|

市场调查报告书

商品编码

1640521

欧洲 ICS:市场占有率分析、产业趋势与成长预测(2025-2030 年)Europe ICS - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

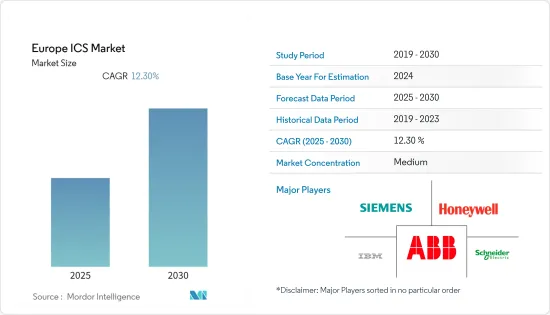

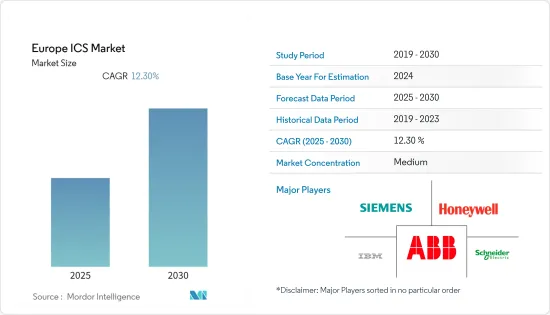

预测期内欧洲 ICS 市场预计复合年增长率为 12.3%

关键亮点

- 降低製造成本以及物联网和机器对机器 (M2M) 技术的应用的需求日益增加。政府委託的一项调查显示,如果英国製造业能够挺过第四次工业革命,那么它在未来十年内可以收回4.55 亿英镑(5.5 亿美元)并创造数千个就业机会。有可能的。

- 该地区的汽车和製造业正在大规模采用自动化工具。物联网实现了汽车产业的自动驾驶辅助、车辆维护、乘客资讯娱乐和车对车通讯。

- 政府控制和维护网路安全产业的努力遭到了商业团体的反对。抵制建立根据网路安全指标表现对公司进行排名的认证系统正在扼杀提高安全性的创新。然而,该国的产业政策旨在鼓励私人投资和人力资本发展,以应对网路安全挑战。

- 法国国家资讯系统安全局(ANSSI)提案了类似的基于类别的方法来解决法国的网路安全问题。该国的工业网络计划包括透过自愿资讯共用系统 (CERT-FR) 建立报告机制、在公司之间共用最佳实践、赞助涉及私营部门的危机管理演习(Piranet),以及为网路安全公司提供认证计划。

- 正如许多组织由于其对工厂功能的重要性而继承了 ICS 一样,许多组织中的 ICS 硬体和软体的老化也是增加复杂性的因素。 ICS 时代的到来为网路攻击创造了更多机会和复杂性。

- 新冠疫情迫使製造业重新评估传统生产流程,主要推动整个生产线的数位转型和智慧製造实践。製造商也被迫开发和实施多种新的灵活技术来监控他们的产品和品管。

欧洲工业控制系统市场趋势

汽车产业推动市场成长

- 汽车业是全球自动化生产设施占比较大的产业之一。为了保持效率,各汽车製造商的生产设施正在自动化。电动车(EV)取代传统汽车的趋势日益增长,预计将进一步增加汽车产业的需求。例如,瑞银预计到2025年欧洲电动车销量将达到633万辆,其次是中国,销量为484万辆。

- 人工智慧使汽车组装更俱生产力、效率和成本效益。现场工业机器人,尤其是圆柱形机器人透过自动化製造改变了汽车生产。

- E2EW 系列采用氟聚合物涂层来提高抗飞溅性,经过优化,可承受传统汽车焊接工艺的恶劣条件。新感测器还支援 IO-Link 功能,可从单一位置即时收集有关接近感测器检测水平和温度变化的资料。这些感测器也广泛应用于远距侦测、防撞、物体尺寸确定和导航等工业应用。

- 国际汽车零件公司 (IAC) 已在其位于英国海伍德的工厂实施了製造 4.0 和智慧工厂应用。该应用引入了智慧物流、企业对企业整合和协作机器人(cobots)。德国汽车零件製造商博世已在其印度工厂投资约 3,100 万欧元(3,280 万美元),用于开发工业 4.0 解决方案。

- 根据欧洲汽车工业协会 (ACEA) 的数据,到 2022 年,欧盟约有 44% 的新车註册将实现一定程度的电气化。电动车新註册量成长约28%,达到112万辆,而柴油和汽油汽车新註册量则停滞不前。截至 2022 年,欧盟新註册乘用车中约有 16% 将是柴油车,约有 36% 将是汽油车。

