|

市场调查报告书

商品编码

1640357

亚太地区药品包装:市场占有率分析、产业趋势与成长预测(2025-2030)Asia Pacific Pharmaceutical Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

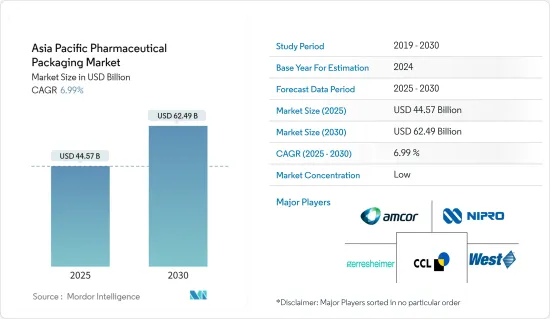

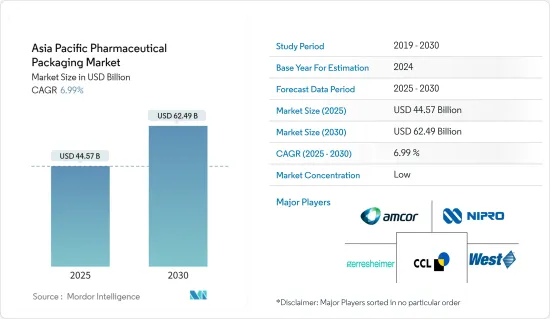

亚太地区药品包装市场规模预估至2025年为445.7亿美元,预估至2030年将达624.9亿美元,预测期间内(2025-2030年)复合年增长率为6.99%。

主要亮点

- 药品包装是容纳、维护、保护和分发安全有效的药品所必需的要素的集合,确保在药品有效期之前随时获得安全有效的剂型。适当的包装材料对于提供防篡改安全至关重要,这有助于阻止假药的消费。此外,优质包装材料必须符合严格的监管准则。

- 由于製药业投资的增加,预计药品包装製造商将在亚太地区看到庞大的商机。对药品的需求不断增长以及製药技术的进步直接推动了对玻璃瓶、安瓿和其他玻璃包装解决方案的需求。随着慢性病发病率持续上升以及 COVID-19 疫苗产量仍然很高,对初级包装(尤其是玻璃容器)的需求预计将激增。

- 玻璃包装预计将推动该地区药品包装领域的市场成长。製药公司使用玻璃容器来包装各种药品,包括注射剂、口服固态、液体製剂和生技药品。玻璃容器和包装快速成长的因素包括药品製造业务、特种药品需求的增加以及医疗基础设施的扩张。这一趋势在中国、印度、日本和韩国等国家尤其明显,这些国家的製药业正经历显着成长,对玻璃包装解决方案的需求也迅速增加。

- 预计塑胶瓶产业在未来几年将经历显着成长。该地区 PET 的使用量正在稳步增加,与玻璃相比,重量减轻高达 90%,从而实现更具成本效益的运输。目前,在製药领域,由 PET 製成的塑胶瓶正在取代笨重而精緻的玻璃瓶,为各种液体提供可重复使用的包装。製药业塑胶 PET 技术的进步预计将提振市场前景。

- 此外,政府加强该地区製药业的措施预计将推动市场扩张。例如,中国政府为促进国家医疗保健系统现代化而采取的措施预计将刺激药品包装行业的进步。此外,中国正在积极改善药品包装基础设施和资源,同时增加药品种类,这将为药品包装企业开闢新的途径。

- 中国在全球医药市场的份额稳步提升,成为消费大国和全球医药产业和供应链的重要组成部分。近年来,在科学技术进步的推动下,製药业的快速扩张预计将持续下去。 2023 年 12 月,丹麦製药公司诺和诺德透露,计划在 2026 年 6 月在该地区投资 4 亿元人民币(5,960 万美元)新公司。这些重大发展预计将推动对药品包装服务的需求。

