|

市场调查报告书

商品编码

1640400

欧洲仓储机器人市场:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Europe Warehouse Robotics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

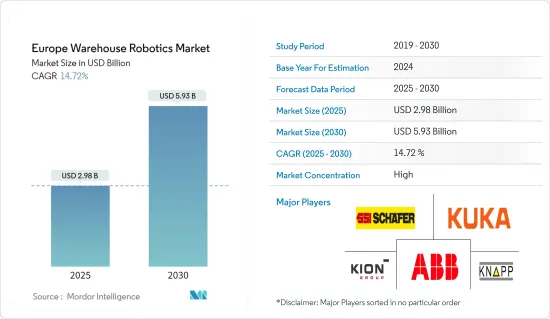

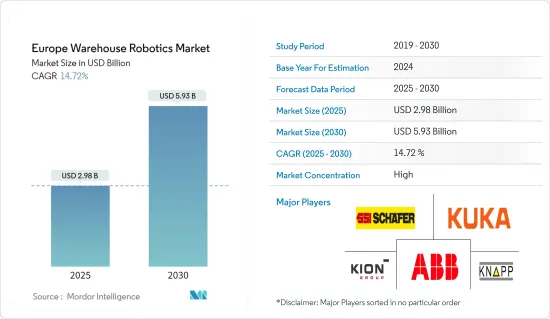

欧洲仓储机器人市场规模预计到2025年为29.8亿美元,预计2030年将达到59.3亿美元,预测期内(2025-2030年)复合年增长率为14.72%。

欧洲电子商务、汽车和製药等关键行业的成长以及人们对高效仓储和库存管理需求的认识不断增强,是推动所研究市场成长的关键因素。

主要亮点

- 自动化仓库管理透过减少产品交付错误和降低业务成本提供了极大的便利。 3PL 公司和仓库自动化解决方案的主要最终用户 DHL 表示,辅助拣选机器人代表了效率的巨大飞跃,每小时拣选的物品数量增加了 180%。这些趋势正在推动仓储行业的供应商增加对自动化和机器人的投资。

- 仓库数量的增加、市场需求和消费模式的变化、欧洲人事费用的上升以及可扩展技术解决方案的可用性共同推动了欧洲各国的仓库机器人市场。例如,根据欧盟统计局的数据,2022年第二季欧元区每小时人事费用增4%,欧盟(EU)上涨4.4%。

- 此外,工业物联网 (业务) 和互联繫统网路的出现使各行业能够执行大量仓库任务,例如配料、拣选、订购、包装、仓库安全、检查等。这些趋势正在为所研究的市场创造有利的成长前景。

- 与全球趋势类似,欧洲的电子商务产业也正在经历显着成长。不断增长的需求和趋势(例如即时/一日交付)正在对勘探市场的发展产生积极影响,电子商务仓储行业是仓储机器人采用率最高的行业之一。

- 此外,技术的逐步进步加上製造设施的持续发展预计将影响预测期内的市场成长率。

- 市场成长受到高成本的限制,阻碍了大规模采用,特别是在中小型仓库领域。对仓库中使用机器人的严格监管要求也阻碍了市场成长。但像 Kuka Robotics 这样的供应商不仅提供机器人租赁,还推出了SmartFactory 即服务,让客户可以选择租用由机器人组成的整个自动化工厂。

欧洲仓储机器人市场趋势

电子商务产业对仓库自动化投资的增加推动市场成长

- 近年来,欧洲电子商务产业蓬勃发展。市场扩张、互联网和智慧型手机普及率的提高以及购物便利性是推动该地区电子商务领域成长的主要因素。此外,由于大流行导致客户购物模式发生行为变化,预计电子商务产业将进一步成长。

- 根据 Ecommerce Europe 和 EuroCommerce 发布的《2022 年欧洲电子商务报告》,欧洲电子商务产业在 2021 年成长了 13%,达到 7,180 亿欧元(7,831.5 亿美元)。报告称,儘管欧洲各地取消了大流行限制,但该行业仍显示出稳定成长,并且预计在预测期内将继续保持这种趋势。

- 一些电子商务公司正在投资新的仓库技术以提高工作效率,进一步推动市场成长。例如,亚马逊于 2022 年 4 月宣布将投资 10 亿美元用于仓储技术,以协助建立其供应链、履约和物流技术。透过这项投资,该公司旨在提高送货速度并提升物流和仓库工人的体验。此外,该公司还收购了 Kiva Systems 来开发用于仓库的轮式机器人,并推出了多个机器人仓库以加快交付流程。