网路攻击的增加也是推动市场发展的因素之一

- 根据 IBM 的 X-Force 威胁情报指数 2022,针对 ICS 和操作技术(OT) 资产的威胁正在增加。例如,从 2021 年 1 月到 9 月,X-Force 观察到针对连接埠 502 的恶意侦察活动增加了 2,204%。大多数目标都使用了 ICS 硬体组件、监控和资料收集 (SCADA) 中的已知漏洞以及密码喷洒攻击等暴力破解登入技术的组合。

- ARC 顾问集团最近针对工业控制系统 (ICS) 网路安全状况进行的一项调查发现,近 70% 的公司预计针对其 OT/ICS 基础设施的攻击很有可能发生。西门子和波耐蒙研究所也进行了研究,并得出了类似的结论。研究表明,OT 比 IT 更容易受到网路攻击。约 54% 的受访者预计未来几年内他们将至少成为一次针对关键基础设施的网路攻击的受害者。

- 美国智慧工厂遭受的网路攻击增多,引发了人们对工业控制系统使用的担忧,政府也制定了策略来遏制此类犯罪的上升。同时,智慧工厂也越来越多地使用国产工业控制系统来防范网路安全漏洞的风险。Panasonic北美等公司提供完整的智慧製造解决方案,包括 ERP。

- ENISA 称,2020 年 4 月至 2021 年 7 月期间,欧洲公共行政部门遭遇了 198 起网路事件,成为最大的受攻击部门。数服务供应商位居第二,有 152 个上榜。金融领域位居第五,共发生97件案件。由于这些因素,该地区的供应商持续成长。

- 因此,在过去几年中,石油和燃气公司一直在大力投资网路安全技术,包括事件回应解决方案和可以从ICS 环境收集日誌的软体,以提高网路可见度、分段性,并防止横向移动并消除直接威胁。

欧洲 ICS 行业概况

欧洲 ICS 市场需要变得更有凝聚力,因为它由多家参与企业主导。参与企业主要参与产品开发和伙伴关係、合併和收购等策略活动。我们正在开发的主要市场如下:

- 2022 年 9 月 - ICS 和工业IoT(IIoT) 安全领域的领导者 XOne Networks 和 Valmet 宣布建立合作伙伴关係。两家公司计划共同为工业自动化领域的客户提供当今脆弱的营运技术 (OT) 环境所需的保护。 TXOne Networks 的安全测试、端点保护和网路防御解决方案,以及领先的 Valmet DNA 分散式控制系统 (DCS)、Valmet IQ品管系统(QCS)、机器视觉、分析仪和仪器仪表、阀门、工业互联网融合,提供许多优点。 Valmet 的保全服务可协助工业客户更好地保护、应对和恢復网路安全事件

- 2022年7月-ABB和SKF签署谅解备忘录,分析在製造流程自动化方面合作的可能性。该谅解备忘录在瑞典韦斯特拉斯的 ABB 机器人体验中心签署。透过此次伙伴关係,ABB和SKF将确定和评估增强製造能力的解决方案并帮助客户提高生产效率。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 竞争对手之间的竞争强度

- 替代品的威胁

- 评估宏观经济趋势对产业的影响

第五章 市场动态

- 市场驱动因素

- 网路攻击增加

- IT 与 OT 网路的融合

- 市场限制

- 安全系统实施的复杂性

- ICS 安全产业中各种经营模式的出现

第六章 市场细分

- 透过操作技术

- 监控、控制和资料采集 (SCADA)

- 分散式控制系统(DCS)

- 可程式逻辑控制器 (PLC)

- 智慧电子设备 (IED)

- 人机介面 (HMI)

- 其他系统

- 按软体

- 资产绩效管理 (APM)

- 产品生命週期管理 (PLM)

- 製造执行系统(MES)

- 企业资源规划 (ERP)

- 按最终用户产业

- 石油和天然气

- 化工和石化

- 电力和公共产业

- 饮食

- 汽车与运输

- 生命科学

- 用水和污水

- 金属与矿业

- 纸浆和造纸

- 电子/半导体

- 其他的

- 按国家

- 英国

- 德国

- 法国

- 欧洲其他地区

第七章 竞争格局

- 公司简介

- IBM

- Siemens AG

- ABB

- Honeywell International Inc.

- Tofino Security

- Kasa Companies Inc.

- Kasa Companies Inc.

- Schneider Electric

- Sourcefire Inc.