- 包装产业受到 COVID-19 大流行的严重影响。重点转向感染疾病和疫苗减少了糖尿病和高血压等治疗领域成功的临床试验和研发工作。然而,在疫情期间,製药业对各种疾病的药品需求激增,导致包装业务的大量投资。幸运的是,製药业透过强调安全卫生包装的需求来应对这场流行病,从而迅速復苏。

亚太地区药品包装市场趋势

玻璃包装预计将显着成长

- 玻璃包装被广泛认为是包装行业医药产品的主要选择。它的受欢迎是由于它的可持续性品质、惰性、不渗透性、可回收性以及在不影响品质的情况下重复使用的能力。由于药物需求大幅增加,COVID-19 大流行进一步刺激了对玻璃包装的需求。随着世界各地的製药商核准和分销新药和疫苗,玻璃包装的使用预计将继续扩大。

- 玻璃包装主要作为药品的主要包装选择,使其成为製药业的首选。其主要原因是其具有永续性、惰性、不渗透性、可回收而不损失品质以及可重复使用等优点。玻璃容器作为主要包装材料之一已广泛应用于製药领域。随着慢性病盛行率的增加和 COVID-19 疫苗产量的持续增加,对初级包装(尤其是玻璃容器)的需求预计将激增。

- 亚太地区慢性病盛行率的上升是推动药品包装市场扩张的关键因素。糖尿病、心血管疾病、癌症、呼吸系统疾病等疾病需持续用药。因此,人们越来越需要各种药品包装解决方案,以最佳效率安全地储存、保护和分发这些药品。据世界卫生组织(WHO)称,非传染性疾病的增加导致该地区,特别是中东和非洲的慢性病负担日益加重。

- Stoelzle 是一家初级包装玻璃解决方案製造商,于 2023 年 11 月在 CPHI 巴塞隆纳贸易展览会上推出了其最新的环保 PharmaCos 系列。这个新的包装解决方案系列采用了高比例的回收玻璃(73% 琥珀色玻璃和 38% 火石玻璃)和轻质瓶子设计。此外,这条新生产线是在製药级设施中生产的,以满足医疗产业的严格标准。供应商的此类重大创新预计将推动市场成长。

- 根据Bormioli Pharma介绍,目前市面上有多种专门针对II型和III型玻璃设计的再生玻璃产品。这些产品使用的材料来自外部供应链,并经过製药用途认证。透过化学和机械加工,回收材料转化为玻璃粉末,形成新生产週期的基础。同时,Bormioli Pharma 正在积极进行低排放气体反应器开发计划。这些熔炉采用创新技术和工业流程,最大限度地减少我们的环境足迹。

- 此外,日本等国家的玻璃包装技术市场预计将受到製药商为提高药品生产而增加投资的推动。一个着名的例子是武田公司于 2023 年 3 月宣布计划投资约 1,000 亿日圆(7.5 亿美元)在大阪建造一座新的血浆衍生疗法 (PDT) 生产设施。这项投资标誌着武田在日本有史以来最大规模的产能扩张。这座最先进的设施计划于 2030 年投入运作,将是日本同类设施中最大的,并将显着提高武田的等离子体製造能力。

印度预计将出现显着成长

- 印度预计将成为药品包装市场成长最快的地区之一。近年来,由于技术创新和新疗法的兴起,药品包装领域经历了显着增长。 COVID-19 大流行的爆发凸显了高效产品包装和分销的重要性。因此,人们越来越重视加速製造和分销流程,包括包装。因此,随着对更快操作的需求不断增加,包装公司被迫快速创新。

- 印度预计将成为製药业的主要企业,特别是在学名药和具有成本效益的药品生产领域。作为许多已开发国家学名药的主要供应国,中国发挥着重要作用。学名药生产和国际分销的增加是推动印度医药包装产业扩张的关键因素。此外,慢性病的快速增加和药品生产业务投资的增加将导致市场需求大幅增加。

