|

市场调查报告书

商品编码

1639531

中东电力产业的燃气涡轮机MRO:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Middle East Gas Turbine MRO in the Power Sector - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

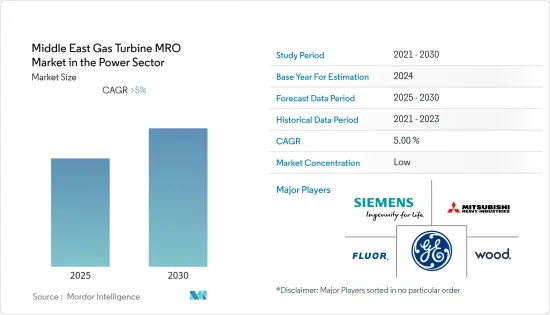

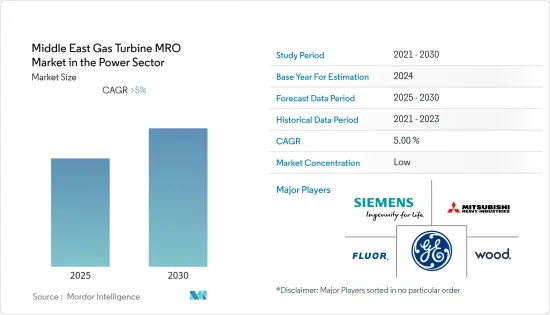

中东电力产业的燃气涡轮机MRO 市场预计在预测期内复合年增长率将超过 5%。

由于计划延误和取消以及电力需求减少,市场受到了 COVID-19 大流行的负面影响。然而,市场在2022年开始復苏。

燃气涡轮机老化、维持营运效率的需求以及发电厂严格的排放法规等因素预计将在预测期内推动市场成长。对燃煤发电厂能源产出环境影响的担忧以及对燃气涡轮机清洁能源不断增长的需求预计将推动电力行业市场中燃气涡轮机机MRO 市场的成长。然而,向太阳能和风能等可再生能源发电的日益转变正在阻碍所研究市场的成长。该地区正在经历从煤炭和原油发电到天然气发电的转变,预计这将为参与企业提供重大机会。

在该地区,沙乌地阿拉伯预计将主导市场成长。天然气发电厂的投资和天然气发电厂的老化预计将在预测期内推动市场成长。

中东电力产业燃气涡轮机MRO 市场趋势

维修业预计将主导市场

电力生产的增加已将重点转向全球燃气发电厂的发展。排放发电厂排放的温室气体比燃煤发电厂相对较少。全球电力尖峰时段需求不断增加,燃气发电可以最好地满足这一需求。

燃气发电厂的增加将导致燃气涡轮机MRO市场的成长。燃气涡轮机可能需要每四到五年维修或更换一次发动机,但维护在安装后立即开始。

在最新一波扩张中,天然气发电厂在 2002 年达到顶峰,大部分是在 1998 年至 2008 年间新增的。因此,预计全球几乎所有燃气发电厂安装的设备在预测期内都需要大量的 MRO 服务。

在中东,天然气发电量近年来显着成长,从2012年的548.3太瓦时增加到2021年的929.7太瓦时。

因此,电力供应的增加、电动车数量的增加以及对燃煤电厂温室气体排放的日益担忧等因素正在推动燃气涡轮机。产业燃气涡轮机维护市场的成长。

沙乌地阿拉伯可望主导市场

由于该地区能源需求和天然气使用量的增加,预计沙乌地阿拉伯将在预测期内主导市场。

该国国家石油公司沙特阿美的目标是到 2030 年将其天然气产量增加一倍,其中大部分将用于发电等国内用途。这为该国电力产业的燃气涡轮机MRO市场创造了巨大的机会。

该国天然气发电量从2008年的109.5太瓦时增加到2021年的216太瓦时,增加超过97%。由于政府寻求将发电来源从石油转向天然气,预计天然气发电量将在预测期内大幅增加。

天然气发电在电力市场中占据主导地位,份额约60%。 2021年,天然气发电量为216太瓦时,石油发电量为140太瓦时,可再生能源发电量为0.8太瓦时。

因此,上述因素预计将在预测期内推动市场成长。

中东电力产业燃气涡轮机MRO 产业概况

中东电力产业燃气涡轮机MRO 市场适度细分。主要企业包括通用电气、西门子股份公司、三菱重工有限公司和约翰伍德集团有限公司(排名不分先后)。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2027年之前的市场规模与需求预测(单位:十亿美元)

- 最新趋势和发展

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 按服务类型

- 维护

- 维修

- 检修

- 按地区

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- General Electric Company

- Mitsubishi Heavy Industries Ltd

- Bechtel Corporation

- Flour Corporation

- John Wood Group PLC

- Siemens AG

- Sulzer AG

- Babcock & Wilcox Enterprises Inc.

