|

市场调查报告书

商品编码

1637743

北美 3D 4D 技术:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)North America 3D 4D Technology - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

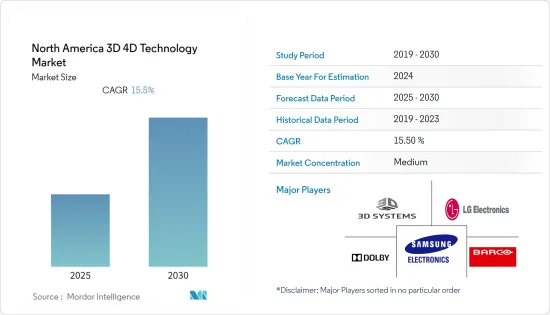

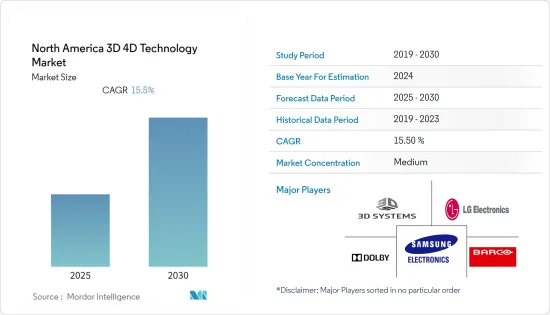

预计预测期内北美 3D 和 4D 技术市场复合年增长率将达到 15.5%。

主要亮点

- 疫情推动了企业对 3D 列印的需求,以协助中断的供应链,企业为长期改善列印产品的类型和范围而采取的倡议,以及企业为开拓数位库存而采取的倡议。 3D列印市场成长的因素。从长远来看,企业必须采取新的策略并做出重大调整,以确保未来的疫情不会重复我们目前面临的情况。因此,3D列印已成为企业数位化工作的重要组成部分,预计未来这一趋势将会加速。

- 北美拥有 Autodesk Inc. 和 PhotoModeler Technologies 等市场领导的强大影响力,帮助该地区主导全球市场。在医疗保健领域,随着健康问题的增多,研究人员和参与者不断发展膜蛋白的发现,透过3D重建和解剖部位的新理论进行发明。

- 同样,4D列印技术的进步正在推动医疗领域的技术发展。例如,医生正在使用 4D 列印将可自我变形的部件放入患者体内,从而最大限度地减少手术。新冠疫情导緻美国新住院病例率下降了50%。

- 具有3D、4D影片和互动效果的逼真电影在娱乐领域越来越受欢迎。 3D 动画和电脑图形技术的最新进展使得 3D 成为特效的行业标准。近年来,3D动画在电影中的受欢迎程度已经超越了实体产品和手绘动画。视觉效果(VFX)也常用于电影中,创造出更逼真的场景。电影院越来越多地采用 4D 技术来提供身临其境、多感官的电影体验。

- 3D/4D感测器和摄影机等3D/4D影像设备容易受到灰尘、颗粒和杂质的影响。因此,这些设备需要特别小心,而 3D 和 4D 的成本取决于影像的大小和复杂性,这可能会对市场成长构成挑战。

- 美国国防部表示,新冠肺炎疫情正在影响许多国防部合约的成本、进度和绩效,这种影响超出了承包商的控制范围。美国空军和美国陆军一直在投资 4D 列印技术,主要是为了加强其基础设施,同时确立美国空中力量作为这一行业的主要参与者的地位,因此 COVID-19 疫情的爆发使得这一点成为预测对该地区4D列印的发展产生影响。

北美 3D/4D 技术市场趋势

医疗保健可望占据重要市场占有率

- 医疗领域技术融合的不断加强以及製造业的成长预计将推动 3D 重建需求的大幅成长。此外,空间感知领域的参与者及其在媒体和电影中的应用的新发明正在阻碍 3D 重建的盈利的成长。最终用户愿意为升级服务支付高价,这推动了市场的发展,从而支撑了最初的采用率。

- 光是在美国,每年就有近 20 万例截肢手术,义肢矫正器具估计为 5,000 至 5 万美元。 AM 技术常用于製造完美贴合使用者身体结构的患者专用义肢零件。由于 AM 可以利用多种材料创建复杂的形状,因此它现在被应用于与患者接触的义肢和矫正器具部件。

