|

市场调查报告书

商品编码

1640548

北美语音分析:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)North America Speech Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

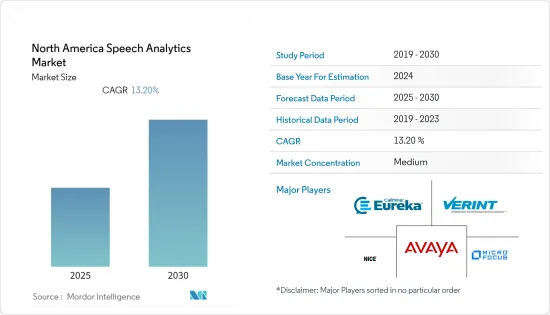

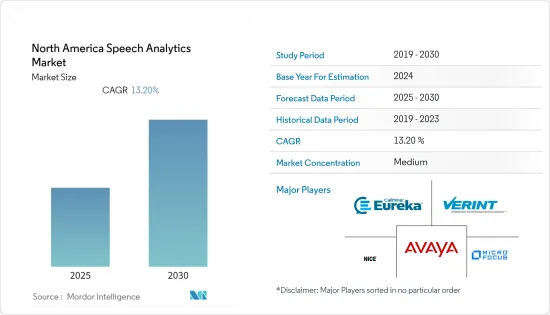

预计预测期内北美语音分析市场复合年增长率将达到 13.2%。

主要亮点

- 该地区的公司正在透过内部记录资料、社交媒体和外部企业联合组织资料来采用语音分析,以创建尖端解决方案,从而更好地了解客户需求并减少客户流失。

- 自然语言处理 (NLP) 透过消费者数位助理和聊天机器人广泛实现,在文字分析、语音感知(语音分析)、情绪分析和变化影响分析等领域具有商业应用。

- 随着最近一系列商业应用中数位技术的采用,客户期望他们的查询能够快速回应、无缝的自助服务选项以及全天候可用的企业沟通管道。语音分析应用程式使企业能够利用语音互动来微调业务流程并满足客户期望。

- 然而,部署基于语音的通讯仍面临挑战。从纯技术层面来说,语音互动对于电脑系统来说比聊天更难支援。不寻常的说话风格、不同的口音、部署复杂性、营运支援、糟糕的发音等使得企业难以采用语音技术。

- 新冠肺炎疫情的出现,在短时间内引发了多场技术革命。各行业采用非接触式服务增加了对语音分析的需求。疫情期间,呼叫量大幅增加,全国各客服中心平均通话时间从3至6分钟增加到10分钟以上。随着对非接触式服务的需求不断增加,在 COVID-19 疫情期间,语音分析的采用也随之增加。

北美语音分析市场趋势

预计客服中心容量的增加将推动市场成长

- 该地区的用户越来越多地在多个平台上采用语音控制,包括个人电脑、平板电脑、联网电视、汽车和穿戴式装置。此外,美国消费科技协会估计,今年美国语音助理设备总数预计将达到 8.7 亿台,较 2017 年预计的4.5 亿台成长 95%。这就需要增加客服中心的容量,尤其是在美国。

- 因此,当地企业主要采用这些解决方案来改善客户服务。例如,美国最大的保险公司大都会人寿采用AI系统主要是为了更好地满足客户的情感需求。该系统专门开发用于使公司员工能够在对话过程中追踪和监控客户情绪并提高客户服务品质。

- 为了满足这一需求,该地区的供应商正在将产品创新和伙伴关係关係作为其策略的一部分。例如,2021 年 9 月,丰业银行与 Google Cloud 合作,以加强该银行的云端优先工作并加速其全球语音、文字和资料分析策略。美洲和世界各地的丰业银行客户将受益于更个人化和主动的银行体验,而 Google Cloud 将成为丰业银行的重要分析合作伙伴。透过使用 Google Cloud 实现语音和资料分析,丰业银行将能够提供更具体和客製化的金融服务。

- 语音分析是一个优势,因为它可以识别麻烦的呼叫者。一个例子是客户变得愤怒或具有攻击性,要求退款或联繫客户支援。为了解决他们的问题并避免造成进一步的干扰,代理商可以藉助语音分析来侦测这些通话。

- 然而,由于实施系统、硬体、维护和熟练操作员的成本高昂,许多公司可能不愿意采用这项技术,并且不愿意在其上投入大量资金。此外,其他公司係统可能也需要升级,例如高品质音讯设备,因为品质差的音讯可能会阻止整个系统产生正确的见解。这可能会给企业带来额外的负担。

美国

- 中央情报局等机构正在积极资助能够帮助其追踪恐怖分子和外国间谍活动的想法。硅谷新兴企业也有很多机会积极创新现有的语音分析解决方案,以开发创新且引人注目的解决方案。

