|

市场调查报告书

商品编码

1640368

拉丁美洲的 3D 4D 技术 -市场占有率分析、行业趋势和统计、成长预测(2025-2030)Latin America 3D 4D Technology - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

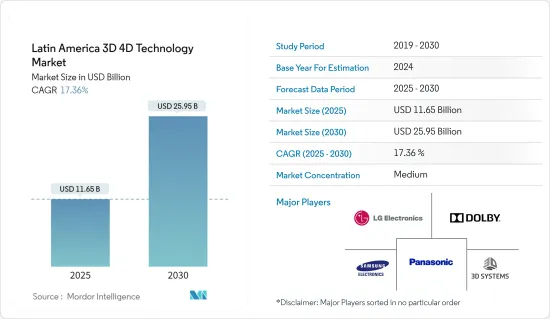

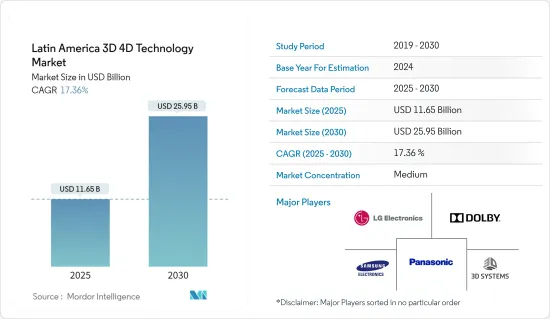

拉丁美洲3D 4D技术市场规模预计到2025年为116.5亿美元,预计到2030年将达到259.5亿美元,预测期内(2025-2030年)复合年增长率为17.36%。

拉丁美洲是一个发展中地区,技术进步的便利性正处于成长阶段。拉丁美洲第一个积层製造联盟成立,旨在加强北美地区的技术、科学和创新合作。

主要亮点

- 随着 3D 和 4D 技术市场的出现和快速成长,拉丁美洲的科技环境正在经历动态和变革性的变化。透过利用3D视觉化原理并添加时间作为第四个维度,这些技术正在彻底改变从製造业、医药到娱乐和教育等产业。

- 此外,在拉丁美洲,3D 和 4D 技术正在被应用于医疗保健、製造和汽车等各个领域。在医学影像、产品开发和其他应用中采用这些技术有可能提高效率和成本效益。

- 此外,预计该地区将加速采用身临其境型娱乐。该地区对 3D 电影、AR 和 VR 设备的接受度不断提高,为相关技术的采用做出了巨大贡献。

- 在3D技术市场中,公司之间的合作日益增多,以进一步开发该技术并促进其广泛使用。 Renato Archer 资讯科技中心和圣保罗大学生物磁实验室等公司合作开发了 InVesalius,这是一种免费的开放原始码3D 医学影像重建技术,可以从 2D DICOM 影像(CT 和 MRI)序列生成 3D 影像。

- 然而,对 3D 和 4D 技术的优势和应用缺乏认识和理解可能会延迟其在各行业的采用。教育和培训计划不足限制了能够有效利用这些技术的熟练劳动力。

- COVID-19 大流行扰乱了供应链,迫使企业转向能够实现远端製造能力的技术,而无需在广阔的地理区域进行投资。此外,大流行还要求公司维护製造零件/物体的资料的数位副本/资产。不管怎样,3D 列印机在这个实验时代代表了一个机会,它可以在需要时利用这些数位设计来製造产品,从而弥补差距。

拉丁美洲3D 4D技术市场趋势

医疗预计将占据重要市场占有率

- 该地区的大多数人口年龄在 15 岁至 64 岁之间,人们越来越关注医疗保健。例如,根据世界银行的报告,该地区约 64% 的人口属于 15-64 岁年龄层。透过利用这个年龄段,我们预计透过强调医疗保健领域的投资和创新来获得动力。

- 例如,巴西正在利用3D列印技术和电脑断层扫描影像以低成本重组头骨碎片。巴西的医生和研发正在使颅骨重组变得负担得起,其中颅骨重组手术的费用高达 5 万美元。

- 此外,阿根廷拉普拉塔国立大学和 CONICET 的研究人员正在开发一种包含第四轴的 3D 生物列印系统。这种新型 3D 列印机可能能够增材製造更复杂的圆柱形、管状或螺旋状网格结构。