- 该地区对塑胶包装类型的需求预计将大幅增加。对医疗用品和药品的需求迅速增长正在推动印度塑胶药品包装的扩张。许多公司正在大力投资这项技术,以增加该地区的市场潜力。例如,2023年3月,西班牙包装公司Inden Pharma打算透过与专门从事药品塑胶包装的奥地利ALPLApharma合作扩大在印度的业务。这些显着的进步预计将推动市场成长。

- 根据InvestIndia的报告显示,印度是全球最大的学名药供应国,占全球供应量的20%。此外,印度也是世界上最大的疫苗生产国。除美国外,印度还拥有最多符合美国食品药物管理局(US FDA)制定标准的製药厂。印度拥有 3,000 多家製药公司和 10,500 多个生产设施,在製药业拥有强大的网路和高技能的劳动力。此外,印度满足全球约60%的疫苗需求,也是百白破、卡介苗和麻疹疫苗的主要供应国。药品製造领域的广泛能力必将刺激该地区的包装业务市场。

- 此外,据InvestIndia称,2018-22财年印度製药业平均成长率为9.47%,达到423.4亿美元,主要得益于出口增加和国内市场成长。据预测,2024年医药产业产值预计将达650亿美元,2030年将达1,200亿美元。为了确保永续成长,政府实施了各种倡议来促进研究和创新。作为 2047 年愿景的一部分,政府的目标是按照 Vasudhaiva Kutumbakam 的原则,将印度打造成负担得起的、创新的和高品质的药品和医疗设备的全球领导者。此类重大发展预计将为包装领域提供市场发展机会。

亚太地区药品包装产业概况

亚太地区药品包装市场与许多地区和全球参与企业竞争激烈。主要参与企业包括 Amcor Ltd.、West Pharmaceutical Services Inc.、CCL Industries Inc. 和 NIPRO Corporation。公司透过推出新产品和扩大生产单位来增加市场占有率。我想宣布一些最近的趋势。

- 2024 年 1 月,Loop Industries Inc. 成立,这是一家干净科技公司,其使命是透过生产 100% 再生聚对苯二甲酸乙二醇酯 (“PET”) 树脂和聚酯纤维以及药品包装和医疗设备。

- 2023 年 6 月,CIncorporated 与 SGD Pharma 合作,在 Telangana 建立了一家最先进的工厂,生产用于药品包装的玻璃。据悉,两家公司将共同投资超过50亿印度卢比建造该工厂。与康宁的合作是改善加工技术和确保製药业强大供应链的重要一步。两家公司共同致力于帮助製药商应对日益增长的产能和品质挑战,并满足全球对基本药物不断增长的需求。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 市场驱动因素

- 新兴国家越来越多采用药品包装

- 市场限制因素

- 原料成本波动

第五章市场区隔

- 按材质

- 塑胶

- 纸板

- 玻璃

- 铝箔

- 按类型

- 安瓿

- 泡壳包装

- 塑胶瓶

- 注射器

- 管瓶

- 点滴

- 其他的

- 按给药方式分

- 口服药品包装

- 注射包装

- 肺部药物包装

- 其他的

- 按国家/地区

- 印度

- 日本

- 中国

- 澳洲

- 其他亚太地区

第六章 竞争状况

- 公司简介

- Amcor Ltd

- CCL Industries Inc.

- West Pharmaceutical Services Inc.

- Gerresheimer AG

- Schott AG

- NIPRO Corporation

- Wihuri Group

- Klockner Pentaplast Group

- Catalent Pharma Solutions Inc.

- Berry Global Group Inc.

第七章 投资分析

第八章市场的未来

The Asia Pacific Pharmaceutical Packaging Market size is estimated at USD 44.57 billion in 2025, and is expected to reach USD 62.49 billion by 2030, at a CAGR of 6.99% during the forecast period (2025-2030).

