备。两家公司将结合各自的专业知识和技术,合作创建最佳化、自动化和可扩展的医疗设备製造工作流程。

- 根据 Spiceworks 的趋势,IT 自动化技术已成为北美和欧洲组织的首要趋势,其中 45% 的受访者已经在利用这些技术,28% 的受访者计划在未来两年内实施这些技术。 5G技术紧随其后,有42%的受访者目前使用中,有25%的受访者考虑在未来两年内采用5G技术。

预计北美将占据重要市场占有率

- 美国是采用3D和4D技术的先驱之一,预计将占据3D技术市场的大部分份额。此外,导致器官和组织移植的慢性病数量增加以及器官捐赠者数量有限也是推动市场成长的主要因素之一。

- 根据器官采购和移植网络 (OPTN) 的数据,大约有 7,500 人在等待器官移植时死亡。此外,全国还有超过107,501人正在等待器官移植。利用 3D 生物列印技术可以解决器官短缺问题,满足日益增长的移植需求。

- 此外,领先的 1-5 级 ADAS 和 AD 感测技术开发商 LeddarTech 宣布推出用于 ADAS 和自动驾驶研发的感测器资料Leddar PixSet。此资料包含 Leddar Pixell(一种 3D 固态闪光 LiDAR 感测器)的完整波形资料。资料集免费提供给学术和研究目的,预计将促进设备开发并促进市场成长。

- 根据最新消息,布法罗大学的科学家最近开发出一种快速的新型 3D 生物列印方法,这可能是实现完全列印人体器官的重要一步。研究人员开发了一种基于 vat-SLA 的方法,将载细胞水凝胶结构的製造时间从 6 小时缩短到 19 分钟。这种最新的生物製造方法可以创建嵌入式血管网络,标誌着高效创建 3D 列印器官迈出了重要一步。

- 另外,2022年8月,麻省理工学院的一个研究小组宣布,他们已经为轨道航天器生产「第一个数字製造的等离子体感测器」。这种感测器通常称为减速电位分析仪 (RPA),它可以让卫星确定大气的化学成分和离子能量分布。 3D 列印、雷射产生的硬体的性能与最新的无尘室製造的半导体等离子体感测器相当。

3D/4D技术产业概况

目前,全球 3D 和 4D 技术市场由各行业的少数拥有强大技术专长的参与者主导。预计全球市场将呈现整合态势,市场主要企业将透过策略合併和联合倡议扩大海外基本客群,以提高市场占有率和盈利。 3D Systems Corporation、杜比实验室公司、LG Electronics Inc.、Barco NV、三星电子、Autodesk, Inc.、Stratus's, Inc.、Panasonic Corporation和Sony Corporation是当今市场上的一些知名参与者。

2023 年 8 月,荷兰显示器技术公司 Dimenco 被着名的 3D 显示器硬体和内容服务供应商 Leia Inc. 收购。这项策略决策结合了两家 3D 产业参与者的优势,有望加速跨平台和装置采用身临其境型3D 体验。此次合併将使那些寻求基于通用行业标准的单一跨平台解决方案的客户受益。

2023 年 7 月,3D Systems Corporation 表示,在 Stratasys Ltd. 认定 3D Systems 的合併提案更优后,该公司计划立即终止与 Desktop Metal, Inc. 的合併协议。 3D Systems 表示,在 Stratasys 股东反对与 Desktop Metal 合併后,该公司做出了这项决定。 3D Systems 和 Stratasys 之间的合併协议已经完成,目前处于託管状态。 3D Systems 预计 Stratasys 将在不久的将来签署该协议。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素与限制因素简介

- 市场驱动因素

- 扩大3D技术在各终端用户产业的应用

- 娱乐产业对 3D 技术的需求日益增加

- 加大研发投入,加速开发高性价比的3D技术

- 市场限制

- 产品相关成本高,且 3D 列印材料供应不足

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 评估新冠肺炎对市场的影响

第五章 市场区隔

- 按产品

- 3D 感测器

- 3D积体电路

- 3D 电晶体

- 3D 列印机

- 3D 游戏

- 其他产品

- 按最终用户产业

- 卫生保健

- 娱乐与媒体

- 教育

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第六章 竞争格局

- 公司简介

- 3D Systems Corporation

- Dolby Laboratories, Inc.

- LG Electronics Inc.

- Barco NV

- Samsung Electronics Co., Ltd.

- Autodesk, Inc.

- Stratus's, Inc.

- Panasonic Corporation

- Sony Corporation

- Intel Corporation

第七章投资分析

第八章 市场机会与未来趋势

The 3D & 4D Technology Market size is estimated at USD 359.80 billion in 2025, and is expected to reach USD 965.27 billion by 2030, at a CAGR of 21.82% during the forecast period (2025-2030).