- 导致器官和组织移植的慢性病增加以及器官捐赠者数量有限是推动市场成长的主要因素之一。据美国食品药物管理局(US FDA)称,3D列印机已被用于製造可适应患者独特体形和解剖要求的医疗设备和手术设备。专门的手术设备使医生能够更有效、更有效率地治疗患者的个人需求。

- 此外,美国医疗设备扩张的机会来自于目前正在进行的一些关键政策和活动。例如,北美放射学会(RSNA)推出了3D 列印特别兴趣小组(SIG)。该组织推出多个跨不同领域的委员会,支持以放射学为中心、以医院为基础的照护现场3D 列印,以影响更多患者。委员会包括义肢和矫正器具、整形外科、监管和合规、模拟等。

3D 列印机是市场驱动力之一

- 3D列印机广泛应用于各行各业,包括航太、医疗、教育和非自订原型製作。商业部门和联邦政府都支持使用这些 3D 列印机。美国国家科学基金会为美国国防部、国立卫生研究院和美国国家航空暨太空总署等任务机构提供基础和应用研究、开发和发展的资金。

- 国家增材製造创新研究所(又称美国製造)是美国製造业倡议的领导机构,该计划为增材製造提供了大量联邦资金。此次产学官合作旨在「加速美国采用增材製造技术并增强美国製造业的竞争力」。近年来,公共和私营部门已向3D列印相关企业和研发投入了数亿美元。

- 医学研究或复杂手术中出现的特别具有挑战性的病例可以从 3D 列印中受益。中国和美国的研究人员正在 3D 列印危险肿瘤的模型,以帮助发现新的抗癌药物,并更好地了解肿瘤如何发展、生长和扩散。 「生物列印的癌症模型甚至可以近似真实肿瘤的 3D 异质性。

- 与其他製造技术相比,3D 列印的不同之处在于生产时间和成本与产品的复杂性无关。相反,设备上沉淀的材料重量决定了前置作业时间。因此,原型和成品的生产时间具有高度可预测性。 3D列印消除了製造复杂电气设备(尤其是多层PCB)时蚀刻、冲压、钻孔和精加工等重复操作。采用正确的积层製造和工艺,可以比传统技术在更短的时间内列印出功能齐全的基板。

北美3D 4D技术产业概况

北美因在 3D/4D 技术研发方面投入了大量新投资而引领市场,因此市场相当分散。该技术的主要市场参与企业包括杜比实验室公司、Sony Corporation、Panasonic Corporation、3D 系统和 Stratasys 公司。

- 2022 年 11 月-3D Systems Corporation 和 ALM 宣布已建立伙伴关係,以扩大对业界领先的 3D 列印材料的使用。透过此次伙伴关係,ALM 将把3D Systems 的DuraForm PAx 材料添加到其产品组合中,为客户提供专门为与现有选择性雷射烧结(SLS) 技术配合使用而设计的独特共聚物。的采用并推动製造过程中的添加剂。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 消费者议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 技术简介

- 3D 技术趋势

- 4D 技术趋势

- 3D/4D技术的应用

第六章 市场动态

- 市场驱动因素

- 扩大3D列印的应用范围

- 预计增加研发投入将推动市场成长

- 市场限制

- 产品相关成本高,且 3D 列印材料可得性

- 缺乏 3D 内容

- 市场机会

- 4D技术的进步

- 3D 技术在医疗保健领域的应用日益广泛

- 自动立体显示器在 3D 广告中的应用日益广泛

第七章 市场区隔

- 按应用

- 电气和电子元件(积体电路、电晶体、感测器等)

- 3D 列印机

- 3D游戏机

- 3D 成像

- 3D 显示

- 其他用途

- 按行业

- 卫生保健

- 娱乐与媒体

- 教育

- 政府

- 产业

- 消费性电子产品

- 按国家

- 美国

- 加拿大

8. 北美 3D/4D 技术-供应商市场占有率分析

第九章 竞争格局

- 公司简介

- 3D Systems Corporation

- Dolby Laboratories, Inc.

- LG Electronics Inc.

- Barco NV

- Samsung Electronics Co., Ltd.

- Autodesk, Inc.