Key Highlights

- Pharmaceutical packaging involves the assembly of elements required to enclose, maintain, safeguard, and distribute a secure and effective medicinal product, ensuring that a secure and effective dosage form is accessible at any given time prior to the drug product's expiration date. Appropriate packaging materials are essential for offering tamper-evident security, which aids in deterring the consumption of counterfeit medications. Furthermore, premium packaging materials must comply with rigorous regulatory guidelines.

- The pharmaceutical packaging manufacturers are anticipated to witness significant opportunities in Asia-Pacific, thanks to the increasing investments in the pharmaceutical sector. The rising demand for pharmaceutical drugs and advancements in pharmaceutical technology are directly contributing to the demand for glass bottles, ampules, and other glass packaging solutions. As chronic illnesses continue to rise and the production of COVID-19 vaccine doses remains substantial, the demand for primary packaging is expected to surge, specifically for glass containers.

- Glass packaging is expected to drive the market's growth in the region's pharma packaging sector. Pharmaceutical companies utilize glass containers to package a diverse array of pharmaceutical products, including injectable medications, solid oral pills, liquid formulations, and biologics. The rapid growth of glass packaging is driven by factors such as pharmaceutical manufacturing operations, the rising demand for specialty pharmaceuticals, and the expansion of healthcare infrastructure. This trend is particularly evident in countries like China, India, Japan, and South Korea, where pharmaceutical industries are experiencing significant growth, leading to a surge in demand for glass packaging solutions.

- The plastic bottles industry is projected to experience substantial growth in the coming years. The utilization of PET is steadily increasing in the region, resulting in a weight reduction of up to 90% compared to glass, thus enabling a more cost-effective transportation procedure. Presently, plastic bottles crafted from PET are extensively substituting bulky and delicate glass bottles in the pharmaceutical sector, providing reusable packaging for different liquids. The rising advancements in plastic PET technology for the pharmaceutical industry are anticipated to boost market prospects.

- Additionally, the government's initiatives to enhance the pharmaceutical sector in the area are anticipated to propel the market's expansion. For example, the measures implemented by the Chinese government to expedite the modernization of the nation's healthcare system are projected to stimulate the advancement of the pharmaceutical packaging industry. Moreover, China is proactively improving its pharmaceutical packaging infrastructure and resources while broadening its range of pharmaceutical products, potentially opening up new avenues for pharmaceutical packaging companies.

- China's presence in the global pharmaceutical market has been steadily growing, serving as both a major consumer and a vital component in the global pharmaceutical industry and supply chains. The rapid expansion of the pharmaceutical sector in recent years, driven by scientific and technological advancements, is projected to continue in the future. In December 2023, Danish pharmaceutical firm Novo Nordisk revealed its plan to invest CNY 400 million (USD 59.6 million) in a newly established company in the region by June 2026. These substantial developments are anticipated to drive the demand for pharmaceutical packaging services.

- The packaging industry experienced significant effects due to the COVID-19 pandemic. With a shift in focus toward infectious diseases and vaccines, there was a decrease in successful clinical trials and research and development activities in therapeutic areas like diabetes and hypertension. However, the pharmaceutical industry witnessed a surge in drug demand for various diseases during the pandemic, leading to substantial investments in the packaging business. Fortunately, the pharmaceutical industry quickly recovered by emphasizing the need for safe and hygienic packaging in response to the pandemic.

Asia Pacific Pharmaceutical Packaging Market Trends

Glass Packaging is Expected to Witness Significant Growth

- Glass packaging is widely considered the leading choice for pharmaceutical products in the packaging industry. Its popularity stems from its sustainable nature, inertness, impermeability, recyclability, and ability to be reused without compromising quality. The COVID-19 pandemic further fueled the demand for glass packaging as the need for medication significantly increased. With the approval and distribution of new drugs and vaccines by pharmaceutical manufacturers in various countries, the use of glass packaging is expected to continue expanding.