3D and 4D technology are swiftly gaining popularity in various industries like healthcare, entertainment, education, manufacturing, automotive, and others due to their advanced visual effects, animations, and graphics capabilities. The 3D and 4D technologies provide a comprehensive platform for hand-drawn animation and physical impact. As a result of their superior technology, the adoption of 3D and 4D technologies has accelerated, which is likely to propel the market's growth.

Key Highlights

- The increasing demand for 3D sensors in consumer electronics and the growing adoption of 3D sensors in the automotive industry is anticipated to drive the market's growth during the forecast period. The home gaming industry offered one of the first practical applications of 3D sensing for consumers, with time of flight (ToF) sensors capturing the movements and gestures of players to create a new interactive gaming experience.

- However, the arrival of 3D sensing is most noticeable in today's smartphone technology. User-facing 3D scanning enhances security through facial recognition while world-facing 3D sensing creates new opportunities for high-performance depth-sensing photography and augmented reality. As the demand for 3D camera technology grows, illumination sources, LAS filters, and engineered diffuser production volumes are expected to soar.

- Further, biometric scanning and other 3D sensing applications are redefining the world of consumer electronics. Tablets and laptops are expanding on mobile devices' AR/VR, motion sensing, and security innovations. For instance, the gesture recognition capabilities of Microsoft Kinect that revolutionized the home gaming industry expanded to multi-player 3D position sensing, facial expression detection, and touchless heart rate monitoring.

- Face recognition functions have been added to 3D sensing applications, enhancing the security of laptop computers and mobile devices while boosting digital photo quality and resolution. Further, biometric scanning and other 3D sensing applications are redefining the world of consumer electronics. Tablets and laptops are expanding on mobile devices' AR/VR, motion sensing, and security innovations. For instance, the gesture recognition capabilities of Microsoft Kinect that transformed the home gaming industry expanded to multi-player 3D position sensing, facial expression detection, and touchless heart rate monitoring.

- Manufacturing with mixed materials or technological products (such as circuit boards) is still in production. 3D printed products are made of layers, which are not as strong as parts produced by conventional techniques, such as injection molding. Manufacturers currently need more in the size of products they can make with 3D printing. The technology's ability to revolutionize mass-production manufacturing is still a long way off. Even today, 3D printers are still largely used for making one-off prototypes or small-scale print runs. Hence, the cost, availability, and material issues associated with 3D printing technologies hinder the market's growth.

- However, implementing 3D and 4D technologies can involve significant upfront costs, including hardware, software, content creation, and training. This cost barrier could limit adoption, especially for smaller businesses or industries with tighter budgets.

3D & 4D Technology Market Trends

Increasing Applications of 3D Printing Across Various End-user Industries

- 3D printers are used in numerous industries, including education, aerospace, healthcare, and non-custom prototyping. Further, 3D printing technology can also be employed to develop new manufacturing processes. The market is anticipated to benefit from innovative 3D and 4D-made shoes. The 4D cushioning in shoes is a contemporary creation for professional athletes and ordinary exercise consumers.

- Further, the potential of metal-based 3D printing would allow for the creation of rare, discontinued replacement parts in numerous applications. Repair shops can handle a variety of clientele, and online retailers can print unique parts, providing more products through a just-in-time inventory approach.

- The automobile industry is rapidly using 3D printing to prototype new car models. It is also used to produce spare and replacement parts in aerospace-related sectors. Further, healthcare has a wide variety of 3D printing applications ranging from molds in dentistry to prosthetics and 3D printed models for complex surgeries. It is promising to prevent card-present fraud in point-of-sale systems and ATMs. For instance, banks are now using 3D printing to design and produce ATM components that contain credit card skimming.

- For instance, Anycubic, a 3D printer manufacturer, recently announced its Anycubic Kobra series and Anycubic Photon M3 series of 3D printers, featuring advanced Anycubic LeviQ auto bed leveling technology and Anycubic LighTurbo matrix light source that provides a radically improved user-friendly experience and enhanced print details. The Kobra Max 3D printer features a build volume of 17.7 x 15.7 x 15.7. / 45 x 40 x 40 cm (HWD), which enables large-scale objects to be printed easily.

- Also, the United States-based 3D printer manufacturer 3D Systems recently entered a partnership with artificial intelligence (AI) medical firm Enhatch to design and deliver patient-specific medical devices more efficiently. The companies will combine their respective expertise and technologies to create an optimized, automated, and scalable workflow for fabricating medical devices through the partnership.

- According to Spiceworks, in North American and European organizations, IT automation technology emerged as the top trend, with 45% of respondents already utilizing it and 28% planning adoption within 2 years. Following closely, 5G technology stood as the second most favored, with 42% currently using it and 25% eyeing adoption within the next 2 years.

