|

市场调查报告书

商品编码

1640453

智慧型穿戴装置 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Smart Wearable - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

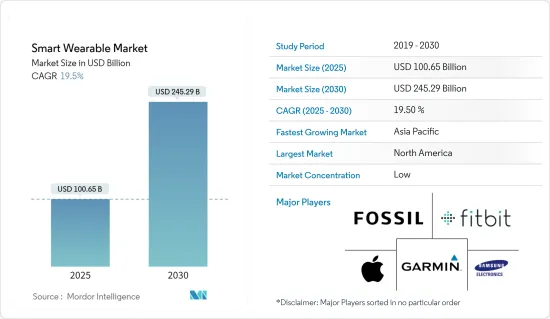

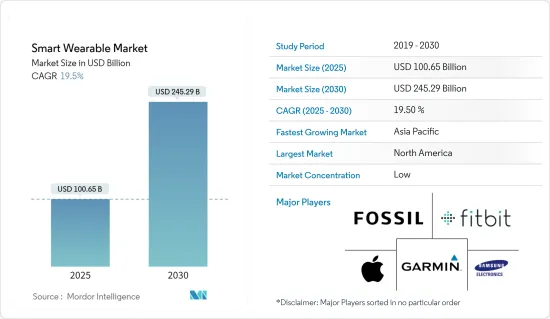

智慧型穿戴装置市场规模预计在 2025 年为 1,006.5 亿美元,预计到 2030 年将达到 2,452.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 19.5%。

关键亮点

- 智慧型穿戴装置市场包括一个专门用于健康和健身追踪的相当大的部分,包括心率监测、睡眠追踪和计步等产品。穿戴式科技可以穿戴在身体的任何部位,是一种将电子产品带入日常生活并回应不断变化的生活方式的新兴趋势。穿戴式科技的发展趋势受到诸如访问互联网的能力以及在网路和设备之间交换资料的可能性等因素的驱动。

- 有几个因素在智慧型穿戴装置中发挥关键作用,包括劳动力对健康和健身的兴趣和意识日益增强、感测器技术的发展、组件的小型化以及物联网 (IoT) 的使用日益增多。

- 随着世界各地的都市化不断加快,对先进、视觉驱动的设备的需求也日益增长,这些设备能够更好地满足消费者的需求,例如将多种功能整合到一个设备中或显示时间表。此外,由于消费能力的提高和日常工作中奢侈标准的提高,智慧型手錶正被全球许多千禧世代迅速接受。

- 透过智慧型装置收集、传输和储存个人健康资讯引发了隐私和资料安全问题。健康资讯的安全性和保密性正成为用户日益关注的问题。

- 2023 年 8 月,智慧型手錶製造商 Play 为国内市场推出了两款新设备:PLAYFIT Flaunt 2 和 PLAYFIT Dial 3 Pro。新款手錶力求时尚,提供良好的电池备用性和先进的功能,并有助于追踪与健身相关的活动。

智慧穿戴市场趋势

智慧型手錶预计将实现大幅成长

- 智慧型手錶是一种戴在手腕上的小型行动装置。许多智慧型手錶可以连接到您的智慧型手机并通知您来电、文字讯息和应用程式通知。有些智慧型手錶还可以打电话。

- 此外,智慧型手錶还可以运行应用程式并播放各种数位媒体,包括透过蓝牙耳机播放音乐曲目和广播串流。许多手錶都配有触控萤幕,让使用者可以使用计算器、温度计和指南针等功能。

- 可以记录单圈时间、距离和路线的智慧型手錶是专为田径运动设计的。它还可以与心率监测器和节奏感测器等配件配对。还有专门为帆船爱好者製作的智慧型手錶,帮助他们追踪速度、风向和风速等变数。

- 智慧型手錶也已发展成为多功能设备,充当智慧型手机的延伸,提供非接触式付款选项、通知和应用程式。截至 2023 年 12 月,荷兰大部分的签帐金融卡付款都是非接触式。

亚太地区可望创下最快成长

- 随着物联网(IoT)的兴起,亚太地区的连网设备数量近年来迅速增长。健身带和智慧型手錶等穿戴式电子产品正在推动蓬勃发展的可穿戴温度感测器市场的新成长要素。预计预测期内亚太地区智慧穿戴装置市场将实现最高成长。