- Glass packaging is primarily provided as the main packaging option for pharmaceutical products and is one of the top choices in the pharmaceutical industry. This is mainly because it offers several advantages, including sustainability, inertness, impermeability, recyclability without any compromise in quality, and reusability. Glass containers have become widely utilized in the pharmaceutical sector as one of the primary packaging materials. As the prevalence of chronic diseases increases and the production of COVID-19 vaccine doses continues to rise, there is an anticipated surge in the demand for primary packaging, specifically glass containers.

- The increasing prevalence of chronic diseases in the APAC region is a major factor driving the expansion of the pharmaceutical packaging market. Conditions such as diabetes, cardiovascular diseases, cancer, and respiratory ailments necessitate continuous medication. As a result, there is a rising need for diverse pharmaceutical packaging solutions to securely store, safeguard, and distribute these medications with optimal efficiency. As per the World Health Organization (WHO), the rise in noncommunicable diseases is contributing to the escalating burden of chronic illnesses in the region, especially in the SEA region.

- The primary packaging glass solutions manufacturer, Stoelzle, unveiled their latest eco-friendly PharmaCos line at the CPHI Barcelona trade show in November 2023. This new line of packaging solutions boasts a high percentage of recycled glass (73% in amber glass and 38% in flint glass) and lightweight bottle design. Additionally, the new line is produced in a pharmaceutical-grade facility to meet the strict standards of the healthcare industry. Such significant innovations by the vendors are expected to drive the market's growth.

- Bormioli Pharma states that currently, various recycled glass products are available specifically designed for type II and type III glass. These products utilize materials sourced from an external supply chain that is certified for pharmaceutical use. Through chemical and mechanical processing, the recycled materials can be transformed into glass powder, which serves as the foundation for the new production cycle. Simultaneously, Bormioli Pharma is actively involved in projects aimed at developing low-emission furnaces. These furnaces incorporate innovative technologies and industrial processes that minimize their environmental footprint.

- Moreover, the market for glass packaging techniques in countries like Japan will be driven by the increasing investments made by pharmaceutical vendors to enhance pharmaceutical production. A notable example is Takeda's announcement in March 2023, stating its plan to invest approximately JPY 100 billion (USD 0.75 billion) in constructing a new manufacturing facility for plasma-derived therapies (PDTs) in Osaka, Japan. This investment represents Takeda's largest-ever expansion of manufacturing capacity in Japan. The upcoming state-of-the-art facility, expected to be operational by 2030, will be the largest of its kind in the country and will significantly increase Takeda's plasma manufacturing capacity.

India is Expected to Witness Significant Growth

- India is expected to be one of the fastest-growing regions in the pharmaceutical packaging market. The pharmaceutical packaging sector has witnessed significant growth in recent years, driven by innovations and the rise of new treatments. The onset of the COVID-19 pandemic underscored the importance of efficient product packaging and distribution. As a result, there's a growing emphasis on accelerating both manufacturing and distribution processes, including packaging. Consequently, packaging firms are under mounting pressure to innovate swiftly, meeting the demand for faster operations.

- India is anticipated to emerge as a key player in the pharmaceutical sector, especially in the production of generic drugs and cost-effective medication. The country plays a vital role as a primary provider of generic medicines to numerous advanced nations. The rising output and international distribution of generic drugs are significant factors driving the expansion of the Indian pharmaceutical packaging industry. Additionally, the surge in chronic illnesses and the rise in investments in drug manufacturing operations will lead to a substantial increase in demand within the market.

- The region is anticipated to experience a notable increase in demand for plastic packaging types. The surge in the need for medical supplies and medications has propelled the expansion of plastic pharma packaging in India. Numerous companies are making substantial investments in this technology to enhance the region's market potential. For instance, in March 2023, Spanish packaging company Inden Pharma intended to broaden its operations in India through a partnership with Austria-based ALPLApharma, which specializes in plastic packaging for pharmaceuticals. These noteworthy advancements are projected to stimulate growth in the market.