North America is Expected to be a Significant Market Share Holding Region

- The United States is one of the pioneers in adopting 3D and 4D technology and is expected to hold a prominent share in the 3D technology market. Furthermore, Growing incidences of chronic illnesses leading to organ and tissue transplants and a limited number of organ donors are among the primary factors driving the market growth.

- According to the Organ Procurement and Transplantation Network (OPTN), about 7500 people die while waiting for an organ transplant. Further, over 107,501 people in the country were waiting for an organ transplant. This shortage could be reduced by using 3D bioprinting to counter the increasing need for transplants.

- Moreover, LeddarTech, a prominent player in Level 1-5 ADAS and AD sensing technology, announced the availability of Leddar PixSet, a sensor dataset for ADAS and autonomous driving research and development. The dataset includes full-waveform data from Leddar Pixell, a 3D solid-state flash LiDAR sensor. The datasets offered free of charge for academic and research purposes are expected to further the device development, thereby driving market growth.

- According to an update, Scientists from the University at Buffalo recently developed a rapid new 3D bioprinting method that could represent a significant step toward fully printed human organs. The researchers developed a vat-SLA-based approach to reduce the time to create cell-laden hydrogel structures from 6 hours to 19 minutes. The updated bio-fabrication method has enabled the production of embedded blood vessel networks, making it a significant step towards efficiently creating 3D-printed organs.

- Also, in August 2022, According to an MIT announcement from a research team, the "first digitally made plasma sensors" for orbiting spacecraft have been produced. The sensors, often referred to as retarding potential analyzers (RPAs), are utilized by satellites to ascertain the atmospheric composition's chemical makeup and ion energy distribution. Hardware that was 3D printed and made using lasers performed on par with modern semiconductor plasma sensors made in a cleanroom.

3D & 4D Technology Industry Overview

The global 3D 4D technology market is currently dominated by a few players in their respective industries with technological expertise. The global market is expected to be consolidated in nature, and the major players with a prominent share in the market are focusing on expanding their customer base across foreign countries by leveraging strategic mergers and collaborative initiatives to increase their market share and profitability. 3D Systems Corporation, Dolby Laboratories, Inc., LG Electronics Inc., Barco N.V., Samsung Electronics Co., Ltd., Autodesk, Inc., Stratus's, Inc., Panasonic Corporation, and Sony Corporation are some of the prominent players present in the current market.

In August 2023, Dimenco, a Netherlands-based player in display technology, was acquired by Leia Inc., a prominent 3D display hardware and content services supplier. This strategic decision combines the strengths of two 3D industry players and is expected to accelerate the widespread adoption of immersive 3D experiences across platforms and devices. This merger might benefit customers looking for a single, cross-platform solution built on a common industry standard.

In July 2023, 3D Systems Corporation stated that the business anticipates an immediate termination of the merger agreement with Desktop Metal, Inc. following Stratasys Ltd.'s decision to consider 3D Systems' merger proposal superior. According to 3D Systems, the decision was made after Stratasys shareholders expressed their opposition to the Desktop Metal merger. A merger agreement between 3D Systems and Stratasys has already been completed; it is now in escrow. 3D Systems anticipates Stratasys to countersign it soon.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Increasing Applications of 3D Technology Across Various End-User Industries

- 4.3.2 Increasing Demand for 3D Technology in the Entertainment Industry

- 4.3.3 Increased Investment in R&D to Drive Development of Cost-Effective 3D Technology

- 4.4 Market Restraints

- 4.4.1 High Product Associated Costs and Availability of 3D Printing Materials

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Assessment of the impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Products

- 5.1.1 3D Sensors

- 5.1.2 3D Integrated Circuits

- 5.1.3 3D Transistors

- 5.1.4 3D Printer

- 5.1.5 3D Gaming

- 5.1.6 Other Products

- 5.2 By End-User Industry

- 5.2.1 Healthcare

- 5.2.2 Entertainment & Media

- 5.2.3 Education

- 5.2.4 Other End-user Industries

- 5.3 By Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia

- 5.3.4 Australia and New Zealand

- 5.3.5 Latin America

- 5.3.6 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 3D Systems Corporation

- 6.1.2 Dolby Laboratories, Inc.

- 6.1.3 LG Electronics Inc.

- 6.1.4 Barco N.V.

- 6.1.5 Samsung Electronics Co., Ltd.

- 6.1.6 Autodesk, Inc.

- 6.1.7 Stratus's, Inc.

- 6.1.8 Panasonic Corporation

- 6.1.9 Sony Corporation

- 6.1.10 Intel Corporation