- 此外,电子购物用户的增加也推动了对仓库机器人和自动化解决方案的投资,领导企业专注于提高供应链效率并缩短时间,以获得竞争优势。根据欧盟统计局和国家电子商务协会的数据,在线购买商品和服务的电子购物者的比例预计将从 2021 年的 74% 增加到 2022 年的 76%。

- 考虑到这些趋势,一些新参与企业正在进入市场。例如,2022年10月,专门从事物流房地产的投资基金abrdn European Logistics Income PLC以总计2,140万欧元(2,332万美元)购买了位于荷兰霍斯特和法国第戎的两个物流仓库。预计这些趋势将在预测期内支援欧洲仓储机器人市场。

德国占有很大的市场占有率

- 德国拥有梅赛德斯、保时捷、宝马、兰博基尼、法拉利等世界知名汽车品牌,是欧洲最大的汽车生产国之一。德国工业协会 (VDA) 的数据显示,2022 年 11 月和 12 月,德国国内汽车产量分别约为 3,855,700 辆和 2,533,700 辆。

- 此外,根据德国联邦汽车管理局(KBA)的数据,2022年12月该国新乘用车销量成长约38.1%,达到314,318辆。总体而言,年度总销量成长约 1.1%,达到 2,651,357 辆。

- 这些趋势支持了国内研究市场的成长,因为汽车供应链涉及多个用于储存原材料和成品的仓库。这些趋势也吸引着新参与企业。例如,2022 年 10 月,总部位于阿拉伯联合大公国的 Acme Intralog 在德国开设了新办事处,以扩大其欧洲业务。该公司生产 AS/RS、输送机、控制系统、穿梭车、小型负载、堆垛机机和全系列物料输送解决方案。

- 仓库机器人的其他主要最终用户行业(例如电子商务、物流和製造)的成长也推动了对新仓库的投资,并为研究市场创造了机会。例如,2023 年 1 月,DHL 宣布将在其位于德国施陶芬堡的工厂启用机器人拣选系统,以改善库存管理。该系统由 160 个机器人组成,将用于为欧洲各地服饰的顾客分类订单。

- 同样在2022年8月,马士基宣布计画在德国杜伊斯堡建造一座43,000平方公尺的流动仓库。

欧洲仓储机器人产业概况

由于初期投资较高,欧洲仓储机器人市场较为集中。 ABB LTD.、KUKA AG、SSI Schaefer AG、KION Group AG 和 KNAPP AG 等主要公司主导欧洲仓储机器人市场。这些拥有压倒性市场占有率的大公司正致力于扩大海外基本客群。这些公司利用策略合作计划来增加市场占有率和盈利。然而,随着技术进步和产品创新,中小企业正在透过赢得新契约和开拓新市场来增加其市场份额。

2023 年 3 月,范德兰德工业荷兰公司 (Vanderlande Industries Nederland BV) 宣布在其智慧物品机器人 (SIR) 技术产品组合中增加一款新型自动拣货机器人,旨在加速机器人在仓库管理中的使用。

2022 年 9 月,领先的案件处理机器人系统供应商 HAI Robotics 与 WINIT 合作,加速英国电子商务仓库自动化。根据协议,HAI Robotics 在英国中部伯明翰附近的 WINIT 仓库安装了大约 100 台机器人。根据该公司介绍,这些机器人在占地3万多平方公尺的仓库中平稳移动,帮助工人对产品进行拣选和分类。

2022 年 6 月,电子商务巨头的机器人部门亚马逊机器人首次推出了最新的仓库自动化机器人。 Cardinal,机械臂,Proteus,一个自主地板系统。据该公司称,这些机器人将整合到同一个货架/单元系统中,以提高仓库效率。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- 产业价值链分析

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- SKU 数量增加

- 加大技术和机器人投资

- 市场限制因素

- 严格的监管要求

- 高成本

第六章 市场细分

- 按类型

- 工业机器人

- 分类系统

- 输送机

- 堆垛机

- 自动储存和搜寻系统(ASRS)

- 移动机器人(AGV 和 AMR)

- 按功能分类

- 贮存

- 包装

- 转运

- 其他的

- 按最终用户使用情况

- 饮食

- 车

- 零售

- 电力/电子

- 製药

- 其他的

- ***按国家/地区

- 英国

- 德国

- 法国

第七章 竞争格局

- 公司简介

- ABB Ltd

- KUKA AG

- SSI Schaefer AG

- KION Group AG

- Mecalux SA

- KNAPP AG

- Kardex AG

- Viastore Systems GmbH(Toyota Industries Corporation)

- BEUMER Group GmbH & Co. KG

- Vanderlande Industries BV

- Siemens AG

第八章市场的未来

第九章投资分析

The Europe Warehouse Robotics Market size is estimated at USD 2.98 billion in 2025, and is expected to reach USD 5.93 billion by 2030, at a CAGR of 14.72% during the forecast period (2025-2030).