- Juniper Networks Inc.

- Emerson Electric Co.

- Mitsubishi Electric Corporation

第八章投资分析

第九章 市场展望

简介目录

Product Code: 54179

The Europe ICS Market is expected to register a CAGR of 12.3% during the forecast period.

Key Highlights

- There is a rise in the need to decrease manufacturing costs and applications of the Internet of Things and machine-to-machine (M2M) technologies. According to a government-commissioned review, the manufacturing sector in the country can unlock GBP 455 million (USD 550 million) over the next decade and create thousands of jobs if it cracks the fourth industrial revolution.

- The bulk adoption of automation tools is witnessed in the region's automotive and manufacturing sectors. IoT allows automated driving assistance, vehicle maintenance, passenger infotainment, & vehicle-to-vehicle communications in the automotive industry.

- The government's efforts to control and maintain the cybersecurity industry has suffered opposition from business associations. The resistance to building a certification regime to rank firms based on their performance against cybersecurity metrics is hampering innovations to upgrade security. However, the country's industrial policy aims to encourage private investment and human capital development in line with addressing the cybersecurity challenge.

- The ANSSI (National Agency for Information Systems Security) suggested a similar class-based approach to dealing with cyber security issues within France. The country's Industrial Cyber Plan strives for a voluntary information-sharing system (CERT-FR) to help a reporting mechanism, sharing best practices among companies, sponsorship of crisis management exercises involving the private sector (Piranet), and certification schemes for cybersecurity firms.

- Aging hardware or software for ICS in numerous organizations is also a factor for increasing complexity, as many organizations even use inheritance ICS due to their importance in the functioning of the plant. The advanced age of ICS creates excellent opportunities for cyberattacks and increases complexities.

- The COVID-19 pandemic has forced manufacturing industries to re-evaluate their traditional production processes, mainly driving digital transformation and smart manufacturing practices across production lines. The manufacturers are also forced to develop and execute multiple new and agile techniques to monitor product and quality control.

Europe Industrial Control Systems Market Trends

Automotive Sector to Drive Market Growth

- The automotive sector is among the major industries with a significant share of automated manufacturing facilities worldwide. The production facilities of different automakers are automated to maintain efficiency. The increasing trend of substituting conventional vehicles with electric vehicles (EVs) is anticipated to augment demand from the automotive sector further. For instance, Europe's projected electric vehicle sales are expected to reach 6.33 million units by 2025, followed by China with 4.84 million units, according to UBS.

- Artificial intelligence has completed automotive assembly lines more productive, efficient, and cost-effective. Industrial robotics on the shop floor, mainly cylindrical robots, have changed automobile production by automating manufacturing.

- The E2EW series is optimized to withstand the extreme conditions of traditional automotive welding processes owing to the fluororesin coating giving improved spatter resistance. The new sensors also support IO-Link capabilities, allowing real-time data gathering on proximity sensors' detection levels & temperature changes from a single location. These sensors are also broadly employed in industrial sensors to detect long-range distances, collision avoidance, determine the size of objects, navigation, and others.

- The International Automotive Components (IAC) implemented Manufacturing 4.0 & smart factory applications at the UK site in Halewood, England. This application installed smart logistics, cross-company integration, & collaborative robots (cobots). Also, German auto parts manufacturer Bosch has invested around EUR 31 million (USD 32.8 million) at its Indian plant to develop Industry 4.0 solutions.

- According to ACEA (European Automobile Manufacturers Association), around forty-four percent of new car registrations in the European Union (EU) were electrified to some degree in 2022. New registrations of battery electric vehicles increased by about twenty-eight percent to reach some 1.12 million units, while diesel & petrol registrations slumped. As of 2022, approx. Sixteen percent of newly registered passenger cars in the European Union were running on diesel, and approx thirty-six percent were fueled by petrol.

Rising Incidence of Cyberattacks is Among the Factors Driving the Market

- According to IBM's X-Force Threat Intelligence Index 2022, the threat targets on ICS and Operational Technologies (OT) assets have increased. For instance, between January and September of 2021, X-Force observed a 2204% increase in malicious reconnaissance activity targeting port 502. Most of these targets used a combination of known vulnerabilities within ICS hardware components, supervisory control and data acquisition (SCADA), and brute-force login tactics such as password-spraying attacks.

- A survey conducted by ARC Advisory Group on the state of cybersecurity of Industrial Control Systems (ICS) recently indicated that around 70% of companies predict an attack on their OT/ICS infrastructure to be very likely. Siemens and Ponemon Institute conducted research and also found similar results. The survey results indicate that OT had a higher chance of cyberattack than IT. About 54% of respondents expect to be stuck with at least one cyberattack on critical infrastructure within the next few years.