- Stratasys, Inc.

- Panasonic Corporation

- Sony Corporation

- Dreamworks Animation SKG, Inc.

第十章 投资分析

第 11 章:投资分析市场的未来

简介目录

Product Code: 46625

The North America 3D 4D Technology Market is expected to register a CAGR of 15.5% during the forecast period.

Key Highlights

- The necessity for 3D printing to aid the disrupted supply chain, firms' moves to improve the variety and range of products to be printed in the long term, and companies' moves toward developing a digital inventory are all factors that will drive the post-COVID-19 3D printing market growth. In a long time, businesses will have to adopt new strategies and make dramatic adjustments to ensure that they do not find themselves in a scenario similar to what they are currently facing due to a future pandemic. As a result, 3D printing is an essential aspect of enterprises' digitalization initiatives, which are expected to speed up in the future.

- The strong presence of market leaders, such as Autodesk Inc. and PhotoModeler Technologies in North America, gave the region a dominant position in the global market. In the healthcare segment, with the increasing health issues, researchers and players continuously develop discoveries in the membrane protein, with inventions through 3D reconstruction and new theories in the anatomy part.

- Similarly, the technological advancements in 4D printing are resulting in the development of technologies in the medical sector. For instance, doctors use 4D printing to minimize surgery procedures to place self-transforming components into the patient's body. Owing to the COVID-19 outbreak, the rate of new hospitalizations declined by 50% in the United States.

- Realistic movies with 3D and 4D motion images and interactive effects are increasingly popular in the entertainment sector. With recent advancements in 3D animation and computer-based graphics, 3D has become the industry standard for special effects. In recent years, 3D animation in films has surpassed both physical products and hand-drawn animation in terms of popularity. Visual effects (VFX) are also commonly utilized in films to create a more realistic setting. Movies increasingly employ 4D technology to provide an immersive, multi-sensory cinematic experience.

- 3D and 4D imaging devices, such as 3D and 4D sensors and cameras, are sensitive to dust, microparticles, and impurities. A slight disturbance affects the quality of the image; hence, these devices require special care, and the 3D and 4D costs depend on the size and complexity of the image, which might challenge the market growth.

- According to the US Department of Defence, the outbreak of COVID-19 is affected the cost, schedule, and performance of many DoD contracts, and such impact is beyond the contractor's control. As the USAF and the US military are investing in 4D printing technology, mainly to bolster infrastructure, while establishing American airpower as a prominent player in the industry, the COVID-19 outbreak is projected to impact the development of 4D printing in the region.

North America 3D 4D Technology Market Trends

Healthcare is Expected to Hold Prominent Market Share

- With the increasing technology integration in the medical field and the growing manufacturing industry, the demand for 3D reconstruction is expected to increase significantly. Furthermore, with new inventions in the field of spatial recognition by the players, and the application usage in media and films, 3D reconstruction inhibits profitable growth. The market is supported by end-users ready to pay premium prices for upgraded services, which support the initial adoption rate.

- It is expected that in the United States alone, close to 200,000 amputations are performed each year, with prosthetics priced from USD 5,000-USD 50,000; replacement or alterations can be time-consuming and expensive. AM technology is regularly used to produce patient-specific components of prosthetics that match perfectly with the user's anatomy. The ability to produce complex geometries from various materials has resulted in AM being adapted at the locations where prosthetics are in contact with a patient.

- Growing incidences of chronic illnesses leading to organ and tissue transplants and the limited number of organ donors are some of the primary factors driving the market growth. According to the US Food and Drug Administration (US FDA), 3D printers are already being relied on to manufacture medical equipment and surgical devices that match a patient's unique body type or anatomical requirements. The specialized surgical equipment enables doctors to treat the individual needs of their patients more effectively and efficiently.

- Moreover, US medical device expansion opportunities come from specific key ongoing policies and activities. For example, the Radiological Society of North America (RSNA) launched the 3D Printing Special Interest Group (SIG). It had set up several committees to work in different areas to support radiology-centered, hospital-based, point-of-care 3D printing to impact more patients. The rooms include prosthetics, anaplastology, regulatory and compliance, and simulations.