The growth of major industries, such as e-commerce, automotive, pharmaceutical, etc., in Europe and the growing awareness driving the need for efficient warehousing and inventory management are among the significant factors driving the studied market's growth.

Key Highlights

- Automation in warehousing offers extreme convenience by reducing errors in product deliveries and business costs. According to DHL, a 3PL company and a significant end-user of warehouse automation solutions, assisted picking robots to represent a breakthrough in efficiency, increasing the number of items picked per hour by up to 180 percent. Such trends encourage vendors in the warehousing sector to increase their investment in automation and robotics.

- The rising number of warehouses and changing market demand and consumption patterns, coupled with the rise in labor costs and availability of scalable technology solutions in Europe, have driven the market for warehouse robots across European countries. For instance, according to Eurostat, the hourly labor costs in the Euro area rose by 4 percent in the euro area and by 4.4 percent in the European Union (EU) in the second quarter of 2022, compared with the same period of the previous year.

- Further, the emergence of the Industrial Internet of Things (IIoT) and the advent of a network of connected systems are helping industries perform a multitude of warehousing tasks, such as material batching, picking, ordering, packaging, warehouse security, and inspection, as well as improve the operational efficiency by huge margins. Such trends are also creating a favorable growth scenario for the studied market.

- Similar to the global trend, the e-commerce industry has also witnessed significant growth in the European region. The growing demand and trends such as instant/single-day delivery are positively impacting the studied market's development, making the e-commerce warehousing sector among the largest adopters of warehouse robots.

- Moreover, incremental advancement in technology, coupled with a sustained increase in the development of manufacturing facilities, is expected to impact the market growth rate during the forecast period.

- The market growth has been restricted by high costs, preventing mass adoption, especially in the small and medium warehouse segment. Also, the stringent regulatory requirement to use robots in the warehouse hinders market growth. However, the vendors in the market, such as Kuka Robotics, are not only providing robots for lease but have also launched a SmartFactory as a Service initiative to give their customers an option to rent out an entire robot-staffed automated plant.

Europe Warehouse Robotics Market Trends

Increasing Investment in Warehouse Automation by E-Commerce Industry to Drive the Studied Market's Growth

- The e-commerce industry in Europe has been gaining traction in recent years. Expanding marketplace, growing internet and smartphone penetration, and shopping convenience are among the significant factors expanding the e-commerce sector's growth in the region. Additionally, the e-commerce industry is also expected to grow further owing to the pandemic-led behavioral changes in customers' shopping patterns.

- According to the 2022 European E-commerce Report by Ecommerce Europe and EuroCommerce, the European e-commerce industry in 2021 grew by 13 percent to EUR 718 billion (USD 783.15 billion); according to the report, the industry witnessed a steady growth despite the pandemic-led restrictions being lifted across the European region and is expected to continue to do so during the forecast period.

- Several e-commerce players are investing in new warehouse technologies to improve work efficiencies, further supporting market growth. For instance, in April 2022, Amazon announced investing USD 1 billion into warehouse technologies to help the company build a supply chain, fulfillment, and logistic technologies. Through this investment, the company aims to improve delivery speed and upscale the experience of logistics and warehouse workers. Furthermore, the company had also acquired Kiva Systems to create wheeled robots for the warehouse and launched several robotic warehouses to speed up the delivery process.

- Furthermore, the increasing number of e-shoppers is also driving investment in warehouse robotics and automation solutions as leading players are focusing on making their supply chain highly efficient and less time-consuming to gain a competitive edge. According to Eurostat and the National E-Commerce Association, the percentage of e-shoppers that purchased goods or services online was expected to grow to 76 percent in 2022 from 74 percent in 2021.

- Considering such trends, several new players are entering the market. For instance, in October 2022, abrdn European Logistics Income PLC, an investment fund specialized in logistics real estate, bought two logistics warehouses, one in Horst, Netherlands, and one in Dijon, France, for an aggregate price of EUR 21.4 million (USD 23.32 million). Such trends are expected to support the European warehouse robot market during the forecast period.