- 这项研究是在人类基因组和干细胞研究中心(HUG-CELL)进行的。 Hug-Cell 是一个研究、创新和传播中心 (RIDC),由圣保罗研究基金会 FAPESP 支持,位于圣保罗大学 (USP)。该研究将 3D 生物列印与细胞重编程和多功能细胞扩增等生物工程技术结合。

- 此外,根据国际糖尿病联盟的资料,拉丁美洲与糖尿病相关的医疗费用约为652.8亿美元。此外,预测表明,到 2030 年,这些医疗保健费用预计将增加至 802 亿美元,到 2045 年将增加至 878 亿美元。如此高的医疗支出极大地促进了3D和4D等有效技术在医疗保健中的应用,并促进了市场的成长。

- 此外,3D 和 4D 技术的变革力量预计将超越临床领域。它有潜力透过促进远端医疗、透过互动教育为患者提供支持,甚至利用 3D 列印实现医疗设备的本地製造来缩小医疗保健差距。

巴西可望获得显着的市场占有率

- 该地区在医疗保健等终端用户行业的支出相对较高。例如,巴西政府将于2022年在医疗保健领域投资超过1,360亿雷亚尔(278.1亿美元),其中超过45%,即约621.9亿雷亚尔(127.2亿美元)将用于住院和门诊服务。被分配给.流行病学监测费用约130亿雷亚尔(26.5亿美元),占全国公共卫生预算的9.6%。如此大的支出可以为采用 3D 和 4D 技术等先进医疗技术创造有利环境。

- 此外,参与企业正在透过併购来占领市场业务。比利时软体和 3D 列印服务提供商 Materialise 收购了巴西医疗设备製造商 Engiplan 75% 的股份。透过这项协议,Materialise 将把其医疗 3D 列印专业知识应用到 Engiplan 的装置组合中。两家公司正在加速 3D 列印医疗植入和设备在巴西市场的采用。

- Engiplan 关于医疗设备的决定提供了更多好处,利用 Materialise 的 3D 列印技术,可以创建高度客製化的植入,满足不同患者的个别解剖需求。

- 此外,游戏是巴西最受欢迎的领域之一。例如,根据 DataReportal 的一项研究,截至 2022 年第三季度,在巴西,88.4% 的网路用户表示他们在某些装置上玩视讯游戏。 77.9% 的参与者最喜欢智慧型手机上的游戏。使用者对游戏的高度参与凸显了 3D 和 4D 技术等创新技术对于吸引游戏玩家的注意力并促进市场成长的重要性。

- 此外,巴西娱乐业预计将迎来3D和4D技术融合的变革浪潮。身临其境型体验、虚拟实境 (VR) 和扩增实境(AR) 可以重新定义受众与内容的互动方式。该行业可能会探索新的创意和娱乐形式,无论是引人入胜的 3D 电影还是体验式 VR 游戏,从而推动未来几年的市场成长。

拉丁美洲3D 4D技术产业概况

拉丁美洲 3D 4D 技术市场需要透过国际参与企业的存在和扩张倡议变得更加凝聚力。随着技术变得更加强大和更具成本效益,市场预计将变得更具竞争力。该市场包括 3D Systems Corporation、杜比实验室公司、LG 电子公司、三星电子公司和松下公司等主要企业。

我们宣布,2023 年 6 月,该地区着名的增值分销商 (VAD) CompuSoluciones 将与 3D 空间资料公司 Matterport, Inc. 合作,成为 Matterport数位双胞胎技术在墨西哥和哥伦比亚的主要分销商。这代表着 Matterport 在拉丁美洲的足迹的显着扩张。透过将 Matterport 纳入其产品中,CompuSoluciones 将能够满足该地区快速扩大的 3D数位双胞胎需求。

- 2022 年 11 月,法国 3D 产品软体供应商达梭系统与 IT 服务公司 DXC Technology 建立策略伙伴关係关係,推动巴西和拉丁美洲的工业创新和数位转型。该协议将使两家公司能够利用达梭系统的 3D 设计工具和产品生命週期管理解决方案 3DExperience 平台,扩大和利用其在多个国家的业务。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 消费者议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 3D 列印最终用户应用的增加

- 研发投资的增加预计将推动市场成长

- 市场限制因素

- 产品相关成本高且 3D 列印材料的可得性

- 地区经济不稳定

第六章 市场细分

- 产品

- 3D感测器

- 3D积体电路

- 3D电晶体

- 3D印表机

- 3D游戏

- 其他的

- 最终用户产业

- 医疗保健

- 娱乐和媒体

- 教育

- 其他的

- 国家名称

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲

第七章 竞争格局

- 公司简介

- 3D Systems Corporation

- Dolby Laboratories, Inc.

