|

市场调查报告书

商品编码

1640341

英国石油和天然气:市场占有率分析、行业趋势和成长预测(2025-2030 年)United Kingdom Oil And Gas - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

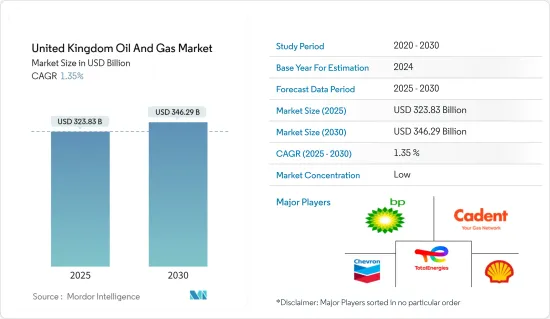

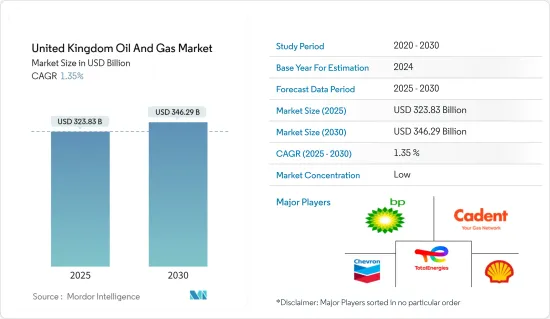

预计2025年英国石油和天然气市场规模为3,238.3亿美元,预计2030年将达到3,462.9亿美元,预测期间(2025-2030年)的复合年增长率为1.35%。

主要亮点

- 从中期来看,预计预测期内该国石油和天然气产量的增加以及石油和天然气基础设施建设投资的增加将推动市场发展。

- 另一方面,由于可再生能源技术的成长和最近的地缘政治发展导致的石油和天然气价格波动预计将在预测期内抑制市场发展。

- 然而,预计预测期内全国范围内新天然气田的发现将为研究市场创造巨大的商机。

英国石油与天然气市场趋势

上游部分预计主导市场

- 英国在北海拥有丰富的石油和天然气蕴藏量,数十年来一直是其主要产油源。儘管蕴藏量正在减少,但公司仍拥有大量资源,需要继续进行勘探和生产。

- 英国在北海拥有完善的海上探勘和生产基础设施。这些基础设施包括海上平台、管道和仓储设施。这种基础设施的存在为上游公司提供了竞争优势,因为它能够有效地开采和运输石油和天然气资源。

- 此外,英国在北海拥有悠久的海上石油和天然气作业历史,在石油和天然气资源的探勘和生产方面积累了重要的技术专长。该行业在钻井技术、油藏管理和生产最佳化等领域累积了知识和经验。这种专业知识使英国在上游石油业务中占据优势。

- 《世界能源统计评论》显示,2022 年英国原油产量将为每天 778,000 桶,较 2021 年下降近 11%。造成这一下降的主要原因是北海蕴藏量下降。为了应对这个问题,英国公司已经开始在其他地区探勘石油和天然气生产。

- 例如,2023年2月,英国本土上游公司Delta Energy宣布在许可证号为P2252的彭萨科拉地区发现重大油气。该公司声称该潜在的天然气储存超过3000亿立方英尺天然气。

- 因此,鑑于上述情况,预计英国上游产业将在预测期内主导石油和天然气市场。

可再生能源的成长预计将抑制市场

- 英国对低碳经济转型有着雄心勃勃的目标。碳定价、可再生能源奖励和更严格的排放标准等政府政策和法规旨在鼓励可再生能源的开发和采用。这些政策可能会减少对石油和天然气的需求,特别是在发电和运输等可再生能源可以提供替代品的领域。

- 此外,随着可再生能源产业的不断扩大,它将吸引大量投资。这可能会耗尽石油和天然气行业的资金,并使传统石油和天然气计划更难获得资金。投资者可能认为可再生能源计划在长期内更具经济可行性和环境永续,从而减少对新的石油和天然气探勘和生产计划。

- 例如,根据国际可再生能源机构的数据,2022年英国的可再生能源装置容量将比2021年增加7%以上。 2022 年可再生能源装置容量将超过 5,200 万千瓦,而 2021 年为 4,890 万千瓦。

- 2022年12月,维斯塔斯宣布已订单英国Infinergy旗下Limekiln计划的108兆瓦订单。业务范围包括V136-4.5MW涡轮机的安装、供货和试运行。风力涡轮机的总数将接近24台。预计安装和试运行将于2024年完成。

- 可再生能源的成长可能会导致对石油和天然气等石化燃料的需求下降。风能、太阳能和水力发电等再生能源来源的成本竞争力越来越强,被认为更环保。能源消耗模式的这种转变可能会减少对石油和天然气的整体需求,特别是在可以轻鬆转换为可再生能源的地区。

- 因此,正如上面指出的那样,预计再生能源来源的不断增加将在预测期内阻碍英国石油和天然气市场的成长。

英国石油与天然气产业概况

英国石油和天然气市场分散。市场上的主要企业(不分先后顺序)包括壳牌公司、英国石油公司、道达尔能源公司、雪佛龙公司和 Cadent Gas Ltd。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概况

- 介绍

- 2028 年市场规模与需求预测(美元)

- 2028 年石油和天然气产量及预测

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 国内石油及天然气产量

- 投资石油和天然气基础设施开发

- 限制因素

- 可再生能源的成长

- 驱动程式

- 供应链分析

- PESTLE分析

第五章 市场区隔

- 按行业

- 上游

- 中游

- 下游

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Shell PLC

- BP PLC

- TotalEnergies SE

- Chevron Corporation

- Cadent Gas Ltd

- ESSO UK Limited

- BG Group Limited

- Valaris PLC

- Centrica PLC

- Dana Petroleum E&P Limited

第七章 市场机会与未来趋势

- 发现新的天然气田

简介目录

Product Code: 51677

The United Kingdom Oil And Gas Market size is estimated at USD 323.83 billion in 2025, and is expected to reach USD 346.29 billion by 2030, at a CAGR of 1.35% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the country's increasing oil and gas production and increasing investments in oil and gas infrastructure developments are expected to drive the market studied during the forecast period.