- 中国是世界电子製造地。这意味着许多穿戴式装置和智慧型装置实际上是在该地区生产的,这可能会降低价格并加快上市时间。此外,该地区的成长可以归因于消费者拥有相对较高的可支配收入,使他们能够负担得起最新智慧设备一推出就购买。

- 此外,推动该国智慧穿戴装置市场成长的关键因素是人们对健身和技术进步的认识不断增强以及高速网路连接的可用性。

- 2023 年 2 月,三星电子与 Natural Cycles 宣布合作,升级 Galaxy Watch 5 系列上基于温度的月经週期监测功能。这是Natural Cycles最尖端科技首次应用于手錶。温度感测器采用红外线技术,无论环境温度变化或睡眠时的动作如何,都能提供更准确的读数。

智慧型穿戴装置产业概况

智慧穿戴装置市场细分化,拥有众多重要参与企业。知名参与企业包括 Fitbit Inc.、Fossil Group Inc.、Garmin Ltd.、三星电子、苹果公司、Cyberdyne Inc.、Transcend Information Inc. 和 GoPro Inc.市场参与企业正在采取联盟和收购等策略来加强其产品供应并获得可持续的竞争优势。

- 2024 年 1 月,Fitbit 和 Quest Diagnostics 宣布合作研究穿戴式装置改善METABOLIC INC.健康的潜力,这会影响罹患糖尿病和心臟病等多种疾病的风险。

- 2023 年 10 月,Fitbit 宣布将使用 AI 将健康指标连结起来,从客户的健康和健身资料中提取更深层的趋势。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场概况

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- COVID-19 和其他宏观经济因素的副作用将如何影响市场

第五章 市场动态

- 市场驱动因素

- 技术进步不断推动市场成长

- 市场限制

- 高成本和资料安全问题

第六章 市场细分

- 按产品

- 智慧型手錶

- 头戴式显示器

- 智慧穿戴

- 耳罩式

- 健身追踪器

- 随身摄影机

- 外骨骼

- 医疗设备

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Fitbit Inc.

- Fossil Group Inc.

- Garmin Ltd

- Samsung Electronics Co. Ltd

- Apple Inc.

- Cyberdyne Inc.

- Transcend Information Inc.

- GoPro Inc.

- Sensoria Inc.

- AIQ Smart Clothing Inc.

- Medtronic PLC

- Withings

- Huami Corporation

- Omron Healthcare Inc.

- Nuheara Limited

- Bragi GmbH

- Microsoft Corporation

- Sony Corporation

- Huawei Technologies Co. Ltd

- Ekso Bionics Holdings Inc.

第八章投资分析

第九章:市场的未来

The Smart Wearable Market size is estimated at USD 100.65 billion in 2025, and is expected to reach USD 245.29 billion by 2030, at a CAGR of 19.5% during the forecast period (2025-2030).

Key Highlights

- The market for smart wearables includes a sizable area dedicated to health and fitness tracking, with products that include heart rate monitoring, sleep tracking, and step counting. With the ability to wear on every part of the body, wearable technology is an emerging trend that brings electronics into everyday life and addresses lifestyle changes. The trend for wearing technology is driven by factors like the ability to access the Internet and data exchange possibilities between a network and an apparatus.

- Several factors, including the growing interest and awareness in people's health and fitness, sensor technology developments, component miniaturization, and the increasing use of the Internet of Things (IoT), play an important role in intelligent wearables.

- The increasing penetration rate of urbanization in different parts of the world has led to increased demand for advanced, visually appealing products to better serve consumer needs, such as multiple features in a single device and a time schedule. In addition, due to their increased spending capacity during their daily work hours and luxury standards, a large number of millennials around the world have quickly adopted smartwatches.

- Privacy and data security concerns are raised by the collection, transmission, and storage of personal health information through smart devices. The security and confidentiality of health information is becoming an increasing concern for users.

- In August 2023, smartwatch manufacturer Play launched two new devices for the domestic market: PLAYFIT Flaunt 2 and PLAYFIT Dial 3 Pro. The new watches aim to be fashionable, offer great battery backup and advanced features, and help track fitness-related activities.

