|

市场调查报告书

商品编码

1640435

数位物流:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Digital Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

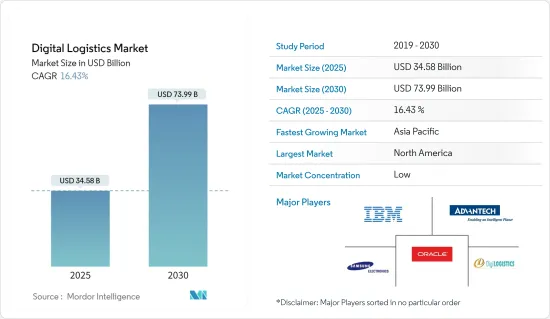

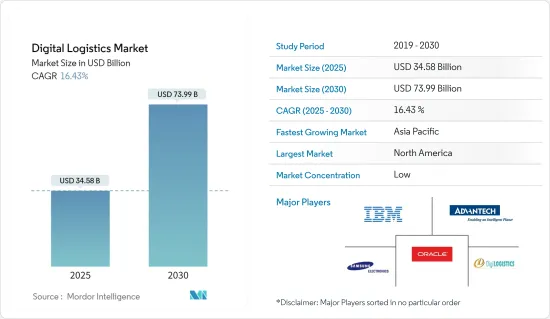

2025 年数位物流市场规模预估为 345.8 亿美元,预计到 2030 年将达到 739.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 16.43%。

主要亮点

- 这一成长是由物流业日益采用先进技术所推动的。此外,这些数位解决方案正在帮助物流公司降低所产生的成本。物流和技术的整合、覆盖整个供应链的云端基础的协作解决方案、仓储、运输和最终消费者资讯的紧密整合以及整个供应链的透明度正在推动所研究市场的成长。

- 数位市场的技术进步和云端运算的不断普及预计将推动对数位物流解决方案的需求。例如,去年四月,Locus 和 loconav 宣布建立策略伙伴关係。 loconav 和 Locus 之间的合作将透过自动化供应链流程加速物流产业的数位转型。

- 由于 COVID-19 疫情爆发,政府采取多项封锁措施,导致许多产业的供应链和物流面临严重中断。为了满足这些必要的交付,公司正在利用数位物流平台转变其供应链能力。根据《物流新闻》报道,使用人工智慧并支援数位付款的数位供应链是解决新冠疫情等紧急情况的解决方案。

- 在过去的十几年中,由于网路购物和网路用户的发展,电子商务公司经历了巨大的成长。电子商务的兴起产生了对更快、更有效率的运输供应商的需求。在网上购物时,客户期望准确的订购、快速的运送和快速的退货流程。企业正在寻找降低订单交付成本和缩短交货时间的方法。电子商务正在推动可见性、成本、易用性、交付速度和无忧退货等因素。必须开发新模型和新技术来满足这一需求,包括物流路线自动化、物流规划数位化和物料运输自动化。因此,履约服务变得更快、更多样化,特别是在最后一英里的交付和退款方面。

数位物流市场趋势

仓库管理系统 (WMS) 领域预计将占据很大份额。

- 数位市场的技术进步和云端运算的不断普及预计将推动对数位物流解决方案的需求。例如,京东和中石化宣布计划在数位供应链模式上建立广泛的伙伴关係。 2022年3月,中国石化安徽分公司与京东签署伙伴关係协议,以多项供应链服务合作,推动全通路营运。该协议涵盖产品和数位供应链、共用仓储设施和智慧物流。京东将发挥技术与供应链服务优势,协助安徽中化集团提高生产效率、降低成本。

- 此外,物流领域产品创新的不断增加也显着提高了市场成长率。例如,2022 年 6 月,Semtech 宣布推出其 LoRa Cloud Locator 服务,该服务测试 LoRa Edge 的超低功耗资产追踪功能。 Semtech 的 LoRa Edge 技术透过在云端基础的求解器中而不是在设备本身上解决资产位置,显着降低了功耗。因此,设备的电池寿命可长达 10 年或更长。 LoRa Edge LR系列晶片使用GNSS和Wi-Fi在室内或室外的任何地方扫描设备的经纬度。结合 LoRa 无线传输到 Semtech 的云端,无论您的资产位于何处,您都可以获得持续覆盖。

- 感测器和物联网分析的市场吸引力有望吸引物流供应商投资数位解决方案。物流中的物联网简化了产品储存并实现了高效率的仓库管理。此外,现代技术使重新思考仓库业务变得更加简单。 RFID 标籤和感测器可以监控库存的状态和位置。实施仓库自动化也有助于最大限度地减少人为错误,因为流程在需要时才会启动和使用。

亚太地区可望创下最快成长

- 由于中国和印度等国家采用了数位技术,亚太地区在预测期间的成长速度最高。物联网、人工智慧和云端运算等技术进步进一步促进了市场成长。

- 儘管面临包括新冠疫情在内的诸多障碍,中国物流业仍在采用数位技术来提高效率。 2022年4月,中共中央、国务院联合发布加速形成国内统一市场的指示。 《意见》指出,中国将优化商贸流通基础设施设计,鼓励线上线下融合发展。