- On the other hand, the growth of renewable energy technologies and volatility in oil and gas prices due to recent geopolitical developments are expected to restrain the growth of the market studied during the forecast period.

- Nevertheless, the discovery of new oil and gas fields across the country is expected to create significant opportunities in the market studied during the forecast period.

UK Oil & Gas Market Trends

Upstream Segment Expected to Dominate the Market

- The United Kingdom has significant oil and gas reserves in the North Sea, which have been a major production source for several decades. Although the reserves have declined, they still present a substantial resource base that requires ongoing exploration and production efforts.

- The United Kingdom has a well-developed infrastructure for offshore exploration and production in the North Sea. This infrastructure includes offshore platforms, pipelines, and storage facilities. The presence of this infrastructure provides a competitive advantage for upstream companies as it enables efficient extraction and transportation of oil and gas resources.

- Moreover, the United Kingdom has a long history of offshore oil and gas operations in the North Sea, resulting in the development of significant technical expertise in the exploration and production of oil and gas resources. The industry has accumulated knowledge and experience in areas such as drilling techniques, reservoir management, and production optimization. This expertise gives the United Kingdom an advantage in upstream activities.

- According to the statistical review of world energy, the United Kingdom produced 778 thousand barrels per day of crude oil in 2022, a decrease of almost 11% compared to 2021. The primary reason for this decline is the declining reserves in the North Sea. To counter this, companies in the United Kingdom have started exploring other regions for oiling gas production.

- For instance, in February 2023, Delta Energy, a local upstream player in the United Kingdom, announced that they had made a significant oil and gas discovery at the Pensacola region on license P2252. The company claims that the potential natural gas reservoir has more than 300 bcf of natural gas in the reservoir.

- Therefore, as per the points mentioned above, the upstream sector in the United Kingdom is expected to dominate the oil and gas market during the forecast period.

Growth of Renewables Expected to Restrain the Market

- The United Kingdom has set ambitious targets to transition to a low-carbon economy. Government policies and regulations such as carbon pricing, renewable energy incentives, and stricter emission standards are designed to promote the development and adoption of renewable energy sources. These policies may reduce demand for oil and gas, particularly in sectors where renewable alternatives are feasible, such as power generation and transportation.

- Moreover, as the renewable energy sector continues to expand, it attracts significant investment. This can divert capital from the oil and gas industry, making it more challenging for traditional oil and gas projects to secure funding. Investors may view renewable energy projects as more financially viable and environmentally sustainable in the long term, leading to a reduction in investment in new oil and gas exploration and production projects.

- For instance, according to the International Renewable Energy Agency, in 2022, the installed renewable energy capacity in the United Kingdom increased by more than 7% compared to 2021. In 2022, the total renewable energy installed capacity crossed 52 GW compared to 48.9 GW in 2021.

- In December 2022, Vestas announced that it had received an order for 108 MW for the Limekiln project owned by Infinergy in the United Kingdom. The work scope includes installing, supplying, and commissioning V136-4.5 MW turbines. The total number of turbines is nearly 24. The installation and commissioning is expected to be completed by 2024.

- The growth of renewable energy can lead to a decline in demand for fossil fuels, including oil and gas. Renewable energy sources such as wind, solar and hydroelectric power are becoming increasingly cost-competitive and are considered more environment-friendly. This shift in energy consumption patterns can reduce the overall demand for oil and gas, particularly in sectors that can readily switch to renewable alternatives.

- Therefore, as per the points discussed above, the increasing adaption of renewable energy sources is expected to hinder the growth of the UK oil and gas market during the forecast period.

UK Oil & Gas Industry Overview

The UK oil and gas market is fragmented. Some of the key players in the market (in no particular order) include Shell PLC, BP PLC, TotalEnergies SE, Chevron Corporation, and Cadent Gas Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Crude Oil and Natural Gas Production and Forecast, till 2028

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.1.1 Domestic Oil and Gas Production

- 4.6.1.2 Investments in Oil and Gas Infrastructure Development

- 4.6.2 Restraints

- 4.6.2.1 Growth of Renewable Energy

- 4.6.1 Drivers

- 4.7 Supply Chain Analysis

- 4.8 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Sector

- 5.1.1 Upstream

- 5.1.2 Midstream

- 5.1.3 Downstream

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Shell PLC

- 6.3.2 BP PLC

- 6.3.3 TotalEnergies SE

- 6.3.4 Chevron Corporation

- 6.3.5 Cadent Gas Ltd

- 6.3.6 ESSO UK Limited

- 6.3.7 BG Group Limited

- 6.3.8 Valaris PLC

- 6.3.9 Centrica PLC

- 6.3.10 Dana Petroleum E&P Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Discovery of New Oil and Gas Fields

02-2729-4219

+886-2-2729-4219