Smart Wearable Market Trends

Smartwatches Are Expected to Witness Significant Growth

- A smartwatch is a small mobile device worn around the wrist. A number of smartwatches connect with smartphones and notify the user about incoming calls, text messages, or notifications from applications. Some smartwatches can even make phones.

- Moreover, smartwatches can run apps and play back any kind of digital media, such as music tracks or radio streams, for Bluetooth headphones. Many of these watches have touchscreens that allow the user to access functions such as the calculator, thermometer, compass, etc.

- Smartwatches, which allow the user to track lap times, distances, and routes, are specifically designed for athletic purposes. They can be coupled with accessories such as a heart rate monitor or cadence sensor, which may work in combination. There are specialty smartwatches built for sailing enthusiasts, helping them track variables such as speed, wind direction, and wind speed.

- Smartwatches have also developed into multipurpose gadgets that work as extensions of smartphones, offering contactless payment options, notifications, and applications. As of December 2023, the vast majority of debit card payments across the Netherlands were contactless.

Asia-Pacific is Expected to Witness the Fastest Growth Rate

- Due to the increasing spread of the Internet of Things (IoT), the number of connected devices in the region has increased rapidly in recent years. Wearable electronic devices such as fitness bands and smartwatches represent a new growth factor for the booming wearable temperature sensor market. The Asia-Pacific region is expected to record the highest growth in the smart wearables market during the forecast period.

- China, in particular, is a global manufacturing hub for electronics. This means that many wearables and smart devices are actually produced in the region, leading to potentially lower prices and quicker market availability. In addition, this region's growth can be attributed to the relatively high disposable income of its consumers, who can afford to buy the latest smart devices as soon as they are released.

- Moreover, the main factors driving this country's smart wearables market growth are the growing awareness of fitness and technology progress and the availability of high-speed Internet connections.

- In February 2023, Samsung Electronics Co. Ltd and Natural Cycles announced a partnership to upgrade the Galaxy Watch 5 series' temperature-based menstrual cycle monitoring capabilities. This was the first time Natural Cycles' cutting-edge technology was adapted for a wristwatch. The temperature sensor uses infrared technology to give more accurate readings, regardless of temperature changes in the environment or movement during sleep.

Smart Wearables Industry Overview

The smart wearables market is fragmented due to the presence of many significant players. Some prominent players include Fitbit Inc., Fossil Group Inc., Garmin Ltd, Samsung Electronics Co. Ltd, Apple Inc., Cyberdyne Inc., Transcend Information Inc., and GoPro Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- January 2024: Fitbit and Quest Diagnostics announced a collaboration to study the potential of wearable devices to improve metabolic health, which influences the risk of developing several diseases, including diabetes and heart disease.

- October 2023: Fitbit announced it would use AI to connect the dots between health metrics and extract deeper trends in customer health and fitness data.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGTHS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Driver

- 5.1.1 Incremental Technological Advancements Aiding the Market Growth

- 5.2 Market Restraint

- 5.2.1 High Cost and Data Security Concerns

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Smartwatches

- 6.1.2 Head-mounted Displays

- 6.1.3 Smart Clothing

- 6.1.4 Ear Worn

- 6.1.5 Fitness Trackers

- 6.1.6 Body-worn Camera

- 6.1.7 Exoskeleton

- 6.1.8 Medical Devices

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia

- 6.2.4 Australia and New Zealand

- 6.2.5 Latin America

- 6.2.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Fitbit Inc.

- 7.1.2 Fossil Group Inc.

- 7.1.3 Garmin Ltd

- 7.1.4 Samsung Electronics Co. Ltd

- 7.1.5 Apple Inc.

- 7.1.6 Cyberdyne Inc.

- 7.1.7 Transcend Information Inc.

- 7.1.8 GoPro Inc.

- 7.1.9 Sensoria Inc.

- 7.1.10 AIQ Smart Clothing Inc.

- 7.1.11 Medtronic PLC

- 7.1.12 Withings

- 7.1.13 Huami Corporation

- 7.1.14 Omron Healthcare Inc.

- 7.1.15 Nuheara Limited

- 7.1.16 Bragi GmbH

- 7.1.17 Microsoft Corporation

- 7.1.18 Sony Corporation

- 7.1.19 Huawei Technologies Co. Ltd

- 7.1.20 Ekso Bionics Holdings Inc.