- LG Electronics Inc.

- Barco NV

- Samsung Electronics Co., Ltd.

- Autodesk, Inc.

- Stratasys, Inc.

- Panasonic Corporation

- Sony Corporation

- Nimble Giant Entertainment, SA

第八章投资分析

第9章市场的未来

The Latin America 3D 4D Technology Market size is estimated at USD 11.65 billion in 2025, and is expected to reach USD 25.95 billion by 2030, at a CAGR of 17.36% during the forecast period (2025-2030).

Latin America is a developing region where the ease of technological advancement is in a growing phase. The first additive manufacturing consortium was created in Latin America to enhance its north-central region's technological, scientific, and innovation cooperation.

Key Highlights

- The Latin America region is experiencing a dynamic and transformative shift in its technological landscape, with the emergence and rapid growth of the 3D and 4D technology market. These technologies are revolutionizing industries across the spectrum, from manufacturing and healthcare to entertainment and education, leveraging the principles of three-dimensional visualization and adding time as a fourth dimension.

- Moreover, several sectors in the Latin America region, like healthcare, manufacturing, and automotive, significantly embrace 3D and 4D technology for various uses. The efficiency and cost-effectiveness of these technologies may be increased by employing them for medical imaging, product development, and other applications.

- Additionally, the region is expected to experience an upsurge in the prevalence of immersive entertainment. The growing acceptance of 3D movies, AR, and VR devices in the region would have contributed significantly to adopting related technology.

- Players are increasingly collaborating in the 3D technology market to develop the technology further and boost its adoption. Companies, such as Renato Archer Information Technology Center and Biomagnetism Laboratory at the University of Sao Paulo, in partnership, have developed a free open source 3D medical imaging reconstruction- InVesalius that generates a 3D image from a sequence of 2D DICOM images (CT or MRI).

- However, a lack of awareness and understanding of the benefits and applications of 3D and 4D technologies could delay adoption across industries. Insufficient education and training programs limit the skilled workforce to leverage these technologies effectively.

- The disruption caused in the supply chain during the COVID-19 pandemic has forced companies to look at technologies that allow for remote manufacturing capabilities without the need for investment in large areas. Furthermore, the pandemic has created the need for companies to maintain digital copies/assets relating to data to manufacture a component/object. In any case, the 3D printer bridges the gap by utilizing these digital designs to produce products when required, thus providing opportunities in these testing times.

Latin America 3D 4D Technology Market Trends

Healthcare is Expected to Hold Prominent Market Share

- The region has most of its population within the age group of 15-64, increasing the emphasis on healthcare. For example, the World Bank reported that approximately 64% of the region's population falls under the 15-64 years category. As a result of capitalizing on the age group, it is expected to gain momentum by looking at the investments and innovations taking place in the healthcare sector.

- For instance, Brazil works with 3D-printing technology and CT-scanned imagery to reconstruct skull fragments at a lower cost. Doctors and researchers in Brazil develop affordable cranial reconstruction, which can cost up to USD 50,000 for cranial reconstruction surgery.

- Additionally, researchers from the National University of La Plata and CONICET in Argentina are developing a 3D bioprinting system incorporating the 4th axis. This new 3D printer will likely enable the additive manufacturing of more complex cylindrical, tubular, or helical mesh structures.

- This study was conducted at the Human Genome and Stem Cell Research Center (HUG-CELL). Hug-Cell is a research, innovation, and dissemination center (RIDC) backed by the FAPESP, Sao Paulo Research Foundation, and is housed at the University of Sao Paulo (USP). The study incorporated 3D bioprinting with bioengineering techniques, such as cell reprogramming and the expansion of pluripotent stem cells.

- Further, according to data from the International Diabetes Federation, diabetes-related medical costs in Latin America were about USD 65.28 billion. In addition, according to forecasts, these costs are anticipated to increase to USD 80.20 billion by 2030 and USD 87.80 billion by 2045. Such significant health expenditures could considerably favor utilizing effective technologies like 3D and 4D in healthcare, thereby driving market growth.

- Also, the transformative power of 3D and 4D technologies is anticipated to extend beyond the clinical realm. They might hold the potential to bridge healthcare disparities by facilitating telemedicine, empowering patients through interactive education, and even enabling localized production of medical devices using 3D printing.