3D Printer is One of the Factor Driving the Market

- 3D printers are utilized in a wide range of industries, including aerospace, health, education, and non-custom prototyping. Both the commercial sector and the federal government have backed these 3D printing uses. The National Science Foundation has provided financing for basic and applied research and research and development from mission organizations such as the Department of Defense, the National Institutes of Health, and the National Aeronautics and Space Administration.

- The National Additive Manufacturing Innovation Institute (also known as America Makes) is the flagship institute of the Manufacturing USA initiative and has provided substantial federal funding for additive manufacturing. This collaboration between industry, academia, and the government aims to "[accelerate] the adoption of additive manufacturing technology in the United States to boost American manufacturing competitiveness." Hundreds of millions of dollars have been invested in both public and private 3D printing-related firms and research and development in recent years.

- Medical research and the outcomes of complex operations and particularly difficult cases can benefit from 3D printing. Both Chinese and American researchers have 3D-printed models of dangerous tumors to aid in the discovery of novel anti-cancer medications and better understand how tumors develop, grow, and spread. "Bioprinted cancer models can even approximate the 3D heterogeneity of real tumors.

- In comparison to other manufacturing techniques, 3D printing is unusual in that the time and expenses involved in fabrication are independent of the complexity of the product. Instead, the weight of the materials being deposited in the device determines the lead time. As a result, prototype and completed product fabrication timeframes are extremely predictable. 3D printing reduces repetitive etching, pressing, drilling, and finishing operations during the production of complicated electrical devices, notably multilayer PCBs. A fully working board can be printed in less time than a traditional technique with the correct additive manufacturing technology and process.

North America 3D 4D Technology Industry Overview

North America is the leading market as it has many new investments in the research and development of 3D/4D technology and therefore is a moderately fragmented market. The key market participants of this technology are Dolby Laboratories Inc., Sony Corporation, Panasonic Corporation, 3D Systems, and Stratasys Inc.

- November 2022 - 3D Systems Corporation & ALM announced they have entered into a partnership to expand access to industry-leading 3D printing materials. With this partnership, ALM will add 3D Systems' DuraForm PAx material to its portfolio, providing its customers access to a unique copolymer designed explicitly for use with available Selective Laser Sintering (SLS) technologies to accelerate materials adoption, and drive additive in the manufacturing industry growth.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Consumers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 Technology Snapshot

- 5.1 Trends in 3D Technology

- 5.2 Trends in 4D Technology

- 5.3 Applications of 3D/4D Technology

6 MARKET DYNAMICS

- 6.1 Market Drivers

- 6.1.1 Increasing applications of 3D printing

- 6.1.2 Increased investment in R&D expected to boost market growth

- 6.2 Market Restraints

- 6.2.1 High Product Associated Costs and availability of 3D printing materials

- 6.2.2 Lack of 3D Content

- 6.3 Market Opportunities

- 6.3.1 Growing advancement in 4D Technology

- 6.3.2 Increasing usage of 3D Technology in Healthcare

- 6.3.3 Increasing adoption of auto stereoscopic display in 3D advertising

7 MARKET SEGMENTATION

- 7.1 By Application

- 7.1.1 Electrical & Electronic Components (IC, Transistors, Sensors Etc)

- 7.1.2 3D Printer

- 7.1.3 3D Gaming Console

- 7.1.4 3D Imaging

- 7.1.5 3D Displays

- 7.1.6 Other Applications

- 7.2 By Industry

- 7.2.1 Healthcare

- 7.2.2 Entertainment & Media

- 7.2.3 Education

- 7.2.4 Government

- 7.2.5 Industrial

- 7.2.6 Consumer Electronics

- 7.3 By Country

- 7.3.1 United States

- 7.3.2 Canada

8 North America 3D/4D Technology - Vendor Market Share Analysis

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles

- 9.1.1 3D Systems Corporation

- 9.1.2 Dolby Laboratories, Inc.

- 9.1.3 LG Electronics Inc.

- 9.1.4 Barco N.V.

- 9.1.5 Samsung Electronics Co., Ltd.

- 9.1.6 Autodesk, Inc.

- 9.1.7 Stratasys, Inc.

- 9.1.8 Panasonic Corporation

- 9.1.9 Sony Corporation

- 9.1.10 Dreamworks Animation SKG, Inc.

10 INVESTMENT ANALYSIS

11 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219