- InvestIndia reports that India is the largest global provider of generic medicines, making up 20% of the global supply by volume. Additionally, India is the top producer of vaccines worldwide. Outside of the United States, India has the highest number of pharmaceutical plants that comply with the standards set by the US Food and Drug Administration (US FDA). With over 3,000 pharmaceutical companies and more than 10,500 manufacturing facilities, India possesses a robust network and a highly skilled workforce in the pharmaceutical industry. Moreover, India fulfills approximately 60% of the global demand for vaccines and is a major supplier of DPT, BCG, and Measles vaccines. These extensive capabilities in pharmaceutical manufacturing will undoubtedly stimulate the packaging business market in the region.

- Moreover, InvestIndia states that the Indian pharmaceutical industry experienced an average growth rate of 9.47% from FY18 to FY22, reaching USD 42.34 Billion, mainly due to increased exports and a growing domestic market. Forecasts suggest that the pharma sector is expected to reach a value of USD 65 billion in 2024 and USD 120 billion in 2030. To ensure sustained growth, the government has implemented various initiatives to promote research and innovation. As part of its vision for 2047, the government aims to establish India as a global leader in producing affordable, innovative, and high-quality pharmaceuticals and medical devices, in line with the principle of Vasudhaiva Kutumbakam. Such significant developments will provide market opportunities in the packaging sector.

Asia Pacific Pharmaceutical Packaging Industry Overview

The Asia-Pacific pharmaceutical packaging market is competitive, with many regional and global players. Some major players are Amcor Ltd, West Pharmaceutical Services Inc., West Pharmaceutical Services Inc., CCL Industries Inc., and NIPRO Corporation. Companies are increasing their market share by launching new products and expanding production units. Some of the recent developments are:

- January 2024: Loop Industries Inc., a clean technology company whose mission is to accelerate a circular plastics economy by manufacturing 100% recycled polyethylene terephthalate ("PET") plastic and polyester fiber, and Bormioli Pharma, an international player in pharmaceutical packaging and medical devices, launched an innovative pharmaceutical packaging bottle manufactured with 100% recycled virgin quality Loop PET resin.

- June 2023: CIncorporated partnered with SGD Pharma to establish a state-of-the-art facility for producing pharmaceutical packaging glass in Telangana. It was reported that the two companies would collectively invest more than INR 500 crore in setting up this facility. This collaboration with Corning is a significant move in advancing converting technology within the pharmaceutical sector and ensuring a robust supply chain. By working together, these companies aim to assist pharmaceutical manufacturers in addressing the growing challenges related to capacity and quality, as well as meeting the rising global demand for essential medications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Supplier

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Increasing Adoption of Pharmaceutical Packaging in Emerging Economies

- 4.5 Market Restraints

- 4.5.1 Fluctuations in Raw Material Cost

5 MARKET SEGMENTATION

- 5.1 By Material

- 5.1.1 Plastic

- 5.1.2 Paper and Paper Board

- 5.1.3 Glass

- 5.1.4 Aluminum Foil

- 5.2 By Type

- 5.2.1 Ampoules

- 5.2.2 Blister Packs

- 5.2.3 Plastic Bottles

- 5.2.4 Syringes

- 5.2.5 Vials

- 5.2.6 IV fluids

- 5.2.7 Other Types

- 5.3 By Drug Delivery Mode

- 5.3.1 Oral Drug packaging

- 5.3.2 Injectable Drug packaging

- 5.3.3 Pulmonary Drug Packaging

- 5.3.4 Other Drug Delivery Modes

- 5.4 By Country

- 5.4.1 India

- 5.4.2 Japan

- 5.4.3 China

- 5.4.4 Australia

- 5.4.5 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Amcor Ltd

- 6.1.2 CCL Industries Inc.

- 6.1.3 West Pharmaceutical Services Inc.

- 6.1.4 Gerresheimer AG

- 6.1.5 Schott AG

- 6.1.6 NIPRO Corporation

- 6.1.7 Wihuri Group

- 6.1.8 Klockner Pentaplast Group

- 6.1.9 Catalent Pharma Solutions Inc.

- 6.1.10 Berry Global Group Inc.