|

市场调查报告书

商品编码

1683107

亚太动力燃气涡轮机MRO 市场 -市场占有率分析、产业趋势和成长预测(2025-2030 年)Asia-Pacific Gas Turbine MRO in Power Sector - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

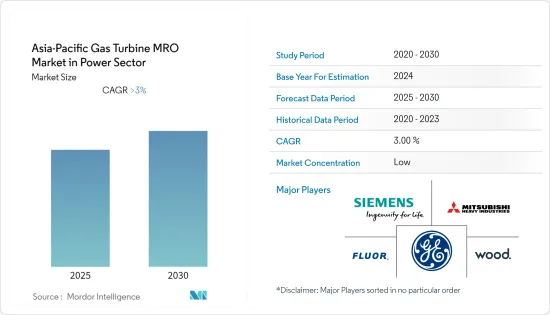

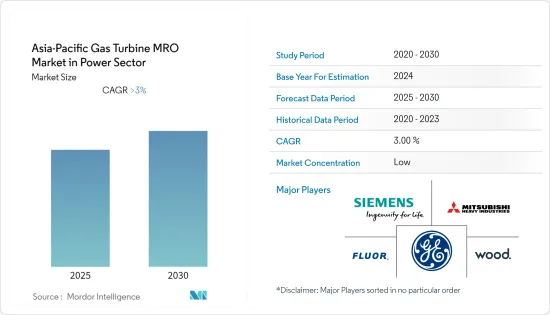

预测期内,亚太地区动力燃气涡轮机MRO 市场预计复合年增长率超过 3%

关键亮点

- 由于多种因素,例如该地区航空业的成长、由于对温室气体排放的日益关注而导致的天然气发电厂发电量的增加、维持涡轮机效率以及发电厂的严格排放法规,预计维护部门将在预测期内占据市场主导地位。

- 为了维持全球发展,对电力的需求不断增加,需要对发电厂进行持续的大量投资。这极大地促进了近期燃气涡轮机MRO 市场的成长,预计在预测期内将保持不变。

- 由于经济成长、航空业发展、燃气发电厂数量增加以及燃气发电厂老化等因素,预计中国将主导市场成长。

亚太地区燃气涡轮机MRO 市场趋势

维修部门占据市场主导地位

- 由于天然气产量的增加,世界各地对开发燃气发电厂的兴趣日益浓厚。燃气发电厂排放的温室气体比排放燃煤发电厂排放较少。此外,全球尖峰时段电力需求正在增加,而燃气发电可以最有效地满足这一需求。

- 燃气发电厂的兴起将推动燃气涡轮机MRO市场的成长。燃气涡轮机每四到五年需要维修或更换一次发动机,但维护在安装后立即开始。该地区的燃气发电量从 2008 年的 1,001.7 TWh 增加到 2018 年的 1,485.8 TWh,增幅超过 45%。

- 亚太地区占全球航空旅客周转量的48%以上,近年来经历了显着增长,其中中国以18%的份额领先该地区。航空业的这一成长与燃气涡轮机MRO产业密切相关。

- 此外,由于汽车电气化,未来电力需求预计会增加。一些国家已订定目标,逐步停止销售以石化燃料为动力的乘用车。

- 因此,预计电力供应改善、电动车兴起以及对燃煤发电厂温室气体排放日益关注等因素将推动发电厂燃气涡轮机市场的发展,从而推动亚太地区燃气涡轮机维护市场的发展。

中国主导市场

- 由于该地区能源需求和天然气使用量的不断增加,预计中国将成为预测期内该地区成长最快的市场。为了减少温室气体排放,该地区已大幅增加天然气发电的使用量。

- 中国天然气发电量从2008年的34.6亿千瓦时增加到2018年的223.6亿千瓦时,短短10年间增加了546%以上。中国的精製能力也不断提升,中化泉州石化100万吨/年乙烯及精製扩建计划近期签约。

- 为了因应中国工业化带来的污染问题日益严重的问题,从燃气涡轮机到清洁能源发电的转变正在获得相当大的发展势头。

- 中国的航空业也呈现上升势头,2008年国内旅客周转量达2365亿人公里,2018年达到8,007亿旅客周转量,成长235%。几乎所有现代飞机都使用燃气涡轮机动力来源,这为该国的燃气涡轮机MRO 创造了巨大的市场。

- 因此,预计上述因素将在预测期内推动市场发展,与近年来观察到的趋势类似。

亚太地区动力燃气涡轮机MRO 产业概况

亚太动力燃气涡轮机MRO 市场部分整合。主要企业包括通用电气、西门子股份公司、三菱重工有限公司和约翰伍德集团有限公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2025 年市场规模与需求预测(十亿美元)

- 最新趋势和发展

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场区隔

- 服务类型

- 维护

- 维修

- 大修

- 地区

- 中国

- 日本

- 印度

- 其他亚太地区

第六章 竞争格局

- 併购、合资、合作、协议

- 主要企业策略

- 公司简介

- General Electric Company

- Mitsubishi Heavy Industries Ltd

- Bechtel Corporation

- Flour Corporation

- John Wood Group PLC

- Siemens AG

- Sulzer AG

- Babcock & Wilcox Enterprises Inc.