Brazil is Expected to Witness Significant Market Share

- The region has a comparatively high expenditure in end-user industries such as Healthcare. For instance, the Brazilian government invested more than BRL 136 billion (USD 27.81 billion) in Healthcare in 2022, of which more than 45 percent, or around BRL 62.19 billion (USD 12.72 billion), was allocated to inpatient and outpatient services. Epidemiological monitoring accounted for around BRL 13 billion (USD 2.65 billion), or 9.6% of the country's public health budget. Such significant expenditures can serve as a conducive environment for adopting advanced medical technologies like 3D and 4D technologies,

- Furthermore, players are engaging in mergers to gain market business. Belgian software and 3D printing service provider Materialise acquired a 75% stake in Engimplan, a Brazil-based medical device manufacturer. Materialise will apply its medical 3D printing expertise to Engimplan's device portfolio in this agreement. Both companies will accelerate the introduction of 3D-printed medical implants and instruments in the Brazilian market.

- Engimplan's decision on medical devices will provide additional advantages and enable the creation of highly customized implants that can accommodate the various patients' individual anatomical needs by utilizing 3D printing technology from Materialise.

- Further, gaming is one of the most prevalent sectors in Brazil. For instance, in Brazil, 88.4% of internet users reported playing video games on any device as of the third quarter of 2022, according to a DataReportal Survey. Among 77.9% of the participants, smartphone gaming was the most preferred choice. Such significant user engagement in gaming emphasizes the importance of innovation like 3D and 4D technologies to capture the attention of gamers and increase market growth.

- Furthermore, the entertainment industry in Brazil is expected to witness a transformative wave with the integration of 3D and 4D technologies. Immersive experiences, virtual reality (VR), and augmented reality (AR) can redefine the audience's engagement with content. The industry might explore new forms of creativity and entertainment, whether an engaging 3D film or a hands-on VR game, thereby driving market growth in the coming years.

Latin America 3D 4D Technology Industry Overview

The 3D 4D technology market in Latin America needs to be more cohesive owing to the presence and expansion initiatives of international players. The market is expected to become competitive as the technology becomes more robust and cost-effective. A few prominent players in the market include 3D Systems Corporation, Dolby Laboratories, Inc., LG Electronics Inc., Samsung Electronics Co., Ltd., and Panasonic Corporation.

In June 2023, CompuSoluciones, a prominent value-added distributor (VAD) of technology in the region, announced a partnership with Matterport, Inc., a 3D spatial data company, to become a key distributor of Matterport's digital twin technologies in Mexico and Colombia. This signifies a substantial expansion of Matterport, Inc.'s footprint in Latin America. CompuSoluciones will be able to satisfy the region's rapidly expanding need for 3D digital twins by including Matterport in its offering.

- In November 2022, a strategic partnership was launched between Dassault Systemes, a France-based 3D product-based software provider, and DXC Technology, an IT services firm, to promote industrial innovation and digital transformation in Brazil and Latin America. The agreement will allow both businesses to utilize the 3D EXPERIENCE platform, a 3D design tool and product lifecycle management solution from Dassault Systemes, to grow and leverage their presence in several nations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Consumers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing End-User Applications of 3D Printing

- 5.1.2 Increased Investment in R&D Expected to Boost Market Growth

- 5.2 Market Restraints

- 5.2.1 High Product Associated Costs and Availability of 3D Printing Materials

- 5.2.2 Economic Instability of the Region

6 MARKET SEGMENTATION

- 6.1 Products

- 6.1.1 3D Sensors

- 6.1.2 3D Integrated Circuits

- 6.1.3 3D Transistors

- 6.1.4 3D Printer

- 6.1.5 3D Gaming

- 6.1.6 Other Products

- 6.2 End-user Industry

- 6.2.1 Healthcare

- 6.2.2 Entertainment and Media

- 6.2.3 Education

- 6.2.4 Other End-user Industries

- 6.3 Country

- 6.3.1 Brazil

- 6.3.2 Argentina

- 6.3.3 Mexico

- 6.3.4 Rest of Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 3D Systems Corporation

- 7.1.2 Dolby Laboratories, Inc.

- 7.1.3 LG Electronics Inc.

- 7.1.4 Barco N.V.

- 7.1.5 Samsung Electronics Co., Ltd.

- 7.1.6 Autodesk, Inc.

- 7.1.7 Stratasys, Inc.

- 7.1.8 Panasonic Corporation

- 7.1.9 Sony Corporation

- 7.1.10 Nimble Giant Entertainment, SA