- 过去十年,美国国防部门已在国防高级研究计划局(DARPA)等研发计划上投资了数十亿美元,主要是为了向国家情报机构和军队提供先进的监视技术。

- 美国政府机构消费者金融保护局 (CFPB) 和商品期货交易委员会 (CFTC) 积极调查电话录音,发现某些负责人过于自信地提出提高借款人信用评分的建议。他们也歪曲了对收款成本的排除,并误导债务人相信需要电子付款。 CFPB对语音资料进行了调查和检验。此外,语音分析也用于主动预测互动带来的风险。在执法领域,语音分析可用于侦测诈欺。

- 今年早些时候,业界领先的业务改进对话智慧供应商 CallMiner 宣布与 Genesys Cloud CX 和 Amazon Connect 建立新的整合。这些伙伴关係使公司能够快速轻鬆地存取其当前和即将推出的联络中心即服务 (CCaaS) 部署的强大的即时分析功能。

- 今年早些时候,CallMiner 和领先的云端基础的会话人工智慧 (CAI) 大规模供应商 Boost.ai 宣布建立新的策略合作关係。 CallMiner 和 Boost.ai 的结合使企业能够记录和调查基于文字和语音的客户对话,从每次客户互动(包括与虚拟代理的互动)中获得有价值的见解。此次合作将利用 Boost.ai 的对话式 AI 及其与客户进行深入对话的能力。

北美语音分析产业概况

北美语音分析市场竞争激烈,主要参与者包括: Verint System Inc.、Nice Ltd.、Avaya Inc.、Micro Focus International PLC 和 Callminer Inc. 此外,该地区在技术采用和创新方面是最先进的,因此预计市场将在预测期。

2022 年 7 月: 资料与语音分析公司 Oral Analytics 合作,将 Oral 的 SpeechVitals 技术纳入资料的云端分析网路。该技术将应用于任何重视声音的研究领域,包括神经退化和神经精神病学。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- COVID-19 市场影响

第五章 市场动态

- 市场驱动因素

- 增加客服中心容量,主要在美国

- 使用不同语言的移民人口不断增长

- 市场挑战

- 由于供应商的行销力度有限,认知度有限

- 市场机会

- 北美零售商采用先进技术使其成为潜在买家

第六章 市场细分

- 按部署

- 本地

- 一经请求

- 按组织规模

- 中小企业

- 大型企业

- 按最终用户

- BFSI

- 卫生保健

- 零售

- 政府

- 其他最终用户(通讯、旅游和酒店业)

- 按国家

- 美国

- 加拿大

第七章 竞争格局

- 公司简介

- Verint System Inc.

- Nice Ltd

- Avaya Inc.

- Micro Focus International PLC

- Genesys Telecommunications Laboratories Inc.

- Callminer Inc.

- Raytheon BBN Technologies

- Calabrio Inc.

- VoiceBase Inc.

- OpenText Corporation

第八章投资分析

第九章:市场的未来

The North America Speech Analytics Market is expected to register a CAGR of 13.2% during the forecast period.

Key Highlights

- Enterprises across the region have incorporated speech analytics through internally recorded data, social media, and external syndicated data to create a cutting-edge solution to understand customer requirements better and reduce churn.

- Natural language processing (NLP) is a well-known artificial intelligence feature implemented universally, through consumer digital assistants and chat-bots, along with commercial applications in the field of textual analysis, voice sense (speech analysis), sentimental analysis, and change impact analysis.

- In recent times, with the increased adoption of digital technologies across various business applications, customers expect a quick response to queries, seamless self-service options, and 24/7 availability of businesses' communication channels. With speech analytics applications, businesses are using spoken interactions to finetune business processes to meet customer expectations.

- However, the market studied is witnessing challenges in deployment for voice-based communications. On a purely technical level, it is more challenging for a computer system to deal with voice interactions than chat. Unusual speech patterns, different accents, deployment complexity, operational support, and poor pronunciation make it hard for businesses to adopt voice technology.

- The onset of COVID-19 brought several technological revolutions in a short time. The need for speech analytics has increased with the adoption of contactless services across various industries. During the pandemic, there has been a severe surge in the number of calls, and the average call duration, which averages between 3-6 minutes, increased to 10+ minutes at the call centers in the country. With such an increase in the need for contactless services, the adoption of speech analytics has increased during the COVID-19 pandemic.

North America Speech Analytics Market Trends

Increasing Call Center Capacity Expected to Boost the Market Growth

- The region is witnessing increased usage of voice controls by users across multiple platforms like PCs, tablets, connected TVs, automobiles, and wearables. Moreover, the total number of voice assistant devices is expected to reach 870 million in the United States this year, a 95% increase from a total of 450 million estimated in 2017, according to Consumer Technology Association Estimates. This has created a need for increasing call center capacity, especially in the United States.

- As a result, regional enterprises are adopting these solutions primarily to increase their customer service. For instance, one of the largest insurance companies in the United States, MetLife, adopted an AI system primarily to improve responses to its customers' emotional needs. The system was specifically developed to help the company's staff track and monitor customers' emotions during conversations, thereby enhancing the quality of customer service interactions.