- Weg SA

- Rolls-Royce Holding PLC

- MAN SE

第七章 市场机会与未来趋势

简介目录

Product Code: 49406

The Asia-Pacific Gas Turbine MRO Market in Power is expected to register a CAGR of greater than 3% during the forecast period.

Key Highlights

- The maintenance sector is expected to dominate the market during the forecast period, owing to various factors, such as the growth of the aviation industry in the region, increase in power generation from gas-based plants due to rising concerns over greenhouse gas emissions, maintaining the efficiency of turbines, and stringent emissions norms on power plants.

- The increasing demand for electrical energy to sustain global development requires consistent heavy investments in power supply generation. This has helped the growth of the market for gas turbines MRO significantly in recent, andit is expected to do so during the forecast period.

- China is expected to dominate the market growth, owing to the factors like economic growth, growth of the aviation industry, increase in the number of gas-based power generation plants, and the aging gas-based power plants.

APAC Gas Turbine MRO Market Trends

Maintenance Sector to Dominate the Market

- The increase in the production of natural gas has shifted the global focus on the development of gas-fired power plants. The greenhouse gases emitted from gas-fired power plants are comparatively lower than that emitted from coal-fired power plants. Moreover, the demand for peak power is increasing globally, which can be most effectively met by gas-based power generation.

- The increase in the number of gas-based power generation plants leads to growth in the gas turbine MRO market. While a gas turbine may need an engine repair or replacement in 4-5 years, the maintenance starts soon after installation. Electricity generation from gas in the region grew from 1001.7 TWh in 2008 to 1485.8 TWh in 2018, registering a growth of over 45%.

- Asia-Pacific holds over 48% of the global revenue passenger kilometers in airplanes, with significant growth in recent years and China leading the region with an 18% share. This increase in the aviation industry goes hand in hand with the gas turbine MRO industry.

- Furthermore, the electricity demand is expected to increase in the future, fueled by the electrification of the automobile. Several countries have adopted targets of phasing out the sale of passenger cars running on fossils.

- Therefore, factors, such as increased access to electricity, rise in the number of electric vehicles, and increased concerns over greenhouse gas emissions from coal-based power plants, are expected to help drive the gas turbine market in power sector, which is expected to drive the Asia-Pacific gas turbine maintenance market.

China to Dominate the Market

- China is expected to be the fastest-growing market in the region during the forecast period, due to an increase in energy demand and natural gas usage in the region. There has been a major increase in the use of gas for power generation in the region, aiming at reducing greenhouse gas emissions.

- Electricity generation from gas in China grew from 34.6 TWh in 2008 to 223.6 TWh in 2018, registering a growth of over 546% in just a decade. The refining capacity of China is also on the rise, with a recent contract for 1 MTA ethylene and refinery expansion project of Sinochem Quanzhou Petrochemical.

- With the rising pollution concerns due to industrialization in the country, the shift toward clean energy generation from gas turbines has gained considerable momentum.

- The country's aviation industry is also on the rise, with 236.5 billion revenue passenger kilometer flown in the domestic sector in 2008, and with a growth of 235% reaching 800.7 billion revenue passenger kilometer flown in the domestic sector in 2018. This has created a huge market for gas turbine MRO in the country, as almost all of the modern airplanes use gas turbine for motive power for jet propulsion.

- Therefore, the aforementioned factors are expected to drive the market during the forecast period, similar to the trend witnessed in recent years.

APAC Gas Turbine MRO Industry Overview

The Asia-Pacific gas turbine MRO in power sector market is partially consolidated. Some of the major companies are General Electric, Siemens AG, Mitsubishi Heavy Industries Ltd, and John Wood Group PLC, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2025

- 4.3 Recent Trends and Developments

- 4.4 Market Dynamics

- 4.4.1 Drivers

- 4.4.2 Restraints

- 4.5 Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes Products and Services

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Service Type

- 5.1.1 Maintenance

- 5.1.2 Repair

- 5.1.3 Overhaul

- 5.2 Geography

- 5.2.1 China

- 5.2.2 Japan

- 5.2.3 India

- 5.2.4 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 General Electric Company

- 6.3.2 Mitsubishi Heavy Industries Ltd

- 6.3.3 Bechtel Corporation

- 6.3.4 Flour Corporation

- 6.3.5 John Wood Group PLC

- 6.3.6 Siemens AG

- 6.3.7 Sulzer AG

- 6.3.8 Babcock & Wilcox Enterprises Inc.

- 6.3.9 Weg SA

- 6.3.10 Rolls-Royce Holding PLC

- 6.3.11 MAN SE

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219