- Weg SA

第七章 市场机会及未来趋势

The Middle East Gas Turbine MRO Market in the Power is expected to register a CAGR of greater than 5% during the forecast period.

The market was negatively impacted by the COVID-19 pandemic due to delays and cancellations of projects and decreased demand for electricity. However, the market rebounded in 2022.

Factors such as the aging fleet of gas turbines, the need to maintain operational efficiency, and stringent emissions norms from power plants are expected to drive the market's growth during the forecast period. The increasing demand for cleaner energy from gas turbines over concerns about the environmental impact of energy generation from coal-fired plants is expected to boost the growth of the gas turbine MRO market in the power sector market. However, the increasing shift toward renewable energies, such as solar and wind, for power generation hampered the growth of the market studied. An increasing shift from coal and crude oil toward gas-based power generation in the region is expected to provide significant opportunities to the market players.

Saudi Arabia is expected to dominate the market's growth in the region. Investments in gas-based power generation plants and aging gas-based power plants are expected to drive the market's growth during the forecast period.

Middle East Power Sector Gas Turbine MRO Market Trends

Maintenance Sector is Expected to Dominate the Market

The increase in the production of electricity shifted the global focus on the development of gas-fired power plants. The greenhouse gases emitted from gas-fired power plants are comparatively lower than those from coal-fired power plants. The demand for peak power is increasing globally, which can be most effectively met by gas-based power generation.

The increase in the number of gas-based power generation plants leads to growth in the gas turbine MRO market. While a gas turbine might need an engine repair or replacement in four-five years, the maintenance starts soon after installation.

In the most recent wave of additions, gas-based power plants witnessed a peak in 2002, with the majority added between 1998 and 2008. Thus, the equipment installed in approximately all the gas-fired power plants across the world is expected to require significant MRO services during the forecast period.

In the Middle East, electricity generation from gas witnessed significant growth in recent years, from 548.3 TWh in 2012 to 929.7 TWh in 2021.

Therefore, factors such as increased access to electricity, a rise in the number of electric vehicles, and increased concerns over greenhouse gas emissions from coal-based power plants are expected to help drive the gas turbine market's growth in the power sector, which, in turn, is expected to drive the gas turbine maintenance market's growth in the power sector.

Saudi Arabia is Expected to Dominate the Market

Saudi Arabia is expected to dominate the market studied during the forecast period due to an increase in energy demand and natural gas usage in the region.

The country's national oil company Saudi Aramco has aimed to double its gas production by 2030, most of which will be used for domestic purposes like power generation. This has created a huge opportunity for the gas turbine MRO market in the power sector in the country.

The country witnessed a growth of over 97% in electricity generation from gas, from 109.5 TWh in 2008 to 216 TWh in 2021. Electricity generation from gas is expected to see significant growth in the country in the forecast period due to the government's efforts to shift from oil to gas as a source of electricity generation.

Electricity generation from natural gas dominates the power market at around 60% share. In 2021, electricity generation from natural gas was 216 TWH, from oil was 140 TWH, and from renewables was 0.8 TWh.

Therefore, the aforementioned factors are expected to drive the market's growth during the forecast period.

Middle East Power Sector Gas Turbine MRO Industry Overview

The Middle Eastern gas turbine MRO market in the power sector is moderately fragmented. Some of the major companies are (in no particular order) General Electric, Siemens AG, Mitsubishi Heavy Industries Ltd, and John Wood Group PLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Market Dynamics

- 4.4.1 Drivers

- 4.4.2 Restraints

- 4.5 Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes Products and Services

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Service Type

- 5.1.1 Maintenance

- 5.1.2 Repair

- 5.1.3 Overhaul

- 5.2 By Geography

- 5.2.1 Saudi Arabia

- 5.2.2 United Arab Emirates

- 5.2.3 Rest of Middle East

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 General Electric Company

- 6.3.2 Mitsubishi Heavy Industries Ltd

- 6.3.3 Bechtel Corporation

- 6.3.4 Flour Corporation

- 6.3.5 John Wood Group PLC

- 6.3.6 Siemens AG

- 6.3.7 Sulzer AG

- 6.3.8 Babcock & Wilcox Enterprises Inc.

- 6.3.9 Weg SA