- To cater to this demand, vendors in the region are adopting product innovations and partnerships as a part of their strategy. For instance, in September 2021, Scotiabank partnered with Google Cloud to strengthen the bank's cloud-first commitment and speed up its global speech, text, and data analytics strategy. Customers of Scotiabank in the Americas and worldwide will benefit from a more individualized and proactive banking experience owing to Google Cloud, a valued partner of Scotiabank for analytics. By implementing voice and data analytics utilizing Google Cloud, this relationship enables Scotiabank to provide financial services that are more specifically tailored.

- Speech analytics can identify troublesome callers, which is one of its advantages. Customers who are enraged or aggressive, who request refunds, or who contact customer support are examples of this. In order to resolve their issues and stop them from causing more disruption, agents can detect these calls with the aid of speech analytics.

- However, the high costs involved, such as the installed system, Hardware, maintenance, and skilled operator, are something that many companies may find overwhelming, and they might be reluctant to spend large amounts of sums on such technology. Moreover, other company systems, such as quality audio devices, may also need to be upgraded, as, with poor-quality audio, the entire system may be unable to produce correct insights. This may add extra burden on companies.

United States Expected to Grow Significantly

- Agencies like the CIA actively fund ideas that might help track terrorists and foreign spy activity. This also opens many opportunities for Silicon Valley startups, actively innovating the existing speech analytics solutions to develop innovative and attractive solutions.

- The US defense sector has been investing billions of dollars over the recent decade in research and development projects like the Defense Advanced Research Projects Agency (DARPA), primarily to provide the nation's intelligence agencies and defense forces with advanced surveillance technologies.

- The US government agencies Consumer Financial Protection Bureau (CFPB) and the Commodities Futures Trading Commission (CFTC) aggressively examined phone recordings and discovered that certain phone representatives were overconfident about improving debtors' credit scores. It misrepresented the exclusion of collection costs and encouraged debtors to believe electronic payments were required. The CFPB examined and verified the audio data. Additionally, proactive risk prediction from the interactions was made using audio/voice analytics. In the field of enforcement, fraud can be found using audio analytics.

- Earlier this year, CallMiner, the industry's leading supplier of conversation intelligence for business improvement, announced new integrations with Genesys Cloud CX and Amazon Connect. These partnerships allow businesses to quickly and easily access robust real-time analytics capabilities within current or upcoming Contact Center as a Service (CCaaS) deployments.

- This year, CallMiner, and Boost.ai, a leading cloud-based conversational artificial intelligence (CAI) at scale provider, announced a new strategic relationship. Combined with Boost.ai, CallMiner enables businesses to record and examine text- and voice-based client conversations, allowing them to gain useful insights from all customer contacts, including those with virtual agents. The collaboration will rely on Boost.ai's conversational AI and its capacity for in-depth client dialogues.

North America Speech Analytics Industry Overview

The market for speech analytics in North America is highly competitive owing to the presence of major players such as Verint System Inc., Nice Ltd., Avaya Inc., Micro Focus International PLC, and Callminer Inc. Moreover, the region is amongst the most advanced in terms of technology adoption and innovation, and thus the market is expected to move toward fragmentation during the forecast period.

July 2022: Medidata partnered with voice analytics business Aural Analytics. Through the cooperation, Medidata's cloud analytics network will incorporate Aural's Speech Vitals technology. The technology will be employed in all research fields, including neurodegenerative, neuropsychiatric, and others, where speech may be important.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Call Center Capacity, Especially in the United States

- 5.1.2 Increase in the Number of Migrant Population Speaking Different Languages

- 5.2 Market Challenges

- 5.2.1 Lack of Awareness Due to Limited Marketing by the Vendors

- 5.3 Market Opportunities

- 5.3.1 Advanced Technologies Adopted by Retailers in North America Pose them as Potential Buyers

6 MARKET SEGMENTATION

- 6.1 Deployment

- 6.1.1 On-premise

- 6.1.2 On-demand

- 6.2 Size of Organization

- 6.2.1 Small and Medium Enterprises

- 6.2.2 Large Enterprises

- 6.3 End User

- 6.3.1 BFSI

- 6.3.2 Healthcare

- 6.3.3 Retail

- 6.3.4 Government

- 6.3.5 Other End Users (Telecommunication and Travel and Hospitality)

- 6.4 Country

- 6.4.1 United States

- 6.4.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Verint System Inc.

- 7.1.2 Nice Ltd

- 7.1.3 Avaya Inc.

- 7.1.4 Micro Focus International PLC

- 7.1.5 Genesys Telecommunications Laboratories Inc.

- 7.1.6 Callminer Inc.

- 7.1.7 Raytheon BBN Technologies

- 7.1.8 Calabrio Inc.

- 7.1.9 VoiceBase Inc.

- 7.1.10 OpenText Corporation