Germany to Hold a Significant Market Share

- Germany is home to many world-famous automobile brands such as Mercedes, Porsche, BMW, Lamborghini, Ferrari, etc., making the country among the largest producers of automobiles in Europe. According to the German Association of the Automotive Industry (VDA), in November and December 2022, about 3,85,700 and 2,53,700 cars were produced in the country, respectively.

- Furthermore, according to Germany's Federal Motor Vehicle Office (KBA), the sales of new passenger vehicles in the country increased by about 38.1 percent to reach 314,318 units in December 2022. Overall, the total annual sales increased by about 1.1 percent to 2,651,357 units.

- As the automotive supply chain involves several warehouses for storing raw and finished products, such trends support the growth of the studied market in the country. Such trends are also attracting new players to enter the country. For instance, in October 2022, Acme Intralog, a UAE-based company, opened a new office in Germany to expand its European operations. The company produces a complete range of AS/RS, conveyors, control systems, shuttles, mini loads, stacker cranes, and other material handling solutions.

- The growth of other major end-user industries of warehouse robots, including e-commerce, logistics, manufacturing, etc., also drives investments in new warehouses, creating opportunities in the studied market. For instance, in January 2023, DHL announced opening a robot picking system at its facility in Staufenberg, Germany, to manage its inventory better. This system comprises 160 robots, which are used to sort orders for clothing store customers across Europe.

- Similarly, in August 2022, Maersk announced its plans to construct a 43,000 square-meter Flow Warehouse in Duisburg, Germany, offering cross-dock, pallet storage, and all value-added services along the supply chain.

Europe Warehouse Robotics Industry Overview

The European warehouse robotics market is concentrated due to higher initial investments. Major players like ABB LTD., KUKA AG, SSI Schaefer AG, KION Group AG, and KNAPP AG dominate the European warehouse robotics market. With a prominent market share, these significant players focus on expanding their customer base across foreign countries. These companies leverage strategic collaborative initiatives to increase their market share and profitability. However, with technological advancements and product innovations, mid-size to smaller companies are growing their market presence by securing new contracts and tapping new markets.

In March 2023, Vanderlande Industries Nederland BV announced the addition of a new automated piece-picking robot in addition to its Smart Item Robotics (SIR) portfolio of technologies and aimed to accelerate the use of robotics for warehousing.

In September 2022, HAI Robotics, a leading provider of case-handling robot systems, and WINIT partnered to boost e-commerce warehouse automation in the United Kingdom. As per this agreement, HAI Robotics had installed about 100 robots in WINIT's warehouse near Birmingham, in central UK. According to the company, these robots walked smoothly in the 30,000-plus-square-meter warehouse to help the workers pick and sort goods.

In June 2022, Amazon Robotics, the robotic business unit of the e-commerce giant, debuted their latest warehouse automation robots: Cardinal and Proteus, the robot arm, and the autonomous floor system, respectively. According to the company, these robots were to be integrated into the same shelf/cell system to enhance the efficiency of warehouses.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Number of SKUs

- 5.1.2 Increasing Investments in Technology and Robotics

- 5.2 Market Restraints

- 5.2.1 Stringent Regulatory Requirements

- 5.2.2 Hight Cost

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Industrial Robots

- 6.1.2 Sortation Systems

- 6.1.3 Conveyors

- 6.1.4 Palletizers

- 6.1.5 Automated Storage and Retrieval System (ASRS)

- 6.1.6 Mobile Robots (AGVs and AMRs)

- 6.2 By Function

- 6.2.1 Storage

- 6.2.2 Packaging

- 6.2.3 Trans-shipments

- 6.2.4 Other Functions

- 6.3 By End-user Application

- 6.3.1 Food and Beverage

- 6.3.2 Automotive

- 6.3.3 Retail

- 6.3.4 Electrical and Electronics

- 6.3.5 Pharmaceutical

- 6.3.6 Other End User Applications

- 6.4 ***By Country

- 6.4.1 United Kingdom

- 6.4.2 Germany

- 6.4.3 France

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 KUKA AG

- 7.1.3 SSI Schaefer AG

- 7.1.4 KION Group AG

- 7.1.5 Mecalux SA

- 7.1.6 KNAPP AG

- 7.1.7 Kardex AG

- 7.1.8 Viastore Systems GmbH (Toyota Industries Corporation)

- 7.1.9 BEUMER Group GmbH & Co. KG

- 7.1.10 Vanderlande Industries B.V.

- 7.1.11 Siemens AG