- 此倡议符合国家政府鼓励发展第三方物流配送数位平台和培育一系列具有全球影响力的供应链业务的承诺。例如,中国卡车叫车公司满帮物流正在加强利用数位技术提高疫情地区的物流效率。

- 此外,印度的国家物流政策可望透过降低物流成本和提高国产商品在全球市场的竞争力,为该国的经济发展创造无缝衔接的进程。如此高的物流成本已经使印度製造的产品在国际市场上销售处于不利地位。印度製造商急需的转变可能伴随着全面的政策审查,这将使他们能够在国际市场上具有竞争力的价格。统一物流介面平台、数位化系统整合、物流简化和系统改进群是新物流计划的四大主要部分。 「印度製造」、「数位印度」和「Atma-nirbhara 驱动」等政策的成功实施将从国家物流政策中获得另一个组成部分。

数位物流行业概览

数位物流市场较为分散,因为有许多参与者为从中小企业到大型企业等各种类型的组织提供服务。市场的主要企业包括 IBM 公司、研华公司和三星电子。主要市场发展包括:

- 2023 年 11 月,Suttons International 与 LogChain 建立数位化伙伴关係。这项合作是在 LogChain 最近成功促成全球首笔全数数位化跨境货运之后达成的,这提高了物流业的数位透明度和扩充性。萨顿国际 (Sutton International) 已将该平台作为其数位转型历程中的重要组成部分。该平台的采用彰显了萨顿致力于引领业界数位创新的重要一步。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

第五章 市场动态

- 市场驱动因素

- 数位科技的出现

- 电子商务产业的成长与多通路分销网络的出现

- 云端基础应用程式的采用率不断提高

- 市场限制

- 缺乏资讯通信技术基础设施和资料安全问题

- COVID-19 产业影响评估

第六章 市场细分

- 按类型

- 库存管理

- 仓库管理系统 (WMS)

- 车队管理

- 其他类型

- 按最终用户产业

- 车

- 製药/生命科学

- 零售

- 饮食

- 石油和天然气

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- IBM Corporation

- Advantech Corporation

- Oracle Corporation

- Samsung Electronics Co. Ltd

- DigiLogistics Technology Ltd

- Hexaware Technologies Limited

- Tech Mahindra Limited

- JDA Software Pvt Ltd

- UTI Worldwide Inc.(DSV Group)

- SAP SE

- Manhattan Associates Inc.

- HighJump Software Inc.

- Vinculum Group

第八章投资分析

第九章:市场的未来

简介目录

Product Code: 52939

The Digital Logistics Market size is estimated at USD 34.58 billion in 2025, and is expected to reach USD 73.99 billion by 2030, at a CAGR of 16.43% during the forecast period (2025-2030).

Key Highlights

- Growth is driven owing to the increasing adoption of advanced technologies in the logistics sector. Moreover, these digital solutions are helping logistic companies in reducing incurred costs. Convergence of logistics and technology, along with cloud-based collaborative solutions that extend through the entire supply chain, tight integration of warehouse, transport, and end consumer information, and transparency through the supply chain are driving the growth of the market studied.

- The technological advancement in the digital market and rising cloud adoption are expected to fuel the demand for digital logistic solutions. For instance, in April last year, Locus and loconav announced a strategic cooperation. This partnership between loconav and Locus will promote digital transformation in the logistics sector by automating supply chain processes.

- With the outbreak of COVID-19, many industries have faced significant supply chain and logistic disruption owing to the lockdown imposed by various governments. Companies are transforming their supply chain capabilities with digital logistics platforms to meet those essential deliveries. According to Logistics News, digital supply chains using artificial intelligence and enabling digital payments are the solution to emergencies such as the Covid-19 pandemic.

- Over the past ten years, the e-commerce company has experienced tremendous growth due to the development of online shopping and Internet users. More rapid and efficient transportation providers are required due to the growth of e-commerce. When shopping online, customers expect accurate orders, prompt shipment, and return procedures. Businesses are looking for ways to reduce order shipping costs and timeframes. E-commerce is the driving force behind visibility, cost, ease of use, delivery speed, and hassle-free returns. New models and technologies must be created to accommodate this need by automating distribution routes, digitalizing logistics planning, and material movement. As a result, fulfillment services have become quicker and more varied, especially for last-mile delivery and refunds.

Digital Logistics Market Trends

Warehouse Management System (WMS) segment is expected to acquire major share.

- The technological advancement in the digital market and rising cloud adoption are expected to fuel the demand for digital logistic solutions. For instance, JD and Sinopec announced a plan to build a broad partnership with their digital supply chain model. In March 2022, Sinopec's Anhui province branch and JD.com signed a partnership agreement under which they will collaborate on a number of supply chain services and advance omnichannel operations. The agreement encompasses product and digital supply chains, sharing warehouse facilities, and smart logistics. JD will use its technology and supply chain services advantages to assist Sinopec Anhui in boosting productivity and cutting costs.