- With cyberattacks increasing in smart factories in the US, there is growing concerned about using Industrial Control Systems, and the government has strategies to curb the rise of such crimes, which is aligned with the increasing usage of industrial control systems manufactured in the country for smart factories to prevent the risk of cybersecurity breaches. Companies like Panasonic North America offer complete smart manufacturing solutions, including ERP.

- According to ENISA, between April 2020 and July 2021, European public administrations were the target of 198 cyber incidents, making them the biggest targeted sector. Digital service providers were second on the list, with 152 incidents. The financial sector was fifth, with 97 cyber incidents. Such factors allow the market vendor to grow in the region.

- Hence, over the past few years, oil and gas companies have invested heavily in cybersecurity technologies, such as incident response solutions and software capable of collecting logs in ICS environments to enhance visibility and segmenting networks, prevent lateral movement, and eliminate imminent threats.

Europe Industrial Control Systems Industry Overview

The European factory industrial control system market needs to be more cohesive due to several players in the market. Players are primarily involved in product development and strategic activities such as partnerships, mergers, and acquisitions. Some of the key developments in the market are:

- September 2022 - XOne Networks, a leader in ICS and industrial IoT (IIoT) security, and Valmet announced a partnership. Together the companies plan to equip joint industrial automation customers with the protection they require for current vulnerable OT (Operational Technology) environments. The mixture of TXOne Networks' solutions for security inspection, endpoint protection, and network defenses with the top Valmet DNA Distributed Control System (DCS), Valmet IQ Quality Control System (QCS), Machine Vision, Analyzers & Measurements, Valves, and Industrial Internet, presents various advantages: It improves the ability of industrial customers to guard better, respond, and recover from a cybersecurity incident with Valmet's Cybersecurity Services.

- July 2022 - ABB and SKF entered into a Memorandum of Understanding (MoU) to analyze the possibilities for collaboration in the automation of manufacturing processes. The MoU was signed at ABB's Robotics Experience Center in Vasteras, Sweden. Through the partnership, ABB and SKF will recognize and assess solutions to enhance manufacturing capabilities and support clients in boosting production efficiency.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness: Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

- 4.4 Assessment of the Impact of Macroeconomic Trends on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Incidence of Cyberattacks

- 5.1.2 Convergence of IT and OT Networks

- 5.2 Market Restraints

- 5.2.1 Complexity in Implementing the Security Systems

- 5.3 Emergence of Various Business Models in ICS Security Industry

6 MARKET SEGMENTATION

- 6.1 By Operational Technology

- 6.1.1 Supervisory Control and Data Acquisition (SCADA)

- 6.1.2 Distributed Control System (DCS)

- 6.1.3 Programmable Logic Controller (PLC)

- 6.1.4 Intelligent Electronic Devices (IED)

- 6.1.5 Human Machine Interface (HMI)

- 6.1.6 Other Systems

- 6.2 By Software

- 6.2.1 Asset Performance Management (APM)

- 6.2.2 Product Lifecycle Management (PLM)

- 6.2.3 Manufacturing Execution System (MES)

- 6.2.4 Enterprise Resource Planning (ERP)

- 6.3 By End-user Industry

- 6.3.1 Oil and Gas

- 6.3.2 Chemical and Petrochemical

- 6.3.3 Power and Utilities

- 6.3.4 Food and Beverages

- 6.3.5 Automotive and Transportation

- 6.3.6 Life Sciences

- 6.3.7 Water and Wastewater

- 6.3.8 Metal and Mining

- 6.3.9 Pulp and Paper

- 6.3.10 Electronics/Semiconductor

- 6.3.11 Other End-user Industries

- 6.4 By Country

- 6.4.1 United Kingdom

- 6.4.2 Germany

- 6.4.3 France

- 6.4.4 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM

- 7.1.2 Siemens AG

- 7.1.3 ABB

- 7.1.4 Honeywell International Inc.

- 7.1.5 Tofino Security

- 7.1.6 Kasa Companies Inc.

- 7.1.7 Kasa Companies Inc.

- 7.1.8 Schneider Electric

- 7.1.9 Sourcefire Inc.

- 7.1.10 Juniper Networks Inc.

- 7.1.11 Emerson Electric Co.

- 7.1.12 Mitsubishi Electric Corporation

8 INVESTMENT ANALYSIS

9 MARKET OUTLOOK

02-2729-4219

+886-2-2729-4219