- Further, the growing product innovations in the logistics sector are significantly boosting the market growth rate. For instance, in June 2022, Semtech introduced the LoRa Cloud Locator Service to test the LoRa Edge's ultra-low power asset tracking capabilities. By solving the asset's position in a Cloud-based solver rather than on the device itself, Semtech'sLoRa Edge technology considerably lowers power usage. As a result, the device's battery life can last up to or even longer than ten years. The LoRa Edge LR-series chips use GNSS and Wi-Fi to scan for a device's latitude and longitude in any interior or outdoor location. Regardless of where assets are located, continuous coverage is obtained when combined with Semtech'sLoRa radio transmission to the Cloud.

- Advancements in the sensors and IoT analytics market are expected to attract logistics vendors, to invest in digital solutions. IoT in logistics can simplify storing products and ensure efficient warehouse management. Additionally, modern technology has made it much simpler to overhaul warehouse operations. RFID tags and sensors can monitor the status and location of the inventory items. Executing warehouse automation can also minimize human errors because the processes are enabled and used as needed.

Asia Pacific is Expected to Register the Fastest Growth Rate

- Asia-pacific is analyzed to grow at the highest growth rate during the forecast period owing to the adoption of digital technologies in countries such as China, India, and so on. Technological advancements such as IoT, AI, and Cloud further contribute to market growth.

- China's logistics sector is embracing digital technologies to increase efficiency in the face of numerous obstacles, including the COVID-19 pandemic. A directive on accelerating the creation of a unified domestic market was jointly published in April 2022 by the Communist Party of China Central Committee and the State Council. It stated that China would optimize the design of the infrastructure for commerce and trade circulation and encourage the fusion of online and offline development.

- The initiatives are in accordance with the central government's commitment to encourage the development of digital platforms for third-party logistics delivery and to foster a number of supply chain businesses with a global reach. For instance, Full Truck Alliance Co Ltd, a Chinese truck-hailing business, is boosting efforts to use digital technology to improve logistical effectiveness in pandemic-affected areas.

- Further, India's national logistics policy is anticipated to create a seamless course for economic development in the country by lowering logistic costs and enhancing the competitiveness of domestic goods on the global market. Due to these high logistical expenses, domestic commodities produced in India that are sold on the international market are already at a disadvantage. The shift that Indian manufacturers have been yearning for will be brought about by a comprehensive policy overhaul, allowing them to set competitive prices for their goods on the international market. Unified Logistics Interface Platform, Integration of Digital System, Ease of Logistics, and System Improvement Group are the four main parts of this new logistical project. The successful policy execution of Make in India, Digital India, and the "Atma-nirbhara drive" throughout the nation gains another component from the national logistics policy.

Digital Logistics Industry Overview

The Digital Logistics Market is fragmented due to the presence of a large number of players which cater to various types of organizations, such as SMEs to Large Enterprises. Some key players in the market are IBM Corporation, Advantech Corporation, and Samsung Electronics Co. Ltd., among others. Some key developments in the market are:

- November 2023, Suttons International and LogChain have started a digitalization partnership. This collaboration, coming from LogChain's recent success in facilitating the world's first fully digitalized cross-border shipment, symbolizes a mutual commitment to bolstering digital transparency and scalability in the logistics sector. Suttons International is integrating its platform as a pivotal component in its digital transformation journey. The platform's adoption underscores a significant step in Suttons' commitment to spearheading digital innovation within the industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Emergence Of Digital Technology

- 5.1.2 Growth In E-Commerce Industry And Emergence Of Multichannel Distribution Networks

- 5.1.3 Growing Adoption Of Cloud Based Applications

- 5.2 Market Restraints

- 5.2.1 Lack of ICT Infrastructure and Data Security Concerns

- 5.3 Assessment of Impact of COVID-19 on the Industry

6 MARKET SEGMENTATION

- 6.1 Type

- 6.1.1 Inventory Management

- 6.1.2 Warehouse Management System (WMS)

- 6.1.3 Fleet Management

- 6.1.4 Other Types

- 6.2 End-user Vertical

- 6.2.1 Automotive

- 6.2.2 Pharmaceutical / Life Sciences

- 6.2.3 Retail

- 6.2.4 Food and Beverage

- 6.2.5 Oil and Gas

- 6.2.6 Other End-user Verticals

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Advantech Corporation

- 7.1.3 Oracle Corporation

- 7.1.4 Samsung Electronics Co. Ltd

- 7.1.5 DigiLogistics Technology Ltd

- 7.1.6 Hexaware Technologies Limited

- 7.1.7 Tech Mahindra Limited

- 7.1.8 JDA Software Pvt Ltd

- 7.1.9 UTI Worldwide Inc.(DSV Group)

- 7.1.10 SAP SE

- 7.1.11 Manhattan Associates Inc.

- 7.1.12 HighJump Software Inc.

- 7.1.13 Vinculum Group

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219